Specialty Insurance Claim Experts: Streamlining the Process. Specialty insurance claims can be complex, requiring expert knowledge to navigate policies, assess damages, and ensure fair settlements. Specialty insurance claim experts help policyholders maximize their claims while avoiding common pitfalls. Whether you are dealing with property damage, business interruption, or unique liability claims, having an expert by your side can make all the difference.

In this guide, we will explore the role of specialty insurance claim experts, how they help policyholders, and the best practices for handling claims effectively.

What Are Specialty Insurance Claim Experts?

Definition and Role

Specialty insurance claim experts are professionals who specialize in handling unique and complex insurance claims. Unlike general adjusters, these experts have deep knowledge of niche insurance areas such as:

- Property and casualty claims

- Business interruption claims

- Cyber liability claims

- Marine and aviation claims

- Professional liability claims

- Environmental and pollution claims

Why You Need a Specialty Insurance Claim Expert

Many policyholders struggle with claims due to vague policy language, insurer pushback, and complex damage assessments. Specialty insurance claim experts help in:

- Interpreting policy coverage

- Negotiating with insurance companies

- Documenting claims for higher payouts

- Preventing claim denials

How Specialty Insurance Claim Experts Help Maximize Your Claim

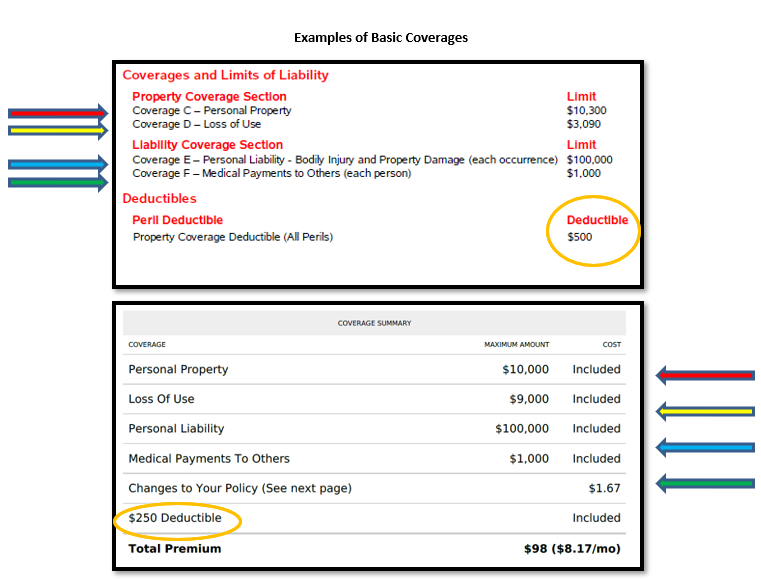

1. Understanding Policy Terms

Insurance policies contain intricate clauses that may limit or extend coverage. Experts analyze your policy to ensure you claim all entitled benefits.

2. Damage Assessment and Documentation

Proper documentation is key to claim approval. Experts conduct thorough assessments and compile necessary evidence, including:

- Photographic proof

- Repair estimates

- Legal documentation

3. Negotiation with Insurers

Insurance companies often offer lower settlements to save costs. Claim experts use their experience to negotiate for fair compensation.

