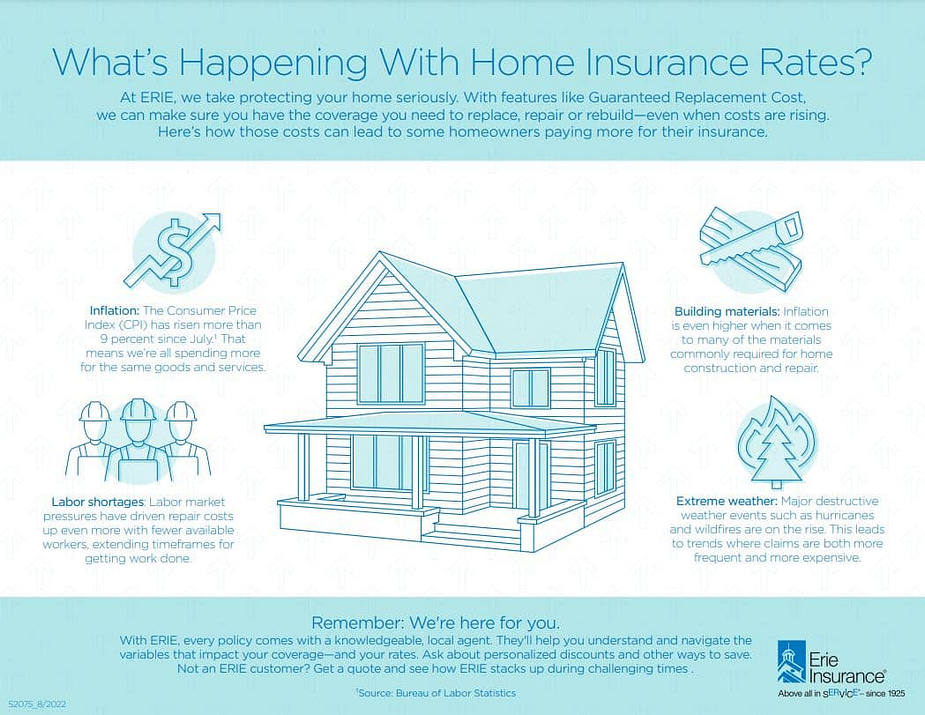

Homeowners Insurance Discount: How to Save Big on Your Policy. Homeowners insurance is a crucial investment for protecting your home and belongings. However, the cost of premiums can be high. Fortunately, there are numerous ways to reduce these costs by taking advantage of homeowners insurance discounts. In this article, we’ll explore various discounts available, how to qualify for them, and tips to maximize your savings.

Understanding Homeowners Insurance Discounts

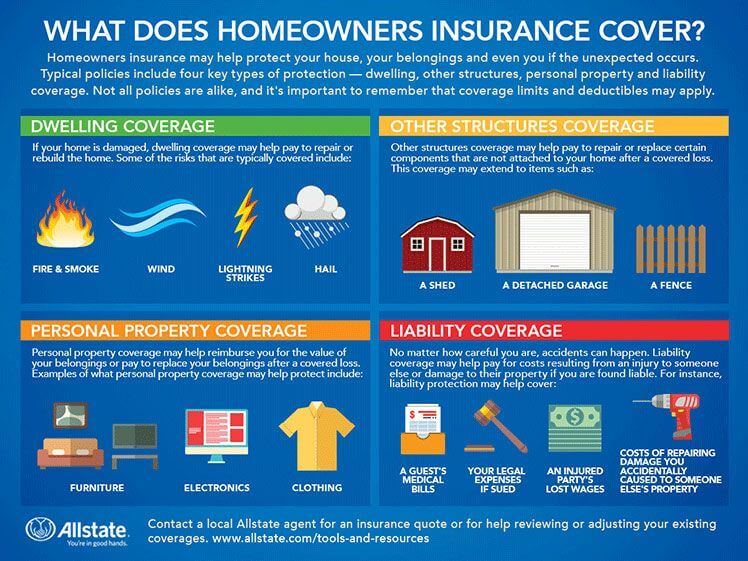

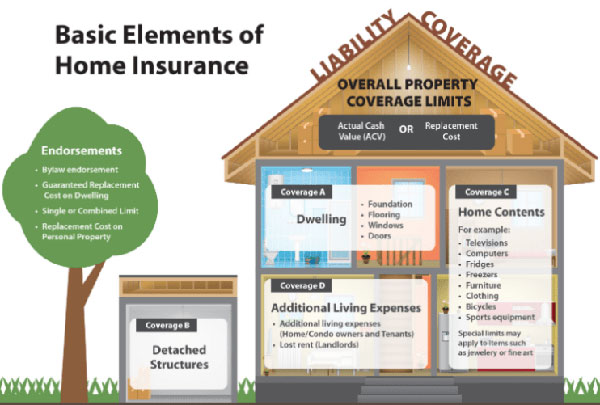

Homeowners insurance discounts are incentives offered by insurance companies to lower your premium based on specific factors such as home security, loyalty, or bundling policies. These discounts vary by insurer and state but can significantly reduce your overall insurance costs.

