Online Trading Platforms: Finding the Best Trading Experience. In today’s fast-paced financial world, online trading platforms are transforming how individuals and institutions engage with the markets. Whether you are new to the world of trading or an experienced investor, understanding how these platforms work and selecting the right one can significantly impact your success. This article will delve into the features, benefits, types, and considerations to keep in mind when choosing an online trading platform.

By the end, you’ll have a clearer understanding of online trading platforms and be better equipped to make informed decisions about which platform aligns best with your trading goals.

1. What Are Online Trading Platforms?

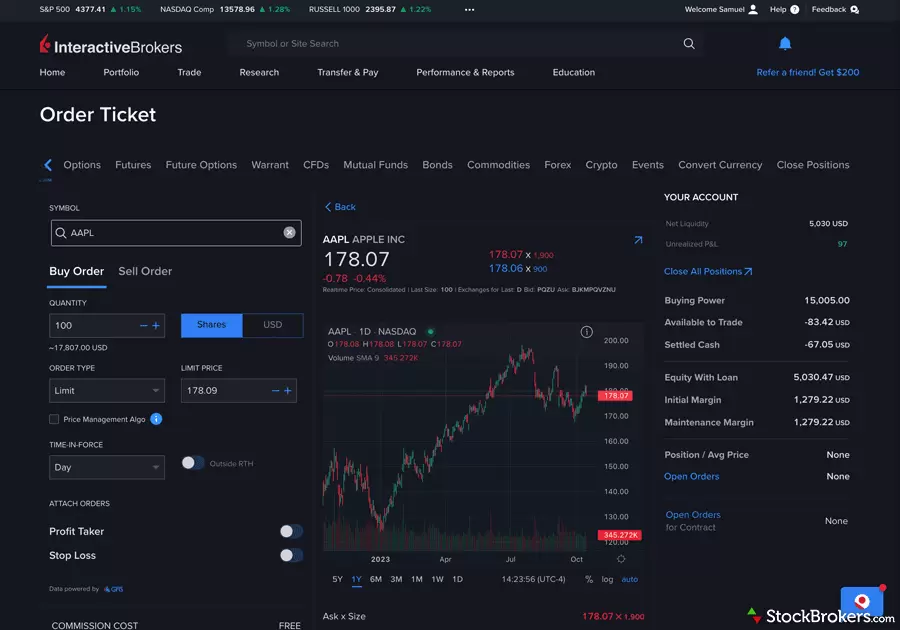

Online trading platforms are software tools that allow individuals to buy, sell, and trade financial products, such as stocks, bonds, ETFs, options, and cryptocurrencies, through the internet. They provide traders with access to various financial markets and offer a range of tools to analyze and execute trades efficiently. These platforms can be web-based, downloadable software, or even mobile applications, enabling traders to trade from virtually anywhere at any time.

2. Types of Online Trading Platforms

There are different types of online trading platforms, each catering to specific types of traders and investors. Here are the most common types:

- Stock Trading Platforms: These platforms are tailored for investors looking to trade stocks and equities.

- Forex Trading Platforms: Designed for traders engaging in currency trading.

- Options Trading Platforms: Specialized platforms that allow users to trade options contracts.

- Crypto Trading Platforms: Platforms that enable the buying, selling, and trading of cryptocurrencies like Bitcoin, Ethereum, and others.

- Multi-Asset Platforms: These platforms provide access to a wide variety of assets, such as stocks, bonds, commodities, and more, in one interface.

3. Key Features of Online Trading Platforms

When comparing online trading platforms, look for these essential features:

- User-Friendly Interface: A clean, intuitive interface helps traders navigate easily, making the platform accessible for beginners.

- Advanced Charting Tools: Technical analysis tools such as price charts, indicators, and drawing tools help traders analyze market trends.

- Research and Educational Resources: Platforms that provide educational resources, research reports, and market insights are essential for both beginners and seasoned traders.

- Security: A reputable trading platform will have robust security measures, including encryption and two-factor authentication (2FA), to protect user data and transactions.

- Mobile Compatibility: Many traders prefer to execute trades on-the-go, so mobile-friendly platforms are a huge benefit.

4. Advantages of Using Online Trading Platforms

Online trading platforms have become increasingly popular due to the following advantages:

- Convenience: Trade from anywhere at any time, as long as you have an internet connection.

- Lower Costs: Online platforms generally charge lower fees compared to traditional brokers.

