Homeowners Insurance Rates: Lower Costs and Get the Coverage. Homeowners insurance rates can be a significant expense for homeowners, but understanding what influences these rates and how to lower them can help you save money while maintaining comprehensive coverage. In this article, we will explore everything you need to know about homeowners insurance rates, factors that affect them, tips for reducing costs, frequently asked questions, and key takeaways.

What Are Homeowners Insurance Rates?

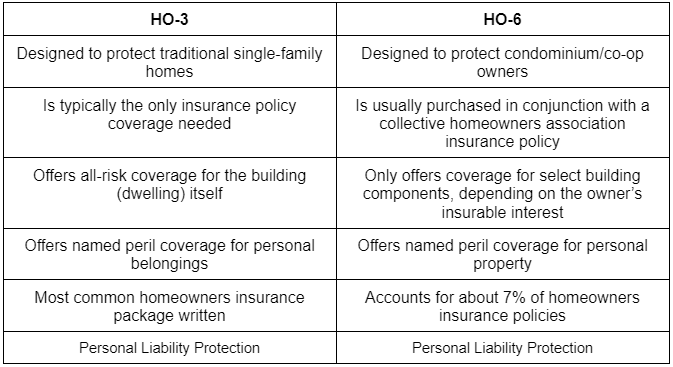

Homeowners insurance rates refer to the amount policyholders pay for coverage against property damage, theft, liability, and other potential risks. These rates vary based on factors such as location, home value, credit score, and claims history.

Factors That Affect Homeowners Insurance Rates

Understanding what affects your homeowners insurance rates can help you make informed decisions. Here are some of the most critical factors:

1. Location

- Homes in areas prone to natural disasters (hurricanes, wildfires, floods) typically have higher rates.

- Crime rates in your neighborhood can impact premiums.

- Proximity to a fire station may lower your insurance costs.

2. Home Value and Replacement Cost

- The cost to rebuild your home influences the insurance premium.

- Higher-value homes require more coverage, leading to higher rates.

3. Construction Materials

- Brick homes may have lower premiums than wooden homes due to fire resistance.

- Older homes may have higher rates if they require expensive repairs or updates.

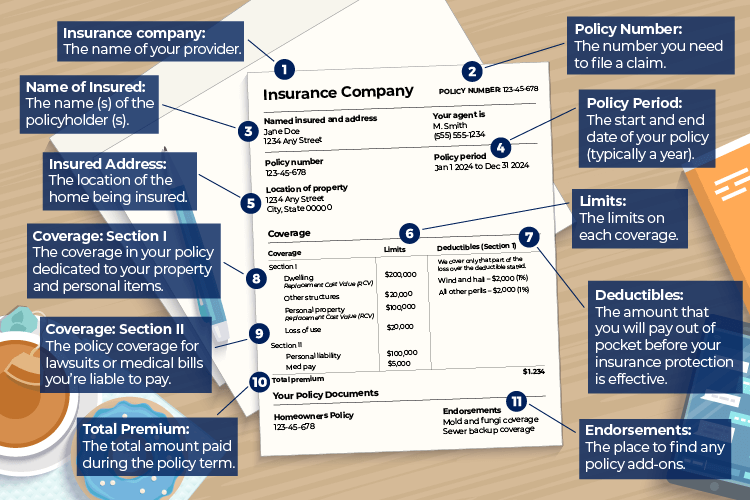

4. Coverage Amount and Deductibles

- More coverage increases premiums.

- Higher deductibles lower premiums but increase out-of-pocket expenses for claims.

5. Claims History

- Multiple past claims can raise rates.

- A clean claims history may qualify you for discounts.

6. Credit Score

- Many insurers use credit scores to assess risk.

- A higher credit score can lead to lower premiums.

7. Security Features and Safety Measures

- Installing burglar alarms, smoke detectors, and deadbolt locks can reduce rates.

- Smart home security systems may qualify for discounts.

10 Tips to Lower Your Homeowners Insurance Rates

Reducing your homeowners insurance rates can be easier than you think. Here are ten effective strategies:

- Compare Quotes from Multiple Insurers – Get estimates from different providers to find the best deal.

- Increase Your Deductible – A higher deductible can lower your premium.

- Bundle Home and Auto Insurance – Many insurers offer discounts for bundling policies.

- Improve Your Credit Score – Paying bills on time and reducing debt can help.

