Insurance Claim Denial Reasons: How to Avoid Causes. Filing an insurance claim can be a stressful process, especially when you’re relying on your policy to cover unexpected expenses. Unfortunately, not all claims are approved. Insurance claim denials can leave policyholders frustrated and confused. Understanding the common reasons for claim denials and how to avoid them can save you time, money, and headaches.

Common Reasons for Insurance Claim Denials

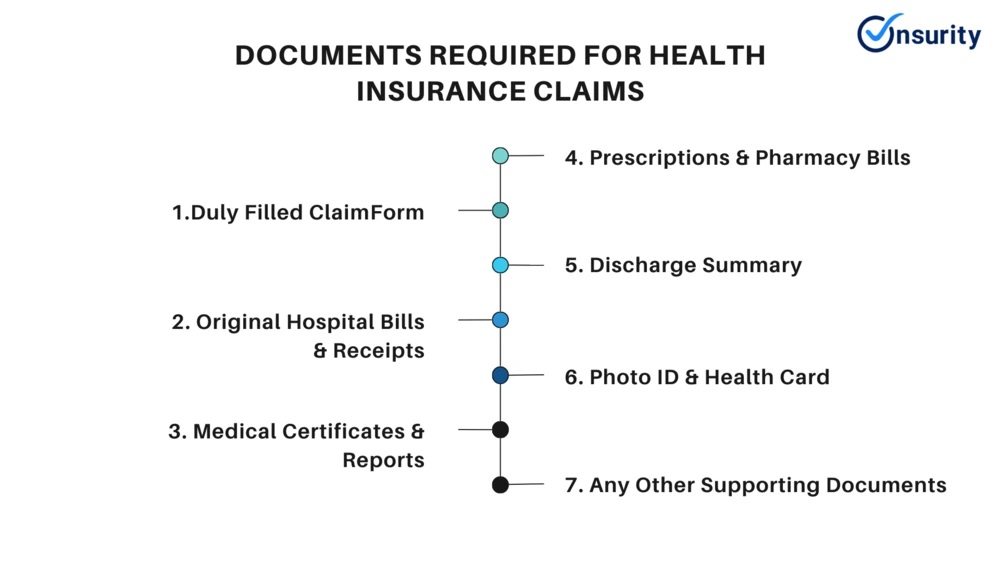

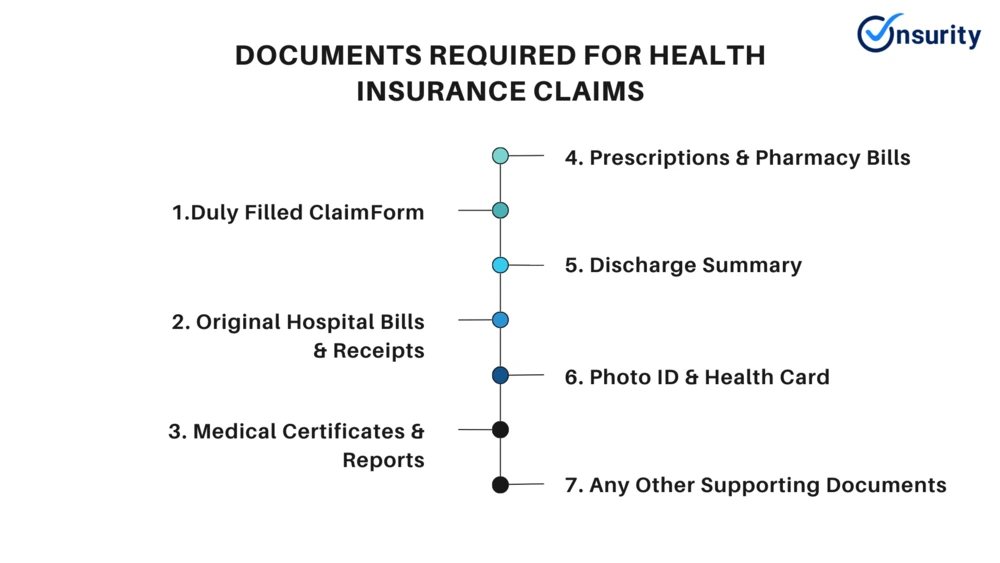

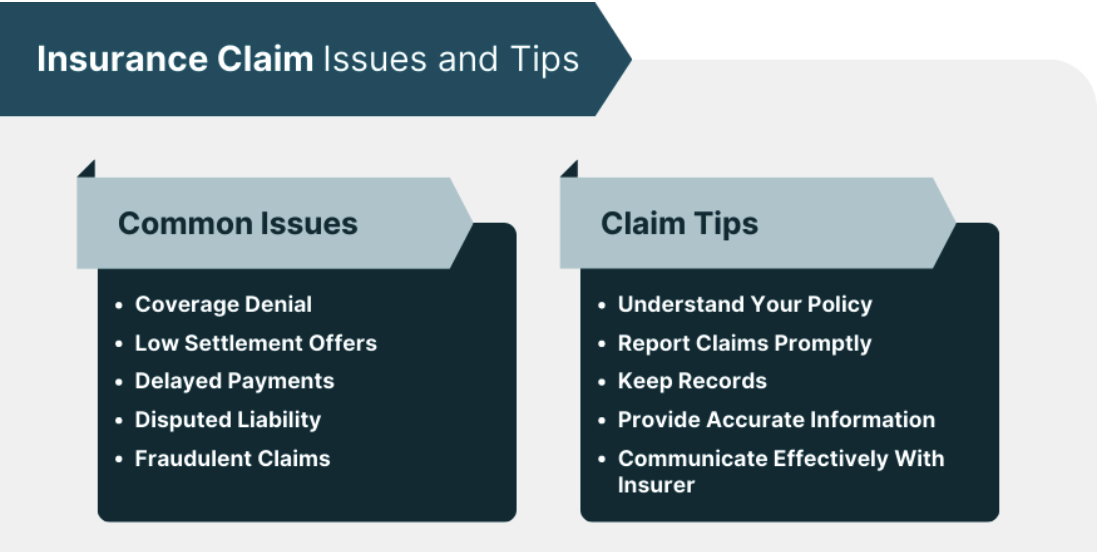

- Incomplete Documentation One of the most frequent reasons for claim denial is failing to submit all required documentation. Insurance companies need clear evidence to process claims, including receipts, medical reports, or accident documentation. Missing paperwork can lead to delays or outright rejection.

- Policy Exclusions Every insurance policy has exclusions—specific scenarios or events not covered. For instance, a home insurance policy might exclude flood damage. Claims filed for excluded incidents are automatically denied.

- Failure to Pay Premiums If your policy is not active due to missed premium payments, your claim will likely be denied. Maintaining consistent payments is essential to keep your coverage valid.

