Small Business Claim Insurance: Navigating Insurance Claims. Running a small business comes with numerous challenges, and one of the most significant concerns is ensuring that your business is properly protected against unforeseen events. Whether it’s damage to property, employee injuries, or legal liabilities, having the right insurance in place is crucial for safeguarding your financial future. This article will explore everything you need to know about small business claim insurance, from the types of insurance you may need to the step-by-step process of filing a claim.

What is Small Business Claim Insurance?

Small business claim insurance refers to the different types of insurance policies available to protect a business from various risks. These risks include property damage, business interruption, employee injuries, and liability claims. Insurance helps mitigate the financial burden associated with unexpected events that can disrupt business operations.

Types of Small Business Insurance

- General Liability Insurance

- Covers claims of bodily injury, property damage, and advertising injury that may occur during the course of business operations.

- Property Insurance

- Protects physical assets such as buildings, equipment, and inventory from damage due to fire, theft, vandalism, or natural disasters.

- Workers’ Compensation Insurance

- Provides financial benefits to employees who are injured or become ill while working for your business. It covers medical expenses and lost wages.

- Professional Liability Insurance (Errors and Omissions Insurance)

- Protects your business from claims of negligence, mistakes, or failure to deliver professional services as expected.

- Business Interruption Insurance

- Covers loss of income if your business is unable to operate due to a covered event, such as a natural disaster or fire.

- Product Liability Insurance

- Provides coverage in case your products cause harm to consumers, including bodily injury or property damage.

- Commercial Auto Insurance

- Covers vehicles owned or used by your business, including accidents, theft, and liability.

- Cyber Liability Insurance

- Protects businesses from financial loss due to data breaches, cyber-attacks, and other online security threats.

- Directors and Officers Insurance (D&O)

- Covers legal fees and liabilities for company directors and officers in case of lawsuits related to their decisions.

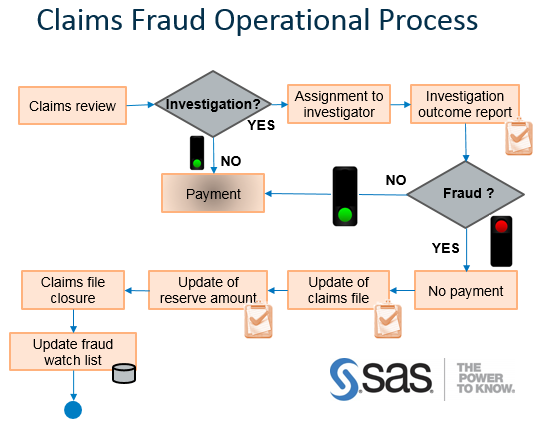

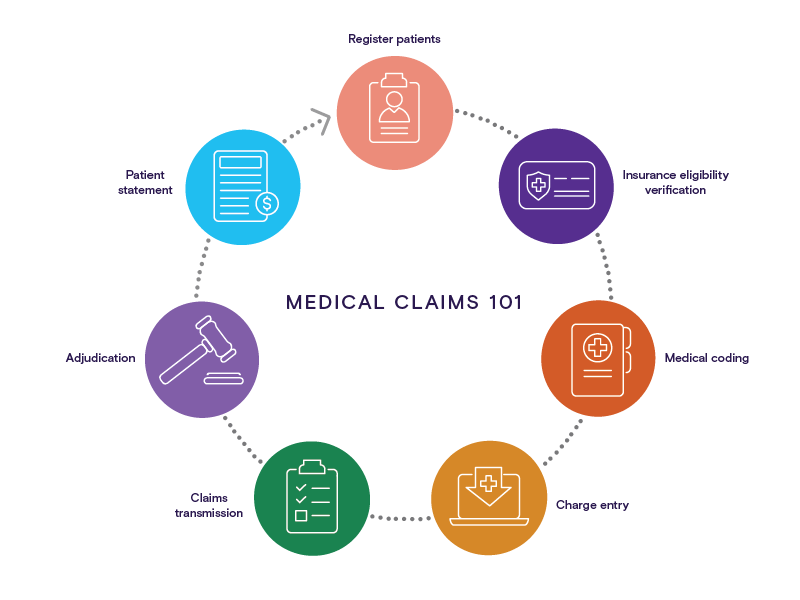

How to File a Small Business Insurance Claim

Filing a small business insurance claim can be a complex process, but understanding the steps involved can make it easier to navigate. Here is a general guide on how to file a claim:

- Assess the Situation

- Before filing a claim, assess the situation to determine the extent of the damage or incident. Gather all relevant information and document the situation with photos or written records.

