Custom Car Insurance Claim: Guide to Hassle-Free Processing. Navigating the complexities of a car insurance claim can be overwhelming, especially when dealing with custom vehicles. Ensuring your unique modifications are covered and your claim is processed smoothly requires a strategic approach. This guide provides in-depth insights into custom car insurance claims, from filing to final settlement, ensuring you’re well-prepared every step of the way.

What Is a Custom Car Insurance Claim?

A custom car insurance claim pertains to filing for coverage or compensation for damages to a vehicle with modifications that extend beyond factory standards. These modifications may include:

- Performance upgrades (e.g., turbochargers, exhaust systems).

- Aesthetic enhancements (e.g., custom paint jobs, body kits).

- Interior modifications (e.g., high-end sound systems, specialized seating).

Insurance for custom cars differs from standard auto policies, emphasizing the value of modifications to ensure they are adequately covered.

Step-by-Step Guide to Filing a Custom Car Insurance Claim

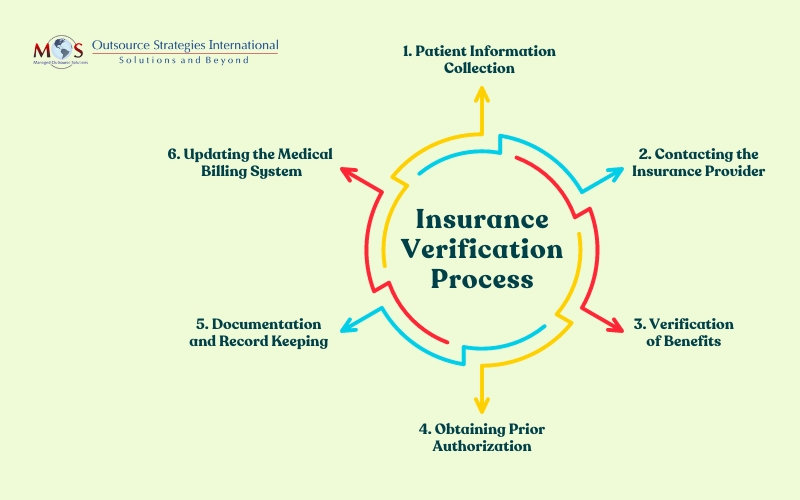

- Document the Damage

- Take clear photographs of the affected areas.

- Highlight custom features impacted by the damage.

- Review Your Policy

- Confirm that your modifications are listed.

- Check for exclusions or special clauses concerning custom components.

- Contact Your Insurer

- Notify your insurance provider promptly.

- Provide all necessary details about the incident.

- Provide Supporting Documentation

- Receipts for customizations.

- Maintenance records for the modifications.

- Schedule an Inspection

- Allow the insurance adjuster to assess the damage.

- Emphasize the value of the custom elements during discussions.

- Obtain Repair Estimates

- Get quotes from specialists experienced in custom vehicles.

- Ensure estimates include restoring custom features.

- Follow Up Regularly

- Stay in contact with your insurer to expedite processing.

- Respond promptly to any requests for additional information.

- Appeal If Necessary

- If your claim is denied, review the reasons and provide counter-evidence.

- Seek legal assistance if required.

Key Factors Insurers Consider

- Value of Custom Modifications: Accurate valuation is critical to ensure proper coverage.

- Documentation: Complete and updated paperwork strengthens your claim.

- Policy Coverage: Specialized custom car policies often provide broader protection compared to standard plans.

- Repair Costs: Insurers assess whether repairs align with the declared value of the vehicle.

Benefits of Custom Car Insurance

- Comprehensive Protection: Coverage tailored for high-value modifications.

- Peace of Mind: Knowing your investment is safeguarded.

- Restoration Guarantees: Assurance that custom features can be restored to pre-incident conditions.

10 Tips for a Successful Custom Car Insurance Claim

- Choose the Right Policy: Opt for insurers specializing in custom vehicles.

- Document All Modifications: Maintain an updated record of receipts and photos.

- Assess Policy Limits: Ensure your policy adequately covers the total value of modifications.

- Perform Regular Valuations: Update your insurer about any new modifications.

- Understand Policy Exclusions: Know what is and isn’t covered.

- Act Promptly: Report incidents as soon as possible.

- Keep Maintenance Records: Prove your vehicle’s condition before the incident.

- Use Reputable Repair Shops: Ensure repairs meet industry standards.

- Communicate Clearly: Provide detailed and accurate information during the claim process.

- Be Prepared to Negotiate: Advocate for the full value of your claim if necessary.

10 FAQs About Custom Car Insurance Claims

- What is considered a custom modification? Any change to the vehicle’s original specifications, including performance or aesthetic enhancements.

- Do all insurers cover custom modifications? No, specialized insurers are typically required for comprehensive coverage.

- How are custom modifications valued? Based on receipts, appraisals, and market value assessments.

- Will my premium increase after a claim? It depends on the policy and the nature of the claim.

- Can I file a claim for partial damages? Yes, you can file for specific damages affecting custom components.

- What documents are needed for a claim? Receipts, photographs, maintenance records, and incident details.

- Are custom audio systems covered? Typically, if declared in the policy.

- What if my claim is denied? Review the reasons, provide additional evidence, and consider appealing.

- Can I use any repair shop? It’s advisable to use shops specializing in custom vehicles.

- How long does it take to process a claim? Processing times vary but can range from weeks to months.

Conclusion

Filing a custom car insurance claim requires diligence, documentation, and understanding of your policy’s specifics. By following the outlined steps and tips, you can streamline the process and secure the compensation necessary to restore your vehicle’s unique features. Remember, investing in a specialized policy tailored to custom vehicles is the cornerstone of effective protection.

With the right preparation and communication, your custom car can be back on the road, reflecting the pride and passion you’ve invested in its creation.