Joint-Life Annuity: A Guide to Secure Retirement for Couples. A Joint-life annuity is a powerful financial tool designed to provide secure, steady income to two people for the duration of their lives. In this article, we will delve into the benefits, types, and considerations surrounding joint-life annuities, providing a clear, easy-to-understand explanation that caters to both beginners and those looking to optimize their retirement planning.

What is a Joint-Life Annuity?

A Joint-life annuity is a type of insurance contract that pays a regular income to two people — typically spouses or partners — for as long as both are alive. This means that in the event of one person’s death, the surviving partner continues to receive the agreed-upon income. It’s an effective way to ensure that both parties are financially protected throughout their retirement.

Joint-life annuities can offer peace of mind, knowing that both partners will be supported financially, regardless of who outlives the other. It is especially useful for couples who rely on their retirement savings to cover living expenses and don’t want to worry about the financial impact of losing one income source.

Benefits of Joint-Life Annuities

- Lifetime Income for Both Partners One of the most significant advantages of a joint-life annuity is that it ensures income for both partners for life. Whether you live longer than expected or face unexpected expenses, you can count on a stable income stream.

- Protection Against Longevity Risk With people living longer, many worry about running out of money in retirement. A joint-life annuity helps mitigate this risk, ensuring that you’ll continue to receive payments regardless of how long you live.

- Financial Security for the Survivor If one partner dies, the surviving partner continues to receive the annuity payments, which can be especially important if one spouse relies more heavily on retirement income.

- Customizable Payout Options Joint-life annuities often allow couples to choose different payout options, such as equal payments or payments that are based on a percentage of the original income amount. This flexibility can make the annuity better suited to your needs.

- Tax Benefits Annuities can offer tax advantages, depending on how they are structured and the country of residence. Many joint-life annuities allow tax-deferred growth, meaning your money can grow without being taxed until withdrawals are made.

Types of Joint-Life Annuities

Joint-life annuities come in different types, each offering varying levels of flexibility and benefits:

- Straight Joint-Life Annuity This option provides the highest monthly payments, but the payments stop once both individuals have passed away. It’s ideal for those who want to maximize their income while both are alive.

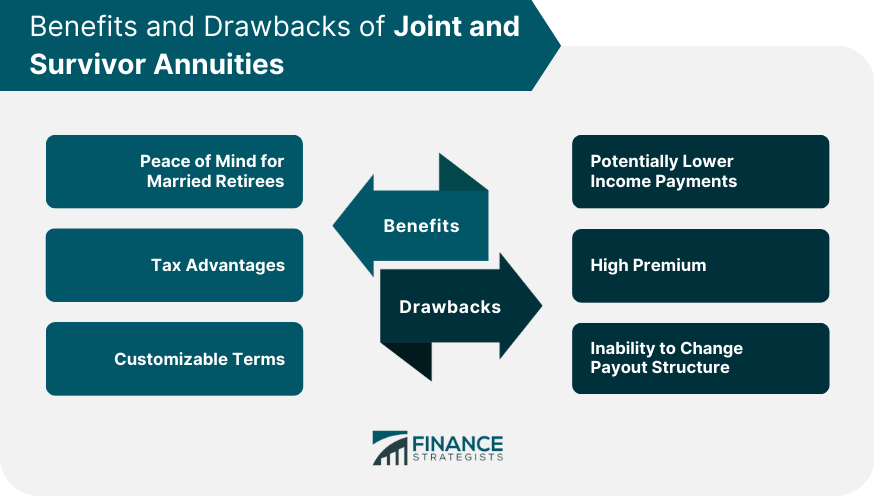

- Joint-Life Annuity with Survivor Benefit This option continues payments to the surviving partner after one person passes away. The amount can remain the same or decrease, depending on the chosen contract terms.

- Joint-Life Annuity with Period Certain This variation guarantees payments for a certain number of years (e.g., 10 or 20 years) even if both partners die before the period ends. This ensures that beneficiaries receive the payments.