- Contact Your Insurance Provider

- Notify your insurance provider as soon as possible. Many insurers have specific timeframes for reporting claims, and failure to report on time could result in denial of coverage.

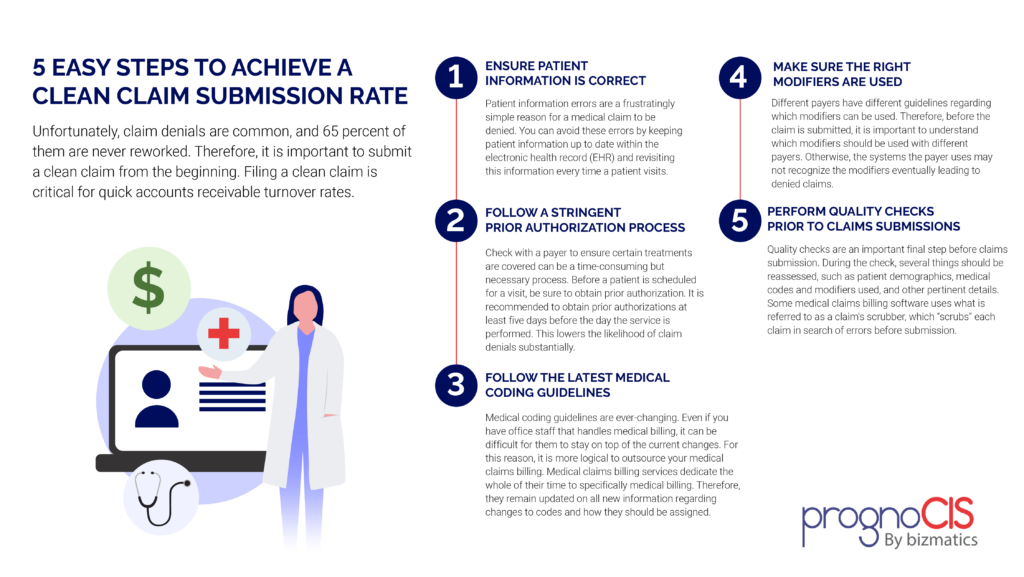

- Provide Required Documentation

- Your insurer will require specific documentation to process the claim, such as photographs, police reports, invoices, and medical records. Be prepared to provide this information.

- Work with an Adjuster

- The insurance company will send an adjuster to assess the damage. Cooperate with the adjuster and provide any additional information they may need.

- Review the Settlement Offer

- Once the claim is processed, the insurance company will make a settlement offer. Review the offer carefully to ensure it accurately reflects the damage and meets your business needs.

- Accept or Dispute the Offer

- If you accept the settlement, the claim will be closed. If you disagree with the offer, you have the option to dispute the decision and negotiate a better settlement.

Common Reasons Insurance Claims Are Denied and How to Avoid Them

- Lack of Coverage for the Specific Incident

- Ensure your policy covers the types of incidents that could occur in your industry. For example, general liability may not cover all types of accidents.

- Failure to Report Timely

- Many policies require claims to be reported within a specific timeframe. Missing this deadline could result in a denial.

- Incomplete or Inaccurate Documentation

- Always provide complete and accurate documentation to support your claim. Inaccurate or incomplete records can lead to denial.

- Failure to Pay Premiums

- If your policy is inactive due to unpaid premiums, the insurer may deny your claim. Always stay up to date with payments.

- Non-Covered Events

- Understand your policy’s exclusions. Events such as flood damage may not be covered under standard property insurance.

Tips for Choosing the Right Small Business Insurance

- Assess Your Business Needs

- Take time to understand the specific risks your business faces, from property damage to liability issues.

- Compare Policies

- Shop around and compare different insurance providers to ensure you’re getting the best coverage for your needs.

