Steps for Claim Approval: Guide to Understanding the Process. When filing an insurance or injury claim, one of the most crucial parts of the process is the claim approval. Whether you are submitting a health, car accident, or workers’ compensation claim, understanding the essential steps can help you navigate the process smoothly and avoid common mistakes. In this comprehensive guide, we will walk you through the critical steps to take for successful claim approval, explain what factors impact approval, and provide helpful tips for a better experience.

Step 1: Gather All Necessary Documentation

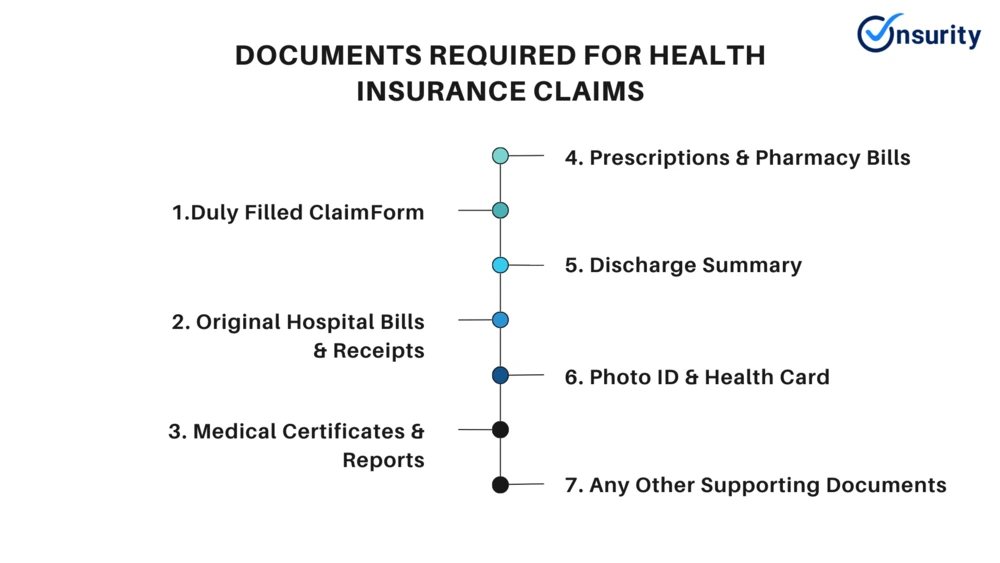

The first and most important step in the claim approval process is ensuring you have all the required documentation. Without the right evidence, your claim may be delayed or denied. Common documents you might need include:

- Medical records

- Police reports (for car accidents)

- Proof of lost wages or income (if applicable)

- Photos of damages or injuries

- Witness statements

- Relevant policy details or agreements

Make sure to keep copies of all documents for your own reference, as well.

