Online Banking Fees: Costs, Avoiding Charges, and Saving Money. Online banking has revolutionized the way we manage our finances, offering convenience, accessibility, and efficiency. However, many customers are unaware of the various online banking fees that can accumulate over time. These fees can quickly eat into savings if not carefully managed. This article explores the different types of online banking fees, how to minimize them, and essential tips to help you save money.

Types of Online Banking Fees

1. Monthly Maintenance Fees

Many banks charge a monthly fee for maintaining an online checking or savings account. This fee can range from $5 to $25, depending on the bank and the type of account. Some banks waive this fee if you meet certain criteria, such as maintaining a minimum balance or setting up direct deposits.

2. Overdraft Fees

Overdraft fees occur when a transaction exceeds your account balance. Banks typically charge $30 to $40 per overdraft. Some banks offer overdraft protection services, which link your checking account to a savings account or credit line to cover insufficient funds.

3. ATM Fees

Using an ATM outside your bank’s network can result in fees ranging from $2 to $5 per transaction. Additionally, the ATM operator may impose an extra charge. Opting for banks with broad ATM networks or reimbursement policies can help minimize these costs.

4. Wire Transfer Fees

Sending or receiving money through wire transfers can be expensive, with domestic transfers costing around $15 to $30 and international transfers reaching $50 or more. Some online banks provide lower fees or free transfers for certain transactions.

5. Foreign Transaction Fees

When making purchases in a foreign currency, banks often charge 1% to 3% of the transaction amount. Selecting a bank that offers no foreign transaction fees can be beneficial for frequent travelers.

6. Inactivity Fees

If you don’t use your online banking account for a certain period, some banks charge inactivity fees. This fee can be avoided by maintaining regular transactions or choosing an account with no inactivity penalties.

7. Paper Statement Fees

Many banks charge $2 to $5 per month for paper statements. Opting for electronic statements (e-statements) can help you avoid this fee while also being environmentally friendly.

8. Early Account Closure Fees

If you close your online banking account too soon after opening it, some banks may impose a fee of $25 to $50. Always check the terms before closing an account.

9. Excess Transaction Fees

Savings accounts may have limits on the number of free withdrawals per month. Exceeding this limit can result in a fee of $10 or more per transaction.

10. Returned Deposit Fees

If a check or online deposit is returned due to insufficient funds from the sender, banks may charge you a fee, usually around $10 to $20.

How to Minimize Online Banking Fees

- Choose a Fee-Free Online Bank: Many online banks offer checking and savings accounts with no monthly maintenance fees.

- Maintain the Required Minimum Balance: Keeping a balance above the required threshold can help avoid maintenance fees.

- Set Up Direct Deposit: Many banks waive monthly fees if you have a qualifying direct deposit.

- Use In-Network ATMs: Always use ATMs affiliated with your bank to avoid extra charges.

- Opt for Electronic Statements: Switching to e-statements eliminates paper statement fees.

- Monitor Your Account Regularly: Keeping track of transactions can help prevent overdrafts and unnecessary fees.

- Link Accounts for Overdraft Protection: Connecting a savings account or credit line can prevent overdraft fees.

- Be Mindful of Transaction Limits: Avoid exceeding withdrawal limits to prevent excess transaction fees.

- Read the Terms and Conditions: Always check the fine print to understand all potential fees.

- Ask for Fee Waivers: Some banks are willing to waive fees if you request them, especially if you’re a loyal customer.

10 Tips to Avoid Online Banking Fees

- Choose an online bank with no monthly fees.

- Maintain the minimum balance required to avoid charges.

- Use fee-free ATMs to withdraw cash.

- Set up alerts to track your account balance.

- Opt for overdraft protection to prevent costly fees.

- Make transactions regularly to avoid inactivity fees.

- Enroll in e-statements to save on paper statement fees.

- Transfer funds wisely to avoid excess transaction fees.

- Read and understand your bank’s fee structure before opening an account.

- Contact your bank to negotiate a fee waiver if charged unexpectedly.

10 Frequently Asked Questions (FAQs)

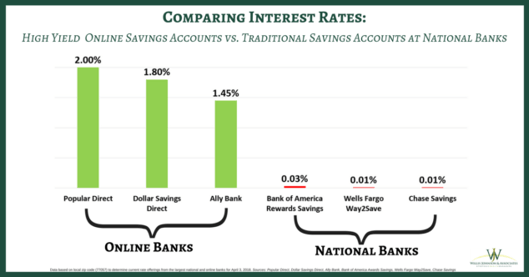

1. Are online banks cheaper than traditional banks?

Yes, online banks generally have lower fees since they don’t have the overhead costs of physical branches.

2. How can I find a bank with no fees?

Compare online banks and look for fee-free checking and savings accounts.

3. Do online banks charge ATM fees?

Some online banks reimburse ATM fees, but others charge fees for out-of-network withdrawals.

4. Can I dispute a banking fee?

Yes, you can call customer service to request a refund or waiver for certain charges.

5. What happens if I overdraft my account?

Your bank may charge an overdraft fee unless you have overdraft protection.

6. Do all banks charge paper statement fees?

Not all banks charge for paper statements, but many encourage e-statements to reduce costs.

7. Can I avoid wire transfer fees?

Some online banks offer free or reduced-cost wire transfers for specific accounts.

8. How can I prevent foreign transaction fees?

Use a bank that offers a no-fee foreign transaction policy or a travel-friendly credit card.

9. Is there a way to get my overdraft fees refunded?

Yes, some banks may waive overdraft fees if you request a refund, especially if it’s your first occurrence.

10. How can I avoid inactivity fees?

Make at least one small transaction every few months to keep your account active.

Conclusion

Online banking fees can quickly add up if not managed properly. Understanding the different types of charges and knowing how to avoid them can help you save money in the long run. By choosing the right bank, maintaining the required balances, and leveraging fee waivers, you can minimize costs and make the most of your online banking experience.

Taking proactive steps, such as setting up alerts, using in-network ATMs, and opting for electronic statements, can further reduce your banking expenses. Stay informed, review your account terms, and adopt smart banking habits to ensure that you are not paying unnecessary fees.