Telehealth Insurance Claim Process: Healthcare Reimbursement. Telehealth has revolutionized how we access healthcare services, offering convenience and accessibility. However, navigating the telehealth insurance claim process can sometimes feel daunting. This guide breaks down the process, ensuring a smooth path to reimbursement for your telehealth expenses.

What is the Telehealth Insurance Claim Process?

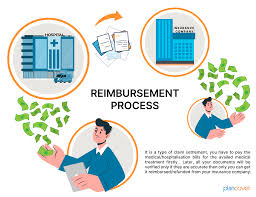

The telehealth insurance claim process involves submitting a request to your insurance provider to cover the cost of virtual medical consultations or treatments. This typically requires accurate documentation, adherence to policy guidelines, and an understanding of claim filing procedures.

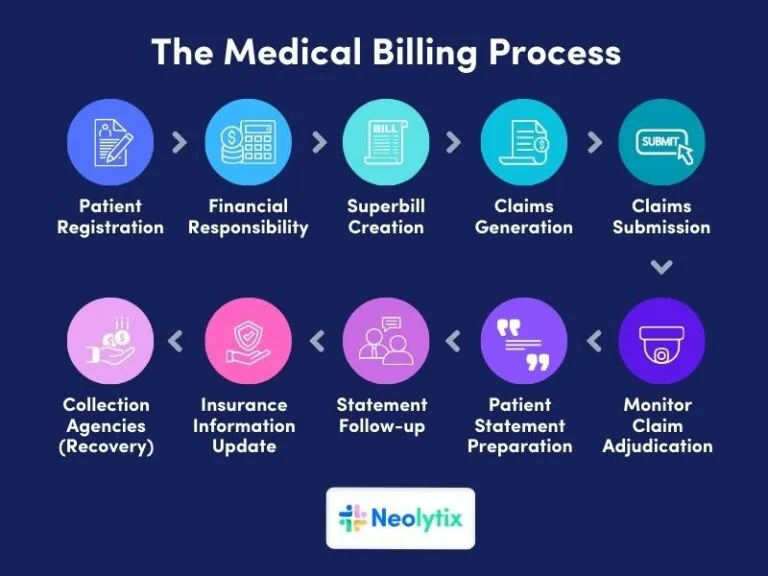

Steps to File a Telehealth Insurance Claim

- Verify Telehealth Coverage

- Check your insurance policy to confirm telehealth services are covered.

- Look for specific terms regarding covered providers and treatments.

- Schedule Your Telehealth Appointment

- Ensure the healthcare provider is in-network if required by your policy.

- Save appointment details like date, time, and provider information.

- Collect Necessary Documentation

- Obtain an itemized bill from your provider.

- Secure a medical report detailing the consultation and prescribed treatments.

- Complete Claim Forms

- Fill out the insurance company’s claim form accurately.

- Provide details such as policy number, patient details, and treatment description.

- Submit Your Claim

- Send the completed claim form and required documents to your insurer via mail or their online portal.

- Retain copies of all submitted materials for your records.

- Track Your Claim Status

- Regularly check for updates through the insurer’s website or customer service.

- Respond promptly to any additional information requests.

Common Challenges in Telehealth Claims and How to Overcome Them

- Claim Denials

- Cause: Non-compliance with policy terms or incomplete documentation.

- Solution: Double-check coverage details and ensure all forms are complete.

- Delayed Reimbursements

- Cause: Processing backlogs or missing information.

- Solution: Follow up consistently and provide any requested information swiftly.

- Out-of-Network Issues

- Cause: Using providers not covered by your policy.

- Solution: Always confirm a provider’s network status before scheduling an appointment.

How to Maximize Success in Telehealth Insurance Claims

- Understand Your Policy

- Read your policy thoroughly to know what is covered.

- Clarify any doubts with your insurer before filing a claim.

- Choose In-Network Providers

- Using in-network providers often results in higher reimbursement rates.

- Organize Documentation

- Keep all medical bills, prescriptions, and claim forms in one place.

- Be Accurate and Prompt

- Ensure all details in your claim form match supporting documents.

- File claims as soon as possible to avoid delays.

10 Tips for Filing Telehealth Insurance Claims

- Confirm telehealth coverage before booking an appointment.

- Choose providers within your insurance network.

- Keep a detailed record of your telehealth visits.

- Understand your insurer’s reimbursement rates.

- Use your insurer’s online portal for faster submissions.

- Double-check all forms for accuracy.

- Retain copies of all submitted documents.

- Respond promptly to requests for additional information.

- Familiarize yourself with the appeals process for denied claims.

- Leverage customer service for guidance when needed.

10 Frequently Asked Questions (FAQs) About Telehealth Insurance Claims

- Is telehealth covered by all insurance plans? Coverage varies; check with your provider for specific details.

- Can I claim telehealth services for mental health treatments? Many policies cover telehealth for mental health, but confirm with your insurer.

- What happens if my claim is denied? You can appeal the decision by providing additional documentation or clarification.

- Are out-of-network telehealth services reimbursed? It depends on your policy. Some insurers provide partial reimbursement.

- How long does the claim process take? Processing times vary but usually range from a few days to several weeks.

- What documents are required for filing a telehealth claim? Itemized bills, consultation reports, and completed claim forms.

- Can I use telehealth for follow-up appointments under insurance? Yes, if your policy covers follow-up visits.

- Do I need pre-authorization for telehealth services? Some insurers require pre-authorization; confirm with your provider.

- Can I file claims for telehealth services received internationally? Only if your policy includes international coverage.

- What if my insurer doesn’t recognize telehealth services? Discuss options with your insurer or explore alternative reimbursement pathways.

Conclusion

Filing a telehealth insurance claim doesn’t have to be a complicated process. By understanding your policy, organizing necessary documents, and promptly submitting claims, you can ensure a hassle-free experience. Telehealth offers unprecedented convenience in healthcare, and being well-informed about the claim process maximizes its benefits.

Whether you’re new to telehealth or seeking better reimbursement success, this guide equips you with the tools to navigate the process confidently. With preparation and diligence, your telehealth claims can be as seamless as the care you receive.