Common Types of Homeowners Insurance Discounts

- Multi-Policy Discount – Bundling home and auto insurance can provide substantial savings.

- Security System Discount – Installing security systems like alarms or cameras can reduce your premium.

- Loyalty Discount – Staying with the same insurer for several years may earn you a discount.

- Claims-Free Discount – Avoiding claims for a certain period can lower your insurance costs.

- New Home Discount – Newly constructed homes often qualify for lower rates.

- Gated Community Discount – Living in a gated community with added security can help you save.

- Non-Smoker Discount – Homes without smokers are less prone to fire risks and qualify for discounts.

- Smart Home Discount – Using smart home devices like leak detectors can earn you savings.

- Paperless Billing Discount – Opting for electronic statements may qualify you for a small discount.

- Higher Deductible Discount – Choosing a higher deductible lowers your premium payments.

How to Qualify for Homeowners Insurance Discounts

To qualify for homeowners insurance discounts, you need to meet specific requirements set by your insurer. Here are some steps to ensure you receive the maximum discounts available:

- Review Your Policy Annually: Insurance policies change, and new discounts may become available.

- Upgrade Your Home Security: Install security measures like burglar alarms, smoke detectors, and surveillance cameras.

- Maintain a Good Credit Score: Many insurers consider credit scores when determining discounts.

- Avoid Filing Small Claims: The fewer claims you make, the more likely you are to receive a claims-free discount.

- Bundle Insurance Policies: Combining home and auto insurance with the same provider can result in lower premiums.

- Ask Your Insurer About Discounts: Some discounts may not be advertised, so it’s always a good idea to ask.

10 Tips to Maximize Your Homeowners Insurance Discount

- Shop Around – Compare multiple insurance providers to find the best discounts.

- Improve Your Home Security – Install modern security systems to reduce risks.

- Increase Your Deductible – A higher deductible means lower premiums.

- Bundle Policies – Consider bundling auto, home, and life insurance with the same company.

- Maintain a Good Credit Score – A higher credit score can qualify you for better rates.

- Install Safety Features – Smoke detectors, sprinkler systems, and reinforced windows can help.

- Stay Claims-Free – Avoiding small claims keeps your insurance costs lower.

- Opt for Paperless Billing – Many insurers offer discounts for electronic billing.

- Check for Age or Loyalty Discounts – Some insurers provide discounts for seniors or long-term customers.

- Ask for Hidden Discounts – Some insurers don’t advertise all available discounts, so always inquire.

10 Frequently Asked Questions About Homeowners Insurance Discounts

- What is the biggest discount on homeowners insurance?

- Bundling home and auto insurance usually provides the biggest savings.

- Do security systems lower homeowners insurance?

- Yes, installing security systems can qualify you for discounts.

- Can I get a discount for living in a gated community?

- Yes, many insurers offer gated community discounts due to lower risk factors.

- Do loyalty discounts really save money?

- Yes, staying with the same insurer can lead to long-term savings.

- Are there discounts for new homeowners?

- Newly constructed homes often qualify for lower insurance rates.

- Does my credit score affect homeowners insurance discounts?

- Yes, a good credit score can help you get better rates.

- Can I get a discount for being claims-free?

- Yes, insurers reward homeowners who avoid filing claims for extended periods.

- Do smart home devices help reduce insurance costs?

- Yes, smart devices that prevent damage (such as water leak detectors) can lead to discounts.

- How do I find out what discounts my insurer offers?

- Check your insurer’s website or speak directly with an agent.

- Do older homes qualify for discounts?

- Some insurers offer discounts if older homes are upgraded with modern safety features.

Conclusion

Homeowners insurance discounts provide an excellent way to lower your insurance premiums without sacrificing coverage. By understanding the various discounts available and taking steps to qualify for them, you can maximize your savings. From installing security systems to bundling policies, every small step helps in reducing your costs.

To ensure you’re getting the best homeowners insurance discounts, review your policy regularly, compare providers, and ask your insurer about available savings. By taking these proactive steps, you can enjoy comprehensive coverage at a lower cost, giving you peace of mind and financial protection.