Best Home Insurance Rates: Find Coverage for Your Home. Home insurance is a critical investment that protects your property from unforeseen damages, theft, and natural disasters. Finding the best home insurance rates can save you hundreds of dollars annually while ensuring your home is adequately covered. This guide provides comprehensive insights into securing the most affordable home insurance rates without compromising on coverage.

Understanding Home Insurance Rates

Home insurance rates are influenced by various factors such as location, property value, and coverage limits. Insurers assess these factors to determine the risk associated with insuring your home. Higher risk often translates to higher premiums.

Factors Affecting Home Insurance Rates

- Location: Homes in areas prone to natural disasters or high crime rates typically have higher premiums.

- Property Value: The higher the value of your home, the more it costs to insure.

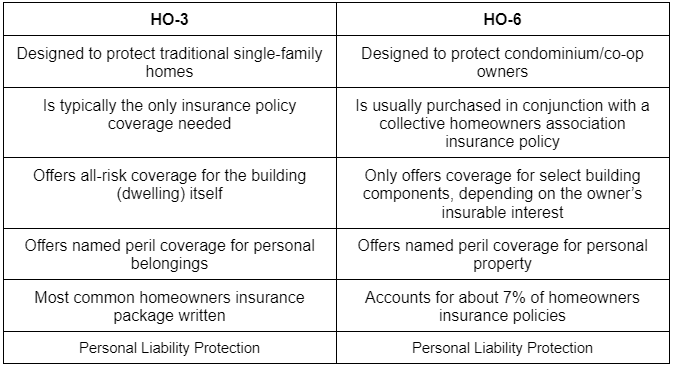

- Coverage Amount: Comprehensive coverage increases premiums compared to basic coverage.

- Home Age and Condition: Older homes or those in poor condition are more expensive to insure.

- Credit Score: A good credit score can significantly reduce your premium rates.

How to Compare Home Insurance Rates

- Online Comparison Tools: Use platforms like Policygenius and The Zebra to compare rates.

- Request Multiple Quotes: Obtain quotes from at least three different insurers.

- Assess Coverage Options: Ensure that the policy covers all essential risks.

Tips to Secure the Best Home Insurance Rates

- Bundle Policies: Combine home and auto insurance for discounts.

- Improve Home Security: Install alarm systems and smoke detectors.

- Increase Deductibles: Higher deductibles lower premium costs.

- Maintain a Good Credit Score: Pay bills on time and reduce debts.

- Review Coverage Annually: Adjust your coverage based on current needs.

- Ask for Discounts: Inquire about available discounts such as loyalty or senior citizen discounts.

- Avoid Small Claims: Limit claims to significant damages only.

- Renovate Your Home: Upgrade plumbing, electrical, and roofing systems.

- Choose a Reputable Insurer: Select companies with good customer service and claim handling.

- Limit High-Risk Additions: Avoid adding structures like swimming pools which increase premiums.

FAQs About Home Insurance Rates

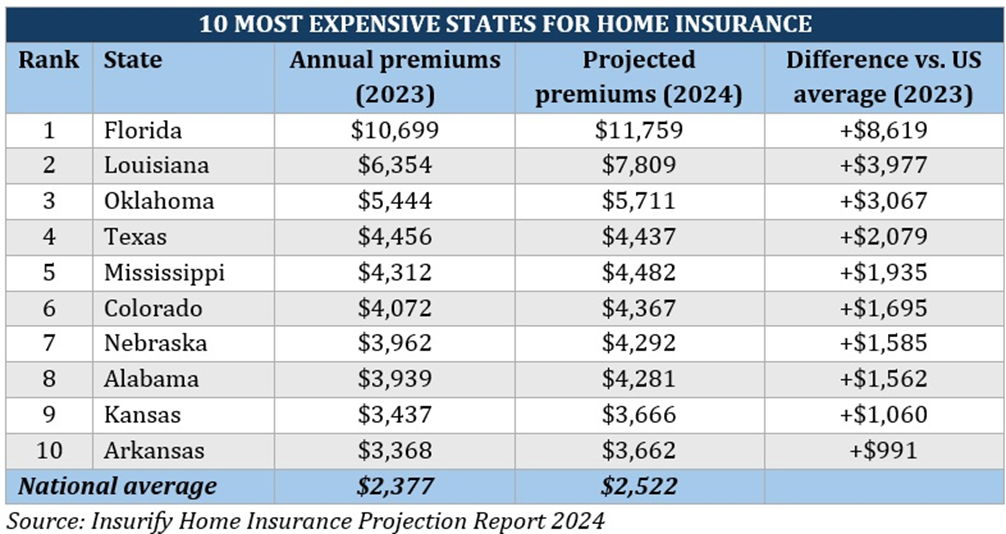

- What is the average cost of home insurance? The average cost ranges from $1,200 to $2,000 annually depending on location and coverage.

- Can I negotiate home insurance rates? Yes, you can negotiate by comparing quotes and requesting discounts.