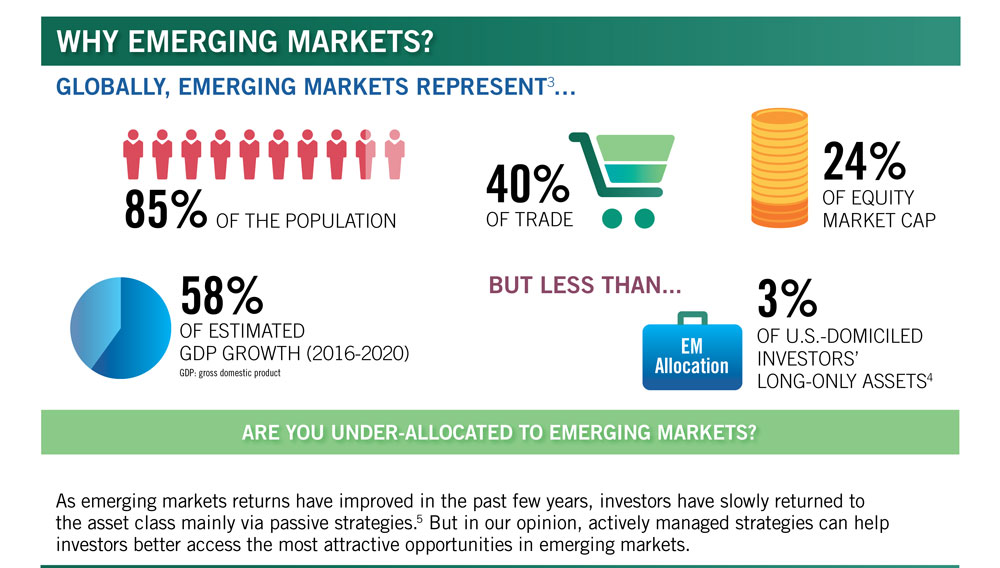

- Access to Global Markets: Many platforms allow you to trade assets in various global markets, diversifying your portfolio.

- Speed of Execution: Trades are executed quickly, often in real-time, giving traders a competitive edge.

- Real-Time Data: Traders can access live market data, ensuring they make well-informed decisions.

5. How to Choose the Right Online Trading Platform

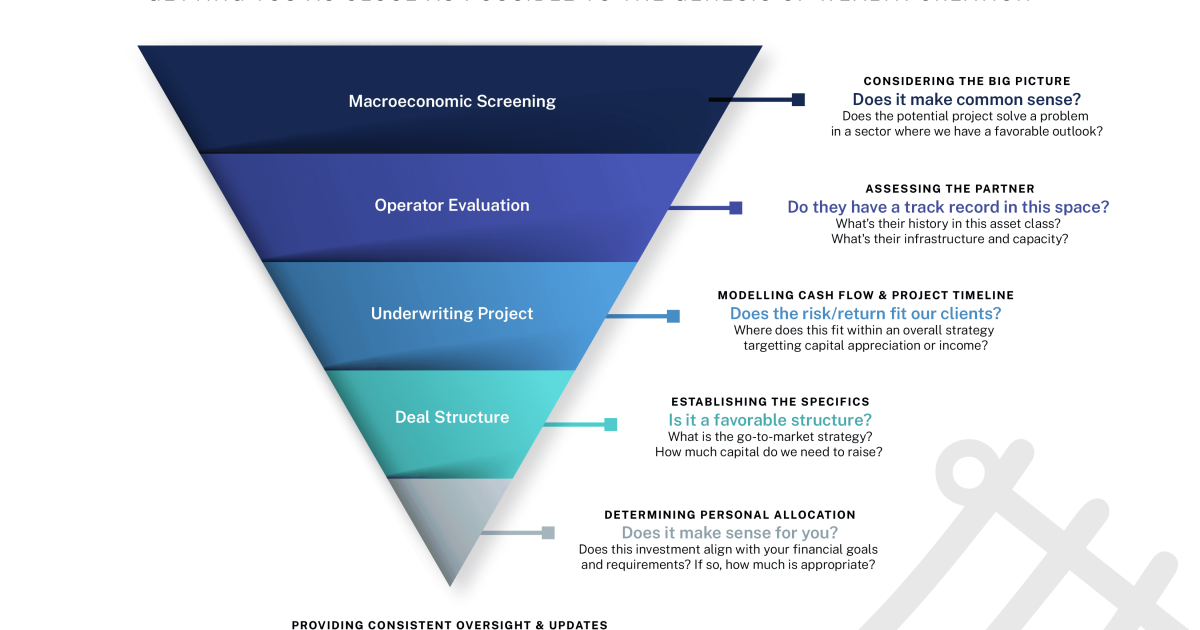

Choosing the right platform can be challenging, as there are numerous options available. Consider the following when selecting a platform:

- Trading Style: If you are a day trader, you may need a platform with fast execution speeds and advanced charting. For long-term investors, platforms with strong research tools might be more important.