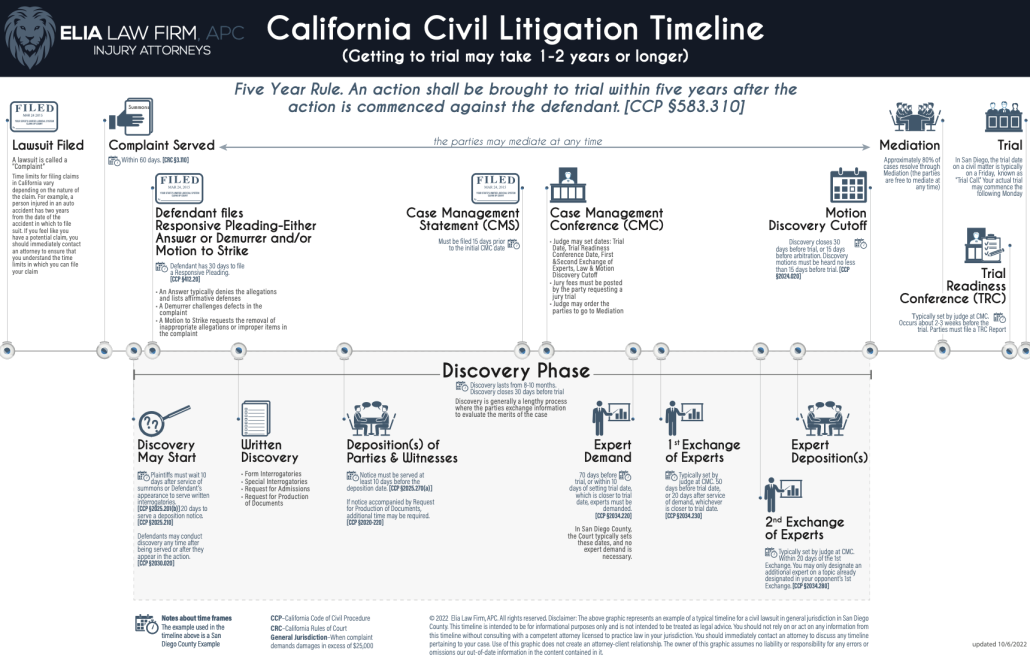

4. Managing Claim Disputes

If a claim is denied or underpaid, experts assist in appealing the decision by providing additional evidence and legal support.

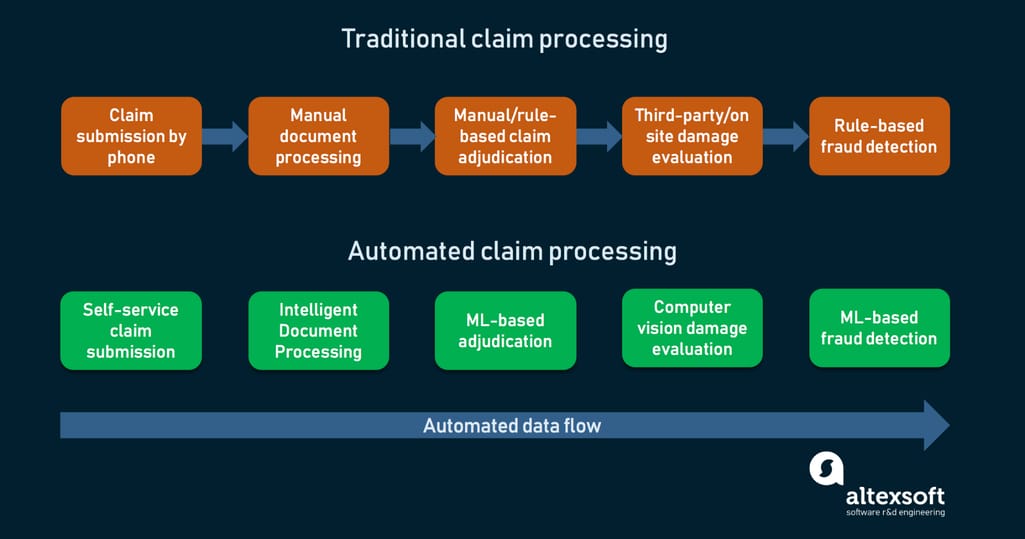

5. Speeding Up the Process

Specialty claim experts streamline the process, reducing delays caused by missing documents or misinterpretation of policies.

