Home Insurance Options Available: Choosing the Best Coverage. Home insurance is a critical safeguard for protecting your most valuable asset—your home. With numerous home insurance options available, it is essential to understand the various coverage types, benefits, and considerations before making a choice. This guide explores the available home insurance options, helping homeowners select the best policy for their needs.

What is Home Insurance?

Home insurance, also known as homeowners insurance, is a type of property insurance that covers losses and damages to a person’s residence, along with furnishings and other assets in the home. It also provides liability coverage against accidents in the home or on the property.

Types of Home Insurance Options Available

1. Basic Homeowners Insurance (HO-1)

This is a bare-bones policy that covers the structure of your home and a few specific perils such as fire, theft, and certain natural disasters.

2. Broad Form Insurance (HO-2)

Provides broader coverage than HO-1, including protection against falling objects, accidental water damage, and more.

3. Special Form Insurance (HO-3)

The most popular policy, covering all perils except those explicitly excluded, such as floods and earthquakes.

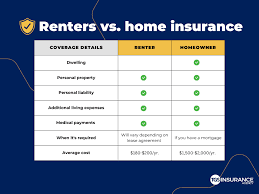

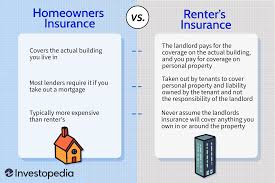

4. Tenant’s Insurance (HO-4)

Designed for renters, covering personal belongings and providing liability coverage but not the building itself.

5. Comprehensive Form Insurance (HO-5)

Offers the most extensive coverage, including high-value items like jewelry and electronics.

6. Condo Insurance (HO-6)

For condominium owners, covering personal property and interior structures.

7. Mobile Home Insurance (HO-7)

Tailored for mobile or manufactured homes.

8. Older Home Insurance (HO-8)

Covers homes that do not meet the standards of newer homes, often older or historic properties.

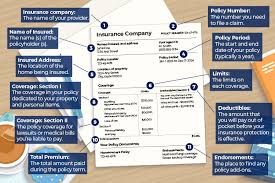

Key Coverage Areas in Home Insurance

- Dwelling Coverage: Protects the structure of your home.

- Personal Property Coverage: Covers your belongings.

- Liability Protection: Provides legal protection against lawsuits.

- Additional Living Expenses: Pays for temporary living costs if your home becomes uninhabitable.

Benefits of Home Insurance

- Financial Protection: Covers repair or rebuilding costs.

- Liability Coverage: Protects against legal claims.

- Peace of Mind: Reduces stress during emergencies.

How to Choose the Best Home Insurance Option

- Assess Your Needs: Evaluate your home value and belongings.

- Compare Policies: Look at different providers and coverage options.

- Check the Coverage Limits: Ensure the policy covers the full value of your home.

- Understand Exclusions: Be aware of what is not covered.

- Look for Discounts: Bundle with auto insurance or install security systems.

10 Tips for Selecting Home Insurance Options Available

- Shop around and compare quotes.

- Assess your home’s value accurately.