- Review Policy Exclusions

- Be clear on what is not covered by your policy to avoid surprises when filing a claim.

- Consider a Bundled Package

- Some insurers offer bundled packages that combine multiple types of coverage at a discounted rate.

- Work with a Trusted Agent

- An experienced insurance agent can help you navigate the complexities of business insurance and find the best options.

- Understand Deductibles and Limits

- Ensure you’re comfortable with the deductible (the amount you pay out-of-pocket) and the policy limits.

- Update Your Insurance Regularly

- As your business grows, your insurance needs will evolve. Regularly review and update your policies.

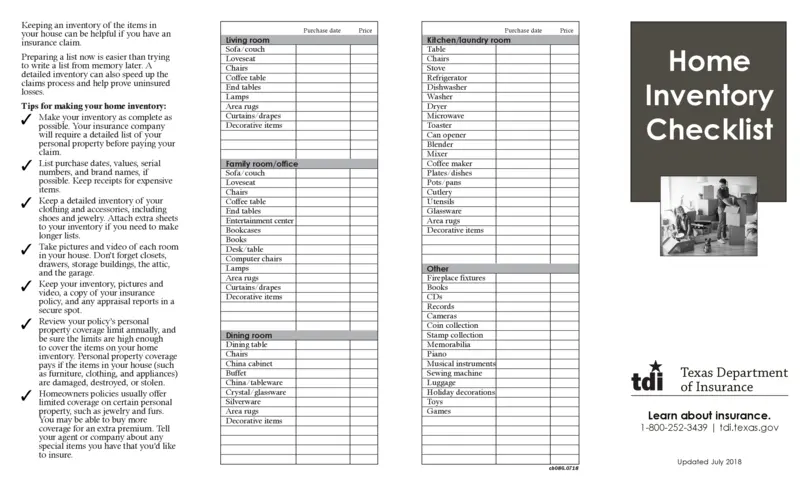

- Document Your Business Assets

- Keep an up-to-date inventory of your business assets to make the claims process smoother.

- Look for Specialized Coverage

- Some industries require specialized insurance, such as cyber liability for tech companies or professional liability for consultants.

- Check for Discounts

- Many insurance companies offer discounts for businesses with a strong safety record or a history of low claims.

Frequently Asked Questions (FAQs)

- What types of insurance do small businesses need?

- The essential types of insurance include general liability, workers’ compensation, and property insurance. Additional coverage may be necessary depending on your business type.

- How do I know if my insurance policy covers a specific event?

- Review your policy’s terms and conditions, or speak with your insurance agent to confirm coverage.

- Can I file a claim for business interruption insurance if my business closes due to a pandemic?

- Many policies exclude pandemics, but it’s important to check the terms of your specific policy.

- What is the difference between general liability and professional liability insurance?

- General liability covers accidents and injuries, while professional liability covers errors or omissions in professional services.

- How do I file a claim for workers’ compensation?

- Report the injury to your insurance company and provide medical records and incident details for processing.

- Can I change my insurance policy after purchasing it?

- Yes, you can modify your policy by adding or removing coverage as needed.

- What should I do if my insurance claim is denied?

- Review the denial reason and consider appealing the decision or seeking legal advice if you believe the claim was wrongfully denied.

- Is business insurance expensive?

- The cost of business insurance varies based on coverage and business size. However, it’s crucial to balance cost with adequate protection.

- Does my small business need cyber liability insurance?

- If you handle sensitive customer data or rely on technology, cyber liability insurance is recommended.

- How can I reduce the cost of business insurance?

- Consider bundling policies, improving your safety record, or opting for a higher deductible to reduce premiums.

Conclusion

Small business claim insurance is an essential tool for protecting your business from unforeseen events that could disrupt operations. By understanding the different types of insurance available and the process for filing a claim, you can ensure that your business is adequately covered. Regularly review your policies, assess your needs, and work with a trusted insurance provider to ensure you have the right coverage for your business.

In the ever-changing landscape of small businesses, insurance provides peace of mind and financial security. Whether you’re dealing with property damage, an employee injury, or a liability issue, having the right insurance coverage in place can help you navigate challenges and protect your business’s future.