Cyber Insurance Claim Process: A Comprehensive Guide. In today’s digital age, the importance of cyber insurance cannot be overstated. Businesses and individuals alike rely on this critical safeguard to mitigate the financial and operational risks associated with cyberattacks. Navigating the cyber insurance claim process, however, can be daunting. This guide will walk you through each step, offering tips, FAQs, and insights to ensure a smooth experience.

What is Cyber Insurance?

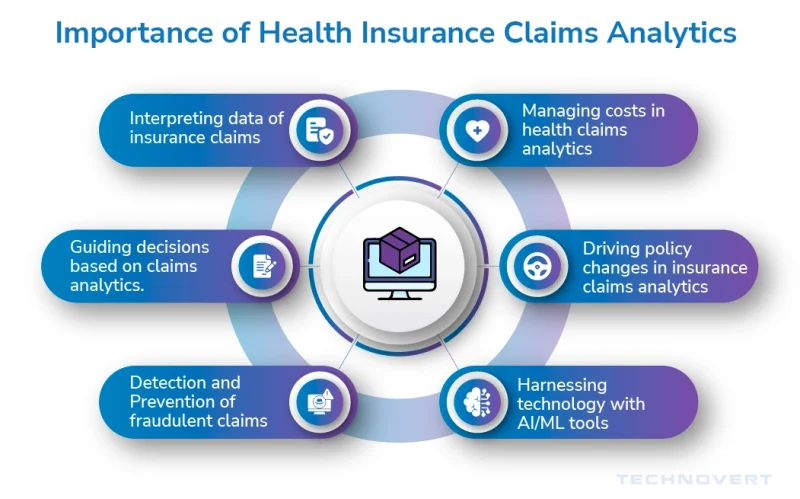

Cyber insurance provides coverage for financial losses resulting from cyber incidents such as data breaches, ransomware attacks, and network disruptions. Policies vary but typically include liability coverage, recovery costs, and business interruption expenses. The growing reliance on digital systems makes this insurance essential for minimizing risks in an increasingly connected world.

Step-by-Step Cyber Insurance Claim Process

1. Understand Your Policy

Before filing a claim, review your policy thoroughly. Key aspects to focus on include:

- Coverage Limits: Understand the maximum amount your policy will pay.

- Exclusions: Identify scenarios that are not covered.

- Notification Deadlines: Adhere to timeframes for reporting incidents.

Having a clear grasp of your coverage will help streamline the claim process.

2. Detect and Assess the Incident

Early detection is crucial. The moment you suspect a cyberattack:

- Isolate Affected Systems: Prevent further spread by disconnecting compromised systems.

- Evaluate the Damage: Determine the scope of the incident, such as stolen data or operational downtime.

- Engage IT Experts: Collaborate with cybersecurity professionals to assess the situation comprehensively.

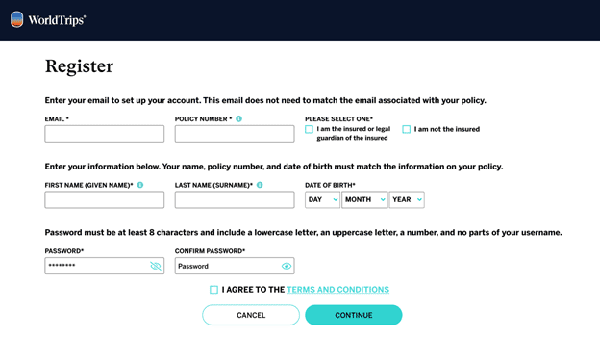

3. Notify Your Insurer

Contact your insurance provider immediately. Provide preliminary details, including:

- Date and time of the incident.

- A description of the breach.

- Steps taken to contain the damage.

Adhering to the insurer’s notification requirements is critical to avoid claim denial.

4. Document the Incident

Detailed documentation strengthens your claim. Ensure you:

- Keep logs of system activity.

- Retain communications related to the attack.

- Compile evidence such as malware samples or ransom notes.

Comprehensive records can expedite claim approval.

5. Engage Incident Response Teams

Many cyber insurance policies include access to specialized incident response teams. These experts:

- Investigate the breach.

- Provide forensic analysis.

- Assist in mitigating further damage.

