Immediate Annuity Benefits: Understanding the Advantages. An immediate annuity is a powerful financial tool designed to provide steady income, often in retirement or for those seeking stable cash flow. This article explores the benefits, how immediate annuities work, and key considerations for selecting the right one.

What is an Immediate Annuity?

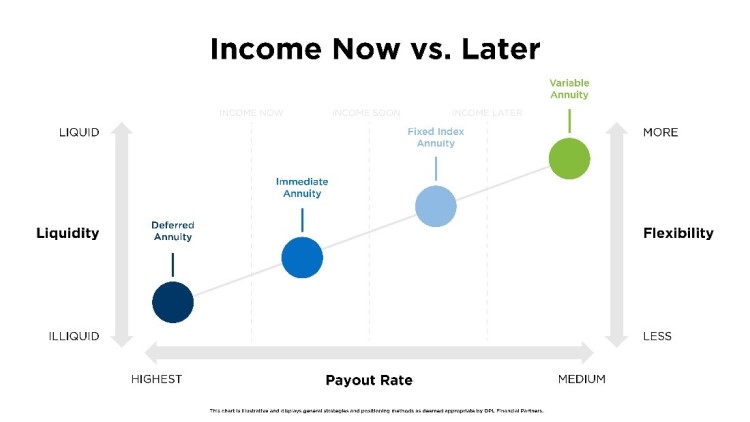

An immediate annuity is a financial product purchased with a lump sum payment, providing guaranteed income almost immediately, typically within a month. Unlike other annuities, it doesn’t require a long accumulation phase, making it ideal for individuals who need immediate financial security.

Top Benefits of Immediate Annuities

- Guaranteed Lifetime Income

One of the main attractions of an immediate annuity is the assurance of a consistent income stream for life, reducing the risk of outliving your savings. - Simplified Financial Management

Immediate annuities simplify budgeting by providing predictable and regular payments, eliminating the need for constant financial planning. - Protection Against Market Volatility

Unlike stocks or mutual funds, immediate annuities are unaffected by market fluctuations, offering peace of mind to investors. - Customizable Payment Terms

Buyers can choose payment schedules—monthly, quarterly, or annually—to align with their financial needs. - Tax Advantages

Immediate annuities may provide tax-deferred growth, with income partially or fully excluded from taxation, depending on your jurisdiction. - Survivor Benefits

Some immediate annuities offer options for continuing payments to beneficiaries, providing added peace of mind. - Support in Retirement

For retirees, immediate annuities provide a stable income that can cover essential expenses like housing, healthcare, and groceries. - Flexibility in Lump Sum Investment

With a variety of premium amounts, immediate annuities cater to diverse financial capacities, allowing both small and large investments. - Customizable Payout Periods

You can tailor an annuity’s payout period, such as for a specific number of years or until the annuitant’s death. - Financial Security for Spouses

Joint-life immediate annuities ensure income continues for a surviving spouse, maintaining family financial stability.

How Does an Immediate Annuity Work?

Immediate annuities involve a straightforward process:

- Lump Sum Investment

The purchaser pays a one-time premium to the insurance company. - Payment Schedule Setup

Payments begin shortly after, based on the agreed-upon schedule. - Income Determination Factors

Payments depend on factors such as the annuitant’s age, gender, and selected payout type (life-only, joint-life, or fixed-period). - Guaranteed Payouts

The insurer ensures consistent payouts, regardless of external factors, like economic downturns.

Who Should Consider an Immediate Annuity?

Immediate annuities are ideal for:

- Retirees seeking stable income.

- Individuals who recently received a windfall (inheritance, settlement, etc.).

- Those wanting to diversify retirement income sources.

- People concerned about market instability.

10 Tips for Maximizing Immediate Annuity Benefits

- Evaluate Financial Goals: Align your annuity with your retirement or income needs.

- Research Providers: Compare the reputation, financial stability, and ratings of insurance companies.

- Understand Payout Options: Choose between life-only, joint-life, or fixed-period payouts based on your goals.

- Shop Around for Rates: Different insurers offer varying annuity rates—compare to secure the best deal.

- Read the Contract Carefully: Understand terms, including fees, payout structures, and cancellation policies.

- Consider Inflation Protection: Look for annuities with inflation-adjusted payouts to maintain purchasing power.

- Seek Professional Advice: Consult financial advisors for tailored recommendations.

- Account for Taxes: Understand the tax implications of your annuity income.

- Combine with Other Income: Use annuities as part of a diversified retirement income strategy.

- Plan for Beneficiaries: If desired, select options that allow benefits to pass on to heirs.

10 Frequently Asked Questions About Immediate Annuities

- What is the minimum investment required for an immediate annuity?

Minimum amounts vary by insurer, typically ranging from $5,000 to $50,000. - How soon do payments begin?

Payments usually start within one month of purchasing the annuity. - Are immediate annuities safe?

Yes, they are generally low-risk since payments are guaranteed by the insurer. - What happens if I die early?

With a life-only payout, payments stop. However, annuities with survivor benefits ensure remaining payments go to beneficiaries. - Can I withdraw my money from an immediate annuity?

Most immediate annuities do not allow withdrawals once payments begin. - Are payments taxable?

Payments may be partially taxable, depending on the source of the premium (pre-tax or after-tax funds). - Can I adjust the payout schedule later?

Payout schedules are typically fixed once the contract is established. - Is inflation protection included?

Some immediate annuities offer inflation-adjusted payouts, but these usually come at a higher cost. - Are immediate annuities better than deferred annuities?

It depends on your financial needs. Immediate annuities suit those requiring immediate income, while deferred annuities grow savings over time. - What factors influence my payment amount?

Factors include age, gender, premium amount, and the chosen payout type.

Conclusion

Immediate annuities offer a reliable way to secure financial stability through guaranteed income, making them a valuable choice for retirees and others seeking dependable cash flow. By understanding their benefits, payment options, and how they work, you can make informed decisions tailored to your financial goals.

Whether you’re navigating retirement or diversifying your income streams, an immediate annuity provides peace of mind, protection from market volatility, and financial security for years to come. Consider consulting with a financial advisor to explore the best options for your unique needs.