Investing in Mutual Funds: Beginners and Seasoned Investors. Investing in mutual funds has become an increasingly popular option for people looking to build wealth, diversify their portfolios, and take advantage of the potential returns the market offers. Mutual funds provide an accessible way for individual investors to gain exposure to various asset classes, such as stocks, bonds, or other securities, without needing in-depth knowledge of each individual investment. This guide will walk you through the essentials of mutual funds, including how they work, types of mutual funds available, factors to consider before investing, and tips for maximizing your returns.

What Are Mutual Funds?

Mutual funds are professionally managed investment vehicles that pool money from many investors to invest in a diversified portfolio of assets. They provide an opportunity for individuals to invest in a variety of securities, such as stocks, bonds, and money market instruments, with a relatively small initial investment.

When you buy shares in a mutual fund, you’re buying a portion of the fund’s overall portfolio. This allows individual investors to own a fraction of many different securities, spreading risk and reducing the impact of any one asset’s poor performance on their overall portfolio.

How Do Mutual Funds Work?

Mutual funds work by pooling money from investors and using that capital to buy a range of assets. Fund managers make investment decisions on behalf of the fund’s investors. These managers choose securities based on the fund’s investment goals, such as growth, income, or stability. The value of a mutual fund share fluctuates based on the performance of its underlying assets, and the net asset value (NAV) is calculated daily to determine the price at which shares can be bought or sold.

Types of Mutual Funds

- Equity Funds

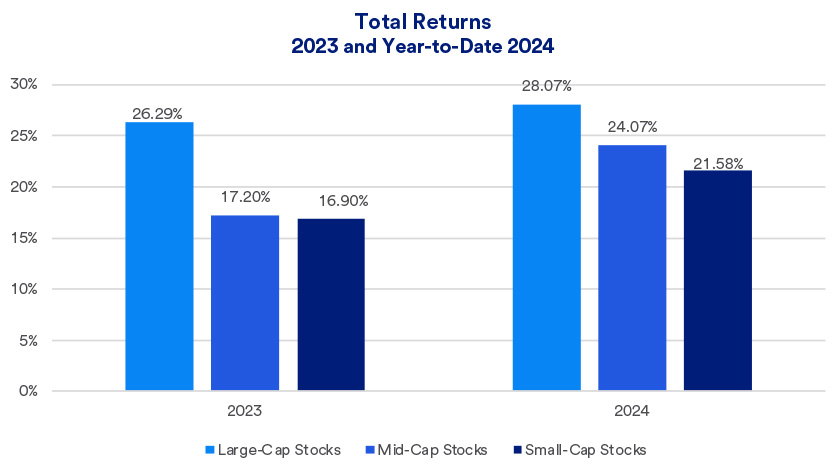

These funds primarily invest in stocks and are aimed at providing capital growth over the long term. They can be further classified into various categories, such as large-cap, mid-cap, and small-cap funds, based on the size of the companies in which they invest. - Bond Funds

Bond funds focus on investing in bonds and other debt securities. They are typically considered safer investments compared to equity funds but may offer lower returns. They can be government, municipal, or corporate bonds. - Money Market Funds

These funds invest in short-term debt securities, offering high liquidity and low risk. They provide relatively low returns but are a popular choice for conservative investors looking for a safe place to park their money. - Balanced Funds

A balanced fund combines stocks and bonds in one portfolio. The goal is to provide a balance of risk and return by diversifying across different asset classes. - Index Funds

These funds track a specific market index, such as the S&P 500. They aim to replicate the performance of the index rather than beat it, often at a lower cost than actively managed funds. - Sector Funds

These funds invest in specific sectors of the economy, such as technology, healthcare, or energy. They can be riskier due to their lack of diversification but may offer higher returns if the sector performs well.

Benefits of Investing in Mutual Funds

- Diversification

By pooling resources, mutual funds offer diversification, spreading risk across a wide range of investments. This reduces the potential impact of a poor-performing asset on your overall portfolio. - Professional Management

With a mutual fund, you benefit from the expertise of professional fund managers who make decisions based on research, analysis, and experience. - Liquidity

Mutual funds are highly liquid, meaning investors can buy and sell shares relatively easily. - Low Minimum Investment

Mutual funds often have low minimum investment requirements, making them accessible for beginners. - Automatic Reinvestment

Many funds offer the option to automatically reinvest dividends and capital gains, enabling the power of compound growth over time.