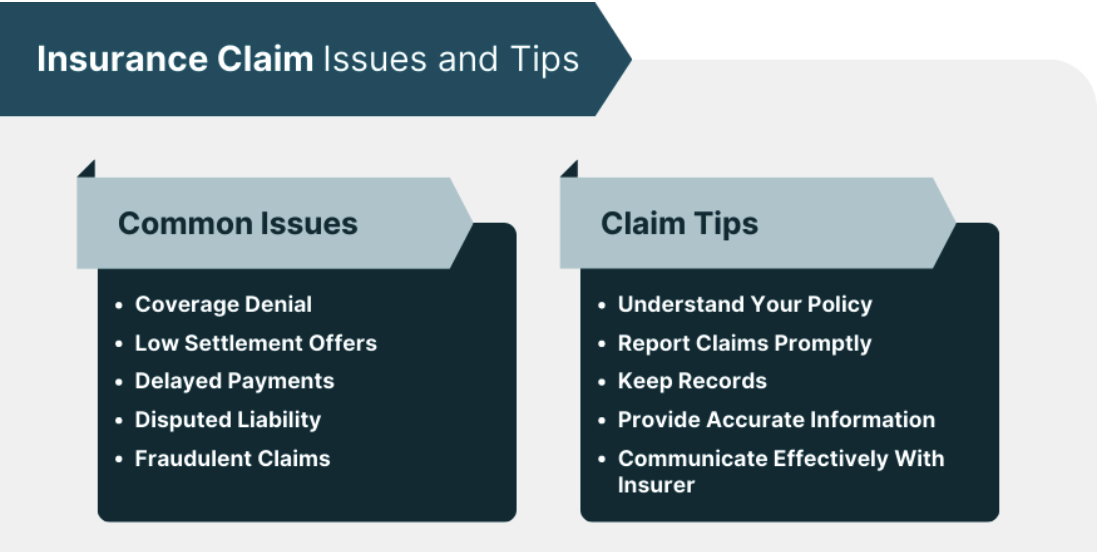

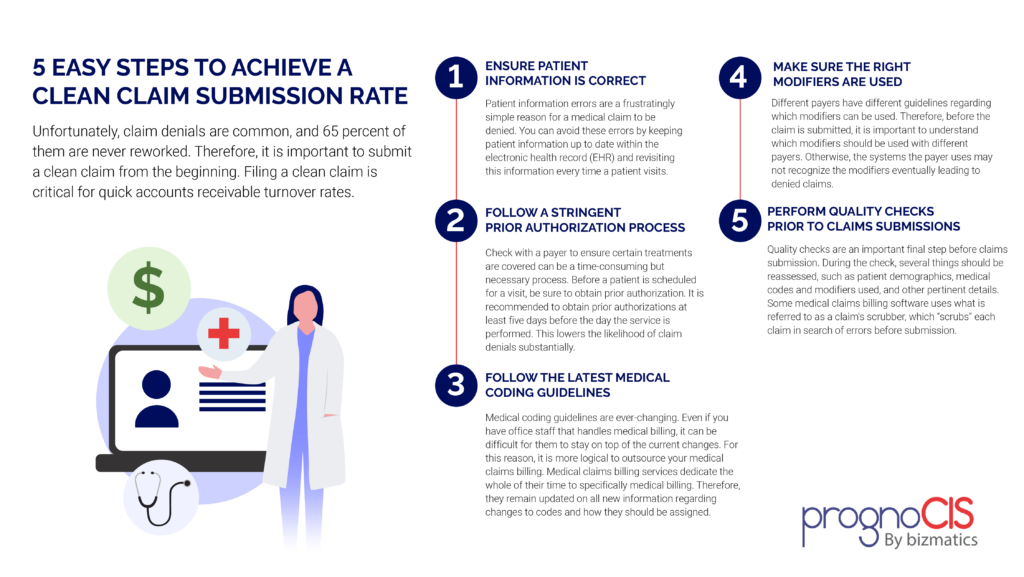

Step 2: Understand the Terms and Conditions of Your Policy

Before filing a claim, read the terms and conditions of your insurance or service policy carefully. Many people skip this step and later find out that their claim is not eligible due to misunderstandings about coverage. Pay attention to any exclusions, deductibles, and required timelines. Understanding what your policy covers can help you avoid unnecessary delays.

Step 3: Submit Your Claim

Once you’ve gathered all the necessary documents and reviewed your policy, you can proceed to submit the claim to your insurance provider or relevant organization. Many companies offer online claim submission portals, while others may require paper forms. Ensure that you submit everything correctly and on time. Missing or incomplete information is a common reason for claim rejection.

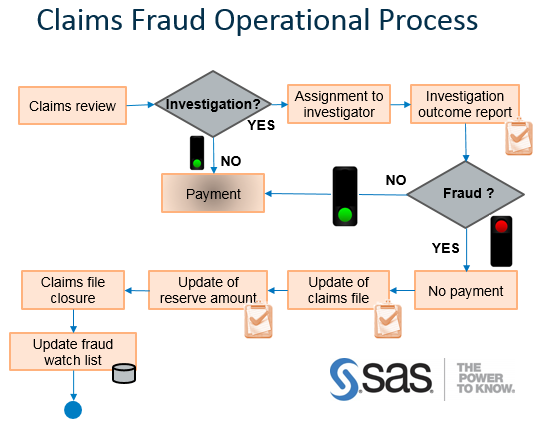

Step 4: Wait for Claim Assessment

After your claim is submitted, it will go through an assessment phase. During this stage, an adjuster or representative from the insurer or organization will review your documents and evaluate whether your claim is valid. They may ask for additional information if needed. This process may take anywhere from a few days to several weeks, depending on the complexity of the claim.

