Public Liability Claim Process: Guide to Securing Compensation. Public liability claims arise when an individual suffers an injury or damage due to negligence in a public place. Whether it’s a slip-and-fall accident, injury at a shopping mall, or harm caused by poorly maintained premises, understanding the public liability claim process is crucial for securing fair compensation. This guide provides a step-by-step explanation of how to file a claim, what to expect, and how to maximize your chances of success.

What is a Public Liability Claim?

A public liability claim is a legal process where an individual seeks compensation from a business, local authority, or property owner responsible for an unsafe public environment. Such claims cover incidents like:

- Slip and fall accidents

- Injuries caused by falling objects

- Accidents due to defective infrastructure

- Dog bites in public areas

- Swimming pool injuries

Step-by-Step Public Liability Claim Process

1. Gather Evidence

The first step in any claim is to collect crucial evidence to support your case. Key evidence includes:

- Photographs and Videos – Capture images of the hazard that caused your injury.

- Witness Statements – Obtain contact details and statements from people who saw the accident.

- Medical Records – Visit a doctor and get a medical report detailing your injuries.

- Incident Reports – If the incident occurred in a store or public facility, report it to the management and request a copy of the report.

2. Seek Medical Attention

Even if injuries seem minor, seek medical assistance immediately. A doctor’s report serves as crucial evidence in proving the severity of your injuries.

3. Notify the Responsible Party

Inform the business, local authority, or property owner about the incident. If they have public liability insurance, they may refer the matter to their insurer for assessment.

4. Consult a Public Liability Lawyer

Engaging an experienced personal injury lawyer significantly improves your chances of a successful claim. A lawyer can:

- Assess the viability of your case

- Gather additional evidence

- Negotiate with insurance companies

- Represent you in court if necessary

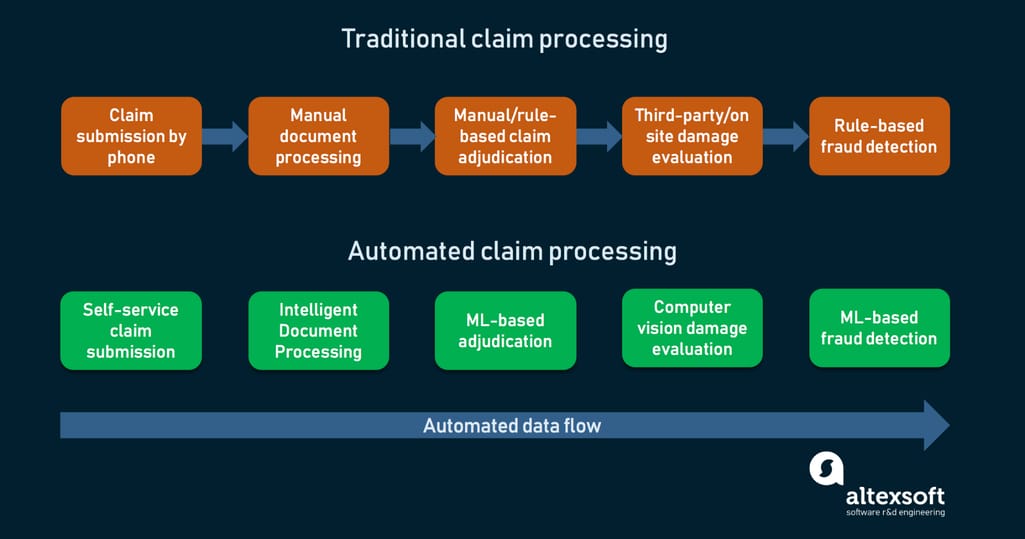

5. File the Claim with the Insurance Company

Most public liability claims are settled through insurance providers. Your lawyer will draft and submit a letter of demand, outlining:

- Details of the accident

- The extent of injuries

- Financial losses incurred

- Compensation amount sought

6. Wait for Insurance Response

After submitting the claim, the insurance company will investigate. They may accept, deny, or negotiate the claim amount. Expect them to:

- Request further evidence

- Conduct independent medical evaluations

- Propose a settlement amount

7. Negotiate Settlement

If the insurance company offers a settlement, your lawyer will negotiate for fair compensation. This covers:

