Low Cost Home Insurance: Affordable Protection for Your Property. Home insurance is essential for protecting your property from unexpected damages, but high premiums can be a burden. Fortunately, low-cost home insurance options provide the coverage you need without breaking the bank. In this comprehensive guide, we’ll explore how to find affordable home insurance, factors affecting rates, money-saving tips, and frequently asked questions.

Understanding Low-Cost Home Insurance

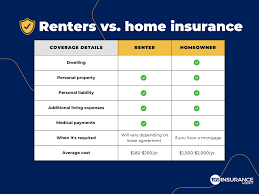

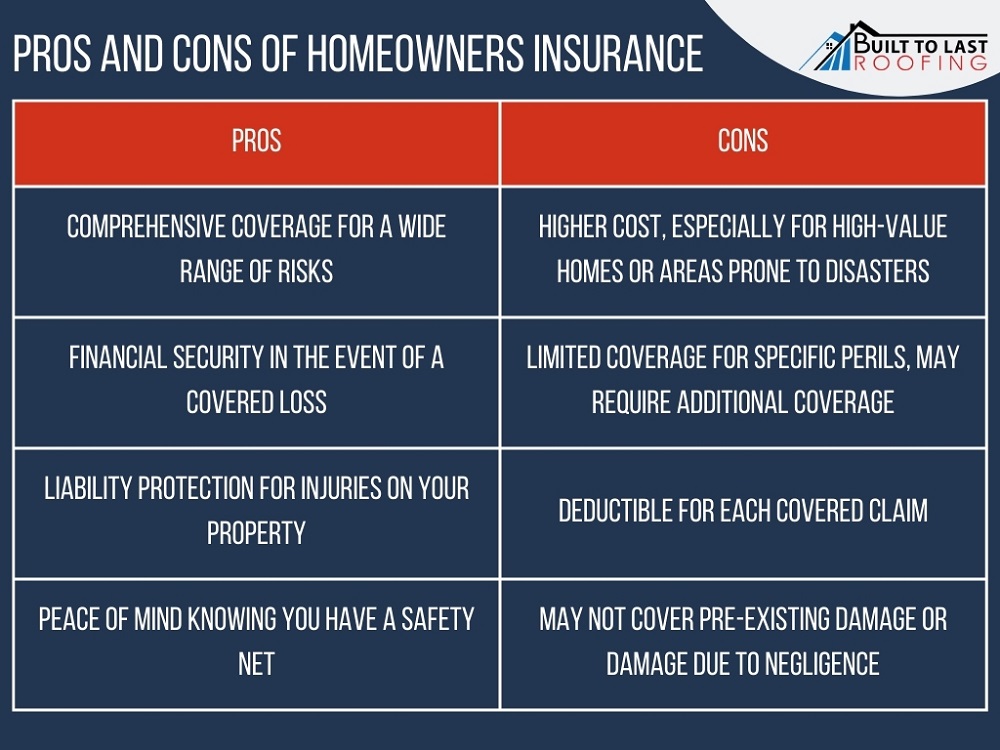

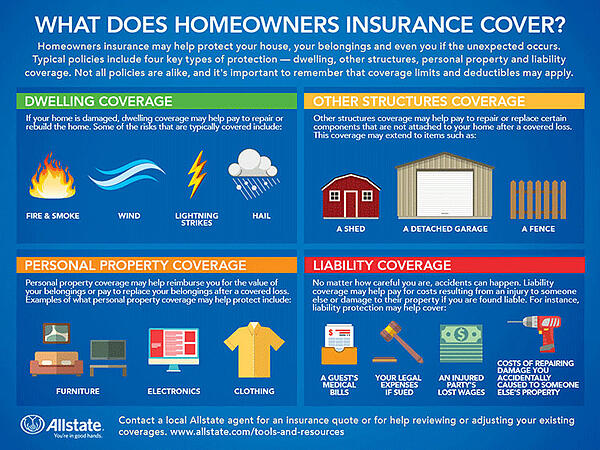

Low-cost home insurance refers to policies that offer essential coverage at an affordable price. While these policies may not have extensive add-ons, they still provide adequate protection against risks such as fire, theft, and natural disasters.