Step 5: Communicate with Your Adjuster

Open communication with your adjuster is key to ensuring a smooth claim approval process. If you are asked for additional documents, try to provide them promptly. If you have questions or concerns about the status of your claim, don’t hesitate to reach out to your adjuster. Good communication can help expedite the process and reduce confusion.

Step 6: Review the Decision

Once your claim has been evaluated, you will receive a decision. There are three possible outcomes:

- Claim Approved – The insurer accepts your claim and will pay the benefits.

- Claim Denied – The insurer rejects your claim. In this case, they should provide a reason for the denial.

- Partial Approval – The insurer agrees to part of the claim but may reduce the payout based on policy terms.

Review the decision carefully and verify that it aligns with your understanding of the policy.

Step 7: Appeal (If Necessary)

If your claim is denied or partially approved, you have the right to appeal. The appeal process typically involves submitting additional documentation or clarifying information that supports your case. Be sure to follow the correct procedure for filing an appeal, as outlined by the insurer or organization. Keep in mind that appeals can take time and may not guarantee a successful outcome.

Step 8: Receive Your Payout

If your claim is approved, the next step is receiving your payout. This may come in the form of a check, direct deposit, or other methods, depending on your agreement. If the claim was for medical expenses, the insurer may pay directly to the healthcare provider. Be sure to verify that the amount matches the agreed-upon coverage.

Step 9: Close the Claim

Once you have received your payout and everything is settled, you can close your claim. Make sure to keep a record of the final resolution for your records. If any issues arise later, this documentation will be helpful in resolving disputes or questions.

10 Tips for a Smooth Claim Approval Process

- Know Your Policy – Familiarize yourself with the details of your policy before filing a claim.

- Stay Organized – Keep track of all documents related to the claim.

- File Promptly – Submit your claim as soon as possible to avoid delays.

- Follow Instructions Carefully – Ensure you fill out forms correctly and provide all requested information.

- Communicate Clearly – Keep your adjuster informed and respond to any requests promptly.

- Document Everything – Keep copies of all paperwork and communications related to your claim.

- Stay Patient – Claims can take time, so remain patient during the assessment period.

- Review the Decision – Understand the reasoning behind any denial or partial approval.

- Seek Professional Help – If necessary, consult a lawyer or expert to help with the appeal process.

- Keep Track of Deadlines – Make sure to meet all deadlines for submission and appeals.

10 Frequently Asked Questions (FAQs)

- How long does it take for a claim to be approved?

- Claim approval time can vary, but it typically takes anywhere from a few days to several weeks.

- What happens if my claim is denied?

- You can appeal the decision or provide additional documentation to support your case.

- What documents are needed for claim submission?

- Documents vary but often include medical records, police reports, and evidence of damages or losses.

- Can I appeal a denied claim?

- Yes, you have the right to appeal if your claim is denied or partially approved.

- How do I know if my claim was processed correctly?

- Review the decision carefully and compare it to your policy to ensure accuracy.

- What if I miss the deadline to submit my claim?

- Many insurers have strict deadlines. Missing the deadline could result in a claim denial.

- Will my premium increase after making a claim?

- In some cases, making a claim may lead to a higher premium, especially for car insurance or health coverage.

- How do I file an appeal for a denied claim?

- Follow the appeal process outlined by your insurer and provide additional supporting documents.

- Can I contact the adjuster during the assessment process?

- Yes, maintaining open communication with your adjuster is essential for smooth processing.

- What if the claim payout is less than expected?

- Review your policy terms and speak to your insurer if you believe the payout is incorrect.

Conclusion

Claim approval can often seem like a daunting process, but with the right knowledge and preparation, it becomes much more manageable. By following these essential steps—from gathering documentation to reviewing the decision—you can navigate the process with confidence. Always remember to maintain clear communication with your insurer or organization, stay organized, and understand your policy. Should you encounter any setbacks, there are always options for appealing the decision.

In the end, a smooth claim approval process is about being informed and proactive. By following the steps outlined above, you ensure that your claim has the best chance of success, making sure you receive the compensation or benefits you deserve. Whether it’s a health claim, car insurance, or workers’ compensation, being prepared is the key to a successful claim resolution.