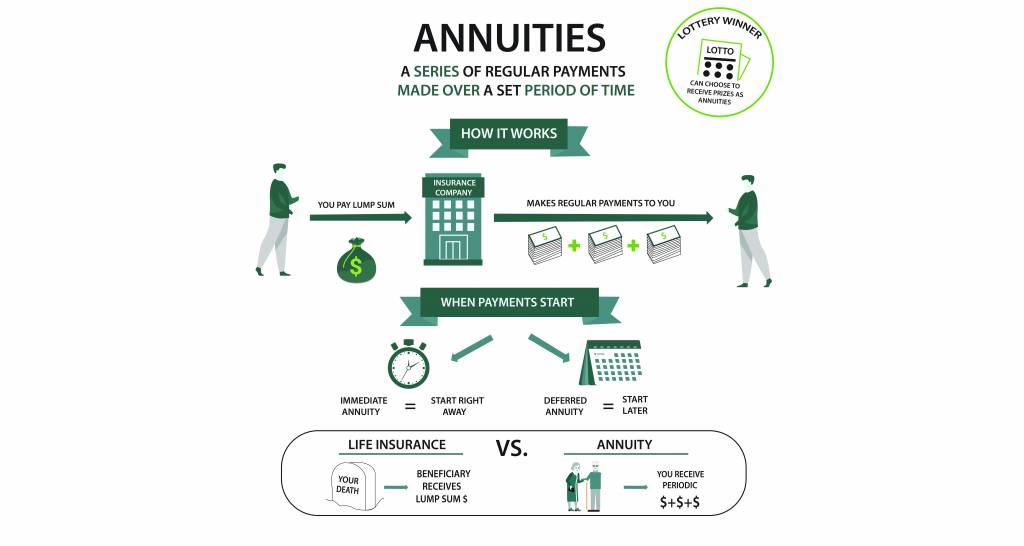

Multi-Year Annuity Rates: Guide to Maximizing Your Investment. An annuity is a financial product that provides a series of payments in exchange for an upfront lump sum. Among the many types of annuities available, the multi-year annuity offers a guaranteed rate of return over multiple years, making it a popular choice for conservative investors seeking stability and predictability in their retirement planning. But what exactly are multi-year annuity rates, and why do they matter?

This guide will provide a detailed explanation of multi-year annuities, factors influencing their rates, how to choose the right product, and tips to maximize your returns. Whether you’re nearing retirement or simply looking for a safe investment option, understanding multi-year annuity rates is crucial for making informed decisions.

1. What Are Multi-Year Annuities?

Multi-year annuities are a type of fixed annuity that guarantees a specific interest rate for a set period, usually between 3 to 10 years. Unlike traditional fixed annuities, which may offer variable rates, multi-year annuities lock in an interest rate for the duration of the contract, providing a predictable income stream.

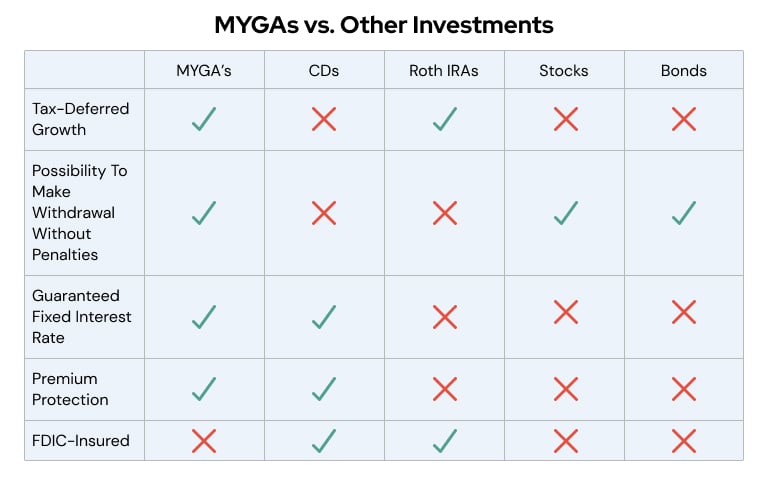

These annuities are often used as part of a diversified retirement portfolio to supplement other investments, such as stocks, bonds, and IRAs. The primary appeal of a multi-year annuity is the stability it offers in an often volatile financial market.

2. Factors Affecting Multi-Year Annuity Rates

Several factors can influence the rates of multi-year annuities. Understanding these variables can help you select the most favorable contract for your financial goals.