Key Features of Low-Cost Home Insurance:

- Basic coverage for structural damage and personal belongings

- Liability protection for accidents on your property

- Coverage for additional living expenses if your home becomes uninhabitable

- Customizable policy options to fit your budget

Factors Affecting Home Insurance Costs

Several factors influence the cost of home insurance. Understanding these elements can help you lower your premium:

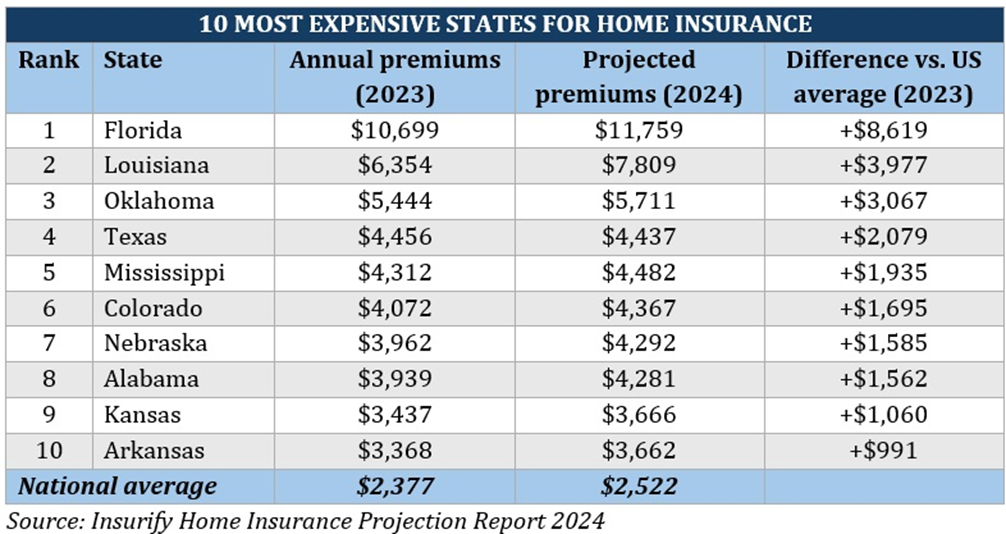

- Location – Homes in disaster-prone areas typically have higher insurance rates.

- Home Value – The cost to rebuild your home affects the insurance premium.

- Credit Score – A higher credit score can result in lower premiums.

- Deductible Amount – Higher deductibles lower the cost of premiums.

- Home Security – Security systems and fire alarms can qualify you for discounts.

- Age and Condition of Home – Older homes may require higher premiums due to maintenance risks.

- Claims History – A history of claims can increase your premium.

How to Find Low-Cost Home Insurance

1. Compare Multiple Insurance Providers

Using online comparison tools helps you find the most affordable home insurance that meets your needs.

2. Bundle Insurance Policies

Many insurance companies offer discounts when you bundle home and auto insurance.

3. Increase Your Deductible

Opting for a higher deductible reduces your monthly premiums, though you’ll pay more out-of-pocket for claims.

4. Ask About Discounts

Check for discounts related to:

- Home security systems

- Loyalty programs

- No-claim history

- Energy-efficient homes

5. Improve Home Security

Installing smoke detectors, security alarms, and deadbolts can lower insurance costs.

6. Maintain a Good Credit Score

A strong credit history can help you qualify for lower insurance rates.

7. Avoid Making Small Claims

Frequent claims may increase your premiums; consider paying minor repairs out-of-pocket.

8. Review Your Policy Annually

Insurance needs change over time, so it’s essential to reassess your coverage every year to ensure you’re getting the best deal.

