Affordable Claim Adjuster Services: Insurance Claims. When dealing with insurance claims, whether due to a car accident, home damage, or personal injury, the process can often feel overwhelming. One essential professional who can help guide you through this challenging time is a claim adjuster. But not all claim adjuster services are created equal. In this article, we will discuss affordable claim adjuster services, how to find the right one, and why it’s crucial to ensure you get the best deal possible when handling insurance claims. We will break down the role of an adjuster, what to look for when hiring one, and tips on making the most of their services.

What is a Claim Adjuster?

A claim adjuster is a professional who works for an insurance company or as an independent contractor to investigate and assess insurance claims. Their primary role is to determine the extent of the insurance company’s liability in relation to a claim. Adjusters examine the damage or loss, review policy details, and help facilitate the claims process. They ensure that all the facts are gathered and the claim is evaluated accurately to ensure a fair payout.

Types of Claim Adjusters

- Staff Adjusters

- These adjusters are employed directly by insurance companies. They handle claims for the insurance company and work within the company’s guidelines.

- Independent Adjusters

- Independent adjusters work for themselves or for third-party companies. They are hired by insurance companies to handle claims on a contract basis.

- Public Adjusters

- Public adjusters represent policyholders, not the insurance company. They work on behalf of the client to help them get a fair settlement from the insurance company.

Why You Should Consider Affordable Claim Adjuster Services

In many cases, individuals may feel hesitant to hire a claim adjuster, fearing high service fees. However, affordable claim adjuster services can provide significant value, ensuring that your insurance claim is handled professionally and fairly. Here are some reasons why you should consider hiring an affordable claim adjuster:

- Expertise in the Claims Process

- Navigating insurance policies and claims can be tricky. Adjusters bring specialized knowledge that can help you avoid mistakes and ensure your claim is processed correctly.

- Accurate Damage Assessment

- A claim adjuster can accurately assess the damage or loss, which may lead to a larger payout. Without their expertise, you might miss out on compensation for certain damages.

- Time and Stress Saving

- The insurance claim process can be long and complicated. A claim adjuster can handle the bulk of the work, reducing your stress and saving you time.

- Negotiation Skills

- Claim adjusters are skilled negotiators who can ensure you get the most favorable outcome. They understand how to handle disputes and work with the insurance company to get the best settlement.

Finding Affordable Claim Adjuster Services

To ensure you are getting affordable claim adjuster services, consider these factors:

- Research Multiple Adjusters

- Don’t settle for the first adjuster you find. Compare the prices and services of multiple adjusters to get the best value for your needs.

- Check for Licensing and Credentials

- Ensure that the adjuster is licensed and has the proper certifications. This is important to ensure that they are qualified to handle your case.

- Look for Reviews and Testimonials

- Research reviews and testimonials from past clients to assess the quality of service the adjuster offers.

- Ask About Fees and Payment Structure

- Ensure that the adjuster’s fees are transparent. Some adjusters charge a flat fee, while others may charge a percentage of the claim settlement. Make sure you understand the cost before hiring.

- Consider Local Adjusters

- Hiring a local adjuster can save on costs, as they may not have to travel long distances to assess your claim.