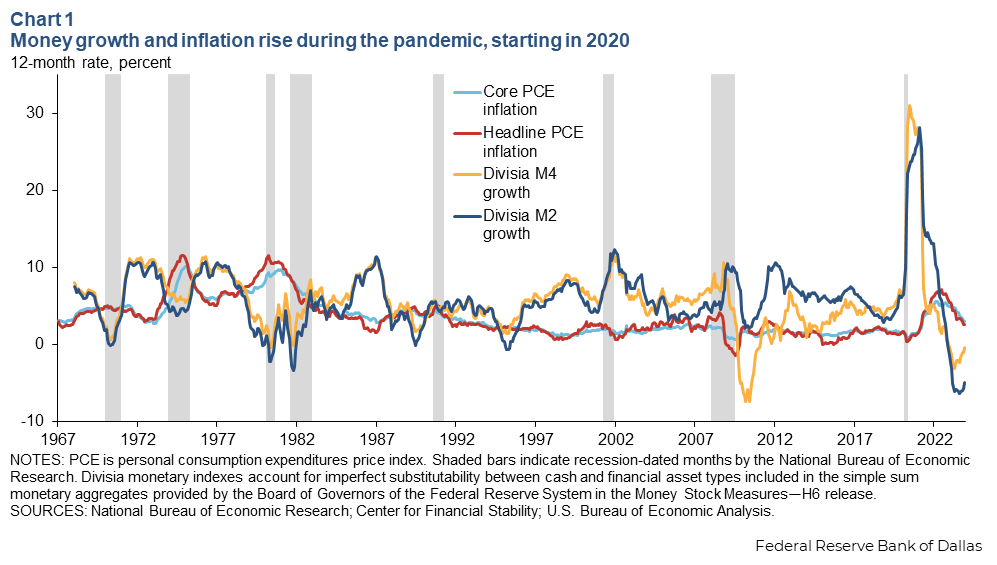

- Interest Rate Environment: The overall interest rates set by central banks play a key role in determining the rates offered by insurers. When interest rates are low, annuity rates tend to be lower, and vice versa.

- Insurer’s Credit Rating: The financial health of the insurance company offering the annuity can impact the rates. A company with a strong credit rating is more likely to offer competitive rates and ensure timely payments.

- Contract Term Length: Longer-term contracts generally offer higher rates because they lock in your investment for a longer period.

- Inflation: Inflation can erode the purchasing power of fixed payments, which is why many investors look for annuities that adjust for inflation or offer higher rates to combat this effect.

3. How Do Multi-Year Annuities Work?

The process of a multi-year annuity typically involves the following steps:

- Purchase: You pay a lump sum or make a series of payments to an insurance company.

- Interest Rate Lock: The insurer locks in a guaranteed interest rate for the agreed-upon number of years.

- Growth: Your investment grows at the locked-in rate.

- Payouts: After the term ends, you can choose to receive periodic payments, or you may reinvest the proceeds into another annuity or financial product.

4. Advantages of Multi-Year Annuities

There are numerous benefits to investing in multi-year annuities, particularly for those looking for a stable income stream during retirement.

- Predictable Returns: The guaranteed interest rate eliminates uncertainty, making it easier to plan your finances.

- Protection Against Market Volatility: Multi-year annuities are immune to stock market fluctuations, offering security for risk-averse investors.

- Guaranteed Income: At the end of the term, you can either withdraw your money or convert it into a stream of payments that will last for a specific period or even for life, depending on the type of annuity.

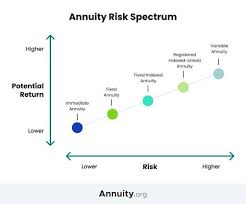

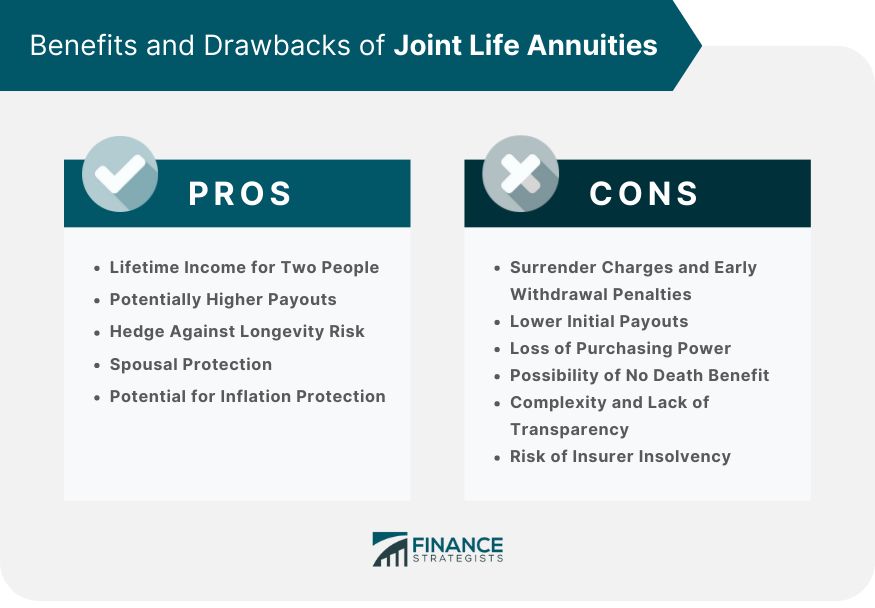

5. Risks Associated with Multi-Year Annuities

Despite their benefits, multi-year annuities do come with some risks:

