Health Claim Denial Appeal: Handle and Overcome Insurance. Health insurance is a crucial safety net, but facing a denied health claim can be both frustrating and overwhelming. Understanding the appeal process is key to ensuring you receive the coverage you deserve. In this comprehensive guide, we will walk you through how to appeal a health claim denial effectively, provide actionable tips, and answer frequently asked questions.

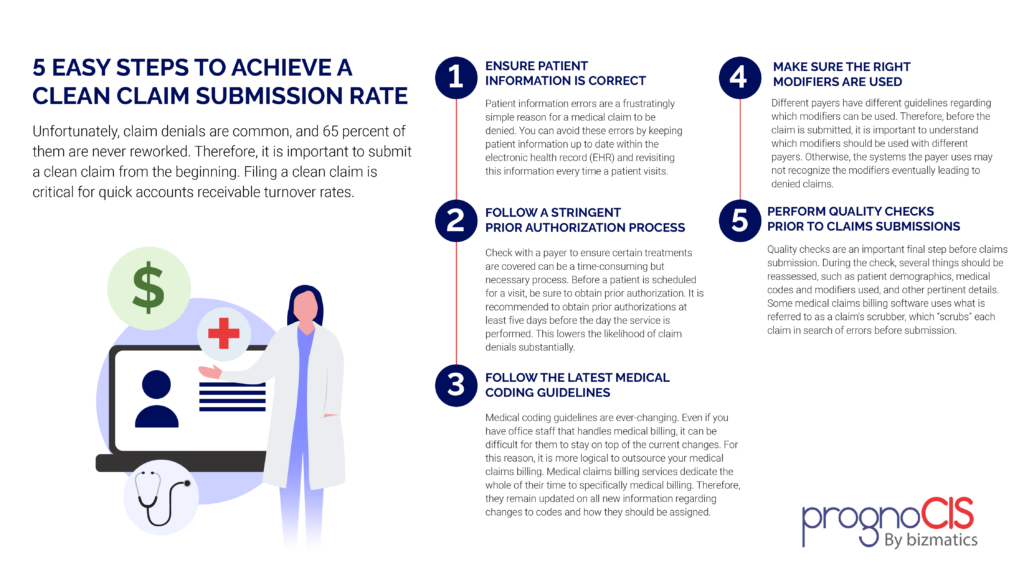

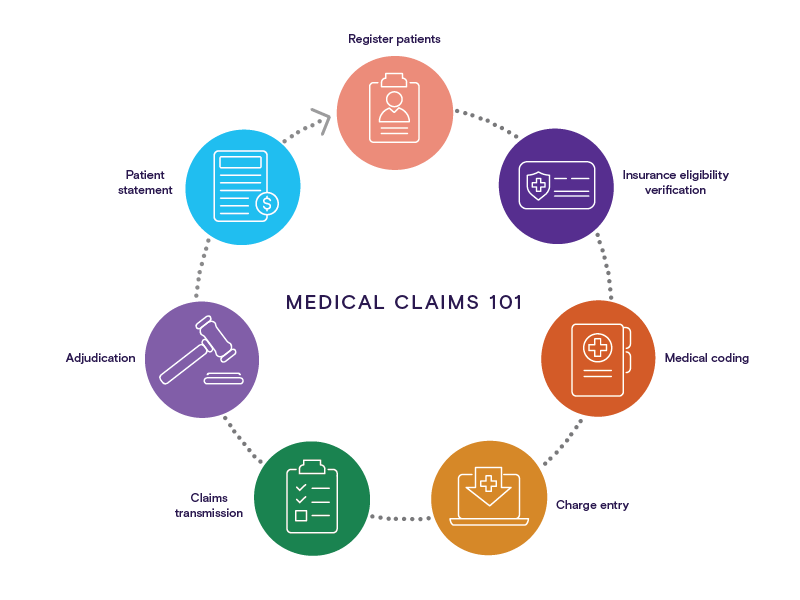

Why Health Claims Get Denied Insurance companies deny claims for various reasons, including:

- Incomplete or Incorrect Documentation: Missing details can result in rejection.

- Policy Exclusions: Certain treatments or procedures might not be covered.

