Earthquake Insurance Claim Filing: A Comprehensive Guide. Natural disasters, especially earthquakes, can cause significant damage to properties, leaving individuals financially burdened. Filing an earthquake insurance claim is a crucial step in recovering your losses. This guide explains the process in detail, helping you maximize your claim while adhering to SEO-friendly practices for easy navigation.

Understanding Earthquake Insurance

What is Earthquake Insurance?

Earthquake insurance is a specialized coverage designed to protect your property and belongings from damage caused by seismic events. Unlike standard homeowners insurance, earthquake insurance specifically addresses earthquake-related damages.

Why Do You Need Earthquake Insurance?

- Protection Against Financial Loss: Earthquakes can cause severe structural damage that is costly to repair.

- Peace of Mind: Knowing you are covered allows you to focus on recovery instead of financial strain.

- Compliance: In some regions, earthquake insurance is mandatory for property owners.

Steps to File an Earthquake Insurance Claim

1. Assess the Damage

Begin by inspecting your property for visible damage, such as cracks in walls, foundation shifts, or damaged belongings. Document everything with photos and videos as evidence.

2. Review Your Policy

Understand the coverage details, deductibles, and exclusions in your earthquake insurance policy. This step ensures you know what to expect during the claims process.

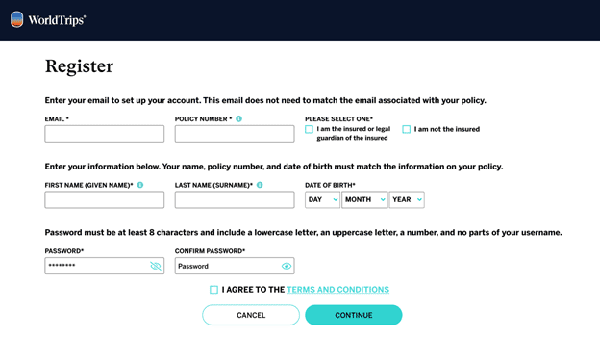

3. Contact Your Insurance Provider

Notify your insurance company immediately after assessing the damage. Provide accurate information about the extent of the damage and schedule an inspection.

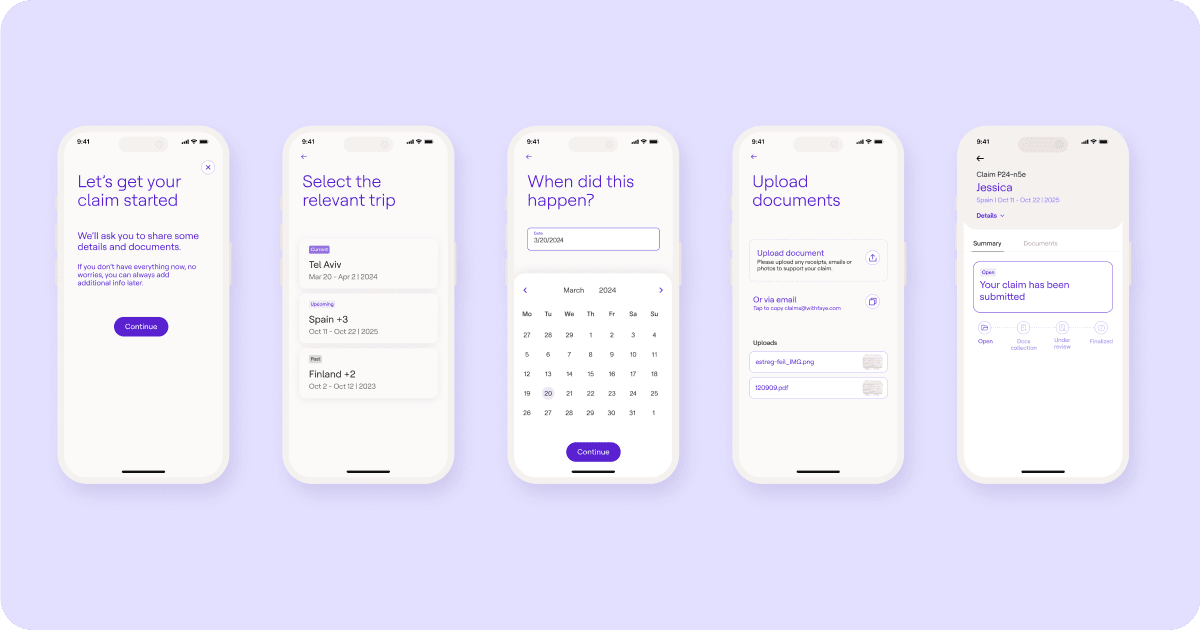

4. Compile Necessary Documents

Gather essential documents, including:

- Policy documents

- Proof of ownership (e.g., deeds, receipts)

- Inventory of damaged items

- Photos and videos of the damage

5. Work with the Adjuster

Your insurance provider will assign an adjuster to assess the damage. Be available during their visit and provide all necessary documentation.

6. Get Repair Estimates

Obtain detailed repair estimates from licensed contractors. These estimates will support your claim and help ensure fair compensation.

7. Submit the Claim

Complete the claim form accurately and submit it along with the required documentation. Retain copies of all submitted materials for your records.

8. Follow Up

Maintain regular communication with your insurance provider to track the claim’s progress. Promptly provide any additional information they request.

9. Receive Compensation

Once approved, you will receive a payout to cover the repair and replacement costs as per your policy’s terms.

10. Rebuild and Recover

Use the compensation to repair your property and replace damaged items, ensuring compliance with safety standards.

Common Challenges in Filing an Earthquake Insurance Claim

Delayed Response

Insurance claims often take time. Avoid delays by promptly providing all required information and following up regularly.

Disputes Over Coverage

Misunderstandings about policy coverage can lead to disputes. Thoroughly review your policy and consult with an expert if needed.

Insufficient Documentation

Lack of proper documentation may hinder your claim. Always maintain detailed records of your property and the damage incurred.

Low Settlement Offers

If you receive a low offer, negotiate with your insurance company. Present additional evidence, such as contractor estimates, to support your case.

10 Tips for Filing an Earthquake Insurance Claim

- Act Quickly: File your claim as soon as possible to avoid delays.

- Document Everything: Take clear photos and videos of the damage.

- Understand Your Policy: Familiarize yourself with the terms and coverage limits.

- Keep Receipts: Save receipts for repairs and temporary accommodations.

- Communicate Effectively: Maintain open communication with your insurer.

- Seek Professional Help: Hire a public adjuster if needed.

- Stay Organized: Keep all claim-related documents in one place.

- Request Clarifications: Don’t hesitate to ask your insurer for clarification.

- Avoid Quick Settlements: Ensure the offer covers all your expenses.

- Know Your Rights: Understand the regulations in your state or region.

10 FAQs About Earthquake Insurance Claims

1. What does earthquake insurance cover?

Earthquake insurance typically covers structural damage, personal belongings, and additional living expenses during repairs.

2. Is earthquake insurance mandatory?

In some regions prone to earthquakes, it may be required by law or lenders.

3. How do I know if my policy covers earthquakes?

Review your policy or consult your insurer for specific details.

4. What is a deductible in earthquake insurance?

A deductible is the portion of the claim you must pay out of pocket before insurance coverage begins.

5. Can I file a claim for minor damages?

Yes, but ensure the repair costs exceed your deductible.

6. How long does the claims process take?

It varies, but most claims are resolved within a few weeks to months.

7. What if my claim is denied?

You can appeal the decision or seek assistance from a public adjuster or legal professional.

8. Are aftershocks covered?

Yes, damages from aftershocks are typically covered if your policy is active.

9. Can I get coverage for retroactive damages?

No, insurance only covers damages that occur after the policy’s effective date.

10. How do I choose the best earthquake insurance policy?

Compare policies based on coverage, deductibles, premiums, and customer reviews.

Conclusion

Filing an earthquake insurance claim can be a complex process, but proper preparation and understanding can simplify it. By following the outlined steps, you can ensure a smoother claims experience and maximize your compensation. Document the damage thoroughly, communicate effectively with your insurer, and don’t hesitate to seek professional help when necessary.

Recovering from an earthquake is challenging, but having a well-executed plan can provide financial relief and peace of mind. Make earthquake insurance a priority to safeguard your assets and reduce stress during unforeseen events.