Flood Insurance Claim Guide: Learning to Get Your Claim Approved. Flooding can cause extensive damage to homes, businesses, and property, often leading to financial loss. For those with flood insurance, knowing how to file a claim effectively can make the process smoother and help ensure that you receive the compensation you’re entitled to. This guide will walk you through the essential steps, tips, and important considerations for a successful flood insurance claim.

What Is Flood Insurance?

Flood insurance is a specific type of coverage that protects against damages caused by flooding, which is typically not covered under standard homeowners or renters insurance policies. The National Flood Insurance Program (NFIP), backed by the federal government, is one of the most common sources for flood insurance in the U.S. There are two primary types of coverage:

- Building Property Coverage – Covers the structure of your home or building, including the foundation, plumbing, electrical systems, and HVAC systems.

- Personal Property Coverage – Covers personal belongings, such as furniture, electronics, clothing, and other items inside the home.

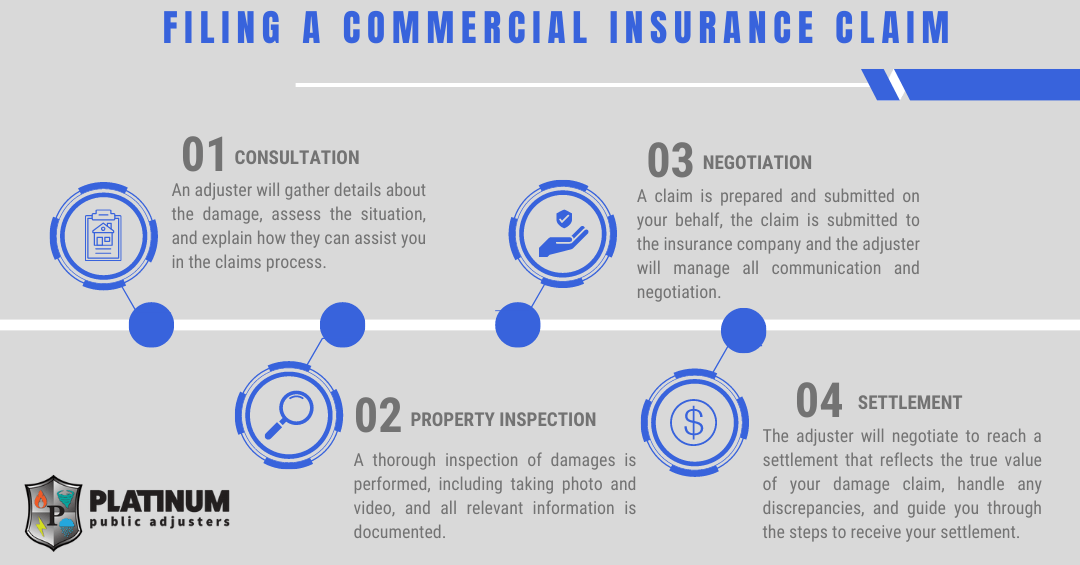

How to File a Flood Insurance Claim: Step-by-Step Process

Filing a flood insurance claim can seem overwhelming, but following a clear, methodical process can help you navigate it successfully. Here’s a detailed step-by-step breakdown:

1. Ensure You Have Flood Insurance

Before filing a claim, it’s important to verify that you have flood insurance. Policies typically need to be in place before a flooding event occurs, and the coverage should be active for the claim process to be valid.

2. Document the Damage

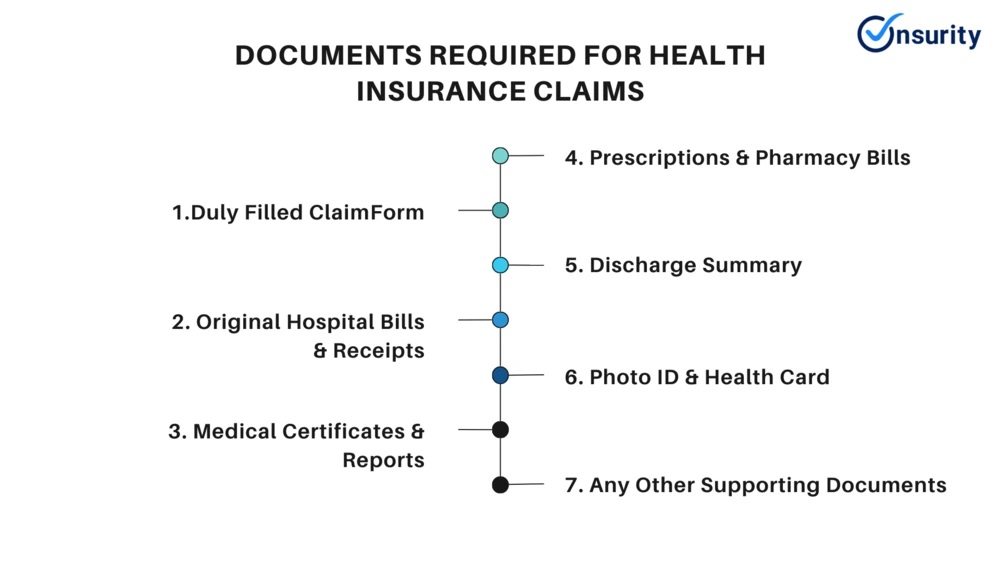

Once it’s safe to return to your property, document all flood damage. This includes taking clear photographs and videos of any destruction. Make sure to capture the extent of the damage to both structural elements and personal belongings. The more detailed and organized your documentation is, the stronger your claim will be.

