Home Insurance for New Home: Guide to Protecting Your Property. Buying a new home is an exciting milestone, but protecting your investment with the right home insurance is just as important. Home insurance provides financial security against unexpected damages, theft, and natural disasters. If you are purchasing a new home, understanding the coverage options and how to choose the best policy is essential.

In this guide, we will explore everything you need to know about home insurance for new homes, including coverage types, costs, tips, FAQs, and how to find the best insurance policy that meets your needs.

What is Home Insurance for a New Home?

Home insurance for a new home is a policy designed to protect homeowners against financial losses due to damage or theft. It typically covers the structure of the house, personal belongings, liability protection, and additional living expenses in case of displacement due to an insured event.

Why is Home Insurance Important for a New Home?

- Protection Against Property Damage – Covers losses from fire, storms, vandalism, and other disasters.

- Liability Coverage – Protects against legal costs if someone is injured on your property.

- Mortgage Requirement – Most lenders require home insurance to approve a mortgage.

- Peace of Mind – Ensures financial stability in the event of unexpected damage.

Types of Home Insurance Coverage

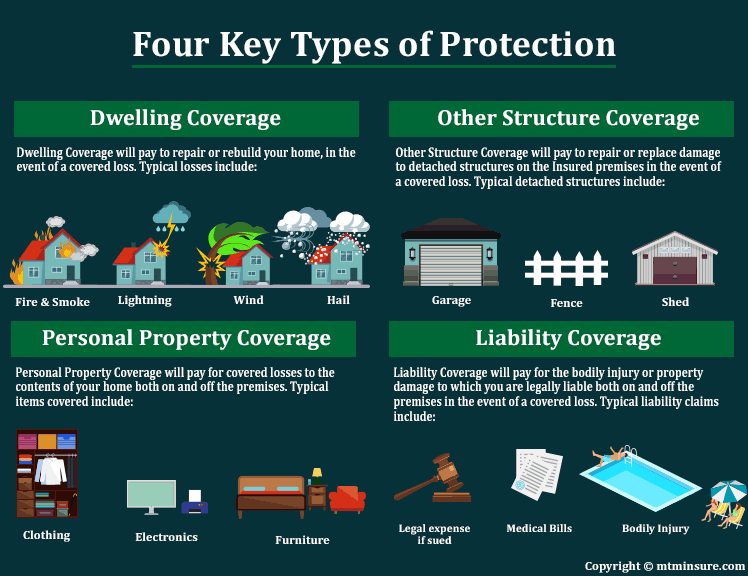

1. Dwelling Coverage

Protects the structure of your home, including walls, roof, and foundation, against covered perils like fire, storms, and vandalism.

2. Personal Property Coverage

Covers personal belongings such as furniture, appliances, and clothing in case of theft, fire, or other covered events.

3. Liability Protection

Provides financial protection if someone is injured on your property and you are found legally responsible.

4. Additional Living Expenses (ALE) Coverage

Covers the cost of temporary living arrangements if your home becomes uninhabitable due to covered damages.

5. Other Structures Coverage

Protects detached structures on your property, such as garages, sheds, or fences.

6. Flood and Earthquake Coverage (Optional)

Standard home insurance policies do not cover floods and earthquakes, so additional policies may be needed based on your location.

