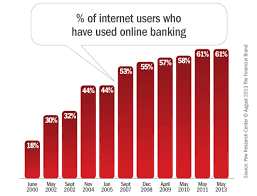

Online Banking Adoption: Embrace Digital Banking Safely. Online banking adoption has surged in recent years as financial institutions and consumers increasingly recognize the benefits of digital banking. From convenient transactions to advanced security measures, online banking provides an efficient and secure way to manage finances. However, some people still hesitate to fully embrace online banking due to concerns about security, accessibility, and ease of use. This article explores the key aspects of online banking adoption, its advantages, potential challenges, and how users can make the most of digital financial services.

Benefits of Online Banking Adoption

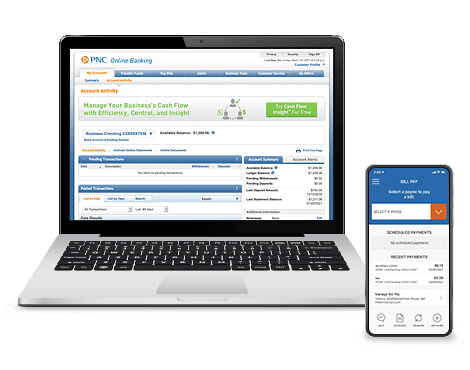

1. Convenience and Accessibility

One of the main reasons for the widespread adoption of online banking is its convenience. Customers can access their accounts 24/7 from anywhere, eliminating the need for physical branch visits.

2. Faster Transactions

Online banking allows instant transfers, bill payments, and mobile deposits, reducing the waiting time associated with traditional banking.

3. Cost-Effective Banking

Most online banking services come with lower fees compared to traditional banking methods. Many banks even offer free online accounts with no minimum balance requirements.

4. Enhanced Security Features

Banks implement strong security measures such as multi-factor authentication (MFA), encryption, and real-time fraud monitoring to protect user data and transactions.

5. Paperless Statements and Digital Records

Online banking helps reduce paperwork by offering digital statements and transaction histories that are easily accessible at any time.

Challenges in Online Banking Adoption

1. Security Concerns

Many users worry about online fraud, phishing scams, and identity theft, making them hesitant to adopt online banking fully.

2. Lack of Digital Literacy

Some individuals, especially older adults, may struggle with navigating digital banking platforms due to limited technical knowledge.

3. Internet Dependence

Online banking requires a stable internet connection, which can be a challenge in remote or underdeveloped areas.

4. Customer Support Limitations

While online banking is efficient, some users prefer in-person interactions for complex financial matters or dispute resolutions.

5. Fraud and Cybersecurity Threats

Hackers continuously develop new techniques to breach security, making it essential for both banks and users to remain vigilant against cyber threats.

How to Adopt Online Banking Safely and Effectively

1. Choose a Reputable Bank

Select a financial institution with strong security protocols, positive customer reviews, and a reliable digital banking platform.

2. Enable Multi-Factor Authentication (MFA)

MFA adds an extra layer of security by requiring multiple verification steps before granting account access.

3. Use Strong and Unique Passwords

Create complex passwords that include a mix of letters, numbers, and special characters. Avoid using the same password for multiple accounts.

4. Monitor Account Activity Regularly

Check your transactions frequently to spot any unauthorized activity and report suspicious transactions immediately.

5. Avoid Public Wi-Fi for Banking Transactions

Public Wi-Fi networks are often insecure, making them a common target for hackers looking to steal sensitive banking information.

6. Keep Your Banking App Updated

Regular updates often include security enhancements that protect against new vulnerabilities and cyber threats.

7. Beware of Phishing Scams

Do not click on suspicious links or provide personal information to unverified sources claiming to be from your bank.

8. Use Secure Devices

Always access your online banking accounts from secure and trusted devices with updated antivirus software installed.

9. Set Up Alerts and Notifications

Enable email or SMS alerts for transactions, logins, and suspicious activity to stay informed about account activity.

10. Educate Yourself on Banking Security

Stay informed about the latest cybersecurity practices and threats to ensure safe online banking habits.

10 Essential Tips for Online Banking Adoption

- Choose an online banking service that fits your financial needs.

- Regularly update passwords and enable security features.

- Use biometric authentication (fingerprint or facial recognition) when available.

- Keep your banking app and operating system updated.

- Always log out from banking sessions, especially on shared devices.

- Do not share sensitive information via email or text messages.

- Check your bank’s fraud protection policies and ensure you understand them.

- Opt for banks that offer customer service through multiple channels, including live chat and phone support.

- Back up important financial documents and transaction receipts.

- Stay cautious about new banking-related scams and fraudulent schemes.

10 Frequently Asked Questions (FAQs) About Online Banking Adoption

1. Is online banking safe?

Yes, online banking is safe when proper security measures like MFA, encryption, and fraud monitoring are in place.

2. Can I access my online bank account from multiple devices?

Yes, but ensure that each device has security features such as strong passwords and updated antivirus software.

3. What should I do if I forget my online banking password?

Most banks offer password reset options through email or phone verification. Contact customer support if needed.

4. Are there any fees for online banking?

Many banks offer free online banking services, but some may charge for premium features or transactions.

5. Can I deposit checks through online banking?

Yes, many banks offer mobile check deposit features through their banking apps.

6. How do I know if an email or message from my bank is legitimate?

Verify the sender’s email address and avoid clicking on links in suspicious messages. Contact your bank directly for verification.

7. What should I do if I suspect fraudulent activity in my account?

Immediately report any suspicious transactions to your bank and change your account credentials.

8. Is online banking available 24/7?

Yes, most online banking services are available around the clock, except during scheduled maintenance.

9. Can I set spending limits for my online transactions?

Yes, many banks allow users to set transaction limits and customize security settings.

10. What happens if I lose my phone with my banking app installed?

Immediately notify your bank, change your passwords, and use remote-wipe features if available to protect your data.

Conclusion

Online banking adoption offers significant benefits, including convenience, cost savings, and enhanced security. However, concerns about fraud, cybersecurity, and accessibility can make some users hesitant. By following best practices such as using strong security measures, staying informed about digital threats, and choosing reputable banking institutions, users can safely enjoy the benefits of online banking.

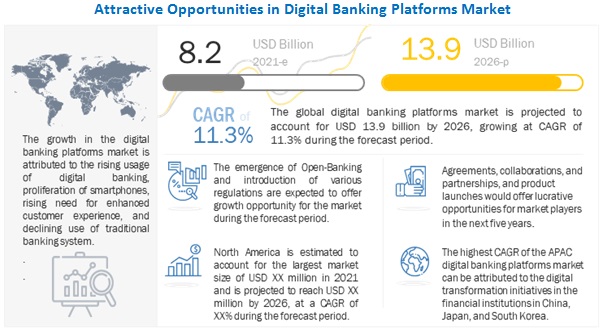

As technology advances, online banking will continue to evolve, providing even greater security and ease of use. Embracing these innovations will ensure that individuals and businesses can manage their finances efficiently and securely in the digital era.