Home Appliance Insurance Claim: A Comprehensive Guide. Filing an insurance claim for your home appliances can seem daunting, but with the right approach, you can ensure a smooth and hassle-free process. Whether your appliance has suffered damage due to unforeseen events or wear and tear, this guide will help you navigate every step of the claim process effectively. Here’s everything you need to know.

What is Home Appliance Insurance?

Home appliance insurance, often referred to as a home warranty, is a service contract that covers the repair or replacement of household appliances and systems. These policies are designed to protect homeowners from unexpected expenses when appliances break down due to normal wear and tear.

Some key features of home appliance insurance include:

- Coverage Scope: Covers major appliances like refrigerators, washing machines, air conditioners, and ovens.

- Peace of Mind: Protects against expensive repair bills.

- Annual or Monthly Premiums: Typically affordable and flexible payment options.

When Should You File a Home Appliance Insurance Claim?

Knowing when to file a claim can save you time and effort. Common situations include:

- Sudden Breakdown: If your appliance stops working unexpectedly.

- Natural Disasters: Damage caused by floods, storms, or other acts of nature (if covered).

- Power Surges: Electrical issues leading to appliance failure.

- Mechanical Failures: Components malfunctioning during regular use.

Step-by-Step Process to File a Home Appliance Insurance Claim

1. Review Your Policy

Before filing a claim, read your insurance policy carefully to understand:

- What is covered.

- Any exclusions.

- Deductible amounts.

2. Document the Damage

Take photographs or videos of the appliance and any visible damage. This visual evidence strengthens your claim.

3. Contact Your Insurance Provider

Reach out to your insurance company via phone or their online portal. Provide the necessary details, including:

- Policy number.

- Description of the issue.

- Supporting documentation (photos, receipts, etc.).

4. Schedule an Inspection

The insurer may send a technician or adjuster to inspect the damaged appliance. Cooperate fully during this process.

5. Get Repair or Replacement Estimates

If required, obtain quotes from certified technicians for repair or replacement costs. Share these with your insurance provider.

6. Wait for Approval

Once the insurer evaluates your claim, they’ll either approve or deny it. Approved claims typically lead to:

- Repairs scheduled by the insurance company.

- Reimbursement for repair or replacement costs.

What to Do If Your Claim is Denied

If your claim is denied, don’t panic. Follow these steps:

- Understand the Reason: Request a detailed explanation.

- Gather Additional Evidence: Provide more documentation or second opinions if necessary.

- Appeal the Decision: Many insurers allow appeals for denied claims.

- Seek Professional Help: Consider consulting a legal expert or insurance advocate.

10 Tips for Filing a Successful Home Appliance Insurance Claim

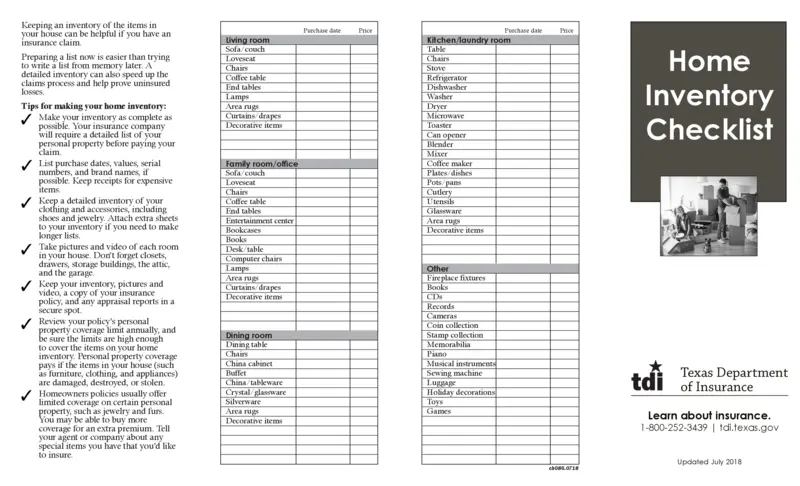

- Keep Your Receipts: Always retain proof of purchase for appliances.

- Maintain Records: Document all repairs and maintenance.

- Know Your Policy: Familiarize yourself with coverage details.

- Act Quickly: File claims as soon as issues arise.

- Provide Accurate Information: Ensure all claim details are correct.

- Take Clear Photos: Capture multiple angles of the damage.

- Follow Instructions: Adhere to your insurer’s claim filing process.

- Be Persistent: Don’t hesitate to follow up if there are delays.

- Request Clarifications: Ask questions to understand your policy better.

- Hire Professionals: Use licensed technicians for repairs.

10 Frequently Asked Questions (FAQs)

- What does home appliance insurance typically cover? Most policies cover mechanical failures, electrical issues, and normal wear and tear.

- Are natural disasters included in the coverage? Coverage varies. Some policies include natural disasters, but others don’t. Check your policy for specifics.

- Can I claim for cosmetic damages? Generally, cosmetic damages are excluded unless they affect functionality.

- How long does the claim process take? The timeline depends on the insurer but usually ranges from a few days to weeks.

- Do I need multiple policies for different appliances? No, most home appliance insurance plans cover multiple appliances under one policy.

- What if I lose my receipt? Alternative proof, like bank statements or warranty registrations, may be accepted.

- Are pre-existing conditions covered? No, most insurers exclude pre-existing conditions from coverage.

- Can I choose my repair technician? Some insurers allow this, while others work with their network of technicians.

- Is there a limit to the number of claims I can file? Policies often have annual claim limits. Verify with your provider.

- What should I do if I disagree with the repair estimate? Discuss your concerns with the insurer or get an independent evaluation.

Conclusion

Filing a home appliance insurance claim doesn’t have to be overwhelming. By understanding your policy, documenting damage, and following the proper steps, you can maximize your chances of a successful claim. Remember to act promptly and stay informed throughout the process to avoid unnecessary complications.

Home appliance insurance offers invaluable protection and peace of mind. With the right approach, you can safeguard your appliances and your budget from unexpected expenses. If you’re considering a policy, invest time in research to choose one that best suits your needs.