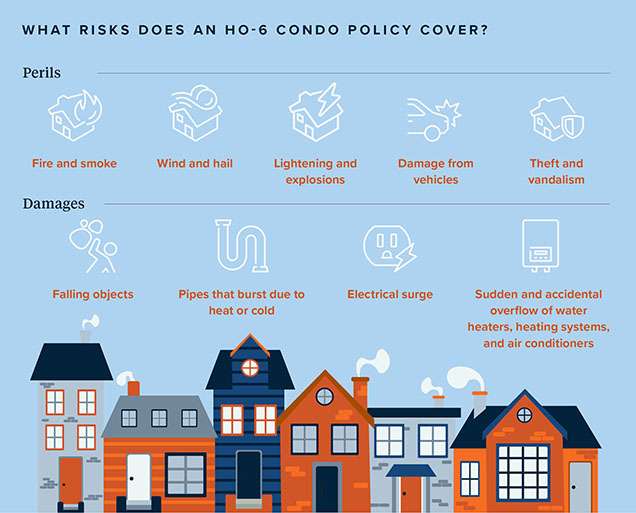

- Does home insurance cover natural disasters? Standard policies cover some disasters, but you may need additional coverage for floods or earthquakes.

- How often should I review my home insurance policy? Review your policy annually or after significant home changes.

- What happens if I miss a payment? Missing payments can lead to policy cancellation.

- Are home insurance rates tax-deductible? Typically, home insurance premiums are not tax-deductible.

- Can my home insurance rates change annually? Yes, rates can change based on inflation, claims history, and insurer policies.

- Does my credit score affect home insurance rates? Yes, a higher credit score can reduce your premiums.

- What is a deductible in home insurance? A deductible is the amount you pay out of pocket before insurance coverage kicks in.

- How can I file a home insurance claim? Contact your insurer, provide necessary documentation, and cooperate with the claims process.

Conclusion

Securing the best home insurance rates requires research, comparison, and proactive measures like maintaining good credit and improving home security. By following the tips provided in this guide, you can find affordable home insurance that offers comprehensive protection for your property.

Choosing the right home insurance policy not only safeguards your home but also provides peace of mind. Regularly reviewing and updating your policy ensures that you continue to receive the best rates and adequate coverage.

Home Insurance Policy Quotes: How to Get the Best Quotes for Your Home Coverage

Home insurance policy quotes are essential for homeowners seeking affordable and comprehensive coverage. Obtaining multiple quotes helps you compare prices, coverage options, and insurer reliability. This guide explores how to get the best home insurance policy quotes and what to consider when choosing a policy.

Importance of Home Insurance Policy Quotes

Quotes provide a detailed breakdown of coverage options and associated costs. They help you make informed decisions and avoid overpaying for unnecessary coverage.

Factors That Influence Home Insurance Policy Quotes

- Location: Proximity to fire stations, crime rates, and natural disaster risks.

- Home Value: Higher value homes require more coverage.

- Coverage Types: Basic, broad, and comprehensive coverage affect quotes.

- Deductibles: Higher deductibles reduce premium quotes.

- Claims History: A history of claims can increase quotes.

How to Obtain Accurate Home Insurance Policy Quotes

- Use Online Tools: Platforms like Insurify and Policygenius offer accurate quotes.

- Consult Local Agents: Local agents provide personalized quotes.

- Provide Accurate Information: Ensure all home details are accurate.

Tips for Getting the Best Home Insurance Policy Quotes

- Compare Multiple Quotes: Don’t settle for the first quote you receive.

- Evaluate Coverage Needs: Choose coverage that suits your home and budget.

- Ask About Discounts: Inquire about bundling, security system, and loyalty discounts.

- Review Deductibles: Opt for higher deductibles to lower premiums.

- Improve Home Security: Enhance security to reduce quotes.

- Maintain Good Credit: A high credit score lowers quotes.

- Avoid Frequent Claims: Limit claims to significant incidents.

- Update Home Systems: Modernize electrical, plumbing, and roofing systems.

- Regular Policy Reviews: Review and adjust coverage annually.

- Choose Reputable Insurers: Select insurers with good reviews and claims handling.

FAQs About Home Insurance Policy Quotes

- What is included in a home insurance policy quote? Coverage details, premium costs, and deductibles.

- How long is a home insurance quote valid? Typically valid for 30 to 60 days.

- Can I get a home insurance quote without an inspection? Yes, but an inspection may be required later.

- Do all insurers offer free quotes? Most insurers provide free quotes.

- Can I change my coverage after receiving a quote? Yes, you can adjust coverage before finalizing.

- Are online quotes accurate? Generally accurate, but final rates may vary after inspection.

- How does my credit score affect quotes? Higher scores lead to lower quotes.

- What is a binder in home insurance? A temporary policy until the final policy is issued.

- Can I negotiate home insurance quotes? Yes, especially if you have multiple quotes.

- What happens if I decline a quote? There are no penalties for declining quotes.

Conclusion

Obtaining multiple home insurance policy quotes ensures you find the best coverage at the most affordable rates. Accurate information, comparison tools, and discount inquiries are key to securing favorable quotes.

A well-researched home insurance policy not only protects your home but also offers financial security. Regularly reviewing quotes and updating your policy guarantees that you receive the best rates and coverage for your needs.