Cheap Homeowners Insurance: Affordable Coverage. Finding cheap homeowners insurance that offers comprehensive coverage can be challenging. However, with the right strategies, you can secure affordable rates without sacrificing essential protection for your home. This guide will help you understand how to find cheap homeowners insurance, factors that influence your premiums, and tips to reduce costs.

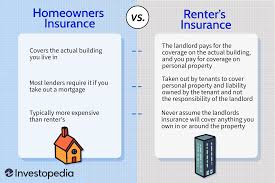

What is Homeowners Insurance?

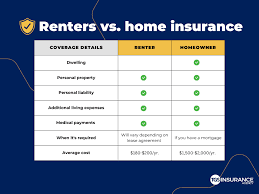

Homeowners insurance provides financial protection against damages to your home, personal property, and liability for injuries occurring on your property. A standard policy covers damages from fire, theft, natural disasters, and more.

Why is Homeowners Insurance Important?

Homeowners insurance is essential because it protects your most valuable asset—your home. It also ensures you have financial support to repair or replace your property if unexpected events occur.

Factors Affecting Homeowners Insurance Rates

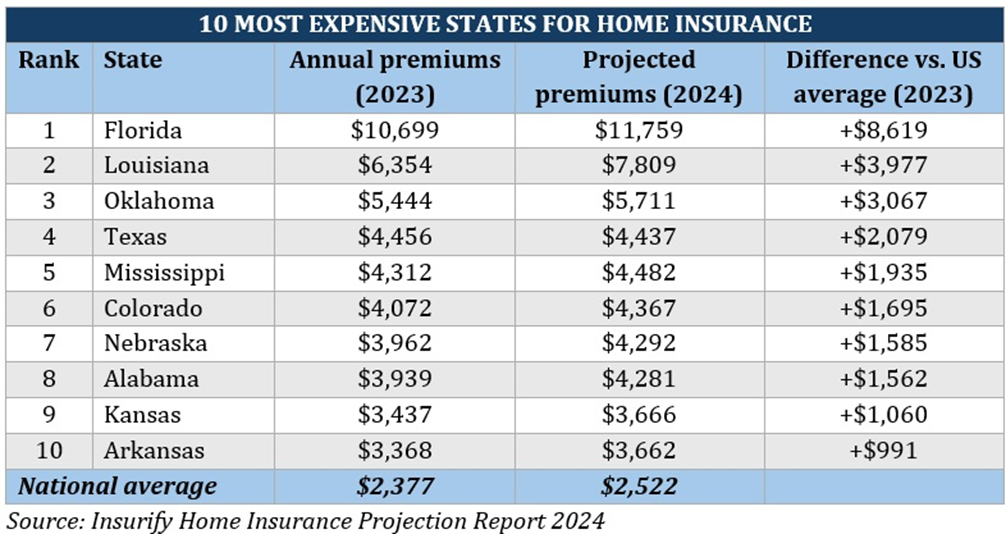

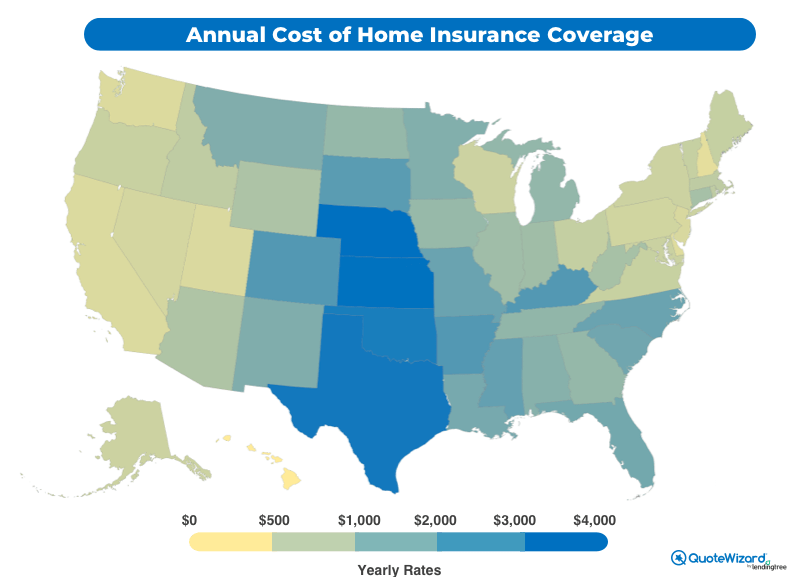

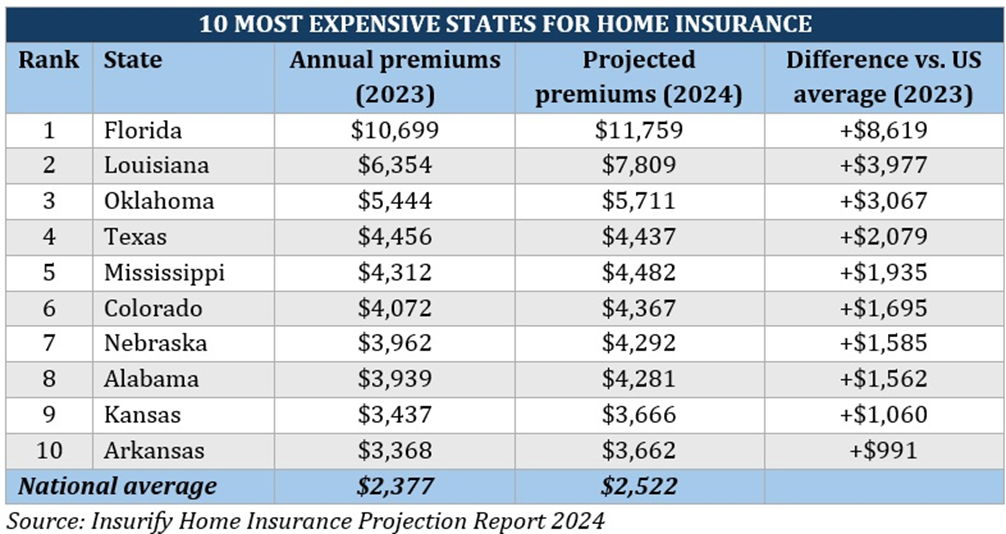

1. Location

Areas prone to natural disasters, crime, or high property values often have higher premiums.

2. Home Value and Age

Newer, high-value homes cost more to insure due to higher replacement costs.

3. Coverage Limits

Higher coverage limits mean higher premiums. Choosing the right limit is essential.

4. Deductibles

A higher deductible lowers your premium but increases out-of-pocket costs during claims.

5. Credit Score

A good credit score can lead to lower premiums as insurers see you as less risky.

6. Claims History

Frequent claims can increase your insurance costs.

7. Home Security Systems

Installing security systems can lower premiums by reducing the risk of theft.

8. Bundling Policies

Combining homeowners insurance with auto or other policies often results in discounts.

How to Find Cheap Homeowners Insurance

1. Compare Multiple Quotes

Use online comparison tools to get quotes from various insurers and find the best rate.

2. Increase Your Deductible

Opting for a higher deductible reduces your monthly premium.

3. Improve Your Credit Score

Pay bills on time and reduce debts to improve your score and lower your premiums.

4. Install Safety Features

Add smoke detectors, burglar alarms, and security cameras to qualify for discounts.

5. Bundle Insurance Policies

Purchase home and auto insurance from the same provider for better rates.

6. Maintain a Claims-Free Record