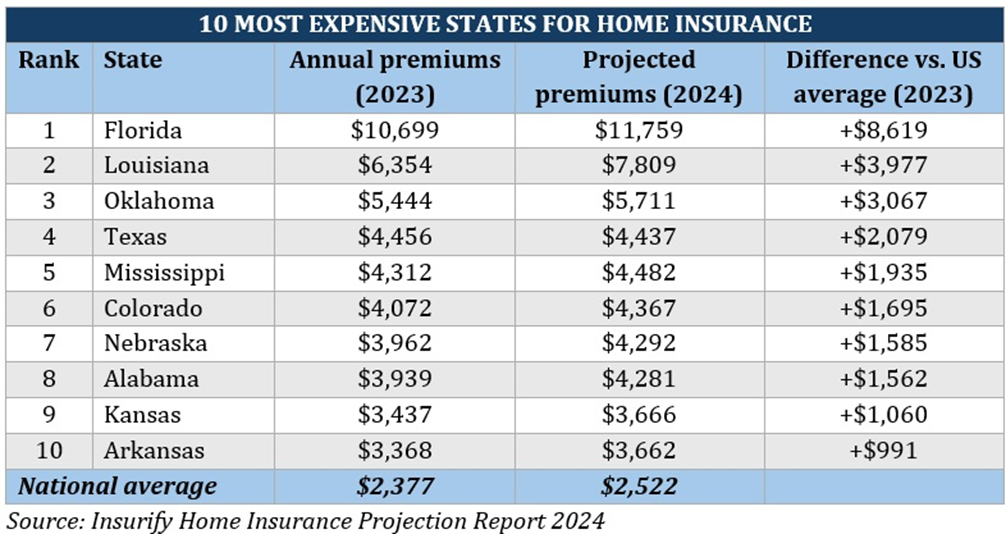

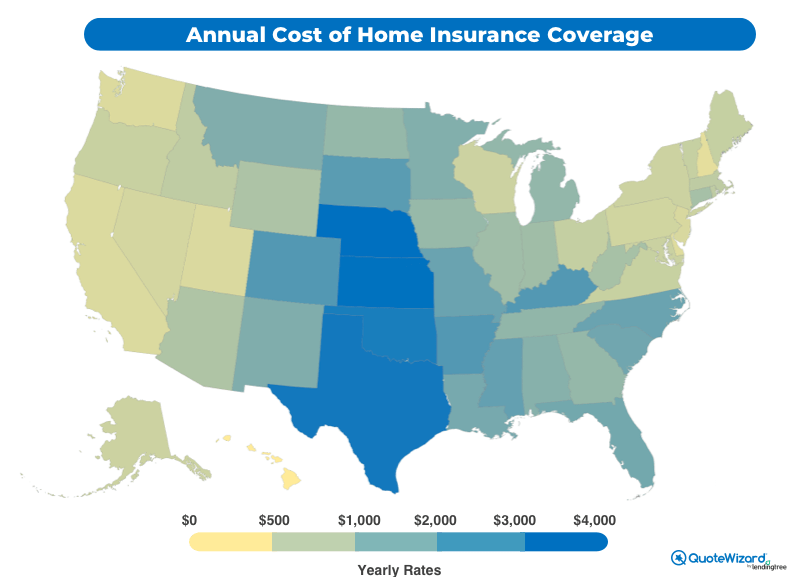

- Consider the location and associated risks.

- Review the policy’s deductible.

- Look for bundling discounts.

- Evaluate the insurer’s reputation.

- Understand the claims process.

- Regularly update your coverage.

- Inquire about additional coverages.

- Seek professional advice if unsure.

10 Frequently Asked Questions About Home Insurance Options Available

- What is the most common type of home insurance? HO-3 policies are the most popular.

- Does home insurance cover natural disasters? Standard policies cover some disasters, but not floods or earthquakes.

- How is home insurance cost calculated? Based on home value, location, and coverage amount.

- Can I change my home insurance policy? Yes, you can update or switch policies.

- What happens if I don’t have home insurance? You risk financial loss from damages or lawsuits.

- Is home insurance required by law? No, but mortgage lenders usually require it.

- What is a deductible? The amount you pay out-of-pocket before insurance covers the rest.

- Does home insurance cover theft? Yes, personal property coverage includes theft.

- Can I bundle home and auto insurance? Yes, many insurers offer discounts for bundling.

- How do I file a home insurance claim? Contact your insurer, document damages, and submit a claim.

Conclusion

Home insurance options available today offer homeowners a variety of coverage levels to suit their needs. From basic protection to comprehensive coverage, understanding the different policies ensures you choose the right insurance for your home. Take the time to assess your needs, compare options, and seek expert advice to secure the best home insurance policy.

In a world full of uncertainties, having the right home insurance provides peace of mind, financial protection, and a safety net for unexpected events. Whether you are a new homeowner or looking to update your current policy, the home insurance options available ensure that your home remains protected in every situation.