Affordable Home Coverage: Protecting Your Home on a Budget. Owning a home is a significant investment, and protecting it with the right home insurance policy is crucial. However, finding affordable home coverage that offers comprehensive protection without breaking the bank can be challenging. This guide will walk you through everything you need to know about securing cost-effective home insurance while ensuring adequate protection for your property and valuables.

What is Affordable Home Coverage?

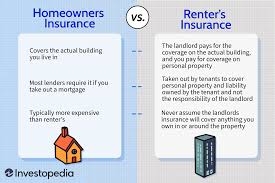

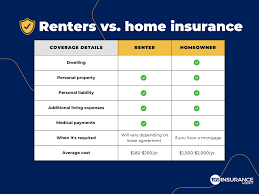

Affordable home coverage refers to budget-friendly homeowners insurance policies that provide essential protections, such as property damage, liability coverage, and personal property protection, at a reasonable price. These policies help homeowners safeguard their homes against unforeseen events, including natural disasters, theft, and accidents.

Why Home Insurance is Essential

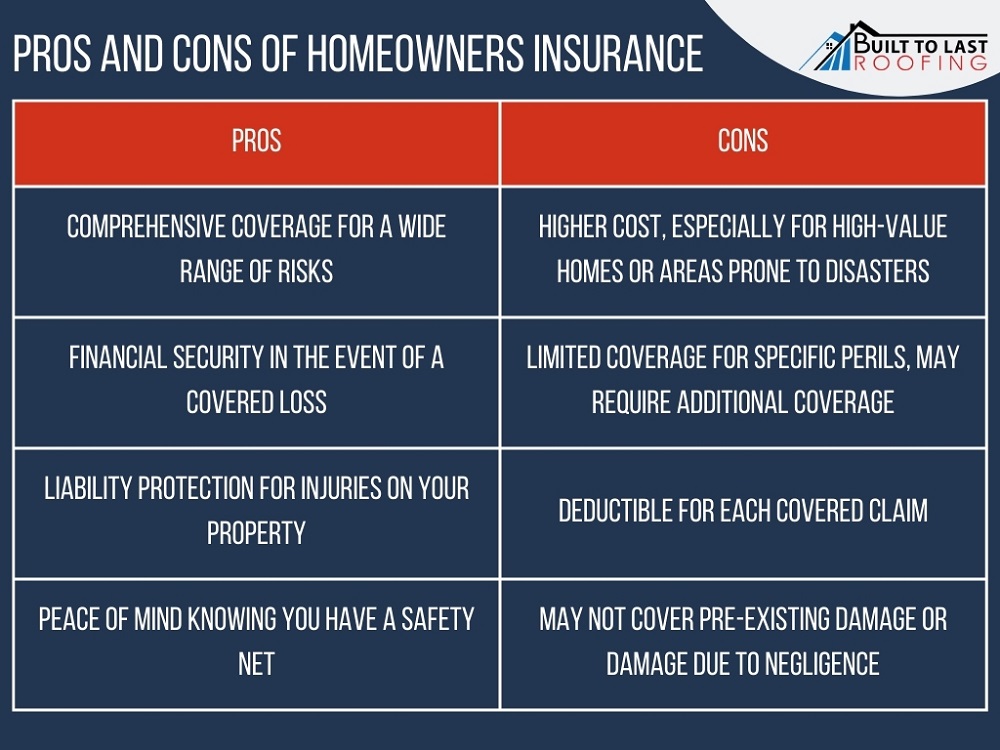

Home insurance is not just a legal requirement in many cases (especially if you have a mortgage); it also provides financial security. Here’s why it’s crucial:

- Protects your home from natural disasters, fire, and theft

- Covers liability expenses in case of injuries on your property

- Offers peace of mind knowing that repairs and damages won’t result in financial hardship

How to Get Affordable Home Coverage

1. Compare Multiple Insurance Quotes

One of the best ways to secure affordable home insurance is by comparing quotes from different providers. Online comparison tools allow you to evaluate coverage options and pricing side by side.