Avoid filing minor claims to keep your premiums low.

7. Ask for Discounts

Inquire about available discounts such as loyalty, senior, or military discounts.

8. Review Coverage Annually

Regularly assess your coverage needs and adjust your policy to avoid overpaying.

9. Avoid High-Risk Additions

Swimming pools and trampolines can increase premiums due to liability risks.

10. Work with an Independent Agent

An agent can help you find the best coverage at the lowest price by comparing multiple insurers.

10 Tips for Getting Cheap Homeowners Insurance

- Shop around for quotes annually.

- Increase your deductible for lower premiums.

- Improve home security with alarms and cameras.

- Maintain a good credit score.

- Bundle policies for discounts.

- Inquire about available discounts.

- Avoid frequent claims.

- Choose a policy with essential coverage only.

- Regularly review and adjust coverage.

- Work with an independent insurance agent.

10 FAQs About Cheap Homeowners Insurance

1. What is the cheapest homeowners insurance company? It varies by location and needs. Compare multiple insurers for the best rate.

2. Can I lower my premium by increasing my deductible? Yes, but you’ll pay more out-of-pocket during claims.

3. Does a security system reduce homeowners insurance costs? Yes, many insurers offer discounts for security systems.

4. How often should I review my homeowners insurance policy? Annually or after major home changes.

5. Does bundling home and auto insurance save money? Yes, bundling often leads to discounts.

6. How does my credit score affect my homeowners insurance? A higher credit score can lead to lower premiums.

7. Are older homes more expensive to insure? Yes, due to higher repair and replacement costs.

8. Can I negotiate my homeowners insurance premium? Yes, by comparing quotes and asking for discounts.

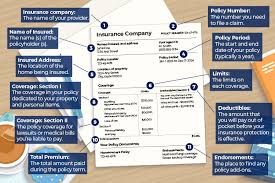

9. What coverage is essential in homeowners insurance? Dwelling, personal property, liability, and additional living expenses.

10. Do I need homeowners insurance if my home is paid off? It’s not required but highly recommended for financial protection.

Conclusion

Cheap homeowners insurance is attainable with the right strategies. By comparing quotes, increasing deductibles, improving your credit score, and installing security features, you can reduce your premiums significantly. Regularly reviewing your policy ensures you maintain the best coverage at the lowest cost. Protect your home affordably without compromising on essential coverage.