Home Insurance Policies: Before Choosing the Right Coverage. Home insurance policies are essential for homeowners who want to protect their property and belongings from unexpected events. Choosing the right policy can be challenging, given the various coverage options available. This guide will help you understand home insurance policies, their benefits, and how to choose the best coverage for your needs.

What Are Home Insurance Policies?

Home insurance policies are agreements between homeowners and insurance companies that provide financial protection against damages, theft, and liabilities related to the home. These policies typically cover repairs, replacements, and legal costs in case of accidents or disasters.

Types of Home Insurance Policies

1. HO-1: Basic Form

Covers specific perils such as fire, lightning, windstorms, and theft. It provides minimal protection.

2. HO-2: Broad Form

Offers coverage for additional perils, including falling objects, freezing pipes, and structural damage.

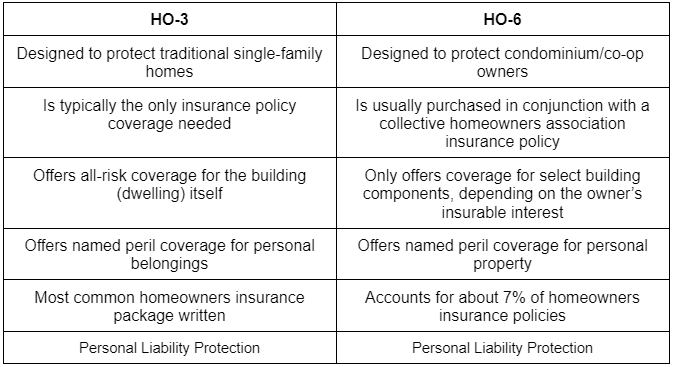

3. HO-3: Special Form (Most Common)

Covers most risks except those explicitly excluded in the policy. It includes dwelling, personal property, and liability protection.

4. HO-4: Renter’s Insurance

Designed for tenants, covering personal belongings and liability but not the structure itself.

5. HO-5: Comprehensive Form

Provides broader coverage, including higher limits for valuable items like jewelry and electronics.

6. HO-6: Condo Insurance

Covers personal property, liability, and interior damages within a condominium.

7. HO-7: Mobile Home Insurance

Tailored for mobile and manufactured homes, offering similar coverage to HO-3.

8. HO-8: Older Home Insurance

Covers homes that might not meet modern building codes, focusing on repair costs instead of replacement value.

What Does Home Insurance Cover?

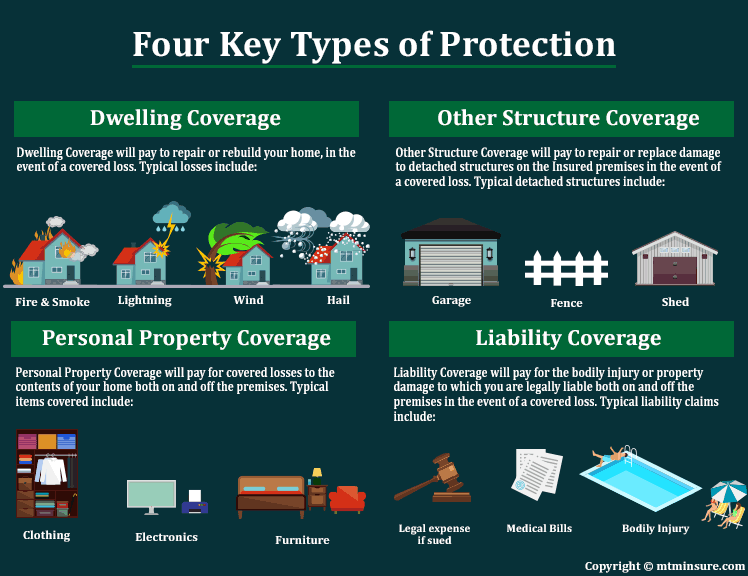

1. Dwelling Coverage

Protects the physical structure of your home from covered perils such as fires, storms, and vandalism.

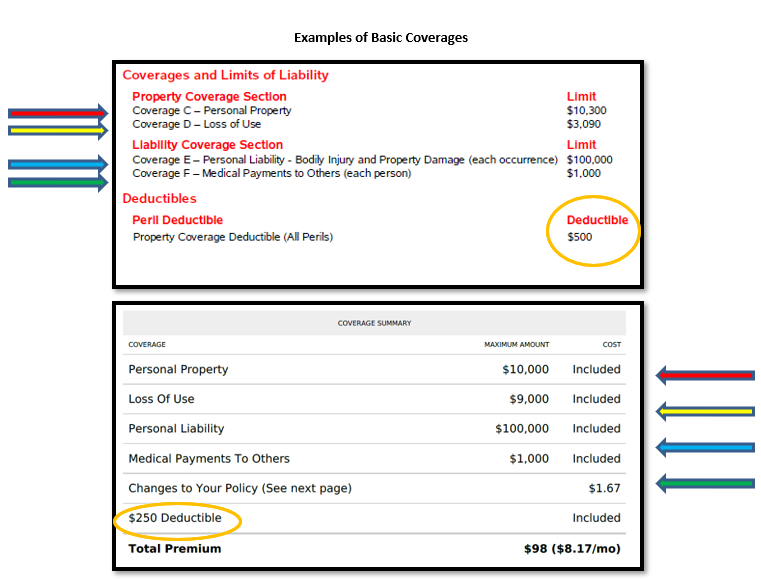

2. Personal Property Coverage

Covers belongings like furniture, electronics, and clothing against theft, fire, or other damages.