- Medical Expenses – Current and future treatment costs

- Loss of Earnings – Compensation for lost income due to injury

- Pain and Suffering – Non-economic damages for trauma and distress

- Rehabilitation Costs – Costs of therapy and recovery programs

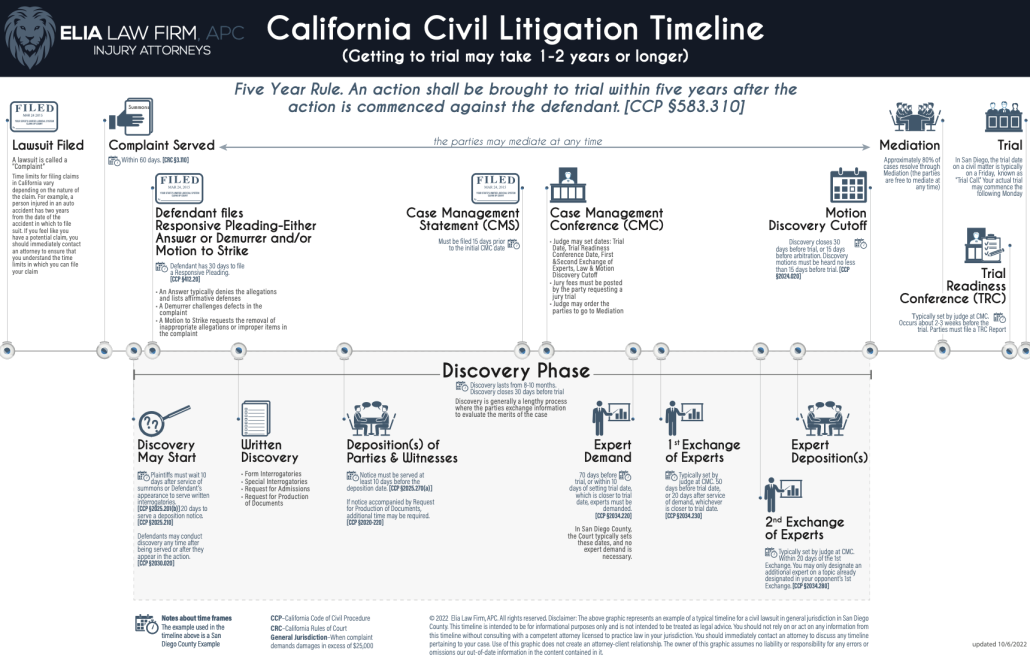

8. Take Legal Action (if Necessary)

If negotiations fail, filing a lawsuit may be necessary. The legal process includes:

- Filing a claim in court

- Mediation or arbitration

- Court trial (if no settlement is reached)

Common Challenges in Public Liability Claims

- Proving Negligence – You must demonstrate that the responsible party failed to maintain a safe environment.

- Insurance Denials – Insurers may argue that the accident was due to personal negligence.

- Delays in Processing – Some claims take months due to investigations and negotiations.

10 Essential Tips for a Successful Public Liability Claim

- Take photos immediately after the incident.

- Gather contact details of witnesses.

- Seek medical attention promptly.

- Keep a record of medical expenses and lost wages.

- Report the incident to the property owner or management.

- Avoid discussing the case with insurers without legal advice.

- Do not accept the first settlement offer without legal review.

- Maintain a detailed record of pain and suffering.

- Follow medical advice for treatment and recovery.

- Hire a public liability lawyer to guide you through the process.

10 Frequently Asked Questions (FAQs)

1. Who can file a public liability claim?

Anyone injured due to negligence in a public or commercial space can file a claim.

2. How long do I have to file a claim?

Time limits vary by jurisdiction, typically ranging from 1 to 3 years.

3. Do I need a lawyer to file a claim?

While not mandatory, hiring a lawyer improves your chances of a successful claim.

4. What if there were no witnesses?

Other evidence, such as photos, medical records, and CCTV footage, can support your claim.

5. Can I claim if I was partially at fault?

Yes, but compensation may be reduced based on contributory negligence.

6. How much compensation can I receive?

It depends on injury severity, financial losses, and non-economic damages.

7. What if the insurance company denies my claim?

You can appeal, negotiate, or take legal action in court.

8. Are legal fees covered in the claim?

Some lawyers work on a no-win, no-fee basis, meaning fees are covered from compensation.

9. How long does the claim process take?

Simple claims may settle in weeks, while complex cases can take months or years.

10. What if I sustained psychological trauma?

You can claim for emotional distress if it’s medically documented.

Conclusion

The public liability claim process ensures that individuals injured due to negligence receive rightful compensation. By gathering evidence, seeking medical help, consulting a lawyer, and negotiating effectively, claimants can maximize their compensation. While challenges may arise, understanding the process and following best practices can improve success rates. If you’ve been injured in a public place, taking swift legal action can secure the justice and financial relief you deserve.