Homeowners Insurance Calculator: Estimate Coverage and Costs. Homeowners insurance is an essential protection for your home, safeguarding it from potential risks such as fire, theft, and natural disasters. However, determining the right coverage amount and calculating insurance costs can be challenging. A homeowners insurance calculator simplifies this process by providing an accurate estimate of the coverage you need based on your property details, location, and personal preferences. In this guide, we will explore how these calculators work, factors influencing insurance costs, tips for using them effectively, and answers to frequently asked questions.

What is a Homeowners Insurance Calculator?

A homeowners insurance calculator is an online tool that helps homeowners estimate the cost of their insurance policy. It considers various factors such as the value of your home, local risks, personal belongings, and coverage preferences. By inputting relevant details, homeowners can get a quick estimate of their potential premium costs and recommended coverage amounts.

How Does a Homeowners Insurance Calculator Work?

Most homeowners insurance calculators require users to enter specific information, including:

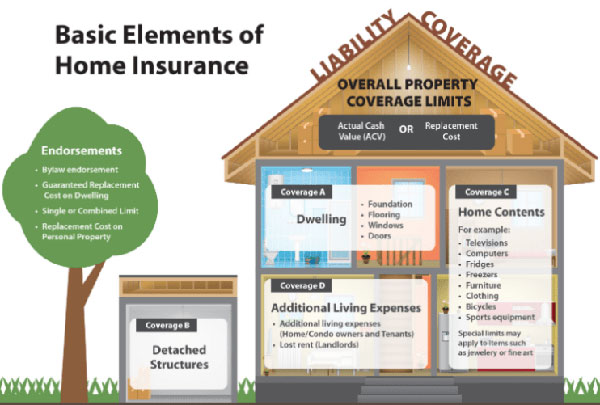

- Home Value: The estimated market value of your home.

- Replacement Cost: The cost to rebuild your home in case of total loss.

- Location: ZIP code and regional risk factors like hurricanes, earthquakes, or floods.

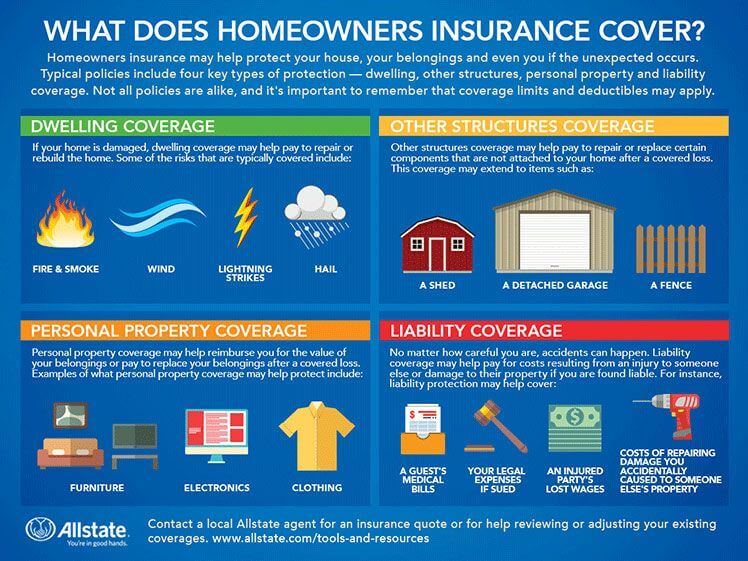

- Personal Property Coverage: The value of personal belongings inside the home.

- Liability Coverage: Protection against legal claims in case of accidents.

- Deductibles: The amount you are willing to pay out-of-pocket before insurance coverage applies.

- Additional Coverage: Extra protection for high-value items or natural disasters not covered in standard policies.

By analyzing these inputs, the calculator provides an estimated insurance premium, helping homeowners make informed decisions.