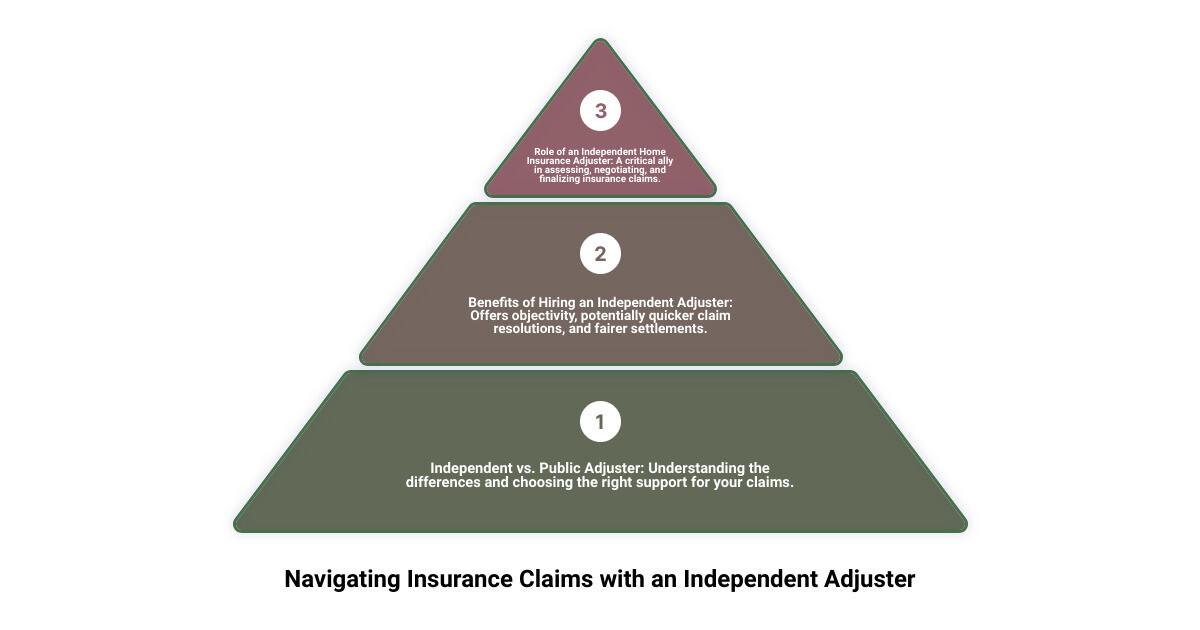

9. Work With an Independent Insurance Agent

An independent agent can help you compare policies from multiple insurers to find the best price.

10. Opt for Basic Coverage

If you’re looking for the most affordable option, choose a policy that covers essential risks and excludes unnecessary add-ons.

10 Tips for Lowering Home Insurance Costs

- Shop around and compare rates.

- Bundle home and auto insurance.

- Increase your deductible.

- Improve home security measures.

- Maintain a good credit score.

- Avoid filing small claims.

- Ask about discounts.

- Regularly review your policy.

- Choose a policy with essential coverage only.

- Work with an independent insurance agent.

10 Frequently Asked Questions (FAQs)

1. What is the average cost of home insurance?

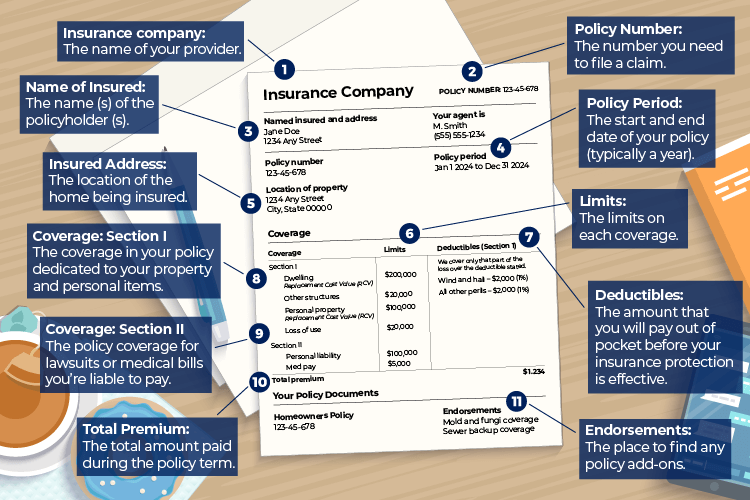

Home insurance costs vary based on location, home value, and coverage level. On average, homeowners pay between $1,200 and $2,500 per year.

2. Can I get home insurance with bad credit?

Yes, but a low credit score may result in higher premiums. Improving your credit can help reduce costs.

3. Does home insurance cover natural disasters?

Standard policies cover some natural disasters, but additional coverage may be needed for floods and earthquakes.

4. Can I switch home insurance providers anytime?

Yes, you can switch providers, but check for cancellation fees and ensure there’s no lapse in coverage.

5. What is a deductible in home insurance?

A deductible is the amount you pay out-of-pocket before insurance covers the rest of a claim.

6. Is home insurance mandatory?

It’s not legally required, but mortgage lenders usually require homeowners insurance.

7. Can I lower my home insurance premium?

Yes, by increasing your deductible, improving security, and maintaining good credit.

8. Does home insurance cover theft?

Yes, most policies include coverage for stolen belongings.

9. How often should I update my home insurance policy?

Review your policy annually to ensure you have adequate and cost-effective coverage.

10. Does home insurance cover home improvements?

Some policies may cover improvements, but you should notify your insurer about renovations.

Conclusion

Low-cost home insurance is an excellent way to protect your home while staying within budget. By understanding the factors that impact insurance rates and implementing cost-saving strategies, you can secure an affordable policy without compromising on essential coverage.

To ensure you’re getting the best deal, compare quotes, take advantage of discounts, and maintain good financial habits. With careful planning, you can find an insurance policy that offers both affordability and peace of mind.