- Limited Liquidity: If you need to access your money before the contract term ends, you may face penalties or early withdrawal fees.

- Inflation Risk: Fixed payments may lose value over time if inflation outpaces the growth of your annuity’s interest rate.

- Lower Returns in Low-Interest Environments: During periods of low interest rates, multi-year annuities may not provide returns as high as other investments.

6. How to Choose the Right Multi-Year Annuity

When selecting a multi-year annuity, consider the following factors to ensure you choose the right one for your financial situation:

- Compare Rates: Shop around to find the highest rates available from different insurers.

- Examine the Length of the Term: Depending on your retirement goals, choose a term length that aligns with your needs.

- Understand Fees: Ensure you understand any fees or penalties associated with early withdrawals.

- Check for Riders: Some annuities offer additional features, such as inflation protection or a death benefit, which could enhance the value of your annuity.

7. Tax Implications of Multi-Year Annuities

Annuities have specific tax advantages and disadvantages that you should be aware of:

- Tax-Deferred Growth: The money in a multi-year annuity grows tax-deferred, meaning you don’t pay taxes on earnings until you withdraw them.

- Taxation Upon Withdrawal: When you begin taking withdrawals, the earnings are taxed as ordinary income, which could be at a higher rate depending on your tax bracket.

8. Multi-Year Annuities vs. Other Fixed Annuities

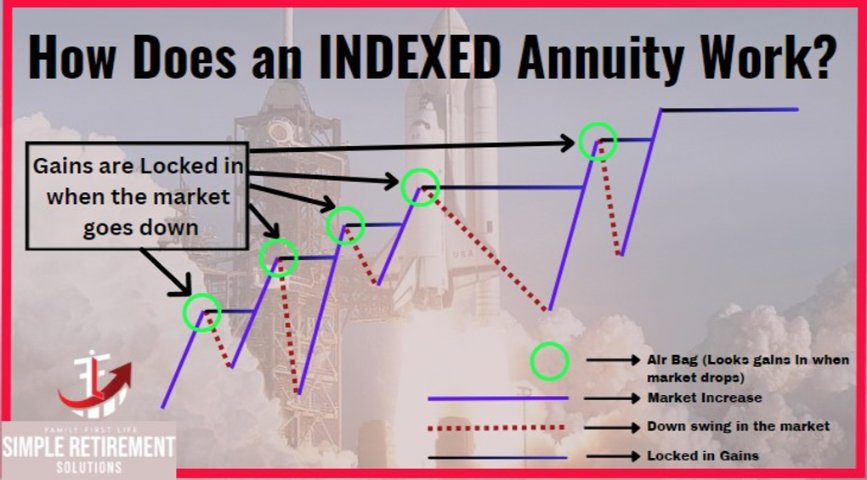

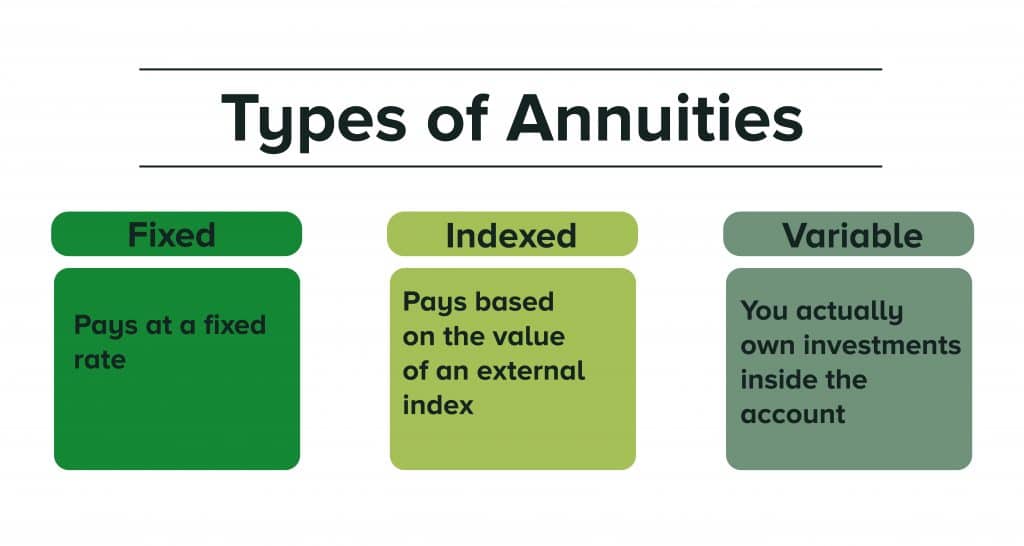

While multi-year annuities provide predictable returns, they are not the only option available. Fixed annuities, indexed annuities, and variable annuities each offer different benefits and risks. It’s important to compare these options based on your risk tolerance, retirement goals, and financial situation before making a decision.

9. Real-World Example of Multi-Year Annuity Performance

Let’s say you purchase a 5-year multi-year annuity with a 3% interest rate. If you invest $100,000, after five years, your investment would grow to $115,927, assuming no withdrawals were made. This predictable growth allows you to plan for your future with greater certainty.

10. Common Misconceptions About Multi-Year Annuities

Many investors misunderstand the flexibility of multi-year annuities. Common misconceptions include:

- “I can’t access my funds until the contract ends.” While withdrawing early may incur penalties, some annuities offer partial withdrawals.

- “The interest rate is fixed for the entire contract.” Some contracts offer interest rate adjustments over time, so always check the terms carefully.

- “I’ll always get the highest rate.” Rates can vary, so it’s important to compare different products to ensure you get the best deal.

11. Tips for Maximizing Your Multi-Year Annuity Investment

- Shop Around for the Best Rates: Compare different providers to find the highest guaranteed rates.

- Consider a Laddering Strategy: Invest in multiple annuities with different terms to create a steady stream of income.

- Avoid Early Withdrawals: Plan to leave your money invested for the full term to avoid penalties.

