Homeowners Insurance Coverage Options: Comprehensive Guide. Homeowners insurance is an essential financial safeguard that protects your home and belongings from unexpected disasters. Whether you are a first-time homebuyer or an experienced homeowner, understanding your insurance options ensures you are adequately covered. This guide explores different homeowners insurance coverage options, their benefits, and how to choose the best policy for your needs.

Understanding Homeowners Insurance Coverage Options

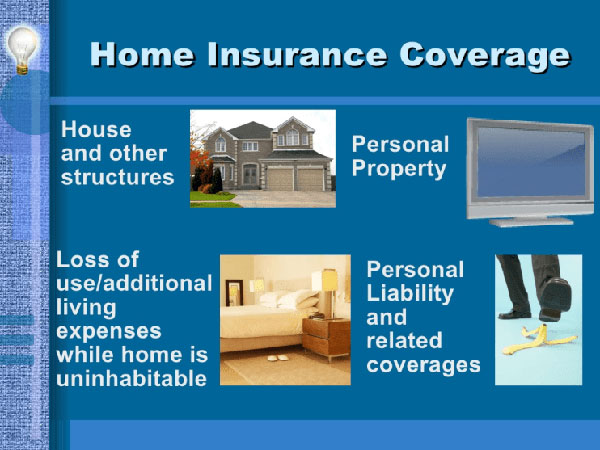

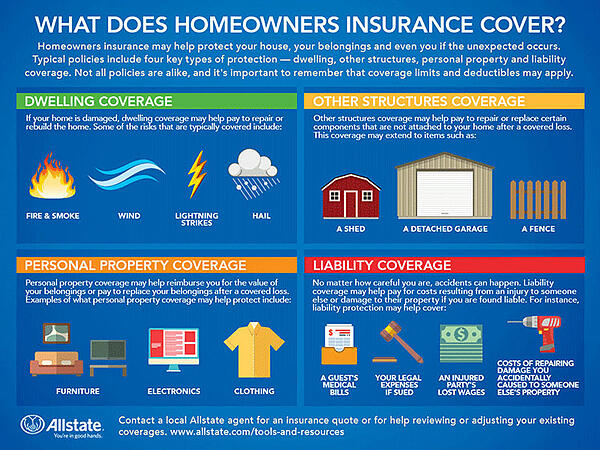

1. Dwelling Coverage

Dwelling coverage is the foundation of homeowners insurance. It covers the structure of your home, including walls, floors, roof, and built-in appliances, against perils like fire, windstorms, and vandalism.

2. Other Structures Coverage

This coverage protects structures on your property that are not attached to your main home, such as garages, fences, and sheds.

3. Personal Property Coverage

Personal property coverage reimburses you for stolen, damaged, or destroyed personal belongings, including furniture, electronics, and clothing.

4. Liability Protection

Liability coverage protects you from legal and medical expenses if someone is injured on your property or if you accidentally damage someone else’s property.

5. Additional Living Expenses (ALE) Coverage

ALE coverage pays for temporary housing and other necessary expenses if your home becomes uninhabitable due to a covered peril.

6. Medical Payments Coverage

This provides financial protection for medical expenses if a guest is injured on your property, regardless of fault.

