Hospital Bill Insurance Claim: A Comprehensive Guide. Navigating the complexities of hospital bills and insurance claims can be overwhelming, but with the right knowledge, the process becomes much smoother. This guide covers everything you need to know about filing a hospital bill insurance claim, ensuring you maximize your benefits and minimize out-of-pocket costs.

Understanding Hospital Bill Insurance Claims

A hospital bill insurance claim is the process of submitting a request to your insurance provider to cover medical expenses incurred during a hospital visit. These claims can be made for various treatments, including emergency care, surgeries, or routine procedures.

Key Components of a Hospital Bill

- Itemized Charges: A detailed breakdown of services and procedures.

- Diagnosis and Procedure Codes: Essential for insurance processing.

- Hospital Fees: Covers room charges, equipment, and medication.

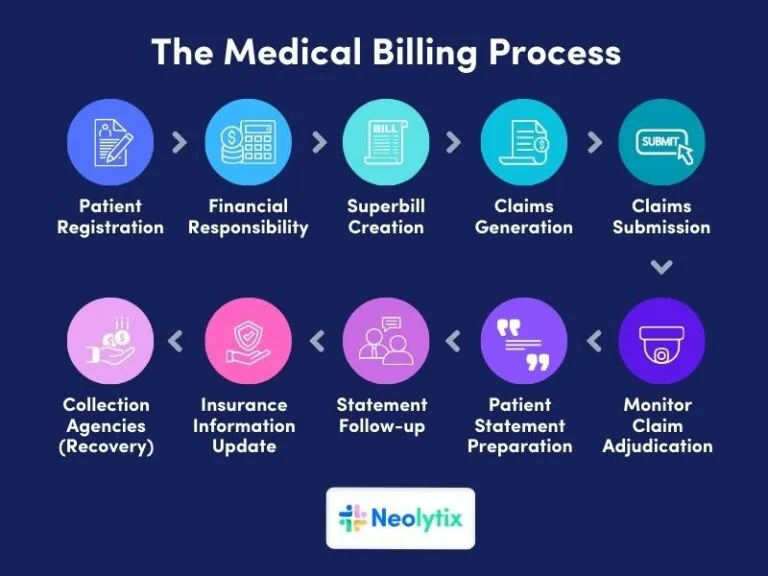

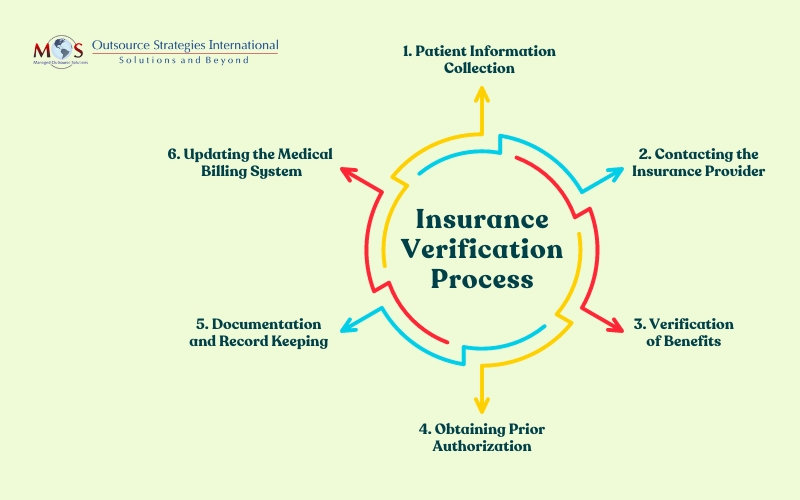

Steps to File a Hospital Bill Insurance Claim

1. Verify Insurance Coverage

- Check your insurance policy for covered treatments.

- Understand exclusions and limitations.

2. Collect Necessary Documents

- Obtain an itemized bill from the hospital.

- Gather prescriptions, lab reports, and discharge summaries.

3. Complete the Claim Form

- Fill out the insurance claim form accurately.

- Include personal details, policy number, and treatment specifics.

4. Submit the Claim

- Submit online or via mail, as specified by your insurer.

- Attach all required documents.

5. Follow Up

- Track your claim status through your insurance portal or by contacting customer service.

- Address any queries promptly to avoid delays.

Common Challenges and How to Overcome Them

1. Claim Rejection

- Reason: Incomplete documentation or policy exclusions.

- Solution: Double-check all paperwork before submission.

2. Delayed Processing

- Reason: High claim volumes or missing details.

- Solution: Submit claims promptly and ensure all forms are complete.

3. Partial Coverage

- Reason: Policy limits or non-covered services.

- Solution: Understand your policy and negotiate with the hospital if needed.

Maximizing Insurance Benefits

1. Use In-Network Providers

- Opt for hospitals and doctors within your insurance network to reduce costs.

2. Understand Pre-Authorization Requirements

- Some treatments require prior approval from your insurer.

3. Keep Records Organized

- Maintain a file of all medical documents and correspondence.

4. Utilize Supplemental Insurance

- Consider additional coverage for gaps in your primary policy.

Tips for a Smooth Hospital Bill Insurance Claim Process

- Always read and understand your insurance policy.

- Keep copies of all medical and billing documents.

- File claims promptly to avoid missing deadlines.

- Verify the accuracy of hospital bills.

- Seek clarification for any unexplained charges.

- Use electronic submission for faster processing.

- Contact customer support for assistance with complex claims.

- Follow up regularly to ensure timely resolution.

- Appeal denied claims with supporting evidence.

- Consult a healthcare advocate if needed.

Frequently Asked Questions (FAQs)

1. What is an insurance claim for a hospital bill?

A formal request to your insurance provider to cover medical expenses from a hospital visit.

2. How long does it take to process a claim?

Typically 15-30 days, depending on the insurer and complexity of the claim.

3. What documents are needed?

Itemized bills, claim forms, medical reports, and insurance policy details.

4. Can I claim for out-of-network services?

Yes, but you may have higher out-of-pocket costs.

5. What if my claim is denied?

You can appeal by providing additional documentation or correcting errors.

6. Do I need pre-authorization?

For some treatments, yes. Check your policy for specifics.

7. What is an Explanation of Benefits (EOB)?

A document from your insurer detailing what was covered and what you owe.

8. Can I negotiate hospital bills?

Yes, many hospitals allow negotiation, especially for uncovered services.

9. What if I’m uninsured?

You can request a payment plan or look for charity care programs.

10. How do I track my claim?

Use your insurer’s online portal or contact customer service.

Conclusion

Filing a hospital bill insurance claim doesn’t have to be stressful. By understanding your policy, organizing your documents, and following the correct procedures, you can streamline the process and ensure you receive the coverage you’re entitled to. Remember, staying proactive and informed is key to managing healthcare expenses effectively.

Taking the time to familiarize yourself with the claims process will save you time, money, and unnecessary stress. With the tips and guidance provided here, you’re well-equipped to handle your next hospital bill insurance claim with confidence.