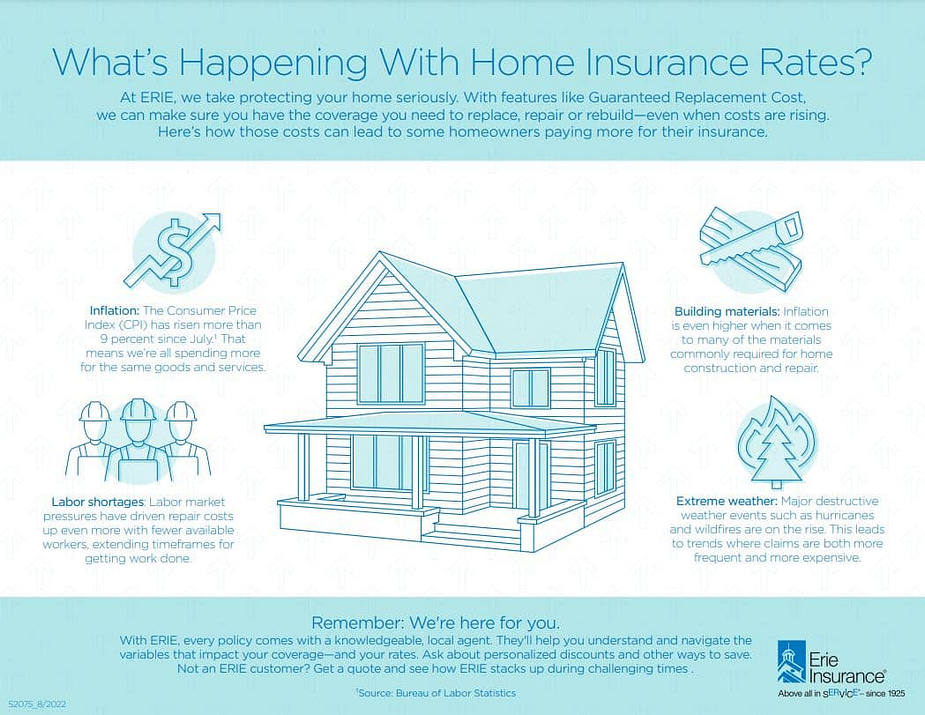

Factors That Affect Homeowners Insurance Costs

Several factors influence the cost of a homeowners insurance policy:

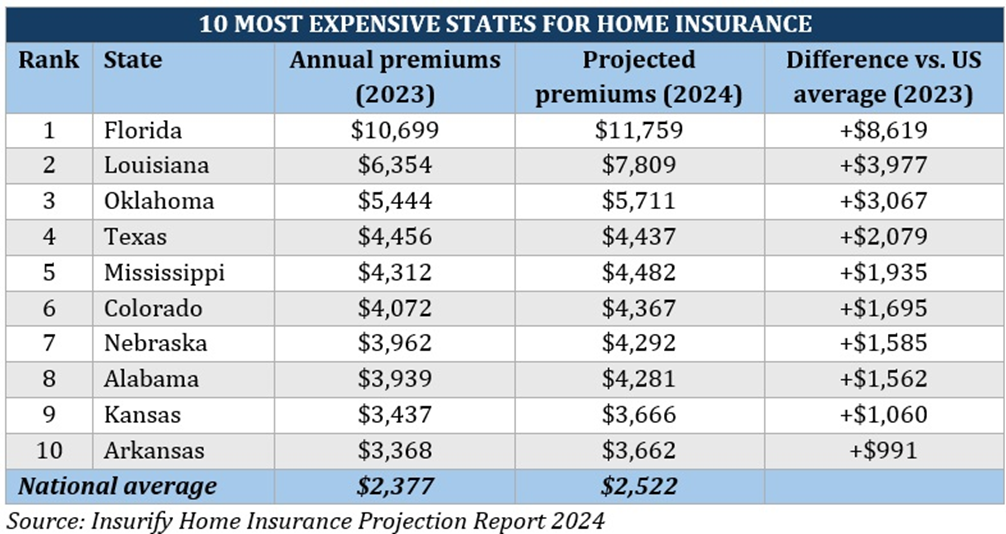

- Home’s Location: High-risk areas (e.g., flood zones) may increase insurance costs.

- Home Value and Size: Larger and more expensive homes require higher coverage limits.

- Construction Materials: Brick homes may have lower premiums than wood-frame homes.

- Age of Home: Older homes may have higher insurance costs due to potential structural issues.

- Home Security: Installing security systems and smoke detectors can reduce premiums.

- Claims History: A history of past claims may increase your insurance rates.

- Credit Score: Insurers may use your credit score to determine policy rates.

- Deductible Amount: Choosing a higher deductible can lower monthly premiums.

- Coverage Limits: More comprehensive coverage increases policy costs.

- Bundled Policies: Combining homeowners and auto insurance can offer discounts.

10 Tips for Using a Homeowners Insurance Calculator Effectively

- Know Your Home’s Value: Use recent appraisals or real estate listings for accurate estimates.

- Consider Replacement Costs: Calculate how much it would cost to rebuild your home, not just its market value.

- Evaluate Personal Property Coverage: Make a detailed inventory of valuable items.

- Understand Deductibles: Choose a deductible that balances affordability and coverage.

- Include Liability Protection: Ensure sufficient coverage for potential lawsuits.

- Check Regional Risks: Consider additional coverage if you live in areas prone to natural disasters.

- Review Discounts: Look for discounts on security systems, smoke alarms, and bundled policies.

- Compare Multiple Quotes: Use results from different calculators to compare coverage options.

- Update Information Regularly: Adjust coverage as your home value and possessions change.

- Consult an Insurance Agent: Get professional advice to ensure you choose the best policy.