- Pre-Existing Conditions Health insurance claims often face denial if the claim relates to a pre-existing condition not covered by the policy.

- Late Filing Most insurance policies have deadlines for filing claims. Failing to meet these deadlines can result in denial, even if the claim is valid.

- Insufficient Coverage Filing a claim that exceeds your policy limits is another common reason for denial. For instance, if your car insurance policy has a damage limit of $10,000 and the repair costs are $15,000, the excess amount won’t be covered.

- Fraudulent Claims Submitting a claim with false or exaggerated information is a surefire way to face denial, and it may even lead to legal consequences.

- Lack of Proof of Loss Insurance providers often require proof of loss, such as photos or repair estimates, to validate your claim. Without adequate proof, your claim might be rejected.

- Errors in the Claim Form Minor errors, such as incorrect policy numbers or misspelled names, can cause delays or denials. Double-check all details before submission.

- Disputed Liability In cases like auto accidents, the insurance company may dispute who was at fault. If liability isn’t clearly established, your claim might be denied.

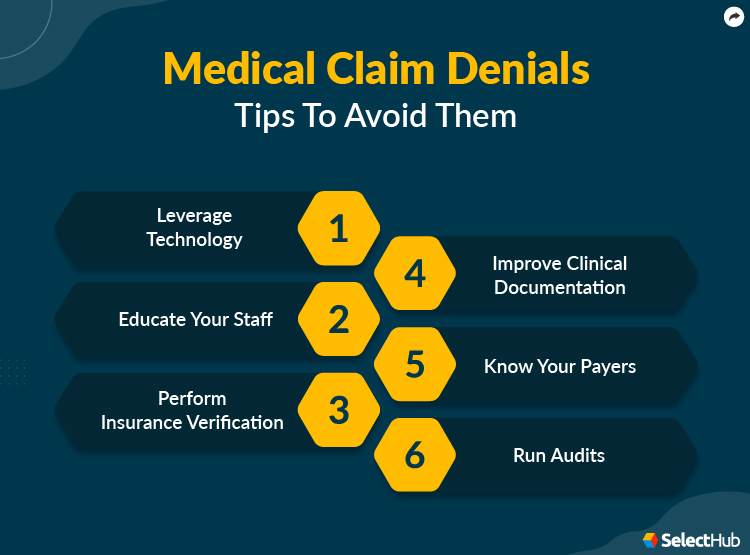

Tips to Prevent Insurance Claim Denials

- Review Your Policy Thoroughly Familiarize yourself with your coverage, exclusions, and limits to avoid surprises during the claims process.

