Surgery Claim Documentation Help: Simplify Your Process. Filing a claim for surgery expenses can be a daunting task, especially when dealing with complex documentation requirements. This guide provides detailed insights into ensuring your surgery claim documentation is accurate, complete, and easy to process. Whether you’re navigating insurance policies or seeking reimbursements, this article will serve as a valuable resource.

Understanding Surgery Claim Documentation

Surgery claim documentation involves submitting the necessary paperwork to an insurance company or healthcare provider to cover surgical expenses. This process includes gathering medical reports, invoices, insurance forms, and other supporting documents. Ensuring accuracy and completeness is critical to avoid claim rejections or delays.

Why is Surgery Claim Documentation Important?

- Facilitates smooth reimbursement of medical expenses.

- Ensures compliance with insurance policy terms.

- Prevents claim denials due to incomplete or incorrect submissions.

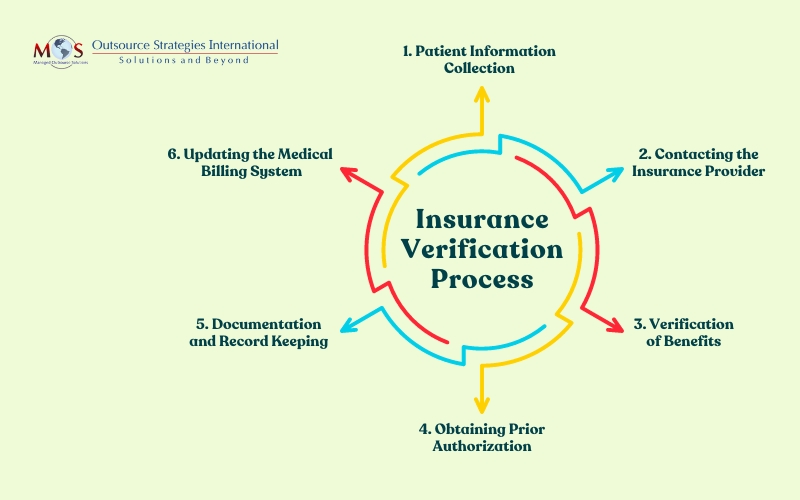

Steps to Prepare Your Surgery Claim Documentation

- Review Your Insurance Policy

- Understand the terms and coverage limits for surgical procedures.

- Check for exclusions or specific documentation requirements.

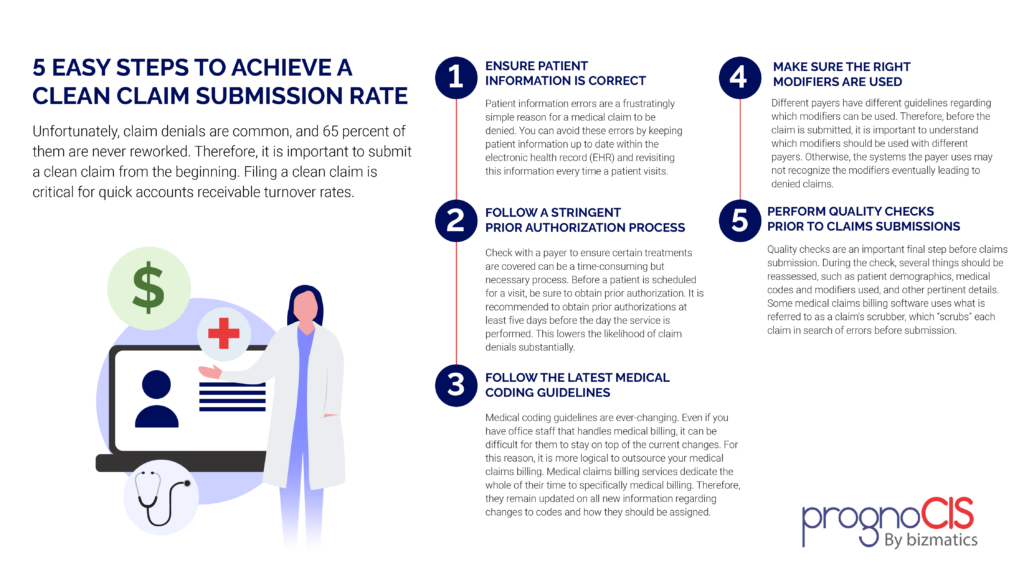

- Collect Pre-Surgery Approvals

- Obtain pre-authorization if required by your insurer.

- Keep copies of all approval letters or emails.

- Gather Medical Reports

- Include detailed surgery reports, doctor’s notes, and diagnostic test results.

- Ensure all documents are signed by the respective medical professionals.

- Compile Expense Invoices

- Collect itemized bills from the hospital and other medical providers.

- Include pharmacy receipts and equipment rental invoices if applicable.

- Fill Out Claim Forms Accurately

- Use the forms provided by your insurer.

- Double-check all details, including personal information and procedure codes.

- Attach Supporting Documents

- Include ID proof, policy details, and a cover letter summarizing your claim.

- Submit the Claim

- Follow your insurer’s submission guidelines (online or physical).

- Keep a copy of all submitted documents for your records.

- Track Your Claim’s Progress

- Use the insurer’s online portal or helpline to monitor the status.

- Respond promptly to any requests for additional information.

Common Mistakes to Avoid

- Submitting incomplete or illegible documents.

- Missing deadlines for claim submission.

- Failing to check for policy updates or changes.

- Providing incorrect banking or contact details.

10 Tips for Effective Surgery Claim Documentation

- Read and understand your insurance policy thoroughly.

- Create a checklist of required documents before starting the process.

- Always request itemized bills from medical providers.

- Maintain a file for all related documents, both digital and physical copies.

- Communicate regularly with your insurer to clarify doubts.

- Ensure all forms are correctly filled and signed.

- Attach proof of pre-authorization, if applicable.

- Submit claims promptly to avoid delays or rejections.

- Keep a record of all correspondence with the insurer.

- Seek professional help if the process feels overwhelming.

10 Frequently Asked Questions (FAQs)

- What documents are required for surgery claim submission?

- Insurance forms, medical reports, invoices, ID proof, and policy details.

- Can I submit a claim for emergency surgery without pre-authorization?

- Yes, but you may need to provide additional justification for the emergency.

- What happens if I submit incomplete documents?

- Your claim may be delayed or rejected until all required documents are provided.

- How long does it take for an insurer to process a claim?

- Processing times vary but usually range from 2 to 6 weeks.

- Can I claim non-surgical medical expenses along with surgery costs?

- Yes, if they are covered under your insurance policy.

- Do I need to submit original documents?

- Some insurers require originals, while others accept copies. Confirm with your provider.

- What if my claim is rejected?

- You can appeal the decision by providing additional information or corrections.

- Is there a time limit for claim submission?

- Yes, most policies specify a time frame, often 30 to 90 days post-surgery.

- Can I hire someone to handle my claim documentation?

- Yes, many professionals specialize in assisting with insurance claims.

- Are there penalties for false or inflated claims?

- Yes, submitting fraudulent claims can lead to legal consequences and policy termination.

Conclusion

Efficient surgery claim documentation is vital to ensure timely reimbursement and minimize stress during recovery. By understanding the process, avoiding common mistakes, and following the outlined tips, you can navigate the documentation process with ease.

Remember, attention to detail and prompt communication with your insurer are key to a successful claim. Whether you’re dealing with routine procedures or emergency surgeries, proper documentation will always be your strongest ally.