Insurance Claim Payout Guide: Learning for a Smooth Process. Insurance claims can be a confusing process, especially when you’re unfamiliar with the intricacies of filing and receiving a payout. Whether you’re dealing with auto, health, home, or life insurance, understanding how the payout process works can make all the difference in ensuring you’re fairly compensated. In this comprehensive Insurance Claim Payout Guide, we will walk you through every aspect of the insurance claim payout process, from the initial filing to receiving your payment.

What is an Insurance Claim Payout?

An insurance claim payout refers to the amount of money that the insurance company agrees to pay to the policyholder or a third party in the event of a covered loss. This payout is determined after the claim is processed and approved based on the type of coverage in the insurance policy.

Understanding the Insurance Claim Payout Process

- Filing the Claim

The first step in the process is filing your claim with your insurance provider. This involves submitting details about the incident or loss, along with any necessary documentation to support your case. - Claim Assessment

Once the claim is filed, the insurance company will assign an adjuster to assess the damage, investigate the details, and review the evidence. The adjuster will also determine the value of your claim based on the terms of your policy. - Claim Approval or Denial

After the assessment, the insurance company will either approve or deny your claim. If approved, they will proceed with determining the payout amount. - Calculating the Payout

The payout amount depends on several factors, including the type of coverage, the deductible, and the value of the loss. Your insurer will calculate the payout accordingly. - Receiving the Payout

Once the payout is approved, you will receive compensation either via check, direct deposit, or another agreed-upon method.

Types of Insurance Claim Payouts

- Auto Insurance Claim Payout

For auto insurance, the payout typically covers vehicle repairs or replacement if your car is damaged or totaled due to an accident. Your insurer may also cover medical expenses or liability claims if someone else is injured. - Home Insurance Claim Payout

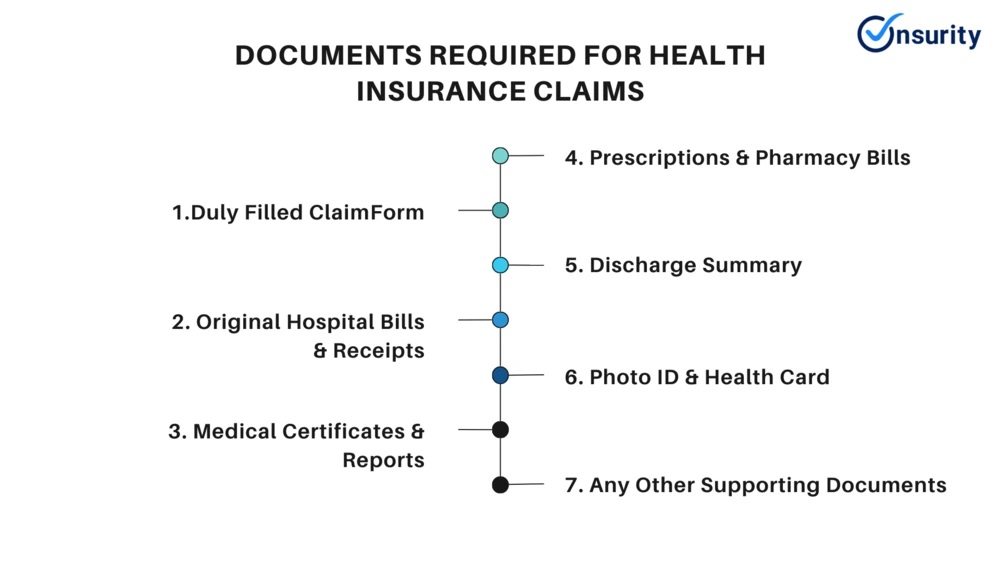

Home insurance payouts help cover damages to your property, personal belongings, or liability for accidents that occur on your property. Payouts can cover repairs, replacements, and other associated costs. - Health Insurance Claim Payout

Health insurance claims focus on medical costs, such as doctor visits, hospital stays, surgeries, and prescription medications. Payouts may cover a portion or the entirety of these costs, depending on your plan and coverage. - Life Insurance Claim Payout

A life insurance payout is provided to beneficiaries after the policyholder passes away. The payout typically covers funeral expenses and can provide financial support for the surviving family members. - Disability Insurance Claim Payout

Disability insurance provides income replacement if you’re unable to work due to illness or injury. The payout amount is typically based on your pre-disability earnings.