- Fees: Ensure the platform’s fee structure aligns with your budget and trading style. Some platforms charge commissions per trade, while others use a spread system.

- Regulation and Reputation: Always choose a platform that is regulated by reputable authorities. This ensures the platform adheres to industry standards and offers security for your investments.

- Customer Support: A responsive customer support team is crucial, especially if you run into issues or need guidance.

- Platform Features: Choose a platform with features that suit your needs, such as automation, risk management tools, and the ability to trade multiple asset types.

6. Popular Online Trading Platforms to Consider

Here are some well-known online trading platforms that are favored by traders:

- MetaTrader 4 (MT4) & MetaTrader 5 (MT5): Popular for forex and CFD trading, these platforms offer advanced charting tools and algorithmic trading capabilities.

- TD Ameritrade: A robust platform for stock and options traders, with access to research and educational materials.

- Robinhood: Known for its user-friendly design and zero-commission trading on stocks and ETFs, Robinhood is popular among beginner investors.

- eToro: Ideal for social trading, where you can copy successful traders’ strategies.

- Coinbase: One of the leading platforms for trading cryptocurrencies, with an easy-to-use interface and strong security features.

7. Risks Involved in Online Trading

While online trading can be profitable, there are also risks involved, such as:

- Market Volatility: The financial markets can fluctuate rapidly, leading to unexpected losses.

- Leverage Risks: Using leverage amplifies both gains and losses, increasing the potential for financial loss.

- Platform Downtime: System outages can prevent you from executing trades at crucial times.

- Fraud and Scams: There are fraudulent platforms out there. Always choose a regulated and well-reviewed platform.

8. Online Trading Platform Trends

The online trading landscape is continually evolving. Some key trends include:

- AI and Automation: Many platforms are integrating AI-driven trading tools to help traders make data-backed decisions.

- Cryptocurrency Growth: As digital assets gain popularity, platforms are introducing features that cater to crypto traders.

- Social Trading: Platforms like eToro are allowing traders to follow and copy the strategies of other successful traders.

- Mobile-First Platforms: More platforms are optimizing their apps for mobile trading, catering to traders who prefer to trade on the go.

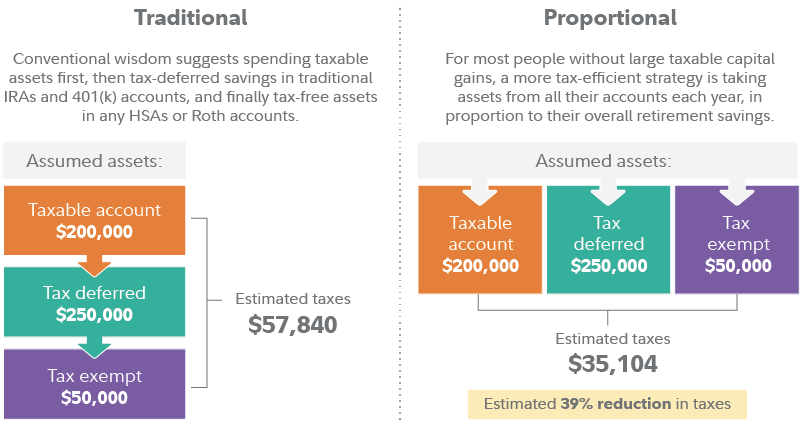

9. Legal and Tax Considerations for Online Trading

Trading on online platforms comes with certain legal and tax obligations:

- Taxes on Trading Gains: In most countries, profits from online trading are taxable. Ensure you understand capital gains tax and other relevant taxes.

- Compliance: Make sure that the platform you choose complies with local financial regulations to avoid legal issues.

10. The Future of Online Trading Platforms

The future of online trading looks promising, with continued advancements in technology. Expect faster, more secure trading experiences and better tools for traders of all skill levels.

