Home Insurance for First-Time Buyers: A Comprehensive Guide. Buying a home for the first time is an exciting milestone, but it also comes with responsibilities—one of the most crucial being securing home insurance. Understanding how home insurance works, what it covers, and how to choose the right policy can protect your investment and provide peace of mind. This guide will walk you through everything you need to know about home insurance for first-time buyers.

What Is Home Insurance?

Home insurance is a financial protection policy that covers damage to your property, personal belongings, and liability for injuries that may occur on your property. It helps homeowners recover from unexpected events such as natural disasters, theft, and accidents.

Why First-Time Buyers Need Home Insurance

First-time homebuyers may not fully realize the risks of homeownership. Here’s why home insurance is essential:

- Protection Against Property Damage: Covers repair or rebuilding costs due to fire, storms, and other hazards.

- Liability Coverage: Protects you if someone is injured on your property.

- Mortgage Requirement: Lenders typically require home insurance as a condition for granting a mortgage.

- Peace of Mind: Knowing you’re financially protected in case of unforeseen damage.

Types of Home Insurance Policies

Understanding the different types of home insurance can help you choose the best policy for your needs.

- HO-1 (Basic Form): Covers limited perils such as fire, theft, and vandalism.

- HO-2 (Broad Form): Provides coverage for additional perils like falling objects and water damage from plumbing issues.

- HO-3 (Special Form): The most common policy, covering all perils except those specifically excluded.

- HO-4 (Renter’s Insurance): For tenants, covering personal property and liability.

- HO-5 (Comprehensive Form): Offers higher coverage limits and protects against most perils.

- HO-6 (Condo Insurance): Designed for condominium owners, covering personal property and unit improvements.

- HO-8 (Older Home Policy): Covers homes that may not meet modern insurance standards.

What Does Home Insurance Cover?

A standard home insurance policy typically includes:

- Dwelling Coverage: Protects the structure of your home against covered perils.

- Personal Property Coverage: Covers belongings like furniture, electronics, and clothing.

- Liability Protection: Pays for medical and legal expenses if someone is injured on your property.

- Additional Living Expenses (ALE): Covers temporary living costs if your home becomes uninhabitable.

Factors That Affect Home Insurance Costs

Several factors influence the cost of your home insurance premium:

- Location: Homes in areas prone to natural disasters or high crime rates may have higher premiums.

- Home Value and Replacement Cost: The higher the value, the more it costs to insure.

- Coverage Amount and Deductible: Higher coverage limits and lower deductibles result in higher premiums.

- Home’s Age and Condition: Older homes with outdated systems may be more expensive to insure.

- Security Features: Installing alarms and security systems can lower your premium.

How to Choose the Right Home Insurance Policy

Finding the best policy requires research and comparison. Follow these steps:

- Assess Your Needs: Determine the amount of coverage required based on your home’s value and risk factors.

- Compare Quotes: Get quotes from multiple insurance providers to find the best rates.

- Check the Policy Details: Read the fine print to understand exclusions and limitations.

- Look for Discounts: Many insurers offer discounts for bundling policies, installing security systems, or maintaining a claims-free history.

- Consult an Insurance Agent: A professional can guide you in selecting the best policy for your situation.