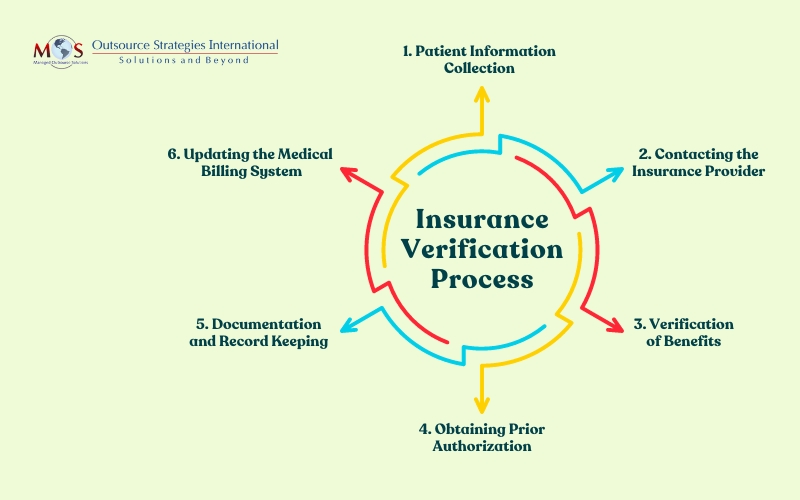

- Pre-Authorization Issues: Lack of prior approval for specific services.

- Coding Errors: Mistakes in medical billing codes can trigger denials.

- Eligibility Issues: Coverage might lapse due to non-payment or other reasons.

Understanding the reason behind your denial is the first step toward a successful appeal.

Steps to Appeal a Health Claim Denial

- Review the Explanation of Benefits (EOB)

- The EOB outlines why the claim was denied. Examine it closely to identify errors or missing information.

- Understand Your Policy

- Familiarize yourself with your insurance policy to determine whether the service is genuinely covered.

- Gather Necessary Documentation

- Collect all relevant medical records, prescriptions, and correspondence related to the denied claim.

- Contact Your Insurance Provider

- Speak with a representative to clarify the denial reason and ask how to correct the issue.

- Write an Appeal Letter

- Draft a formal letter explaining why the claim should be approved. Include:

- Policy details (name, policy number, etc.).

- A clear description of the service provided.

- Supporting documents such as physician’s notes.

- Draft a formal letter explaining why the claim should be approved. Include:

- Submit Your Appeal on Time

- Most insurance companies have strict deadlines for appeals. Ensure your appeal is submitted within the timeframe.

- Follow Up Regularly

- Keep track of your appeal’s status by contacting the insurance company periodically.

- Escalate If Necessary

- If your appeal is denied, request a review by a third party or contact your state insurance commission.

10 Tips for a Successful Appeal

- Stay Calm and Organized: Keep all documents in one place.

- Double-Check Paperwork: Ensure no forms are missing or incorrectly filled out.

- Request Detailed Explanations: Ask for specific reasons behind the denial.

- Use Professional Language: Keep your appeal letter polite and concise.

- Highlight Policy Wording: Reference relevant clauses in your insurance contract.

- Seek Medical Support: Request your doctor’s assistance in providing additional evidence.

- File Promptly: Meet all deadlines without delay.

- Document Everything: Record all interactions with the insurance provider.

- Consult an Expert: Hire a healthcare advocate if necessary.

- Know Your Rights: Understand the laws governing insurance appeals in your state.

10 Frequently Asked Questions About Health Claim Denial Appeals

- Can I appeal a denial more than once? Yes, most insurance companies allow multiple appeals if new evidence is presented.

- How long does the appeal process take? It typically takes 30-60 days, but timelines vary by insurer.

- What if I miss the appeal deadline? Contact your insurer immediately; they might grant an extension in certain cases.

- Does appealing cost money? No, filing an appeal is usually free.

- Can my doctor appeal on my behalf? Yes, many doctors’ offices assist with the appeal process.

- What is an external review? It’s an independent review of your appeal by a third party.

- Do all denials qualify for appeal? No, claims excluded by your policy cannot be appealed.

- Will appealing affect my coverage? No, filing an appeal does not impact your existing coverage.

- What if my appeal is denied? Consider escalating to an external review or seeking legal advice.

- Are there time limits for submitting claims? Yes, check your policy for submission deadlines.

Conclusion

Facing a health claim denial can be daunting, but understanding the appeal process empowers you to fight for your rights. By staying informed, organized, and proactive, you can navigate the system effectively and increase your chances of success.

Remember, persistence is key—if your initial appeal is unsuccessful, don’t hesitate to seek further options. With the right approach, you can turn a denial into an approval and secure the coverage you deserve.