Filing Insurance Claim Online: Guide to a Hassle-Free Process. Filing an insurance claim can often seem daunting, but with the advancements in technology, filing an insurance claim online has become an easier and more efficient process. In this article, we will walk you through the step-by-step process of filing an insurance claim online, tips to make the process smoother, common FAQs, and how to ensure that your claim is successful. Whether you’re dealing with car insurance, health insurance, or home insurance, filing a claim online can save time and effort.

Introduction

Insurance is an essential part of modern life. When an unfortunate incident occurs, whether it’s a car accident, home damage, or a medical emergency, you need to file an insurance claim to receive the necessary compensation. Traditionally, filing claims involved long phone calls and piles of paperwork. However, with the rise of digital platforms, filing insurance claims online has made the process simpler, quicker, and more accessible.

In this article, we will guide you through the process of filing an insurance claim online, provide tips to ensure you do it correctly, and answer some of the most common questions.

1. Understanding the Importance of Filing Insurance Claims Online

Filing an insurance claim online is an efficient way to report a claim and track its progress. Whether it’s for health insurance, auto insurance, or home insurance, doing so online provides several benefits:

- Convenience: You can file a claim anytime and anywhere, eliminating the need to visit an office or make phone calls during business hours.

- Speed: Many insurers process online claims faster than traditional claims, meaning you could receive your payout sooner.

- Documentation: Online claims often provide a clearer and more organized way to submit documents and track communication with your insurer.

- Eco-friendly: Filing online reduces the amount of paper used, making it a more sustainable choice.

2. Step-by-Step Guide to Filing an Insurance Claim Online

Filing an insurance claim online is usually a simple process, but it’s important to follow the correct steps to ensure your claim is processed without delays.

Step 1: Gather All Necessary Information

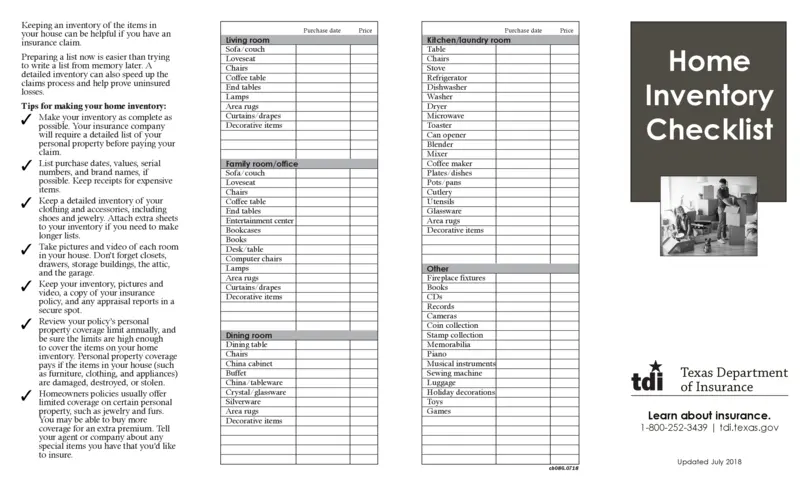

Before you begin the process, make sure you have all the relevant details:

- Personal Information: Your policy number, name, contact details, and other personal information.

- Incident Details: Time, date, and location of the incident. For car accidents, take note of the other party’s details.

- Supporting Documentation: Photos, police reports, medical reports, or any documents that can help substantiate your claim.

Step 2: Visit Your Insurance Provider’s Website

Log in to your insurance provider’s website and navigate to the claims section. Many insurance companies provide a dedicated area for online claims.

Step 3: Complete the Claim Form

Most online claim forms will ask for details about the incident, the damages, and any supporting evidence. Ensure all fields are completed accurately. This step may also include uploading relevant documents such as medical bills, repair invoices, or accident reports.

Step 4: Submit the Claim

Once you’ve filled out the form and attached any required documentation, submit the claim online. You’ll typically receive an email or notification confirming that your claim has been received.

Step 5: Track the Status of Your Claim

Many insurance companies allow you to track the status of your claim in real-time. You can check the progress of your claim, see if additional documents are needed, or communicate with the insurer via a secure online portal.

3. Tips for Filing an Insurance Claim Online

To ensure a smooth and successful claims process, here are some useful tips:

- Read Your Policy Carefully: Understand the terms and conditions of your insurance policy before filing a claim to avoid surprises later.

- Take Photos: Always take clear photos of damages or injuries. These can serve as critical evidence for your claim.

- File Your Claim Promptly: File your claim as soon as possible after the incident. Delays can lead to complications or rejection of your claim.

- Be Honest and Transparent: Provide accurate and truthful information about the incident to avoid issues with your claim.

- Keep a Copy of Your Claim: Save a copy of your online submission and any communication with your insurance company for future reference.

- Double-Check Details: Verify that all information entered in the claim form is correct. A small mistake could cause delays.

- Know Your Rights: Familiarize yourself with your rights as a policyholder, including the timeline for claim processing and what is covered under your policy.

- Use the Online Portal: If available, use your insurer’s online portal to submit documents and track claim progress.

- Stay Organized: Keep all receipts, bills, and other documents related to your claim in one place for easy access.

- Communicate Effectively: If the insurer requests more information or documentation, respond promptly to keep the process moving.

4. 10 Frequently Asked Questions (FAQs) About Filing Insurance Claims Online

- Can I file a claim for any type of insurance online? Yes, most types of insurance, including auto, health, and home insurance, allow online claim submissions.

- What if I don’t have access to a computer? Many insurance companies have mobile apps that you can use to file a claim on your smartphone.

- How long does it take to process an online claim? The processing time can vary depending on the insurer and the complexity of your claim, but online claims are typically processed faster than traditional claims.

- Do I need to pay any fees to file a claim online? Filing a claim online is usually free. However, some insurance companies may charge fees for certain services related to claims.

- Can I track my claim status online? Yes, most insurance companies offer online portals where you can track the status of your claim.

- What documents do I need to submit with my claim? You may need to submit photos, police reports, medical bills, or other documents that support your claim.

- Can I file a claim for damages that occurred a while ago? You should check your policy to see if it covers incidents that happened after a certain period. Many policies have deadlines for filing claims.

- Is it necessary to have an adjuster visit for my claim? Depending on the claim, your insurer may send an adjuster to assess the damage, or they may accept your documentation and photos online.

- What happens if my claim is denied? If your claim is denied, you can appeal the decision or provide additional information to support your case.

- Can I make changes to my claim after submission? In some cases, you may be able to make changes to your claim, but it’s essential to contact your insurer immediately if any corrections are needed.

Conclusion

Filing insurance claims online is an efficient and straightforward process that offers numerous benefits. By following the proper steps and providing accurate information, you can ensure that your claim is processed quickly and smoothly. Remember to gather all the necessary documentation, submit your claim promptly, and track its progress online. If you follow the tips provided in this article, you’ll be better equipped to handle any claims situation with ease.

In conclusion, filing an insurance claim online simplifies the process, making it more accessible and convenient for policyholders. It allows for faster claim resolution and better tracking, ensuring that you can focus on recovering from the incident rather than dealing with cumbersome paperwork. Make sure to follow the outlined steps and keep your information organized to ensure the best possible outcome for your insurance claim.