Speedy Car Claim Settlement: Guide to Fast Insurance Resolutions. When accidents happen, time is of the essence, especially when filing an insurance claim. A speedy car claim settlement can save you stress, time, and money. In this article, we’ll guide you through the steps to achieve a quick resolution and answer common questions about the process.

Why Speedy Car Claim Settlement Matters

The importance of a fast car claim settlement goes beyond convenience:

- Minimized Financial Strain: Quick settlements help you manage repair costs without significant delays.

- Reduced Stress: Prompt resolutions allow you to move on from the accident faster.

- Preservation of Vehicle Value: Speedy repairs prevent further damage or depreciation.

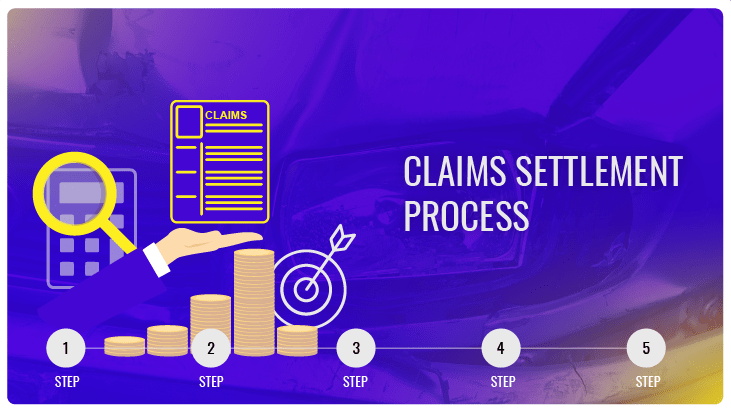

Steps to Ensure a Speedy Car Claim Settlement

1. Document the Incident Immediately

After an accident, collect essential details:

- Photos of the scene, damage, and injuries.

- Contact information of involved parties and witnesses.

- A copy of the police report if available.

2. Notify Your Insurance Company Without Delay

Inform your insurer immediately. Most policies have a set window for reporting claims. Delayed notification can complicate or even invalidate your claim.

3. Provide Accurate Information

Honesty is critical. Any discrepancies can slow down the process or lead to claim rejection.

4. Understand Your Policy

Familiarize yourself with:

- Coverage limits.

- Deductibles.

- Exclusions.

This knowledge ensures you avoid unnecessary back-and-forth with your insurer.

5. Cooperate Fully with Adjusters

Insurance adjusters assess the validity of your claim. Provide them with:

- Complete documentation.

- A clear narrative of the incident.

6. Work with Approved Repair Shops

Most insurers have preferred repair shops. Using one can streamline the approval process.

7. Keep Records of All Correspondence

Document your interactions with your insurer, including emails, calls, and letters. This can resolve misunderstandings swiftly.

8. Consider Hiring an Attorney for Disputes

If your claim faces undue delays, a legal professional can advocate on your behalf.

Common Causes of Claim Delays

- Incomplete Documentation: Missing or incorrect paperwork can halt progress.

- Disputed Liability: When fault is unclear, claims may take longer.

- Policy Misunderstandings: Misaligned expectations regarding coverage.

- High Claim Volumes: Periods like natural disasters can overwhelm insurers.

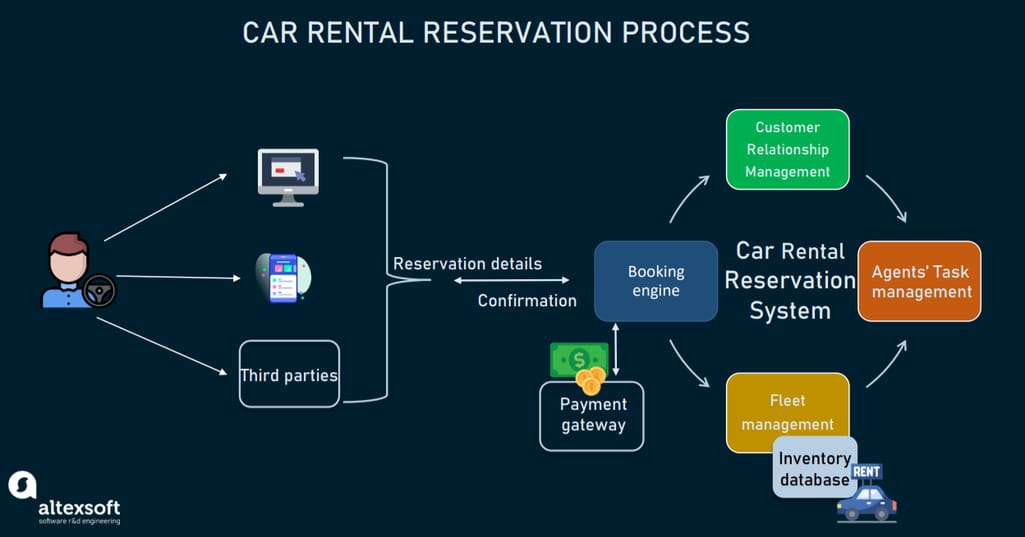

- Third-Party Insurer Issues: Delays from the other party’s insurance provider.

10 Tips for a Faster Car Claim Settlement

- Stay Organized: Keep all claim-related documents in one place.

- Follow Up Regularly: Politely check the status of your claim.

- Be Proactive: Anticipate questions and provide answers promptly.

- Understand Claim Timelines: Learn the typical processing time for your insurer.

- Avoid Errors: Double-check all forms and documents.

- Provide Extra Evidence: Include repair estimates and medical reports where applicable.

- Use Digital Channels: Many insurers offer faster processing through apps or online portals.

- Avoid Blame: Stay neutral when discussing the incident.

- Keep Calm: Courteous communication encourages cooperation.

- Know When to Escalate: If delays persist, escalate to a supervisor or file a formal complaint.

10 FAQs About Speedy Car Claim Settlement

1. How long does a typical car claim settlement take? Most claims are resolved within 30 days, but timelines can vary.

2. Can I expedite my claim? Yes, by promptly providing accurate and complete information.

3. What if the other driver is uninsured? Your uninsured motorist coverage may help. Check your policy details.

4. Will using a preferred repair shop speed up the process? Yes, as insurers often have streamlined processes with their approved shops.

5. What if my claim is denied? Review the denial letter and consult an attorney if needed.

6. Do minor accidents need to be reported? Yes, unreported incidents can lead to future complications.

7. Can I negotiate the settlement amount? Yes, especially if the payout does not cover your losses.

8. What is the role of an insurance adjuster? They evaluate your claim to determine coverage and settlement amounts.

9. Will my premiums increase after filing a claim? This depends on your policy and the accident’s circumstances.

10. How can I avoid claim delays? By promptly providing thorough documentation and responding to queries.

Conclusion

A speedy car claim settlement is achievable with preparation, transparency, and proactive communication. By understanding your policy, gathering comprehensive documentation, and working closely with your insurer, you can minimize delays and secure a fair settlement.

Navigating the insurance claim process doesn’t have to be stressful. With these tips and strategies, you’ll be well-equipped to handle claims efficiently, ensuring you get back on the road with minimal disruption.