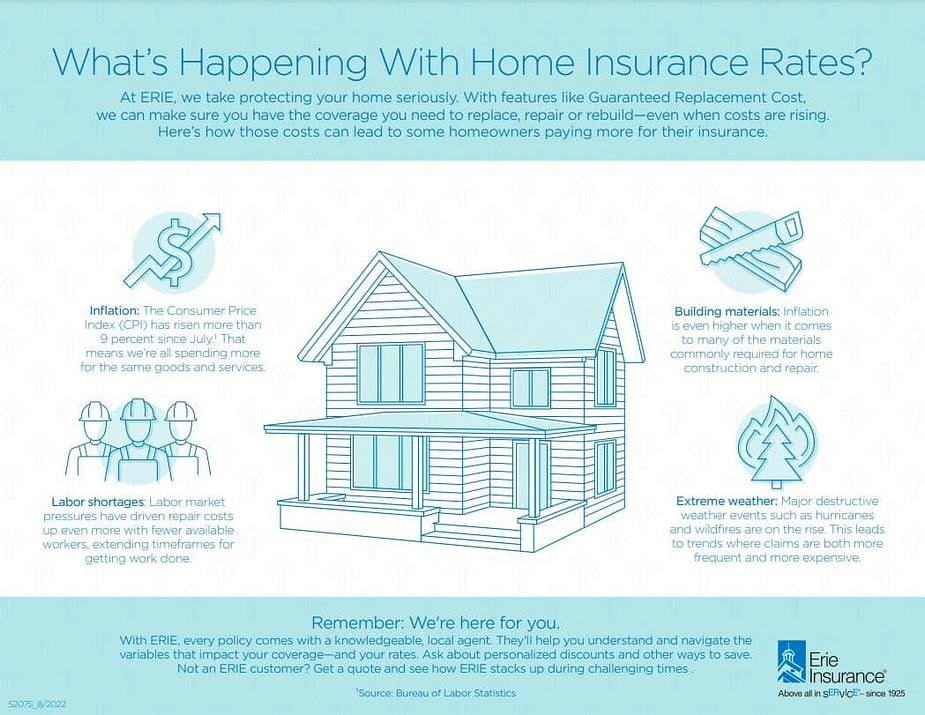

Factors Affecting Home Insurance Costs

Several factors determine the cost of home insurance for a new home:

- Location – Homes in high-risk areas for floods or hurricanes have higher premiums.

- Home Value & Size – Larger and more expensive homes require more coverage.

- Construction Materials – Fire-resistant materials can lower premiums.

- Security Features – Security systems and smoke detectors may reduce costs.

- Claims History – A history of claims can increase your rates.

- Deductible Amount – Higher deductibles result in lower monthly premiums but higher out-of-pocket costs during claims.

How to Choose the Best Home Insurance for Your New Home

- Compare Multiple Insurance Providers – Get quotes from different insurers to find the best coverage and rates.

- Assess Coverage Needs – Ensure the policy covers your home, belongings, and liability risks.

- Check Policy Exclusions – Understand what is not covered, such as floods or earthquakes.

- Evaluate Customer Service & Claims Process – Read reviews and check claim handling efficiency.

- Look for Discounts – Ask about discounts for bundling insurance, security systems, and loyalty programs.

10 Tips for Getting the Best Home Insurance for a New Home

- Choose a policy that offers full replacement cost coverage.

- Compare quotes from at least three insurance companies.

- Increase security measures to qualify for discounts.

- Raise your deductible to lower premium costs.

- Regularly review and update your policy.

- Bundle home and auto insurance for potential savings.

- Understand exclusions and add necessary riders.

- Document home inventory with photos and receipts.

- Check insurer’s financial stability and customer reviews.

- Work with an insurance broker to find the best deal.

10 Frequently Asked Questions About Home Insurance for New Homes

1. Is home insurance mandatory for new homeowners? No, but most mortgage lenders require it.

2. How much home insurance do I need? Your coverage should be enough to fully rebuild your home and replace belongings.

3. Does home insurance cover natural disasters? It depends. Standard policies cover some disasters but not floods or earthquakes, which require separate policies.

4. What is the difference between replacement cost and actual cash value? Replacement cost covers the full cost of rebuilding without depreciation, while actual cash value considers depreciation.

5. Can I change my home insurance provider after purchasing a home? Yes, you can switch providers anytime, but check for cancellation fees.

6. Will my premium increase over time? Yes, factors like inflation, claims history, and location risks can increase premiums.

7. Do home insurance policies cover mold damage? It depends on the cause. Mold from sudden water damage may be covered, but long-term neglect is usually excluded.

8. What should I do if my claim is denied? Review your policy, ask for clarification, and consider an appeal or hiring a public adjuster.

9. Can I lower my home insurance premium? Yes, by increasing security, raising deductibles, and bundling policies.

10. How long does it take to process a home insurance claim? It varies, but most claims are processed within a few weeks to a few months.

Conclusion

Home insurance for a new home is essential for protecting your investment and ensuring financial security. Choosing the right policy requires understanding coverage options, comparing providers, and taking steps to lower your premiums.

By following the tips in this guide, you can find the best home insurance policy that fits your needs and provides peace of mind. Investing in comprehensive coverage will help safeguard your home and personal belongings against unexpected events, ensuring long-term protection for you and your family.