10 Frequently Asked Questions (FAQs)

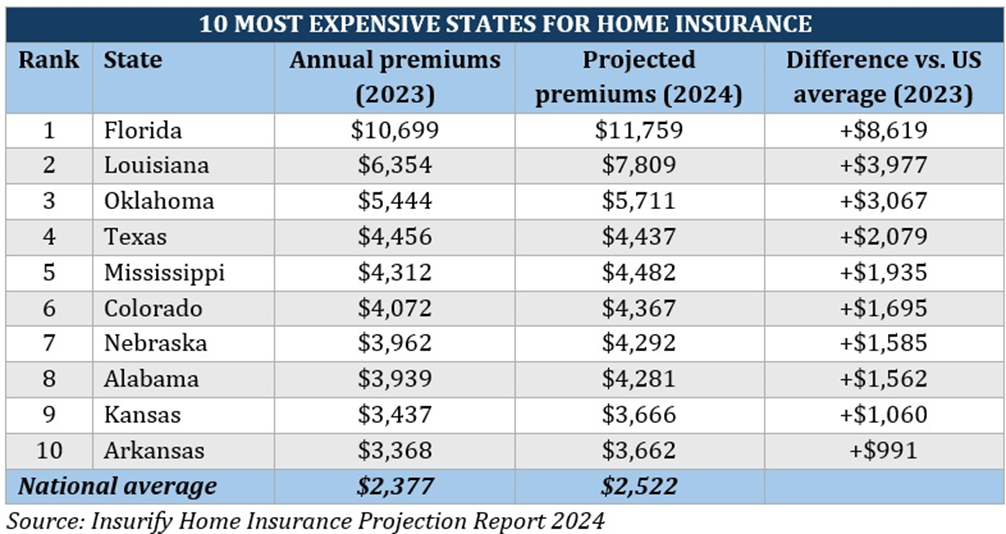

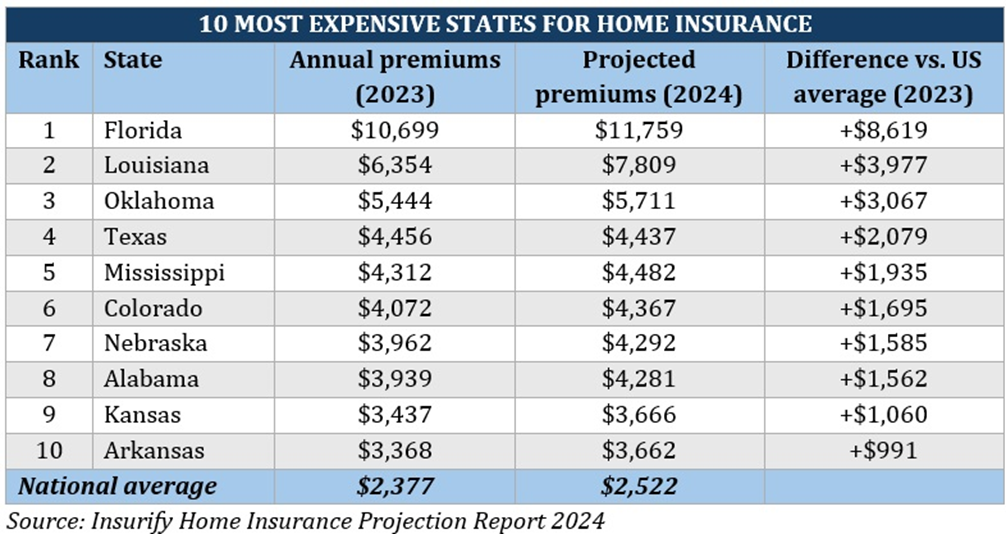

1. What is the average cost of homeowners insurance?

The average cost varies but typically ranges between $1,000 and $3,000 annually, depending on location and coverage.

2. Does homeowners insurance cover flood damage?

Standard policies do not cover floods; separate flood insurance is required.

3. How can I lower my homeowners insurance premiums?

You can lower premiums by increasing deductibles, improving home security, and bundling policies.

4. Is homeowners insurance mandatory?

While not legally required, mortgage lenders often require it.

5. How do I determine my home’s replacement cost?

Use construction cost estimates, home appraisals, or insurance company assessments.

6. Can I change my coverage limits after purchasing a policy?

Yes, you can adjust coverage levels at any time by contacting your insurer.

7. What happens if I underinsure my home?

You may not receive full compensation in the event of a loss, leaving you with high out-of-pocket costs.

8. Does insurance cover home-based businesses?

Standard policies may not; you may need additional business coverage.

9. Can I get homeowners insurance with a bad credit score?

Yes, but you may pay higher premiums.

10. What should I do if my policy is too expensive?

Compare quotes, adjust deductibles, and look for discounts to lower costs.

Conclusion

A homeowners insurance calculator is a valuable tool for estimating insurance costs and coverage needs. By inputting relevant details, homeowners can make informed decisions about their policies, ensuring they have adequate protection at the best price. Understanding the factors that influence insurance rates, following expert tips, and addressing common concerns can help homeowners secure comprehensive and affordable coverage.

To ensure you get the best homeowners insurance policy, use an online calculator, compare multiple quotes, and consult an insurance professional. By doing so, you can protect your home, personal belongings, and financial well-being while keeping costs manageable.