2. Choose a Higher Deductible

Opting for a higher deductible can significantly reduce your monthly premiums. However, ensure you have enough savings to cover the deductible in case of a claim.

3. Bundle Your Insurance Policies

Many insurance companies offer discounts if you bundle home and auto insurance together. This strategy can lead to substantial savings.

4. Improve Home Security

Installing security systems, smoke detectors, and burglar alarms can lower your home insurance premiums. Insurers often provide discounts for homes with enhanced safety features.

5. Maintain a Good Credit Score

A strong credit history can positively impact your insurance rates. Pay your bills on time and monitor your credit report for errors to keep your score high.

6. Review and Update Your Policy Annually

Reevaluating your policy each year ensures that you’re not overpaying for unnecessary coverage. Check for discounts and adjust your coverage based on any home improvements.

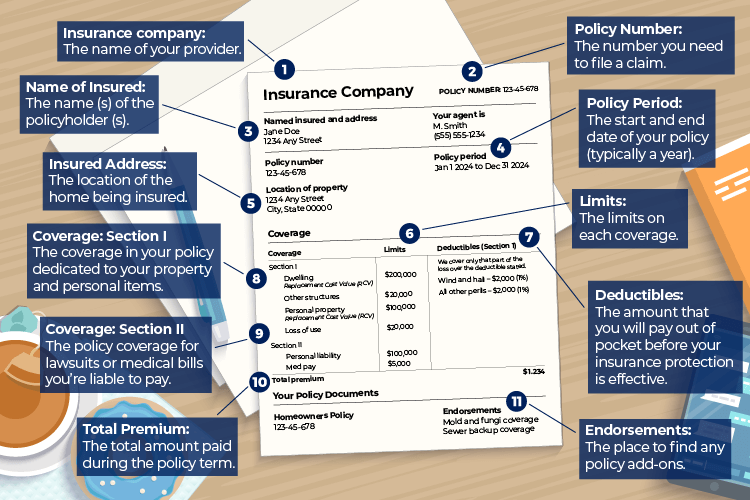

7. Consider Actual Cash Value vs. Replacement Cost

Choosing actual cash value (ACV) over replacement cost value (RCV) can lower premiums, but it means you’ll receive less reimbursement in case of a claim.

8. Look for Discounts

Many insurance providers offer discounts for loyalty, home improvements, being claim-free, or even being a non-smoker. Ask your insurer about available discounts.

9. Avoid Small Claims

Filing multiple small claims can increase your premium rates over time. If possible, handle minor repairs out of pocket to keep your policy affordable.

