Pet Insurance Claim Guide: Everything You Need to Know. Filing a pet insurance claim can seem daunting at first, but with the right guidance, the process becomes smooth and stress-free. This comprehensive guide will help you navigate the steps to claim your pet insurance benefits while maximizing the value of your coverage. Let’s dive into the details of pet insurance claims, common challenges, tips for a successful claim, and frequently asked questions.

What is a Pet Insurance Claim?

A pet insurance claim is a formal request submitted to your insurance provider to cover eligible veterinary expenses for your pet. Once approved, you receive reimbursement based on your policy terms, such as the percentage covered and deductible limits.

How Does Pet Insurance Work?

- Choose a Plan: Policies vary in coverage, including accident-only, illness, or comprehensive plans.

- Pay Veterinary Costs: Most pet insurance providers require you to pay upfront for veterinary services.

- Submit a Claim: Provide all necessary documentation, such as invoices and medical records.

- Receive Reimbursement: The insurer reimburses you according to your plan’s terms, usually within a few weeks.

Types of Pet Insurance Coverage

- Accident-Only Plans: Covers unexpected injuries, such as fractures or cuts.

- Illness Plans: Includes treatment for illnesses like infections or chronic conditions.

- Comprehensive Plans: Offers the broadest coverage, including accidents, illnesses, and wellness care like vaccinations.

- Wellness Add-Ons: Some insurers provide optional add-ons for routine care.

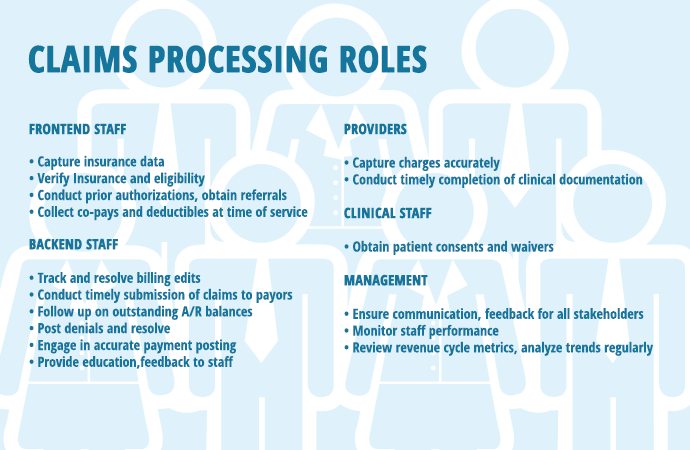

Steps to File a Pet Insurance Claim

- Review Your Policy:

- Understand the terms, exclusions, and waiting periods.

- Check if your treatment qualifies for coverage.

- Collect Documentation:

- Itemized invoices from your vet.

- Medical records detailing the treatment.

- Completed claim form from your insurer.

- Submit the Claim:

- Submit online, via email, or through a mobile app.

- Attach all required documents.

- Track Your Claim:

- Monitor the status using the insurer’s portal.

- Contact customer service for updates if needed.

- Receive Reimbursement:

- Ensure the reimbursement aligns with your policy terms.

- Notify the insurer of any discrepancies immediately.

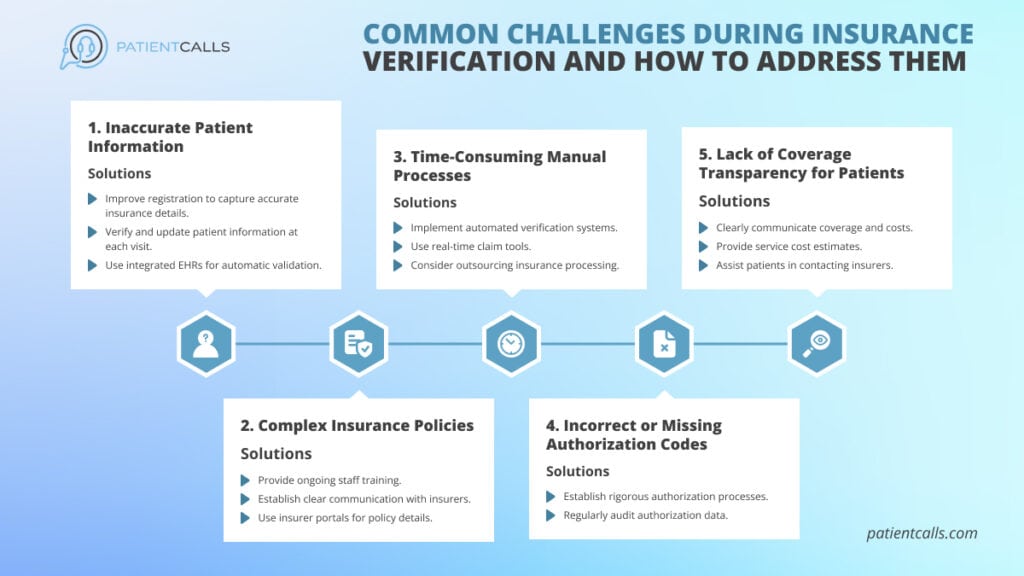

Common Challenges in Filing Claims

- Missing Documentation: Incomplete records can delay the process.

- Pre-Existing Conditions: Most policies exclude pre-existing conditions.

- Claim Denials: Occurs when the treatment isn’t covered or paperwork is incomplete.

- Policy Confusion: Misunderstanding terms like co-pays and limits can lead to disputes.

10 Tips for a Successful Pet Insurance Claim

- Read Your Policy Thoroughly: Familiarize yourself with coverage details and exclusions.

- Keep Accurate Records: Maintain organized medical and expense records.

- Act Quickly: Submit claims promptly to avoid delays.

- Follow Instructions: Complete forms as per the insurer’s guidelines.

- Maintain Clear Communication: Stay in touch with your provider throughout the process.

- Double-Check Details: Verify the accuracy of invoices and forms.

- Understand Reimbursement Rates: Know your policy’s percentage payout.

- Ask Questions: Don’t hesitate to clarify doubts with your insurer.

- Choose the Right Plan: Select a policy suited to your pet’s needs.

- Leverage Digital Tools: Use mobile apps for faster claim submissions.

10 Frequently Asked Questions About Pet Insurance Claims

- What is the typical processing time for claims?

- Most claims are processed within 7-14 business days.

- Can I claim for pre-existing conditions?

- No, pre-existing conditions are typically excluded from coverage.

- Are routine checkups covered?

- Routine care is only covered if your plan includes a wellness add-on.

- What happens if I’m late in submitting my claim?

- Late submissions may result in claim denial. Check your policy’s deadline.

- Is there a limit on the number of claims I can file?

- Some policies impose annual or lifetime limits; others have unlimited coverage.

- Do all vets accept pet insurance?

- Pet insurance typically works through reimbursement, so vet acceptance is not an issue.

- What documents are needed for a claim?

- Invoices, medical records, and a completed claim form are usually required.

- Can I appeal a denied claim?

- Yes, most insurers allow appeals with additional documentation.

- How do deductibles work?

- You pay a set amount before the insurance coverage kicks in.

- Does pet age affect coverage?

- Older pets may face higher premiums or limited coverage options.

Conclusion

Understanding the ins and outs of pet insurance claims ensures a seamless experience and helps you get the most out of your policy. By being proactive, organized, and informed, you can safeguard your pet’s health while minimizing financial stress.

With these insights, filing a claim no longer needs to be an intimidating process. Whether you’re a first-time pet owner or an experienced pet parent, knowing how to handle claims effectively is a vital step in responsible pet ownership.