- Pay Premiums on Time Set reminders or automate payments to ensure your policy remains active.

- Document Everything Keep thorough records of incidents, including photos, receipts, and reports.

- File Claims Promptly Adhere to filing deadlines to avoid complications.

- Communicate Clearly Provide accurate and detailed information when filing your claim.

- Work with a Professional Insurance brokers or agents can help you navigate complex policies and claims.

- Provide Proof of Loss Submit all necessary documentation to support your claim.

- Avoid Exaggeration Ensure your claim is honest and accurately reflects your losses.

- Check for Errors Review your claim form for any mistakes before submission.

- Consult an Attorney If your claim is denied unfairly, consider seeking legal advice.

FAQs About Insurance Claim Denials

- What should I do if my insurance claim is denied? Review the denial letter, gather additional evidence, and appeal the decision if possible.

- Can I appeal a denied insurance claim? Yes, most insurance companies have an appeals process. Check your policy or contact your insurer for details.

- How long does the appeal process take? The timeline varies, but appeals can take anywhere from a few weeks to several months.

- Will filing an appeal affect my coverage? No, appealing a denied claim does not impact your existing coverage.

- Why do insurance companies deny valid claims? Errors, lack of documentation, or policy misinterpretation are common reasons for valid claims being denied.

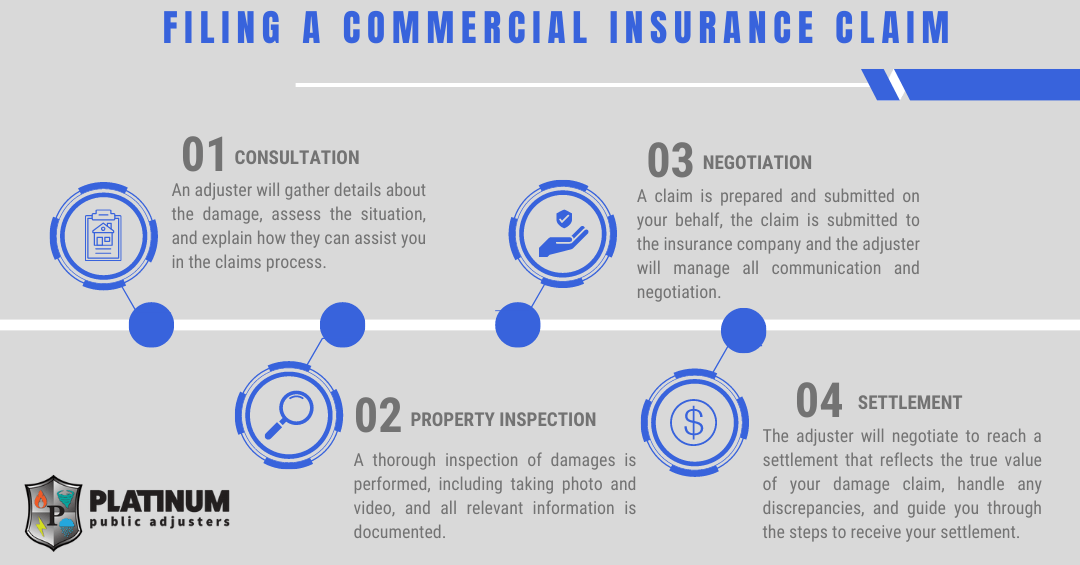

- Can I hire a public adjuster for a denied claim? Yes, public adjusters specialize in helping policyholders negotiate claims with insurers.

- What’s the statute of limitations for filing an appeal? This depends on the insurer and your location. Check your policy for specific time limits.

- Does a denial affect my insurance premiums? Typically, a denial does not directly affect premiums, but repeated claims might.

- How can I verify if my claim was processed correctly? Request a detailed explanation of the denial and review it with an expert.

- Are there cases where denials cannot be appealed? Yes, claims denied due to policy exclusions or fraudulent activity usually cannot be appealed.

Conclusion

Insurance claim denials can be frustrating, but understanding the common reasons for rejection and taking proactive steps can help you avoid these pitfalls. Always read your policy thoroughly, maintain accurate records, and adhere to deadlines. If you’re unsure about the claims process, seek professional guidance.

By following the tips outlined in this article, you can minimize the risk of claim denials and ensure you’re adequately prepared to handle any unforeseen events. Being informed and proactive is the key to successfully navigating the world of insurance claims.