Car Accident Claim Advice: Steps for Boost Your Compensation. Car accidents can be life-altering events, and dealing with the aftermath can be overwhelming. One of the most crucial steps is filing a car accident claim to secure the compensation you’re entitled to for your injuries and damages. This article provides essential car accident claim advice, guiding you through the necessary steps, common mistakes to avoid, and how to maximize your compensation. Whether you’re a first-time claimant or have experience with insurance claims, this comprehensive guide is designed to ensure you’re well-prepared throughout the process.

1. Understanding Car Accident Claims

A car accident claim involves submitting a request to an insurance company for compensation following a collision. This can include damages to your vehicle, medical expenses, lost wages, and other related costs. Understanding the basics of the claims process is essential to ensure you get the compensation you’re entitled to.

Types of Claims

- Property Damage Claims: Compensation for damage to your vehicle.

- Personal Injury Claims: Covers medical expenses, lost wages, and pain and suffering due to injuries.

- Third-Party Claims: Involves claims against another party’s insurance when they are at fault.

2. The Steps to File a Car Accident Claim

To make sure your claim is processed efficiently, follow these essential steps:

Step 1: Ensure Safety and Report the Accident

- Move to a safe location if possible.

- Call emergency services and report the accident.

- Get medical treatment, even if injuries seem minor.

Step 2: Gather Evidence

- Collect the contact information of the other driver, witnesses, and involved parties.

- Take photos of the accident scene, vehicle damage, injuries, and relevant road conditions.

- Obtain a copy of the police report.

Step 3: Notify Your Insurance Company

- Report the accident to your insurer as soon as possible.

- Provide all relevant details about the incident.

Step 4: File the Claim with Your Insurance Company

- Submit your claim, including evidence like photos, witness statements, and medical reports.

Step 5: Communicate and Cooperate

- Work with your insurance adjuster to review the details of your claim.

- Provide any requested documentation to speed up the process.

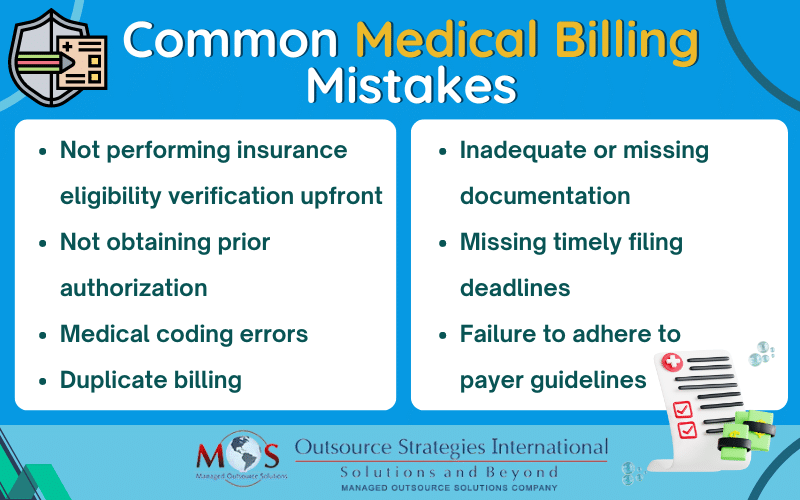

3. Common Mistakes to Avoid During a Car Accident Claim

Several errors can hinder the success of your claim. Here are some mistakes to avoid:

Mistake 1: Failing to Report the Accident Promptly

- Delayed reporting can lead to complications in processing your claim.

Mistake 2: Not Gathering Sufficient Evidence

- Insufficient documentation can lead to a lower payout or denial.

Mistake 3: Admitting Fault at the Scene

- Even if you’re unsure about fault, avoid making statements that could be used against you later.

Mistake 4: Accepting the First Settlement Offer

- Initial offers from insurance companies are often lower than what you deserve. Always negotiate.

Mistake 5: Not Seeking Legal Help

- Consulting with a lawyer, especially in serious cases, can increase your chances of a fair settlement.

4. How to Maximize Your Compensation

To ensure you’re receiving fair compensation, consider these strategies:

1. Keep Detailed Records

- Maintain a record of all medical bills, repair costs, and lost wages.

2. Get a Medical Evaluation Immediately

- Even minor injuries can worsen over time. A doctor’s evaluation is crucial.

3. Work with an Experienced Attorney

- A car accident lawyer can negotiate with insurers on your behalf, ensuring you get a fair settlement.

4. Avoid Signing Anything Without Consulting a Lawyer

- Don’t sign documents from the insurance company until you’ve had legal advice.

5. Consider Future Medical Costs

- Don’t settle for an amount that only covers current expenses. Anticipate future medical treatments as well.

5. Frequently Asked Questions (FAQs)

- How long do I have to file a car accident claim?

- In most states, you have between one and three years to file a personal injury claim, depending on your location.

- What if the other driver doesn’t have insurance?

- If the at-fault driver is uninsured, you may be able to file a claim through your own uninsured motorist coverage.

- Can I still file a claim if I wasn’t directly injured in the accident?

- Yes, you can file a property damage claim for your vehicle’s damages even if you weren’t injured.

- How is fault determined in a car accident?

- Fault is determined by gathering evidence, such as witness statements, police reports, and traffic laws. The insurance company and, in some cases, the court will assess the situation.

- What should I do if the insurance company denies my claim?

- You can appeal the decision by providing additional evidence or consult a lawyer for assistance.

- Is it worth hiring an attorney for a minor car accident?

- Even for minor accidents, a lawyer can help you ensure you are receiving the correct compensation.

- Can I handle a car accident claim on my own?

- While it’s possible, an attorney can help navigate the complexities and maximize your compensation.

- How much compensation should I expect from my claim?

- The amount varies depending on the severity of your injuries, damages to your vehicle, and insurance coverage.

- What if I’m partially at fault for the accident?

- Many states follow comparative negligence laws, where you can still recover compensation even if you’re partially at fault, though it may be reduced.

- How long does it take to settle a car accident claim?

- Settlement time varies depending on the complexity of the case but can range from a few weeks to several months.

6. 10 Tips for a Successful Car Accident Claim

- Always call the police after an accident.

- Collect as much evidence as possible at the scene.

- Take detailed photos of vehicle damage and the accident site.

- Seek medical attention immediately, even for minor injuries.

- Don’t sign any documents from the insurance company without legal advice.

- Avoid admitting fault or making detailed statements at the scene.

- Contact your insurance provider as soon as possible.

- Keep a log of your recovery process, including medical treatments.

- Never settle too quickly; assess the long-term impact of injuries.

- Consider hiring a personal injury lawyer if the case is complicated.

Conclusion

Navigating a car accident claim can be a challenging process, but by following the advice outlined in this article, you can ensure that you handle your claim effectively and maximize your compensation. From gathering evidence to working with a skilled attorney, each step plays a crucial role in securing a favorable outcome. Remember, even if the process seems overwhelming, you’re entitled to fair compensation for your losses, and taking the right actions can significantly improve your chances of receiving it.

In conclusion, the key to a successful car accident claim is being informed and proactive. Stay organized, avoid common mistakes, and don’t hesitate to consult professionals who can guide you through the process. By doing so, you’ll increase your chances of recovering the compensation you deserve, allowing you to focus on your recovery and move forward from the accident.