Home Insurance Deals: The Best Ways to Save on Coverage. Home insurance is essential for protecting your home and belongings from unexpected damages and disasters. Finding the best home insurance deals can save you money while ensuring you have the right coverage. This guide explores everything you need to know about home insurance deals, including how to find the best rates, factors affecting costs, tips for maximizing savings, and frequently asked questions.

Understanding Home Insurance Deals

Home insurance deals refer to discounted or specially priced insurance policies that provide homeowners with comprehensive coverage at lower rates. Many insurance providers offer deals based on bundling policies, maintaining a good credit score, or installing security features in your home.

Types of Home Insurance Coverage

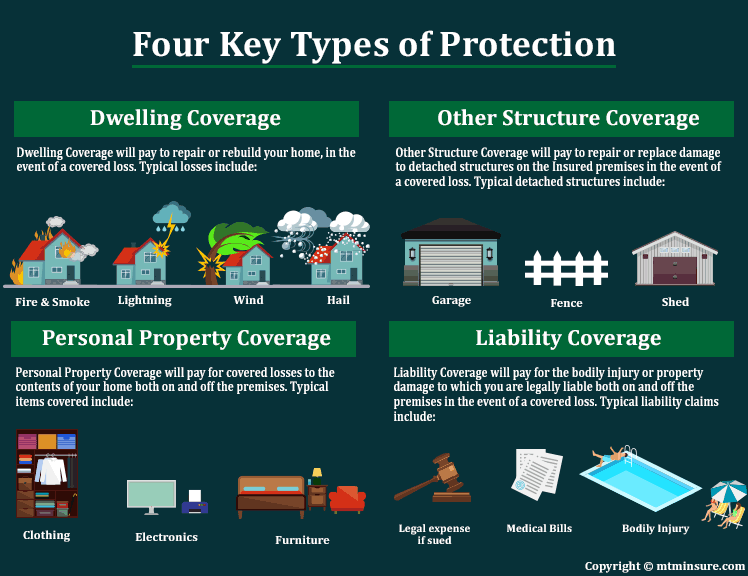

- Dwelling Coverage – Protects the structure of your home from covered perils like fire, storms, and vandalism.

- Personal Property Coverage – Covers belongings like furniture, electronics, and appliances in case of theft or damage.

- Liability Protection – Helps cover legal expenses if someone is injured on your property.

- Additional Living Expenses (ALE) – Pays for temporary housing if your home becomes uninhabitable due to a covered event.

- Medical Payments Coverage – Covers minor medical costs for guests injured on your property.

- Flood and Earthquake Insurance – Often available as add-ons for homeowners in high-risk areas.

Factors That Affect Home Insurance Costs

- Location: High-risk areas (flood zones, crime-prone neighborhoods) increase premiums.

- Home Value and Construction: Larger homes and expensive materials cost more to insure.

- Credit Score: A higher credit score can lead to lower premiums.

- Claims History: A history of frequent claims raises rates.

- Security Features: Smoke detectors, alarms, and security systems can earn discounts.

- Deductible Amount: Choosing a higher deductible reduces monthly premiums.