- Install Security Features – Burglar alarms and smoke detectors can reduce premiums.

- Avoid Small Claims – Filing too many claims can increase rates.

- Ask About Discounts – Some insurers offer discounts for being claim-free, senior citizens, or veterans.

- Maintain Your Home – Regular maintenance prevents costly damages and insurance claims.

- Stay with the Same Insurer – Long-term customers may receive loyalty discounts.

- Consider Home Improvements – Upgrading plumbing, electrical, and roofing can lower insurance costs.

10 Frequently Asked Questions About Homeowners Insurance Rates

1. How are homeowners insurance rates calculated?

Insurers consider factors like home value, location, claims history, and credit score when determining rates.

2. How can I lower my homeowners insurance costs?

You can reduce costs by increasing your deductible, bundling policies, improving security, and maintaining a good credit score.

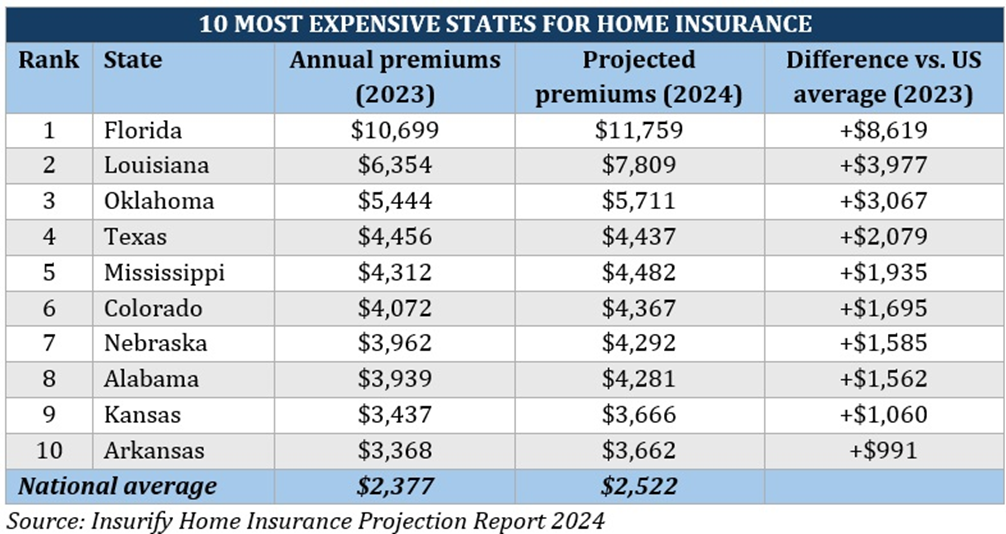

3. Does my location affect my insurance rates?

Yes, homes in disaster-prone or high-crime areas typically have higher rates.

4. What is the average cost of homeowners insurance?

The average cost varies by state and home value but typically ranges between $1,200 and $3,000 per year.

5. Does my credit score impact my homeowners insurance rate?

Yes, many insurers use credit scores to assess risk, which can affect premiums.

6. What does homeowners insurance cover?

It usually covers property damage, personal belongings, liability protection, and additional living expenses if the home becomes uninhabitable.

7. Are there any discounts available for homeowners insurance?

Yes, insurers may offer discounts for security systems, bundling policies, and remaining claim-free.

8. How often should I review my homeowners insurance policy?

It is advisable to review your policy annually or after significant home improvements.

9. Will making a claim increase my homeowners insurance rate?

Yes, frequent claims can result in higher premiums.

10. Is flood insurance included in homeowners insurance?

No, flood insurance is usually a separate policy offered through the National Flood Insurance Program (NFIP) or private insurers.

Conclusion

Homeowners insurance rates are influenced by multiple factors, including location, home value, claims history, and credit score. By understanding these factors and implementing cost-saving strategies, you can significantly lower your premiums while maintaining adequate coverage. Comparing multiple insurers, increasing your deductible, improving home security, and taking advantage of discounts are some of the most effective ways to reduce costs.

Ultimately, homeowners insurance is an essential investment in protecting your home and financial stability. Regularly reviewing your policy and staying informed about cost-saving options can help you manage expenses while ensuring comprehensive coverage for your property. Take proactive steps today to optimize your homeowners insurance rates and enjoy peace of mind knowing your home is well-protected.