Pre-retirement Annuities: Guide to Securing Your Financial Future. Preparing for retirement involves strategic financial planning, and pre-retirement annuities can play a crucial role. These financial instruments help individuals build a steady income stream, ensuring financial stability during their golden years. This article explores everything you need to know about pre-retirement annuities, including their benefits, types, and how to choose the best plan for your needs.

What Are Pre-retirement Annuities?

Pre-retirement annuities are financial products designed to provide regular income after retirement. They allow you to invest during your working years, with the funds growing tax-deferred until withdrawal. This ensures a reliable source of income when you stop working.

Benefits of Pre-retirement Annuities

- Guaranteed Income: Offers a predictable income stream post-retirement.

- Tax Advantages: Contributions and growth are typically tax-deferred.

- Flexibility: Multiple types and payout options to suit individual needs.

- Protection Against Market Fluctuations: Fixed annuities provide stability even in volatile markets.

- Legacy Planning: Some annuities offer death benefits for beneficiaries.

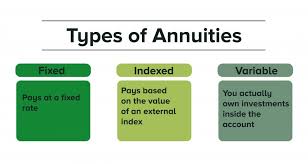

Types of Pre-retirement Annuities

- Fixed Annuities

- Provide guaranteed returns.

- Suitable for risk-averse individuals.

- Variable Annuities

- Investment options in stocks and bonds.

- Potential for higher returns but involves risks.

- Indexed Annuities

- Returns tied to a stock market index like the S&P 500.

- Offer a balance between risk and reward.

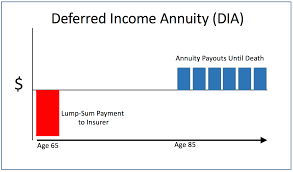

- Deferred Annuities

- Payments begin at a future date.

- Ideal for long-term planners.

How to Choose the Right Pre-retirement Annuity

- Assess Your Retirement Goals

- Calculate the income you’ll need.

- Understand Your Risk Tolerance

- Fixed annuities for conservative investors; variable annuities for those open to risk.

- Compare Providers

- Evaluate fees, rates, and customer service.

- Seek Professional Advice

- Consult a financial advisor for personalized recommendations.

Steps to Start Investing in Pre-retirement Annuities

- Research providers and plans.

- Set a budget for monthly or annual contributions.

- Understand the terms, including fees and withdrawal rules.

- Sign the contract and start contributing.

- Monitor and adjust your plan as needed.

10 Tips for Pre-retirement Annuities

- Start early to maximize compounding benefits.

- Diversify your investment portfolio.

- Regularly review your annuity’s performance.

- Choose a provider with a solid reputation.

- Opt for annuities with low fees.

- Understand the surrender charges before committing.

- Leverage tax advantages for maximum savings.

- Consider inflation-protected options.

- Avoid withdrawing funds prematurely.

- Discuss your options with a financial planner.

10 FAQs About Pre-retirement Annuities

1. What is the minimum age to invest in pre-retirement annuities?

Most providers allow investments starting at age 18.

2. Are pre-retirement annuities tax-deductible?

Contributions are typically tax-deferred, but withdrawals are taxable.

3. Can I withdraw funds early?

Yes, but early withdrawals often incur penalties.

4. How are annuities different from retirement accounts?

Annuities offer guaranteed income, while accounts like IRAs are investment-based.

5. Can I transfer an annuity to another provider?

Some plans allow transfers, though fees may apply.

6. What happens to the annuity if I pass away?

Certain plans provide death benefits to beneficiaries.

7. Do annuities protect against inflation?

Some offer inflation-adjusted payments.

8. What is the average return on pre-retirement annuities?

Returns vary based on type, with fixed annuities averaging 3–5%.

9. How much should I invest?

It depends on your retirement goals and income needs.

10. Are annuities safe investments?

Fixed annuities are low-risk, but variable ones carry market-related risks.

Conclusion

Pre-retirement wage are an essential tool for building a secure financial future. By offering guaranteed income, tax advantages, and customizable options, they empower individuals to enjoy retirement without financial worries. Whether you’re risk-averse or seeking higher returns, there’s an annuity plan for you.

Start planning early and consult with financial professionals to make informed decisions. With the right approach, pre-retirement wage can transform your retirement dreams into a reality.