- Factor in Inflation: Consider annuities that offer inflation protection or higher initial rates to offset rising costs.

- Work with a Financial Advisor: A professional can help you navigate complex annuity options and select the best fit for your needs.

- Check for Riders: Look for additional features like guaranteed minimum income benefits.

- Understand Your Liquidity Needs: Make sure the annuity term aligns with your financial goals.

- Diversify Your Portfolio: Don’t put all your retirement savings into one annuity; mix it with other investments.

- Monitor the Insurance Company’s Financial Health: Make sure the company has strong financial ratings.

- Review Your Annuity Regularly: Keep track of the performance and compare it against market conditions.

12. Frequently Asked Questions (FAQ)

- What is a multi-year annuity?

- A multi-year annuity is a fixed annuity that offers a guaranteed interest rate for a set period of years, providing predictable returns.

- How are multi-year annuity rates determined?

- Rates are influenced by the general interest rate environment, the insurer’s financial stability, and the term length.

- Can I withdraw my money early from a multi-year annuity?

- Early withdrawals typically come with penalties or surrender charges, so it’s important to carefully read the contract terms.

- Are multi-year annuities a good investment for retirement?

- They can be a good option for conservative investors looking for guaranteed income with minimal risk.

- What happens at the end of the annuity term?

- You can either take your lump sum, roll it over into another annuity, or convert it into a stream of payments.

- How do taxes work with multi-year annuities?

- Annuities grow tax-deferred, but withdrawals are taxed as ordinary income.

- What’s the difference between a multi-year annuity and a fixed annuity?

- A multi-year annuity locks in a fixed rate for several years, while a fixed annuity offers a rate for the life of the contract.

- Is my multi-year annuity protected?

- Yes, annuities are typically backed by the insurance company and, in some cases, state guaranty funds.

- Can multi-year annuities be part of my retirement portfolio?

- Yes, they provide a reliable income stream, making them a good choice for a diversified retirement plan.

- What should I look for when comparing multi-year annuities?

- Compare interest rates, contract terms, fees, and the financial health of the insurer before making a decision.

Conclusion

In conclusion, multi-year annuities offer a stable and predictable investment option for those seeking guaranteed returns over a fixed period. While they come with certain risks, such as limited liquidity and inflation exposure, their ability to provide a secure income stream makes them a valuable tool in retirement planning. By carefully selecting the right contract and working with financial advisors, you can maximize the benefits of multi-year annuities and achieve financial peace of mind.

Understanding the nuances of multi-year annuity rates, along with the benefits and risks, is essential in making informed investment decisions. Whether you’re planning for retirement or seeking a conservative investment option, multi-year annuities can play an important role in helping you achieve your long-term financial goals.