What to Expect When Hiring a Claim Adjuster

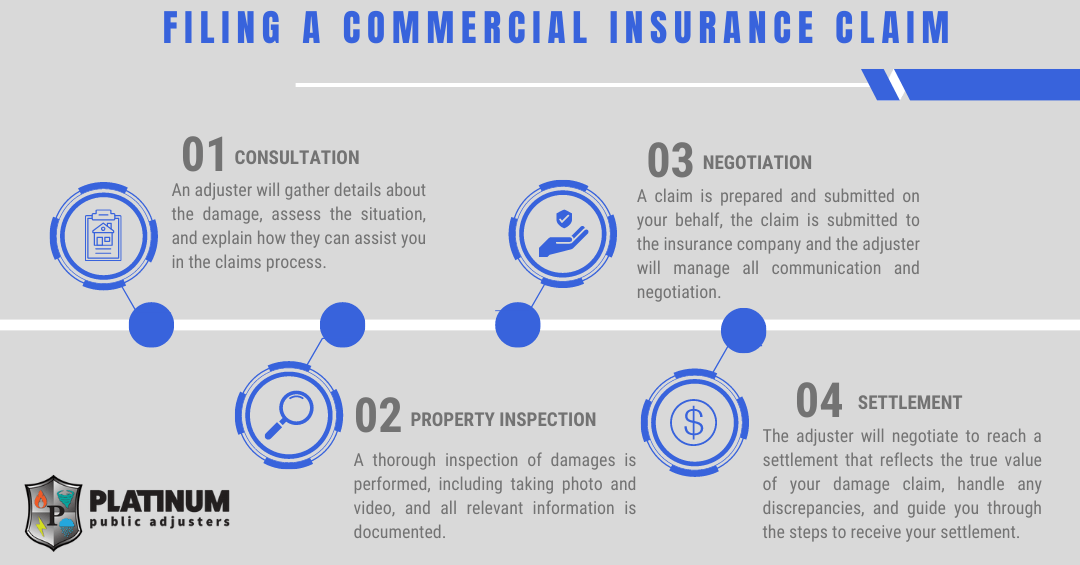

Once you hire an affordable claim adjuster, the next step is to understand the process and what they will do for you. Here is an overview of what you can expect:

- Initial Consultation

- The adjuster will meet with you to discuss the details of your claim and assess the damage. Be prepared to provide all relevant documents, such as your insurance policy and any photos or records related to the incident.

- Damage Assessment

- The adjuster will inspect the damage, either in person or via a remote assessment, and determine the extent of the loss.

- Negotiation

- After evaluating the claim, the adjuster will negotiate with the insurance company on your behalf. They will ensure that the settlement reflects the true value of the damage.

- Final Settlement

- Once an agreement is reached, the adjuster will help finalize the settlement. They will also ensure that all documentation is completed correctly.

10 Tips for Maximizing Affordable Claim Adjuster Services

- Provide All Necessary Documentation – Ensure you have all required documentation, including photos, receipts, and statements, ready for the adjuster.

- Communicate Clearly and Regularly – Keep the lines of communication open and stay updated on the progress of your claim.

- Understand Your Policy – Before hiring an adjuster, familiarize yourself with your insurance policy and know what is covered.

- Be Honest About the Incident – Provide accurate and truthful information about the incident to avoid complications during the claims process.

- Ask Questions – Don’t hesitate to ask your adjuster about the process, fees, and potential outcomes.

- Don’t Rush the Process – Take your time to ensure that all the details are thoroughly reviewed.

- Stay Organized – Keep all documents and receipts related to the claim organized for easy access.

- Request a Written Estimate – Ask for a written estimate from the adjuster before moving forward with their services.

- Use Technology – If possible, use digital tools to track the progress of your claim.

- Don’t Settle for the First Offer – Insurance companies may offer low settlements initially. Be prepared to negotiate.

10 FAQs About Affordable Claim Adjuster Services

- How much does a claim adjuster cost?

- Costs can vary, but affordable claim adjusters typically charge a percentage of the claim settlement, often between 5-15%.

- Do I need a claim adjuster if I have insurance?

- While not mandatory, hiring an adjuster can ensure that your claim is handled correctly and that you receive a fair settlement.

- What’s the difference between an independent adjuster and a public adjuster?

- Independent adjusters work for insurance companies, while public adjusters represent the policyholder.

- Can I hire a claim adjuster for any type of insurance?

- Yes, claim adjusters can assist with auto, home, health, and business insurance claims.

- How long does the claims process take?

- The duration depends on the complexity of the claim, but adjusters can help expedite the process.

- Are there any hidden fees when hiring a claim adjuster?

- Ensure you understand the fee structure upfront to avoid any surprise charges.

- What should I do if I disagree with the adjuster’s assessment?

- You can ask for a second opinion or appeal the decision with your insurance company.

- Will a claim adjuster always get me a higher payout?

- While not guaranteed, adjusters can often help secure a more favorable settlement.

- Can a claim adjuster help with disputes?

- Yes, they are skilled negotiators and can assist in resolving disputes with the insurance company.

- How do I know if a claim adjuster is reputable?

- Check their credentials, reviews, and whether they are licensed in your state.

Conclusion

Affordable claim adjuster services are an essential resource when navigating the often complex world of insurance claims. By understanding the role of an adjuster, following tips for finding the right one, and knowing what to expect from the process, you can ensure that your claim is handled effectively and that you receive the settlement you deserve. With the right guidance, affordable claim adjusters can save you both time and money while easing the burden of dealing with insurance claims.

In conclusion, hiring a reputable and affordable claim adjuster can make a significant difference in the outcome of your insurance claim. They offer expertise and negotiation skills that can lead to higher settlements, more efficient processes, and less stress. Make sure to research and select an adjuster that fits your needs and budget, ensuring that your insurance experience is as smooth and successful as possible.