Used Car Insurance Claim: Everything You Need to Know. When purchasing a used car, ensuring it is adequately insured is essential. In cases of accidents, theft, or other unforeseen damages, understanding how to file a used car insurance claim can make a world of difference. This comprehensive guide will walk you through every aspect of used car insurance claims, tips to simplify the process, and answers to common questions.

Understanding Used Car Insurance Claims

A used car insurance claim refers to the process of requesting compensation from your insurance provider for damages, repairs, or losses related to your pre-owned vehicle. While the process is similar to filing claims for new cars, used cars come with unique considerations such as depreciation and potential pre-existing conditions.

Step-by-Step Guide to Filing a Used Car Insurance Claim

1. Review Your Insurance Policy

- Examine your policy’s coverage details, exclusions, and limits.

- Understand the types of claims you can file, such as collision, comprehensive, or liability.

2. Document the Incident

- Take clear photos of damages to the vehicle and the surrounding area.

- Gather witness information if applicable.

3. Report the Incident to Your Insurance Provider

- Notify your insurer promptly after the incident.

- Provide them with the necessary details, including date, time, and nature of the event.

4. Submit Necessary Documentation

- Fill out the claim form provided by your insurer.

- Attach supporting documents, such as photos, police reports (if applicable), and repair estimates.

5. Cooperate with the Claims Adjuster

- Allow the insurance adjuster to inspect the vehicle and assess damages.

- Answer their questions honestly and thoroughly.

6. Understand Depreciation and Settlement Offers

- Used cars depreciate over time, impacting the claim’s payout.

- Discuss settlement offers and negotiate if necessary.

7. Complete Repairs

- Use a certified repair shop approved by your insurer.

- Retain all invoices and receipts for reimbursement purposes.

8. Monitor the Claim Status

- Regularly follow up with your insurance company until the claim is resolved.

Common Scenarios for Filing a Used Car Insurance Claim

- Accidents and Collisions: Coverage for repair or replacement after an accident.

- Theft: Compensation if your car is stolen.

- Natural Disasters: Damage caused by floods, hail, or other natural calamities.

- Vandalism: Reimbursement for deliberate damage to your vehicle.

- Uninsured Motorists: Protection if hit by an uninsured driver.

Factors That Affect Your Used Car Insurance Claim

1. Car’s Depreciation Value

- The older your car, the lower its market value.

2. Policy Deductibles

- Higher deductibles may reduce claim payouts but lower premiums.

3. Pre-Existing Conditions

- Damages before policy inception may not be covered.

4. Comprehensive vs. Collision Coverage

- Understanding the difference can help you select appropriate coverage.

5. Repair Costs vs. Replacement Value

- Insurers may opt for replacement if repair costs exceed the car’s value.

10 Tips for a Smooth Used Car Insurance Claim Process

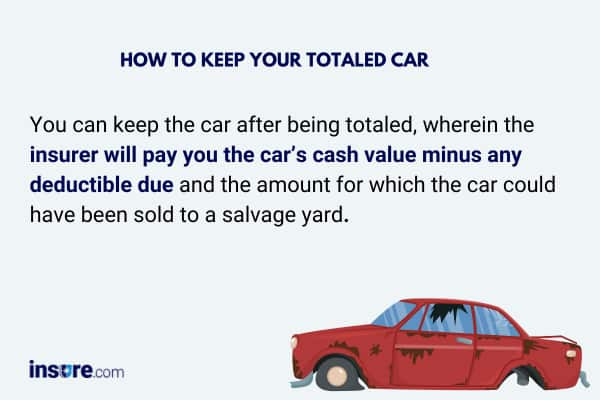

- Understand Your Policy Terms: Familiarize yourself with inclusions and exclusions.

- Report Incidents Immediately: Timely reporting avoids delays in processing claims.

- Maintain Accurate Records: Keep a record of past maintenance and repairs.

- Take Photos Immediately: Capture clear, detailed photos of the damage.

- Cooperate Fully with Your Insurer: Transparency speeds up the process.

- Use Approved Repair Shops: Choose facilities recommended by your insurer.

- Retain All Receipts: Ensure you have proof for reimbursement.

- Keep Track of Deadlines: Submit documents and information promptly.

- Negotiate Payouts if Necessary: Don’t accept low offers without review.

- Seek Legal Advice if Needed: Consult an attorney if disputes arise.

10 Frequently Asked Questions (FAQs) About Used Car Insurance Claims

1. Can I file a claim for pre-existing damages?

No, pre-existing damages before policy activation are not covered.

2. Will my premiums increase after a claim?

Yes, filing claims may lead to higher premiums in the future.

3. How long does it take to process a claim?

Claims can take anywhere from a few days to weeks, depending on complexity.

4. What if the repair cost exceeds my car’s value?

Your insurer may declare the car a total loss and pay the market value.

5. Do I need to pay a deductible?

Yes, deductibles apply before the insurer covers the remaining amount.

6. Is there a time limit for filing claims?

Most insurers have specific deadlines; check your policy for details.

7. What if I disagree with the settlement offer?

You can negotiate or provide additional evidence to support your case.

8. Does insurance cover rental cars during repairs?

Some policies include rental car reimbursement; confirm with your insurer.

9. Are natural disasters covered?

Only if you have comprehensive coverage.

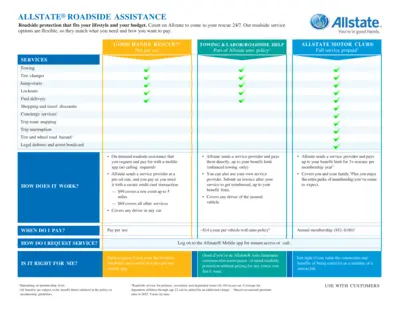

10. What if the accident wasn’t my fault?

Your insurer may seek reimbursement from the at-fault party’s insurer.

Conclusion

Filing a used car insurance claim can seem daunting, but understanding the process, gathering necessary documentation, and maintaining open communication with your insurer can simplify it significantly. Remember to review your policy carefully and follow the outlined steps for a seamless experience.

Used car owners must prioritize choosing the right insurance coverage to protect their vehicles and themselves financially. By staying informed and prepared, you’ll ensure that any unexpected incident is handled efficiently and effectively.