Things to Consider Before Investing in Mutual Funds

- Investment Goals

Before investing in a mutual fund, it’s important to identify your financial goals. Are you looking for long-term growth, income, or a balance of both? Understanding your investment objectives will help you choose the right fund. - Risk Tolerance

Different mutual funds carry different levels of risk. Equity funds tend to be riskier but have the potential for higher returns, while bond funds are typically safer but offer lower returns. Assess your own risk tolerance before choosing a fund. - Expense Ratios

Every mutual fund charges a fee for management and administration, known as the expense ratio. High expense ratios can eat into your returns, so it’s essential to understand the fees associated with the fund you’re considering. - Fund Performance

While past performance is not indicative of future returns, reviewing a fund’s historical performance can help you evaluate how well it has managed risk and returns over time. - Fund Manager’s Experience

The success of a mutual fund often depends on the expertise of its manager. Consider the experience and track record of the fund manager before investing.

How to Choose the Right Mutual Fund for You

Choosing the right mutual fund involves aligning the fund’s characteristics with your financial goals, risk tolerance, and investment horizon. Here’s a step-by-step approach:

- Define Your Investment Goals

Are you saving for retirement, a down payment on a house, or funding a child’s education? The purpose of your investment will guide your fund selection. - Evaluate Your Risk Tolerance

How much risk are you willing to take? If you’re risk-averse, you might prefer bond funds or money market funds. For higher potential returns, equity or sector funds might be a better fit. - Examine Fund Performance

Look at the fund’s historical performance, but don’t rely solely on it. Understand how it performed during different market conditions. - Review Fees and Expenses

Compare the expense ratios of similar funds. Even small differences in fees can impact your long-term returns. - Consult a Financial Advisor

If you’re unsure, it’s a good idea to speak with a financial advisor who can guide you based on your personal circumstances.

10 Tips for Successful Mutual Fund Investing

- Start Early – The earlier you start investing, the more you can benefit from compound interest.

- Diversify Your Portfolio – Spread your investments across different asset classes to reduce risk.

- Invest Regularly – Consider setting up automatic contributions to consistently grow your investment.

- Avoid Emotional Decisions – Stick to your investment strategy and avoid making decisions based on short-term market fluctuations.

- Understand Your Fund’s Strategy – Make sure the fund’s goals align with your own financial objectives.

- Monitor Performance – Periodically review the performance of your mutual funds.

- Reinvest Dividends – Take advantage of compound growth by reinvesting dividends and capital gains.

- Know the Risks – Understand the risks involved, especially in high-risk funds.

- Minimize Fees – Choose funds with lower fees to maximize your returns.

- Review Your Risk Tolerance Periodically – Your risk tolerance may change over time, and so should your portfolio.

10 FAQs About Investing in Mutual Funds

- What is the minimum amount needed to invest in a mutual fund? The minimum investment varies, but many funds require as little as $1,000 or less to start.

- What is an expense ratio? The expense ratio is the annual fee charged by the fund to cover its operating costs.

- How often can I buy and sell mutual funds? Mutual funds can be bought and sold at the end of the trading day, based on their net asset value (NAV).

- Are mutual funds a good investment for beginners? Yes, they offer diversification and professional management, making them ideal for beginners.

- What are the tax implications of investing in mutual funds? Mutual fund investors may be subject to taxes on dividends, capital gains, and income.

- Can I invest in mutual funds through retirement accounts? Yes, you can invest in mutual funds through IRAs, 401(k)s, and other retirement accounts.

- What happens if a mutual fund underperforms? If a fund consistently underperforms, investors may choose to redeem their shares or switch to a different fund.

- Can mutual funds be held in taxable accounts? Yes, you can hold mutual funds in taxable brokerage accounts.

- What is the difference between an actively managed and a passively managed fund? Actively managed funds are run by a manager who makes decisions on investments, while passively managed funds track an index.

- Are mutual funds safe? Mutual funds offer diversification, which can reduce risk, but they are not without risk, especially in volatile markets.

Conclusion

Investing in mutual funds offers a practical, accessible way to diversify your investments, whether you are a beginner or an experienced investor. By understanding the different types of funds, assessing your risk tolerance, and selecting the right fund based on your goals, you can create a solid foundation for your financial future. Remember, patience and consistency are key to seeing long-term benefits.

By following these tips and understanding how mutual funds work, you’ll be better positioned to make informed decisions that align with your financial goals. Whether you’re looking for growth, stability, or a combination of both, mutual funds provide a great way to build wealth over time while managing risk.