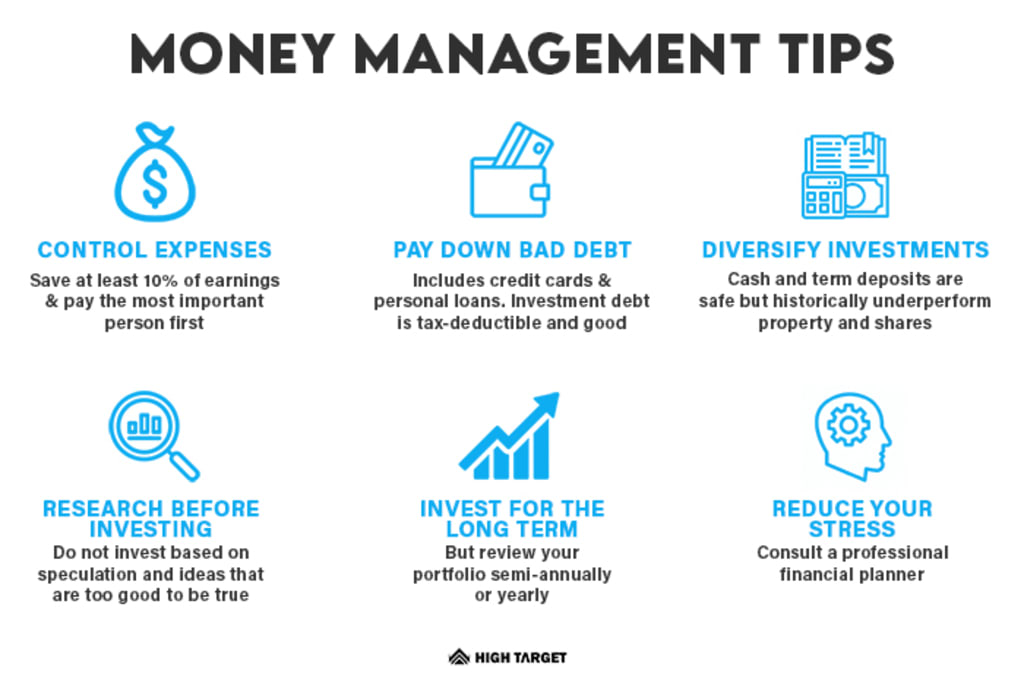

10 Tips for Using Online Trading Platforms Effectively

- Start with a demo account to practice before trading real money.

- Research the assets you plan to trade thoroughly.

- Use stop-loss orders to manage risk.

- Diversify your portfolio to minimize risk.

- Stay updated on market news and trends.

- Choose a platform that matches your trading style.

- Always read the terms and conditions of the platform.

- Regularly review your trading strategy.

- Stay disciplined and avoid emotional trading.

- Invest in learning and improving your trading skills.

10 FAQs About Online Trading Platforms

- What are the best online trading platforms for beginners? Platforms like Robinhood, eToro, and TD Ameritrade are ideal for beginners due to their user-friendly designs and educational resources.

- Do online trading platforms charge fees? Yes, most platforms charge fees, which could include commissions, spreads, and account maintenance fees.

- Can I trade cryptocurrencies on online trading platforms? Yes, platforms like Coinbase and Binance allow users to trade cryptocurrencies.

- Are online trading platforms secure? Reputable platforms use encryption, two-factor authentication, and other security features to protect users.

- Can I trade stocks using my mobile device? Yes, many platforms offer mobile apps that allow you to trade on the go.

- What types of assets can I trade on online trading platforms? You can trade stocks, bonds, options, forex, cryptocurrencies, and ETFs, depending on the platform.

- How do I choose the best online trading platform for me? Consider factors like fees, features, ease of use, and customer support when selecting a platform.

- Is it safe to use online trading platforms? It is safe as long as you use regulated platforms with strong security measures.

- Can I automate my trading on online platforms? Many platforms offer automated trading features, such as algorithmic trading or copy trading.

- What should I do if my online trading platform stops working? Contact customer support immediately, and ensure you have a backup plan in place, such as using a mobile version of the platform.

Conclusion

Online trading platforms provide an efficient and accessible way to trade in a wide range of financial markets. By understanding the features, advantages, and risks of these platforms, you can make more informed decisions when choosing a platform that suits your trading needs. Remember to prioritize security, research, and continuous learning to navigate the trading world successfully.

In conclusion, whether you are just starting or are an experienced trader, selecting the right online trading platform can help you achieve your financial goals. With numerous platforms available, taking the time to research and test different options will ensure you choose one that aligns with your objectives and trading style.