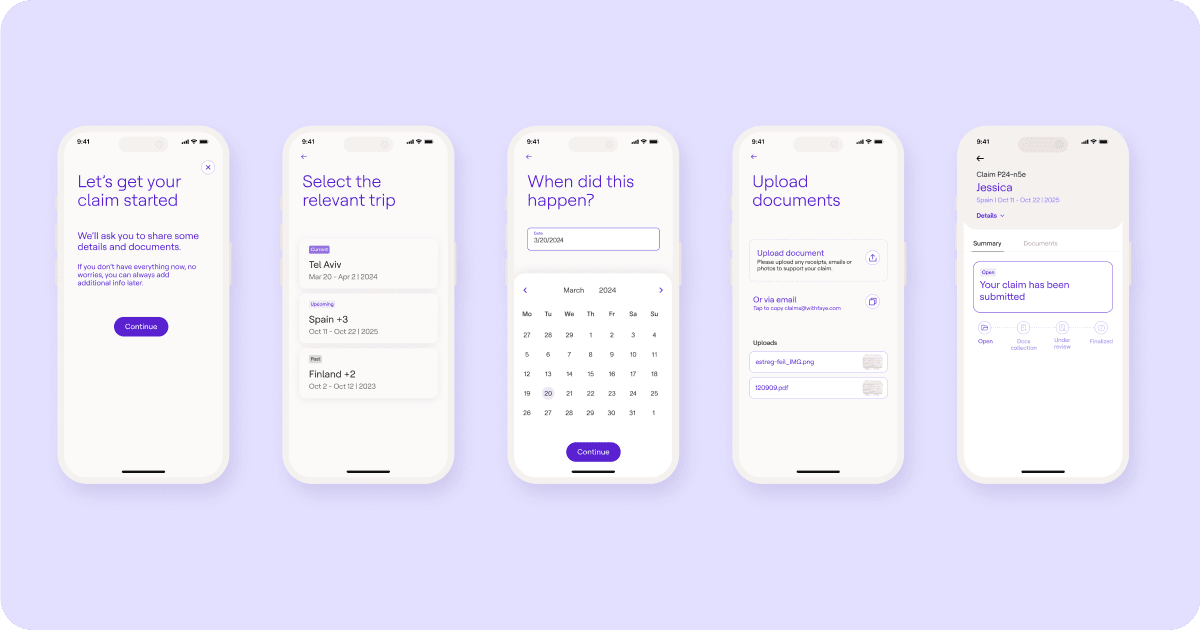

6. Submit Your Claim

File your claim with all necessary documentation. Include:

- Incident reports.

- Cost estimates for recovery.

- Proof of financial losses (e.g., invoices or revenue reports).

The insurer may request additional information during the review process.

7. Follow Up with the Insurer

Stay in regular contact with your insurer to monitor the claim’s progress. Be prepared to:

- Answer follow-up questions.

- Provide supplementary evidence if required.

8. Receive Compensation

Once approved, you’ll receive compensation according to your policy terms. Funds may cover:

- Data recovery costs.

- Legal fees.

- Business interruption losses.

9. Review and Update Your Cybersecurity Measures

Post-incident, evaluate your security protocols. Consider:

- Enhancing firewalls and antivirus solutions.

- Conducting staff training on cybersecurity best practices.

- Implementing incident response plans.

10 Tips for a Smooth Cyber Insurance Claim Process

- Understand Policy Details: Familiarize yourself with coverage specifics and exclusions.

- Monitor for Threats: Use advanced detection tools to identify breaches promptly.

- Document Everything: Maintain thorough records of all cyber incidents.

- Engage Experts Early: Leverage incident response teams for swift action.

- Notify Immediately: Report incidents to your insurer as soon as they occur.

- Follow Guidelines: Adhere to insurer protocols to avoid claim rejection.

- Update Security Measures: Regularly audit and enhance your defenses.

- Practice Transparency: Be honest and accurate in your claim submissions.

- Conduct Regular Training: Educate employees on recognizing and mitigating cyber threats.

- Review Policies Annually: Ensure your coverage evolves with changing risks.

10 Frequently Asked Questions (FAQs)

1. What does cyber insurance typically cover?

It covers financial losses from data breaches, ransomware attacks, business interruptions, and third-party liabilities.

2. Are there exclusions in cyber insurance policies?

Yes, exclusions may include pre-existing vulnerabilities, negligence, and specific attack types.

3. How quickly should I report a cyber incident?

Most policies require immediate notification, often within 24-48 hours.

4. Can I file a claim for ransomware payments?

Some policies cover ransom payments, but terms vary by insurer.

5. What documentation is needed for a claim?

Incident reports, cost estimates, system logs, and evidence of losses are typically required.

6. Does cyber insurance cover regulatory fines?

Some policies include coverage for fines and penalties imposed after a breach.

7. How long does the claim process take?

It varies; straightforward claims may take weeks, while complex cases can take months.

8. Do I need a lawyer for a cyber insurance claim?

While not always necessary, legal advice can be beneficial for large or disputed claims.

9. Can cyber insurance prevent breaches?

No, but it mitigates financial losses and provides resources for recovery.

10. Are small businesses eligible for cyber insurance?

Yes, many insurers offer tailored policies for small and medium-sized enterprises.

Conclusion

Understanding the cyber insurance claim process is essential for minimizing disruptions and financial losses from cyberattacks. By staying informed and proactive, you can ensure a smoother claims experience. Familiarize yourself with your policy, document incidents thoroughly, and engage experts for swift resolution.

As cyber threats continue to evolve, so too must your defenses and insurance coverage. Regularly updating your cybersecurity measures and reviewing policy terms will help safeguard your business in an increasingly digital world.