Factors That Affect Your Insurance Claim Payout

- Policy Coverage Limits

Every insurance policy has a coverage limit, which represents the maximum amount the insurer will pay for a claim. Understanding your policy’s coverage limits is crucial in determining the amount you will receive. - Deductibles

A deductible is the amount you must pay out of pocket before your insurer covers the remaining expenses. Higher deductibles generally result in lower premium payments, but they can reduce your claim payout. - Claims History

If you have a history of frequent claims, your insurer may offer a lower payout or even deny future claims. A clean claims history is essential for receiving the maximum payout. - Policy Exclusions

Most insurance policies have exclusions, which are specific situations or losses that aren’t covered. It’s important to understand what is excluded from your policy to avoid unexpected denials. - Repair Costs

In the case of property or vehicle damage, the insurer will evaluate the cost of repairs or replacements. The payout will be adjusted based on the repair estimate and the policy’s terms.

Tips for Maximizing Your Insurance Claim Payout

- Understand Your Policy

Review your policy regularly to ensure you know what’s covered, what’s excluded, and your coverage limits. - Keep Detailed Records

Document all relevant details about the incident, including photos, repair estimates, and medical bills. This will support your claim. - File Your Claim Promptly

Make sure to file your claim as soon as possible to avoid delays or denials. Check for time limits on submitting claims. - Get Multiple Estimates

For property damage or car repairs, it’s often helpful to obtain multiple estimates to ensure you’re receiving a fair payout. - Be Honest

Always provide accurate and truthful information when filing a claim. Providing false information can result in claim denial or legal consequences. - Consult with an Attorney

If your claim is denied or undervalued, consider seeking legal assistance to ensure you’re getting the payout you deserve. - Review Your Deductible

Consider lowering your deductible if you anticipate filing a claim in the near future to maximize your payout. - Monitor the Claims Process

Stay in touch with your insurer throughout the claims process to address any issues or delays promptly. - Appeal a Denied Claim

If your claim is denied, don’t hesitate to appeal the decision. Provide additional evidence to support your case. - Consider Supplemental Insurance

In some cases, purchasing additional insurance coverage can help ensure you receive a larger payout.

FAQs about Insurance Claim Payouts

- What is an insurance claim payout?

An insurance claim payout is the amount of money an insurance company agrees to pay to a policyholder or third party after a covered loss or incident. - How long does it take to receive an insurance claim payout?

The time it takes to receive a payout varies, but it typically ranges from a few weeks to several months, depending on the complexity of the claim. - Can an insurance company deny a claim payout?

Yes, an insurance company can deny a claim payout if the claim is outside the coverage, if the policyholder violated the terms of the policy, or if the claim is deemed fraudulent. - Why is my insurance claim payout lower than expected?

This could be due to factors like your deductible, policy limits, or exclusions. It may also result from a lower valuation of the damage or loss. - What happens if I disagree with my insurance claim payout?

If you disagree with the payout amount, you can request a review or appeal the decision. You may also hire a lawyer to negotiate on your behalf. - Are insurance payouts taxable?

In most cases, insurance payouts for property damage or health-related claims are not taxable. However, life insurance payouts may be taxable in certain circumstances. - What is the difference between actual cash value and replacement cost?

Actual cash value takes depreciation into account, while replacement cost covers the full cost of replacing the damaged property without depreciation. - How do I file an insurance claim?

To file a claim, contact your insurance company, provide the necessary documentation, and follow their instructions for submitting the claim. - Can I increase my insurance claim payout?

You can increase your payout by ensuring you have the appropriate coverage limits, reviewing your policy regularly, and providing thorough documentation during the claims process. - What should I do if my claim is denied?

If your claim is denied, carefully review the denial letter, provide additional information if necessary, and file an appeal with your insurer.

Conclusion

Navigating the insurance claim payout process can be challenging, but understanding the steps involved and the factors that affect your payout can help you make informed decisions. By reviewing your policy, filing claims promptly, and keeping detailed records, you can improve your chances of receiving a fair payout. If you’re ever unsure about the process, consulting with an attorney or insurance expert can ensure that you receive the compensation you deserve.

Being proactive and knowledgeable about your insurance policy can save you time and stress, allowing you to focus on recovering from the incident. In the end, a well-managed insurance claim can help you bounce back from unexpected losses and secure your financial future.