Wellness Program Claim Benefits: Unlocking the Full Potential. Maintaining a healthy lifestyle and achieving wellness goals have become priorities for many individuals. Wellness programs, often provided by employers or insurance providers, offer structured support to help people improve their physical, mental, and emotional health. However, understanding and claiming the benefits of these programs can sometimes be challenging. This article explores everything you need to know about wellness program claim benefits, ensuring you can maximize their potential.

What Are Wellness Programs?

Wellness programs are organized initiatives aimed at improving overall health and well-being. They may include a variety of components, such as:

- Fitness activities: Gym memberships, yoga classes, or virtual fitness sessions.

- Mental health support: Counseling services, stress management workshops, or mindfulness apps.

- Nutrition guidance: Access to dietitians, healthy meal plans, or online nutrition courses.

- Preventive care: Screenings, vaccinations, or annual health check-ups.

These programs not only promote healthier habits but can also reduce healthcare costs, boost employee productivity, and improve quality of life.

How to Claim Wellness Program Benefits

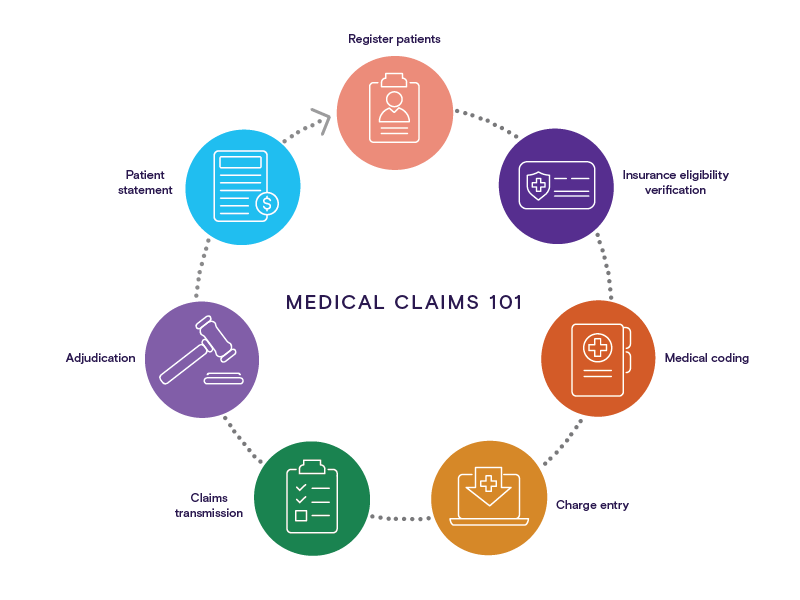

Claiming wellness program benefits typically involves several steps:

- Understand the Program: Review the program’s documentation to know what benefits are available and the eligibility criteria.

- Enroll in the Program: Register for the wellness program through your employer, health insurer, or other provider.

- Track Your Activities: Use wellness apps or program tools to log your participation in activities.

- Submit Claims: Fill out claim forms and attach any required documentation, such as receipts or proof of participation.

- Follow Up: Check the status of your claims and address any issues promptly.

Each program has specific rules, so it’s crucial to stay informed about deadlines, required documents, and submission procedures.

The Financial and Health Benefits of Wellness Programs

Wellness programs offer tangible benefits that can positively impact your finances and health. These include:

- Cost Savings: Many programs reimburse expenses for gym memberships, fitness classes, or preventive care.

- Improved Health: Regular participation can lead to better physical fitness, reduced stress levels, and overall improved well-being.

- Incentives: Some programs provide monetary rewards, gift cards, or discounts on insurance premiums for achieving wellness milestones.

By taking advantage of these benefits, you can save money while investing in your long-term health.

10 Tips for Maximizing Wellness Program Claim Benefits

- Read the Fine Print: Familiarize yourself with the program’s terms and conditions.

- Set Clear Goals: Define what you want to achieve through the program.

- Utilize Available Tools: Leverage apps or portals provided by the program for tracking and reporting.

- Keep Documentation Handy: Save all receipts, certificates, or other proof of participation.

- Communicate with Providers: Contact the program administrators for clarification on benefits or claims.

- Join Wellness Challenges: Participate in challenges to earn additional rewards.

- Attend Workshops: Engage in seminars or webinars offered by the program.

- Share with Your Network: Encourage family or coworkers to join, boosting accountability and enjoyment.

- Stay Consistent: Regularly engage in activities to meet program requirements.

- Review and Update: Periodically review your progress and adjust goals if necessary.

10 Frequently Asked Questions (FAQs)

- What is the primary purpose of wellness programs?

Wellness programs aim to improve participants’ overall health and reduce healthcare costs. - Are wellness programs free?

Some are free, while others may require partial payment or reimburse specific activities. - What types of activities qualify for wellness program benefits?

Fitness classes, health screenings, and mental health support are common examples. - How can I find out if I am eligible?

Check with your employer or program provider for eligibility criteria. - Can I claim benefits for family members?

Some programs extend benefits to dependents; verify this with your provider. - Do wellness programs offer rewards?

Yes, many programs provide rewards like gift cards, discounts, or insurance premium reductions. - What should I do if my claim is denied?

Contact the program administrator for clarification and submit an appeal if needed. - How long does it take to process a claim?

Processing times vary but typically range from a few days to a few weeks. - Can I use multiple wellness programs simultaneously?

Yes, if permitted by the providers. - Are wellness program benefits taxable?

Some benefits may be taxable; consult a tax advisor for specifics.

Conclusion

Wellness programs are a powerful tool to improve your health and financial well-being. By understanding their structure, maximizing benefits, and staying consistent with participation, you can achieve significant gains in your lifestyle. Additionally, these programs often provide rewarding incentives, making the journey to better health even more worthwhile.

Whether you’re an individual looking to enhance your wellness journey or an employee aiming to leverage workplace programs, wellness initiatives hold the key to a healthier, more balanced life. Start exploring and claiming your wellness program benefits today for a brighter, healthier future!