Protect Home Insurance: Securing Your Property and Savings. Home insurance is an essential safeguard that protects homeowners from unexpected financial burdens due to damage, theft, or liability claims. Understanding how to optimize and protect home insurance ensures you get the best coverage while avoiding unnecessary costs. In this guide, we explore everything you need to know to protect your home insurance policy and maximize its benefits.

Understanding Home Insurance Coverage

1. What Is Home Insurance?

Home insurance is a policy that provides financial protection against risks such as fire, theft, natural disasters, and liability claims. It ensures homeowners can recover from damages without bearing the full financial burden.

2. Types of Home Insurance Policies

- HO-1 (Basic Form): Covers specific perils like fire, theft, and vandalism.

- HO-2 (Broad Form): Covers a wider range of perils, including falling objects and water damage.

- HO-3 (Special Form): The most common policy, covering all perils except those explicitly excluded.

- HO-5 (Comprehensive Form): Offers broader protection, including personal belongings at replacement cost.

- HO-6 (Condo Insurance): Specifically for condominium owners.

- HO-8 (Older Homes Insurance): Designed for historic or older homes with unique structures.

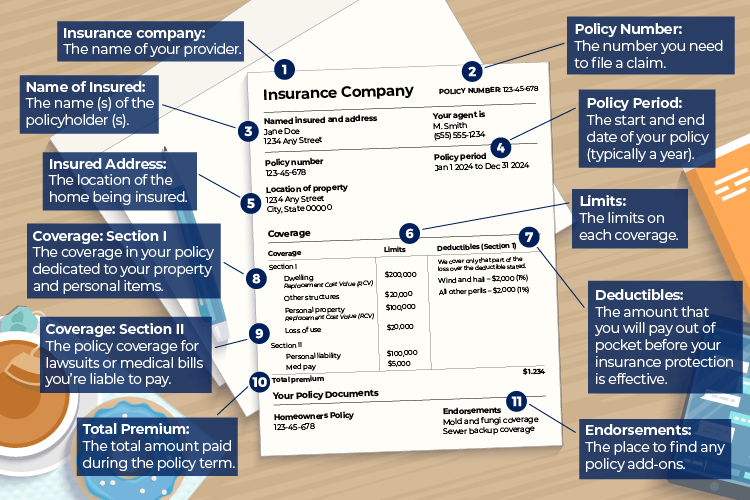

3. What Does Home Insurance Cover?

A standard home insurance policy typically covers:

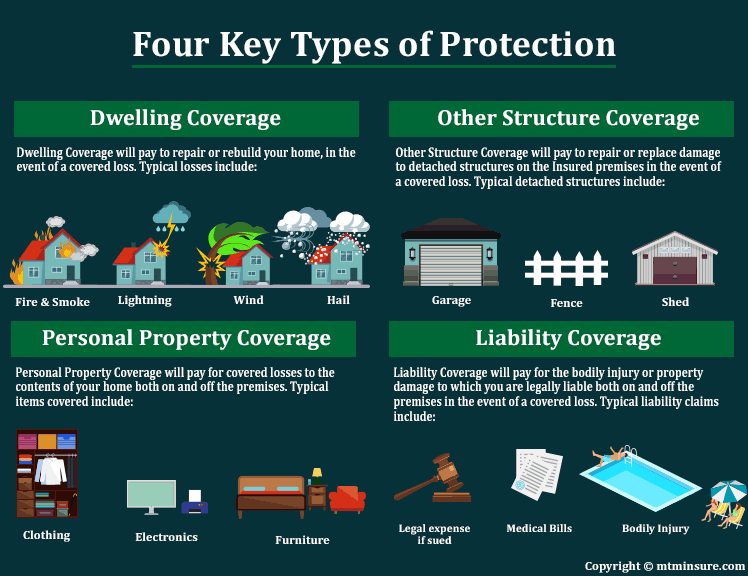

- Dwelling Coverage: Protects the structure of the home.