How to Find the Best Home Insurance Deals

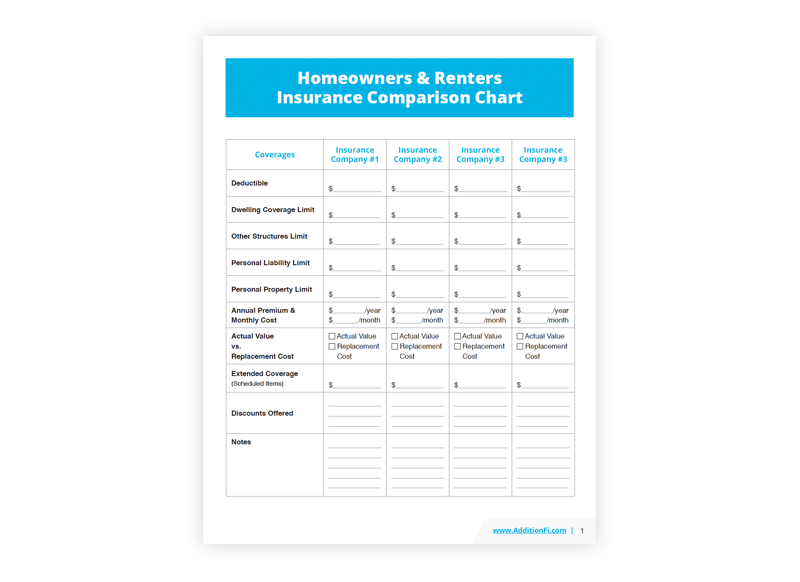

1. Compare Multiple Providers

Get quotes from at least three insurance companies to compare coverage options and prices.

2. Bundle Home and Auto Insurance

Many insurers offer discounts when you bundle home and auto policies together.

3. Improve Home Security

Installing security cameras, deadbolt locks, and alarm systems can lower premiums.

4. Raise Your Deductible

Opting for a higher deductible reduces your premium, but be sure you can afford it in case of a claim.

5. Maintain a Good Credit Score

A strong credit score can help you qualify for better rates and discounts.

6. Ask About Discounts

Many insurers offer discounts for seniors, non-smokers, and long-term policyholders.

7. Avoid Making Small Claims

Frequent claims can increase your rates; consider paying for minor repairs out of pocket.

8. Review Your Policy Annually

Check your policy each year to ensure you’re getting the best deal and update coverage as needed.

9. Join a Homeowners Association

Some insurers offer discounts to HOA members due to lower risk levels in managed communities.

10. Negotiate with Your Insurer

Loyal customers may qualify for special loyalty discounts; always ask if better rates are available.

10 Tips to Save More on Home Insurance

- Shop Around Annually – Never settle for the first quote; compare policies yearly.

- Upgrade Your Home’s Electrical and Plumbing – Reduces the risk of fire and water damage.

- Avoid High-Risk Additions – Pools and trampolines can increase your premium.

- Live Near Emergency Services – Homes close to fire stations may get lower rates.

- Use Loyalty Discounts – Long-term customers may receive premium reductions.

- Go Paperless – Some companies offer discounts for choosing electronic billing.

- Enroll in Auto-Pay – Automatic payments can sometimes earn small discounts.

- Inquire About Occupational Discounts – Teachers, military members, and first responders may receive lower rates.

- Pay Annually Instead of Monthly – Many insurers offer discounts for lump-sum payments.

- Ask About Claims-Free Discounts – If you haven’t filed a claim in years, you may qualify for a lower rate.

10 FAQs About Home Insurance Deals

1. How can I lower my home insurance premiums?

You can lower premiums by bundling policies, raising deductibles, improving home security, and maintaining a good credit score.

2. Is home insurance mandatory?

While not legally required, mortgage lenders usually require home insurance.

3. What’s the best home insurance company?

The best company depends on your location, coverage needs, and budget. Compare multiple providers for the best deal.

4. Can I change my insurance provider anytime?

Yes, you can switch providers at any time, though you may face cancellation fees.

5. Does home insurance cover natural disasters?

Standard policies cover common disasters like fire and storms but may exclude floods and earthquakes, which require separate coverage.

6. How often should I review my home insurance policy?

You should review your policy annually or whenever you renovate your home or purchase high-value items.

7. Can home insurance cover rental properties?

Standard policies do not cover rental properties; you’ll need landlord insurance.

8. What is an insurance deductible?

A deductible is the amount you pay out of pocket before insurance covers the rest.

9. What happens if I miss a premium payment?

Missing payments may result in policy cancellation or increased rates.

10. How do I file a home insurance claim?

Contact your insurer, document damages, and provide necessary evidence such as photos and receipts.

Conclusion

Finding the best home insurance deals requires research, comparison, and strategic planning. By shopping around, bundling policies, and maintaining a good credit score, you can significantly reduce your premiums without sacrificing coverage. Additionally, taking advantage of available discounts and improving home security can help maximize your savings.

Understanding how home insurance works and what factors influence pricing will allow you to make informed decisions. Whether you’re a first-time homebuyer or looking to switch providers, following these tips will help you secure the best deal and ensure your home remains protected against unexpected events.