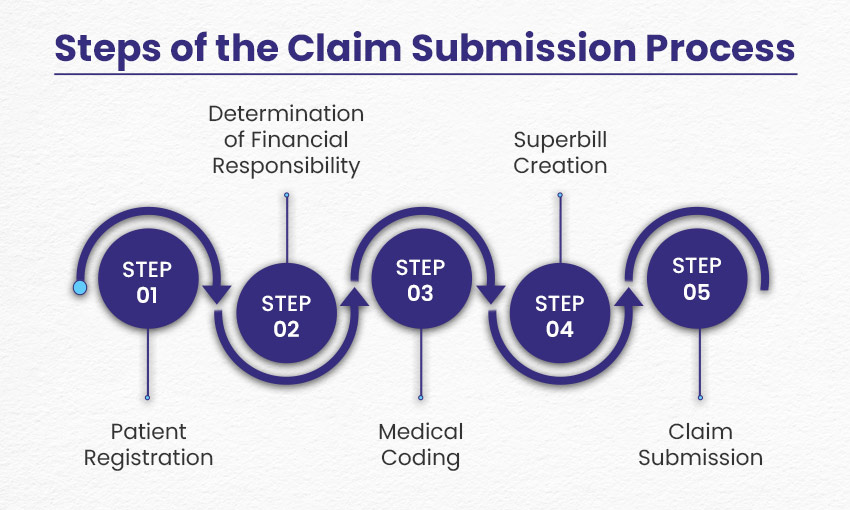

Steps to File a Specialty Insurance Claim Successfully

- Review Your Policy: Understand your coverage and limitations.

- Gather Documentation: Collect evidence such as receipts, reports, and photos.

- Contact a Claim Expert: Seek professional guidance early.

- File Your Claim Promptly: Avoid missing deadlines.

- Negotiate the Settlement: Don’t accept the first offer without reviewing it with an expert.

- Appeal if Necessary: If denied, work with experts to challenge the decision.

10 Tips for Maximizing Your Insurance Claim

- Read your policy thoroughly before filing a claim.

- Document everything, including damages and communications with insurers.

- Take high-quality photos and videos of the damage.

- Seek multiple repair estimates for accuracy.

- Keep a log of all claim-related expenses.

- Never accept an initial settlement offer without reviewing it.

- Hire a public adjuster or claim expert for guidance.

- Be honest and accurate in your claim reports.

- Follow up regularly with the insurance company.

- Know your rights and don’t hesitate to appeal a denial.

10 Frequently Asked Questions (FAQs)

1. What does a specialty insurance claim expert do?

They help policyholders navigate complex claims, negotiate settlements, and ensure fair compensation.

2. How do I know if I need a claim expert?

If your claim is complex, involves high-value losses, or has been denied, hiring an expert is beneficial.

3. Can a claim expert increase my settlement amount?

Yes, they can negotiate higher payouts by providing better documentation and leveraging policy terms.

4. How much does hiring a claim expert cost?

Costs vary but are often based on a percentage of the final settlement or a flat fee.

5. How long does the claims process take?

It depends on the complexity, but experts help speed up the process by avoiding common delays.

6. Will hiring an expert guarantee my claim approval?

While they improve your chances, no claim is guaranteed. However, they significantly increase the likelihood of a fair outcome.

7. What types of claims do specialty experts handle?

They handle unique claims such as business interruptions, environmental damages, and cyber liability claims.

8. Can I appeal a denied claim?

Yes, with the help of an expert, you can gather additional evidence and request a review.

9. What should I do if my claim is undervalued?

Consult a claim expert to renegotiate and provide stronger supporting documentation.

10. How can I prevent claim delays?

Ensure all required documents are submitted correctly and follow up regularly with your insurer.

Conclusion

Navigating specialty insurance claims can be challenging, but with the right expertise, policyholders can maximize their payouts and avoid unnecessary delays. Specialty insurance claim experts provide essential guidance, from policy interpretation to claim negotiation, ensuring you receive the compensation you deserve.

By understanding your policy, documenting your losses, and seeking professional assistance when needed, you can significantly improve your chances of a successful claim. If you face challenges with your insurance claim, don’t hesitate to consult an expert and take proactive steps toward securing your financial recovery.