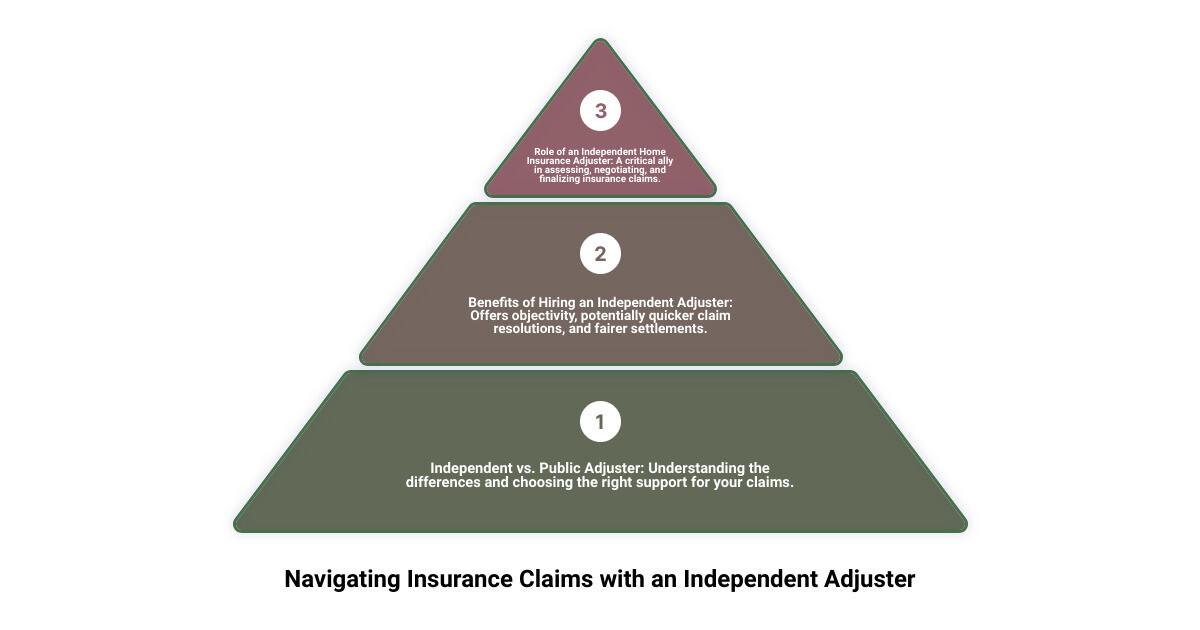

10. Work with an Independent Agent

Independent insurance agents can help you find the best deals by shopping for policies across multiple insurance providers.

10 Tips for Reducing Home Insurance Costs

- Regularly check for policy discounts.

- Improve your home’s safety with security upgrades.

- Increase your deductible to lower monthly premiums.

- Maintain a solid credit score.

- Avoid making unnecessary small claims.

- Bundle home and auto insurance for better rates.

- Compare insurance providers annually.

- Install storm shutters or impact-resistant windows.

- Stay loyal to insurers that offer long-term discounts.

- Make energy-efficient upgrades that qualify for policy discounts.

10 Frequently Asked Questions (FAQs)

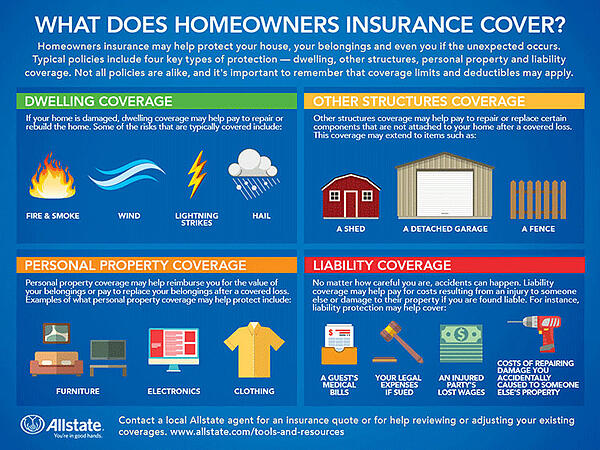

1. What does home insurance typically cover?

Most policies cover damage from fires, storms, theft, and liability protection if someone is injured on your property.

2. Can I negotiate my home insurance premium?

Yes! Many insurers offer discounts, and you can adjust your coverage to match your budget.

3. Is home insurance mandatory?

While not legally required, mortgage lenders typically require homeowners insurance.

4. How do I lower my home insurance cost?

Compare quotes, bundle policies, increase your deductible, and look for discounts.

5. Does home insurance cover natural disasters?

Standard policies cover some disasters, but additional coverage may be needed for floods and earthquakes.

6. What happens if I don’t have home insurance?

Without coverage, you’re financially responsible for any damages or losses to your property.

7. Can I change my home insurance policy anytime?

Yes, you can switch providers or adjust your coverage, but check for cancellation fees.

8. How often should I review my policy?

Annually or whenever significant home changes occur, such as renovations.

9. What’s the difference between ACV and RCV?

ACV pays the depreciated value, while RCV covers the full cost of replacing damaged items.

10. Does home insurance cover mold damage?

It depends on the cause. Mold from sudden leaks may be covered, but gradual damage is typically excluded.

Conclusion

Affordable home coverage is within reach if you take the right steps to compare policies, utilize discounts, and maintain a good credit score. By understanding your options and making strategic decisions, you can protect your home without overspending.

The key to finding cost-effective home insurance is regular policy reviews, proactive home maintenance, and leveraging discounts. With the right approach, you can ensure your home is protected while keeping your insurance costs manageable.