- Personal Property: Covers belongings such as furniture, electronics, and clothing.

- Liability Protection: Covers legal expenses if someone is injured on your property.

- Additional Living Expenses (ALE): Covers costs if you need temporary housing due to home damage.

How to Protect Home Insurance Coverage

4. Choose the Right Policy for Your Needs

Evaluate your home’s value, location, and potential risks to select the most appropriate coverage. Consider additional riders if standard coverage is insufficient.

5. Regularly Review and Update Your Policy

Update your policy annually to reflect changes such as home renovations, increased property value, or acquiring valuable assets.

6. Maintain a Good Credit Score

Insurance companies use credit scores to determine premiums. A high credit score can help lower your insurance costs.

7. Implement Safety and Security Measures

Installing security systems, smoke detectors, and reinforced doors can reduce risks and potentially lower insurance premiums.

8. Understand Policy Exclusions

Familiarize yourself with what your policy does not cover, such as floods or earthquakes, and consider additional coverage for these risks.

9. Avoid Filing Small Claims

Frequent claims can increase premiums or lead to policy cancellation. Handle minor repairs independently when possible.

10. Bundle Insurance Policies

Combining home and auto insurance with the same provider can result in discounts and cost savings.

10 Essential Tips to Protect Home Insurance

- Conduct a Home Inventory: Document possessions with photos and receipts to simplify claims.

- Raise Your Deductible: A higher deductible reduces premiums but requires more out-of-pocket expenses for claims.

- Ensure Sufficient Coverage: Make sure your policy covers the full replacement cost of your home.

- Compare Multiple Insurance Quotes: Get quotes from different providers to find the best deal.

- Understand Liability Limits: Ensure your policy provides enough coverage for personal liability claims.

- Secure Additional Coverage for High-Value Items: Jewelry, artwork, and collectibles may require separate riders.

- Regularly Inspect Your Home: Address maintenance issues to prevent claim denials due to negligence.

- Avoid Coverage Gaps: Ensure continuous coverage even when switching providers.

- Stay Informed About Local Risks: Know potential hazards in your area to tailor coverage accordingly.

- Work with an Insurance Agent: A professional can help navigate complex policies and find the best options.

10 Frequently Asked Questions (FAQs)

1. What factors influence home insurance rates?

Rates depend on location, home condition, security features, and claim history.

2. Does home insurance cover water damage?

It depends on the cause. Sudden leaks may be covered, but gradual leaks or floods often require additional policies.

3. Can I switch home insurance providers?

Yes, you can switch providers anytime. Be sure to compare policies and avoid gaps in coverage.

4. Is home insurance mandatory?

While not legally required, mortgage lenders often require it to protect their investment.

5. How do I file a home insurance claim?

Notify your insurer, document the damage with photos, provide necessary paperwork, and work with an adjuster.

6. Does home insurance cover mold damage?

Only if mold results from a covered peril, like water damage from a burst pipe.

7. Are detached structures covered under home insurance?

Yes, most policies include coverage for garages, sheds, and fences under ‘Other Structures’ coverage.

8. How can I lower my home insurance premiums?

Increase your deductible, install security systems, and bundle policies for discounts.

9. What is loss of use coverage?

It pays for temporary living expenses if your home becomes uninhabitable due to a covered loss.

10. Can I insure a rental property with home insurance?

No, you need landlord insurance, which covers tenant-related risks.

Conclusion

Protecting home insurance is not just about having a policy—it’s about choosing the right coverage, understanding exclusions, and implementing proactive measures to minimize risks. Regular policy reviews, maintaining a strong credit score, and enhancing home security can help keep premiums low while ensuring adequate protection.

By following these essential tips and staying informed about your policy, you can safeguard your home, finances, and peace of mind. Home insurance is a valuable investment, and taking the right steps to protect it ensures you get the best coverage without unnecessary expenses.