7. Flood and Earthquake Coverage

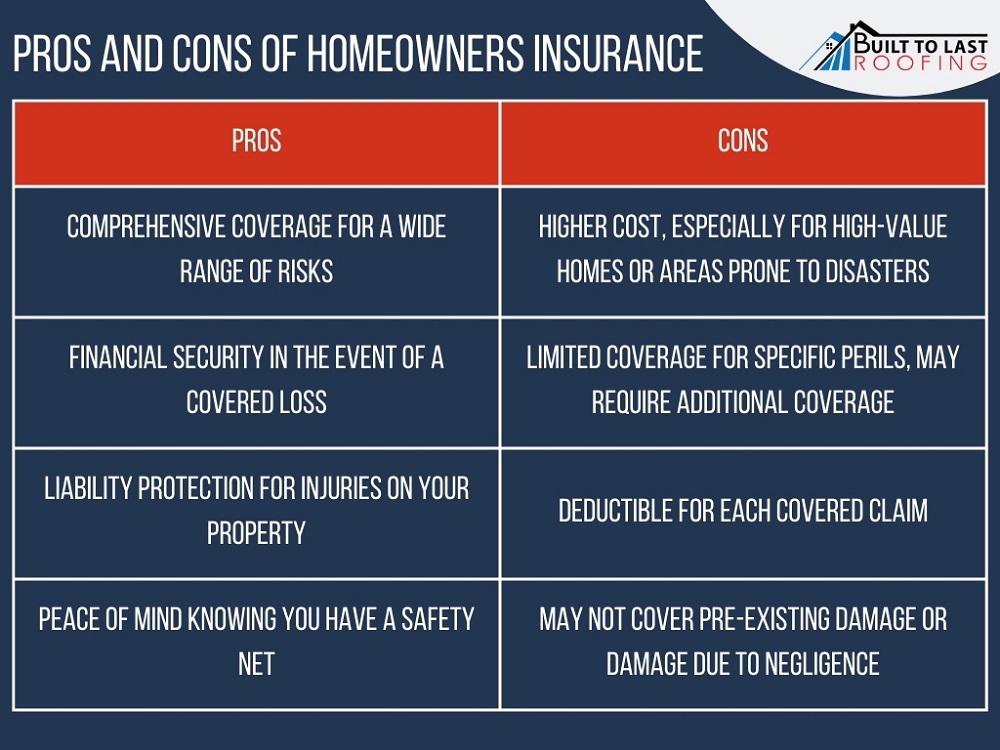

Standard homeowners insurance does not cover flood and earthquake damage. These coverages require separate policies or endorsements.

8. Replacement Cost vs. Actual Cash Value

Homeowners can choose between replacement cost coverage, which reimburses the cost of replacing damaged property, and actual cash value coverage, which considers depreciation.

9. Loss of Use Coverage

This ensures you have funds to cover extra living expenses, such as hotel stays and meals, while your home is being repaired.

10. Scheduled Personal Property Coverage

For valuable items like jewelry, art, or collectibles, this coverage provides additional protection beyond the standard policy limits.

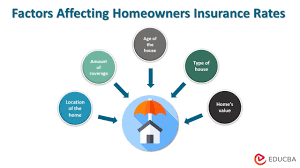

How to Choose the Right Homeowners Insurance Coverage

Assess Your Home’s Value

Evaluate the cost of rebuilding your home to determine the appropriate dwelling coverage amount.

Consider Location-Based Risks

Assess risks like floods, hurricanes, or earthquakes to decide if additional coverage is necessary.

Compare Insurance Providers

Get quotes from multiple insurers to find the best coverage at a competitive price.

Understand Policy Exclusions

Review policy exclusions to identify any gaps in coverage that may require endorsements.

Evaluate Deductibles

A higher deductible can lower your premium but means higher out-of-pocket costs in case of a claim.

10 Essential Tips for Homeowners Insurance

- Regularly review your policy to ensure it meets your changing needs.

- Bundle policies to save money on insurance premiums.

- Install security systems to qualify for discounts.

- Maintain your home to prevent claim denials.

- Document your belongings with photos or videos for accurate claims.

- Understand your policy’s exclusions to avoid surprises.

- Increase liability coverage if you have high-risk items like a pool.

- Opt for replacement cost coverage for better reimbursement.

- Check insurer ratings and customer reviews before purchasing a policy.

- File claims promptly and provide thorough documentation.

10 Frequently Asked Questions (FAQs)

1. Is homeowners insurance required? While not legally required, mortgage lenders typically require it to protect their investment.

2. What does a standard homeowners policy cover? It covers dwelling, personal property, liability, and additional living expenses.

3. Does homeowners insurance cover water damage? It depends on the cause; sudden leaks are covered, but flood damage requires a separate policy.

4. Can I change my coverage limits? Yes, you can adjust coverage limits based on your needs and property value.

5. How do I file a homeowners insurance claim? Contact your insurer, provide documentation, and follow their claims process.

6. Does homeowners insurance cover home-based businesses? Standard policies provide limited coverage; additional business insurance may be needed.

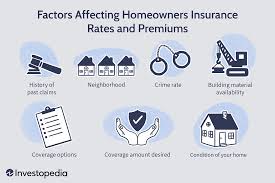

7. What factors affect homeowners insurance premiums? Location, home value, claims history, credit score, and coverage levels impact costs.

8. Is mold damage covered? Mold caused by covered perils may be included, but neglect-related mold is usually excluded.

9. How can I lower my homeowners insurance premiums? Increase deductibles, improve home security, and bundle policies.

10. What happens if I don’t have enough coverage? You may have to pay out-of-pocket for uncovered damages, making adequate coverage essential.

Conclusion

Homeowners insurance coverage options provide essential financial protection against unexpected disasters. Choosing the right coverage ensures your home, belongings, and liability risks are well-protected. By understanding different policy options, comparing providers, and reviewing coverage limits, you can secure the best policy for your needs. Investing in the right homeowners insurance today can provide peace of mind and financial stability for the future.