3. Liability Protection

Provides financial coverage if someone is injured on your property or if you accidentally cause damage to others.

4. Additional Living Expenses (ALE)

Covers temporary living expenses if your home becomes uninhabitable due to a covered event.

5. Medical Payments Coverage

Pays for medical expenses of guests injured in your home, regardless of fault.

Factors That Affect Home Insurance Rates

1. Location

Areas prone to natural disasters or high crime rates tend to have higher insurance premiums.

2. Home Age and Condition

Older homes may require higher premiums due to increased repair costs.

3. Coverage Limits

Higher coverage limits result in higher premiums but offer better protection.

4. Deductible Amount

A higher deductible lowers monthly premiums but increases out-of-pocket expenses in case of a claim.

5. Security Features

Homes with security systems, smoke detectors, and fire alarms may qualify for discounts.

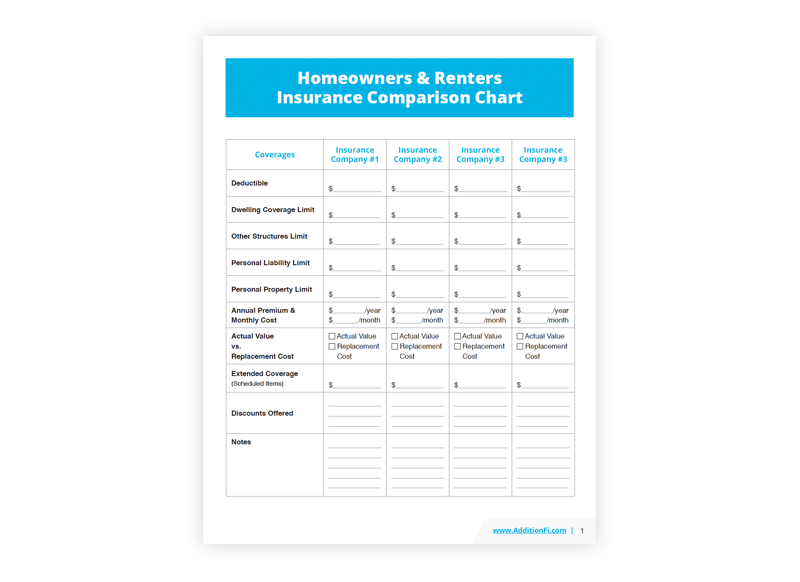

How to Choose the Best Home Insurance Policy

- Assess Your Needs – Determine the coverage amount based on home value and personal property.

- Compare Multiple Quotes – Get quotes from different insurers to find the best price.

- Check Policy Exclusions – Understand what is and isn’t covered in your policy.

- Consider Discounts – Look for bundling options, security system discounts, or loyalty rewards.

- Review Customer Reviews – Choose an insurer with good customer service and claims processing.

10 Tips for Saving on Home Insurance

- Increase your deductible to lower monthly premiums.

- Bundle home and auto insurance for discounts.

- Improve home security with alarms and surveillance cameras.

- Maintain good credit for better insurance rates.

- Avoid small claims to keep your premiums low.

- Regularly review and update your policy coverage.

- Make home improvements that reduce risk (e.g., storm-resistant roofs).

- Ask about discounts for retirees or long-term policyholders.

- Choose a policy with replacement cost coverage instead of actual cash value.

- Shop around annually to find better deals.

10 Frequently Asked Questions (FAQs)

1. What is the difference between replacement cost and actual cash value? Replacement cost covers full replacement without depreciation, while actual cash value factors in depreciation.

2. Does home insurance cover flooding? Standard policies do not cover flooding; separate flood insurance is required.

3. Can I change my home insurance provider anytime? Yes, but check for cancellation fees and compare policies before switching.

4. What happens if I don’t have home insurance? You risk financial losses due to damages, theft, or liability claims.

5. How do I file a home insurance claim? Contact your insurer, document damages, and provide necessary evidence for processing.

6. Are home-based businesses covered under home insurance? Standard policies may not cover business activities; additional business coverage is required.

7. Does home insurance cover mold damage? Coverage depends on the cause of mold. Neglect-related mold is usually not covered.

8. Can I get home insurance with bad credit? Yes, but poor credit may result in higher premiums.

9. How often should I review my home insurance policy? Review annually or after major home upgrades or changes.

10. What is liability coverage in home insurance? It covers legal and medical costs if someone is injured on your property.

Conclusion

Home insurance policies provide financial protection against various risks, including property damage, theft, and liability. Understanding different types of coverage, factors affecting rates, and how to choose the right policy ensures you get the best protection for your home and belongings.

By carefully selecting your policy and taking advantage of discounts, you can secure reliable coverage while keeping costs manageable. Make sure to review your policy regularly to keep it aligned with your needs.