3. Contact Your Insurance Provider

Reach out to your insurance provider as soon as possible to report the flood damage. Be ready with your policy number, a summary of the damages, and any evidence you’ve gathered. They will provide guidance on the next steps and assign an adjuster to your case.

4. Meet with the Adjuster

An insurance adjuster will typically visit your property to assess the damage. During this inspection, it’s important to accompany the adjuster and point out any areas of concern. Make sure to keep a list of the items or areas that have been damaged, and if you can, have a contractor or repair professional present to give an estimate.

5. Make Temporary Repairs

While you cannot make permanent repairs before your adjuster inspects the property, you should make reasonable, temporary repairs to prevent further damage. Keep all receipts for any materials or services used for these repairs, as they may be reimbursed as part of your claim.

6. Review the Settlement Offer

Once your claim has been processed, your insurer will send a settlement offer. Review the offer carefully to ensure it aligns with the damage documented. If you feel the settlement is insufficient, you can negotiate or appeal the decision with the help of an attorney or claims expert.

7. Appeal the Decision If Necessary

If you disagree with the insurance company’s decision or settlement amount, you can appeal the claim. This may involve submitting additional documentation, getting an independent assessment, or hiring a claims adjuster or attorney to help.

Common Mistakes to Avoid During the Flood Insurance Claim Process

Filing a flood insurance claim can be complicated, and several common mistakes could delay or reduce your settlement. Here’s a list of the most frequent errors to avoid:

- Not Reporting the Damage Quickly – Many policies require that you notify the insurance company promptly, usually within a few days of the incident. Delaying the report could jeopardize your claim.

- Failing to Document the Damage Properly – Without detailed photographs and videos, it can be difficult to prove the extent of the damage.

- Making Permanent Repairs Before the Inspection – While temporary repairs are allowed, permanent fixes can interfere with the insurance assessment.

- Not Keeping All Receipts for Repairs – Any out-of-pocket expenses you incur for repairs should be documented, as they may be reimbursable.

- Underestimating the Scope of Damage – Be thorough in documenting every area affected by the flood. Missing even small details can impact the payout.

- Ignoring Policy Limits and Deductibles – Ensure that you fully understand your coverage limits and deductibles to avoid surprises during the settlement.

- Overlooking Small Personal Property Items – Don’t forget to include smaller items, such as electronics and personal belongings, in your claim.

- Relying Solely on the Adjuster’s Report – Get a second opinion if necessary, especially if you believe the adjuster missed critical damage.

- Failing to Seek Professional Help – If you’re unsure about the process, consider hiring a public adjuster or attorney to assist with filing and negotiations.

- Not Keeping a Copy of All Correspondence – Maintain a record of all communications with your insurer, including emails, phone calls, and letters.

10 Tips for a Successful Flood Insurance Claim

- Get the policy details early to understand your coverage limits and exclusions.

- Take detailed photos of the damage immediately after the flooding occurs.

- Create a detailed inventory of damaged items with descriptions and estimated values.

- Keep a log of all communications with your insurance company.

- Do not discard damaged property until the adjuster has inspected it.

- Consult a professional if you’re unsure how to proceed with complex claims.

- Understand your deductible and how it affects your claim payout.

- Get multiple repair estimates to support your claim.

- File the claim promptly to avoid missing deadlines.

- Stay organized and keep all receipts related to repairs and temporary accommodations.

10 Frequently Asked Questions (FAQs) about Flood Insurance Claims

- How long do I have to file a flood insurance claim? Generally, you have 60 days from the date of the flood event to file a claim under most flood insurance policies.

- Can I make repairs before my adjuster arrives? Yes, you can make temporary repairs, but make sure you don’t permanently fix any damage until the adjuster has assessed it.

- Will my flood insurance cover all of the damage? Your coverage depends on your policy limits. It typically covers structural damage and personal property, but exclusions may apply.

- What if my claim is denied? You can appeal the decision. Consider hiring an attorney or claims adjuster to help with the appeal process.

- How does flood insurance differ from homeowners insurance? Homeowners insurance generally does not cover flooding, whereas flood insurance is specifically for flood-related damages.

- Are there any exclusions to flood insurance? Yes, exclusions may include coverage for certain types of flooding (e.g., surface water or sewer backups) or items not covered under the policy.

- Will I need a lawyer to file a flood insurance claim? While not required, having a lawyer or public adjuster can help ensure you receive a fair settlement.

- Can I claim damage to my car due to flooding? Flood damage to vehicles may be covered under your auto insurance policy, not flood insurance.

- Does flood insurance cover losses due to business interruptions? Most flood insurance policies do not cover business interruption losses, but separate business interruption insurance can help.

- What is the role of an insurance adjuster in a flood claim? The adjuster assesses the damage, determines the claim’s value, and provides a report to the insurance company for processing.

Conclusion

Filing a flood insurance claim can be a detailed and sometimes complicated process, but by following the steps outlined in this guide, you can make sure you’re well-prepared. From documenting damage to understanding your policy and navigating negotiations, a well-organized approach increases the chances of a successful claim. With these tips and answers to frequently asked questions, you can take proactive steps to ensure you’re properly compensated for flood-related damages.

Taking the time to carefully follow the claims process ensures that you maximize your coverage and minimize delays. Whether you’re dealing with damage to your home or personal property, being thorough and informed can make a significant difference in the outcome of your claim. Remember, flood insurance exists to help you recover, and understanding how to use it effectively is key to protecting yourself and your property.