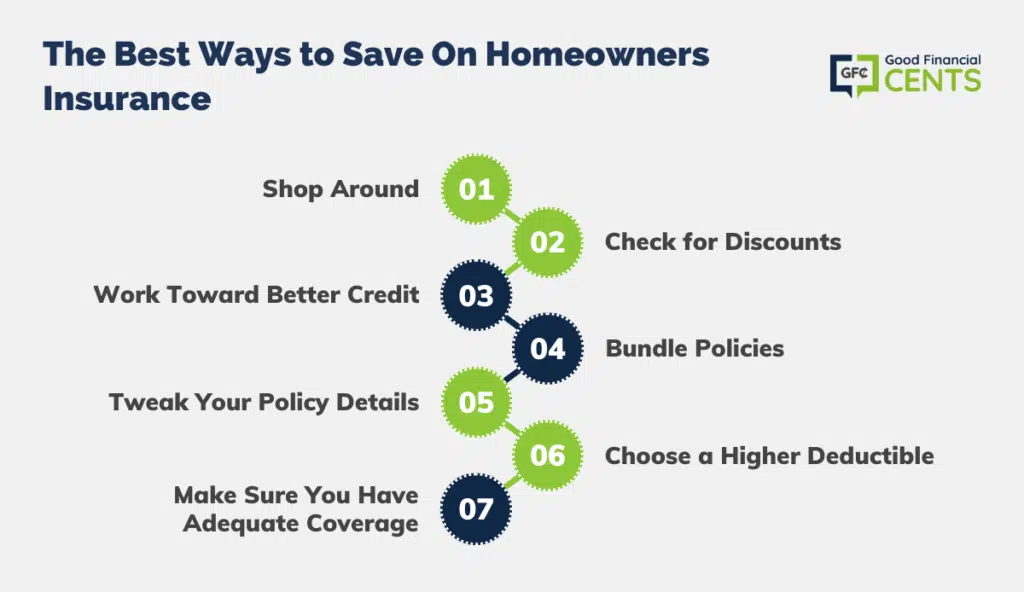

10 Tips for First-Time Home Insurance Buyers

- Start Shopping Early – Don’t wait until closing to find a policy.

- Understand Your Policy – Know what’s covered and what’s excluded.

- Consider a Higher Deductible – This can lower your premium costs.

- Bundle Your Policies – Combining home and auto insurance can save money.

- Ask About Discounts – Look for discounts for security systems, smoke detectors, and claims-free history.

- Review Your Policy Annually – Update your coverage as your needs change.

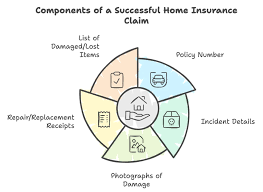

- Document Your Belongings – Keep an inventory of valuables to simplify claims.

- Check Your Credit Score – A good credit score can lower your insurance premium.

- Choose a Reliable Insurer – Read customer reviews and check financial stability.

- Don’t Overinsure or Underinsure – Ensure your coverage matches your home’s value.

10 Frequently Asked Questions (FAQs) About Home Insurance

1. Do I need home insurance if I don’t have a mortgage?

Yes, while not required, home insurance protects your investment.

2. What is the difference between replacement cost and actual cash value?

Replacement cost covers full repairs, while actual cash value accounts for depreciation.

3. Does home insurance cover natural disasters?

It depends on the policy; standard plans may not cover floods or earthquakes.

4. How can I lower my home insurance premium?

Increase your deductible, improve security, and maintain a good credit score.

5. What happens if I don’t have home insurance?

You risk financial loss in case of damage or liability claims.

6. Can I change my home insurance provider?

Yes, you can switch insurers at any time, but check for cancellation fees.

7. Does home insurance cover mold damage?

Only if caused by a covered peril, not due to neglect.

8. Is home insurance tax-deductible?

Generally, no, but exceptions exist for rental properties.

9. Will my policy cover a home-based business?

Standard policies may not cover business-related losses; additional coverage is needed.

10. How quickly can I get a home insurance policy?

Most policies can be issued within a few days, but some may take longer based on risk assessments.

Conclusion

Home insurance for first-time buyers is essential for protecting one of the most significant investments of your life. By understanding the types of policies available, what they cover, and how to choose the right plan, you can ensure your home is financially secure. Take the time to compare quotes, look for discounts, and consult an insurance expert to find the best coverage for your needs.

With the right home insurance policy, you can enjoy your new home with confidence, knowing that you’re protected against unexpected events. Investing in a well-suited policy today can save you from financial stress in the future, making homeownership a rewarding experience.