How Does a Joint-Life Annuity Work?

The way a joint-life annuity works is relatively simple. A person (or couple) pays an initial lump sum or makes periodic payments to an insurance company. In return, the company agrees to pay back a fixed amount of money for the rest of the couple’s lives, no matter how long they live.

The amount of income received typically depends on several factors:

- Age and Health of the Annuitants: The older and healthier the individuals, the higher the monthly payment may be.

- Type of Annuity Chosen: Different payout options may affect the overall payout amount.

- Annuity Premium: The size of the initial investment or the premium paid affects the amount of income you’ll receive.

Key Considerations Before Purchasing a Joint-Life Annuity

- Cost and Affordability Joint-life annuities often require a substantial upfront investment. It’s essential to determine whether the cost is affordable and if it aligns with your overall financial plan.

- Inflation Risk Over time, inflation can erode the purchasing power of fixed annuity payments. Some joint-life annuities offer inflation protection, which can adjust your payouts in line with the cost of living.

- Joint vs. Single Life While a single-life annuity only covers one individual, a joint-life annuity provides coverage for both partners. It’s essential to weigh the costs of providing lifetime coverage for two individuals.

- Payout Structure Some joint-life annuities offer flexible payout options, while others provide a fixed amount. Understand the different structures to select the best option for your retirement needs.

- Survivor Benefits If you’re concerned about your partner’s financial stability after your passing, look for joint-life annuities that provide survivor benefits, ensuring the surviving partner is financially supported.

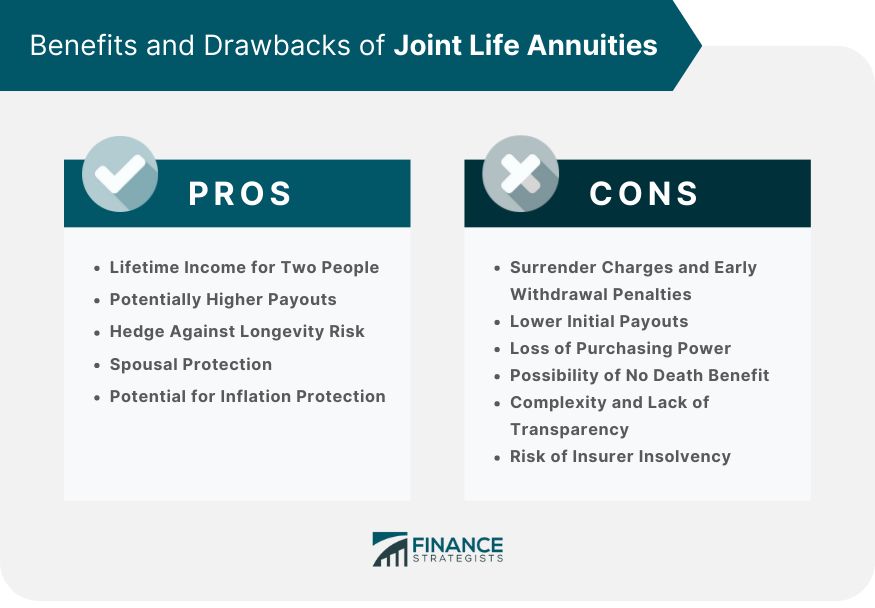

Pros and Cons of Joint-Life Annuities

Pros:

- Provides consistent income for both partners for life.

- Offers financial protection to the surviving spouse.

- Customizable options to suit your financial goals.

Cons:

- Requires an initial lump sum payment, which might not be affordable for all couples.

- May not leave an inheritance, as payments stop once both individuals have passed away (unless a survivor benefit is included).

- Inflation may reduce the value of payments over time.

10 Tips for Maximizing the Benefits of a Joint-Life Annuity

- Assess Your Retirement Income Needs – Calculate how much income you need and compare joint-life annuities to other income sources.

- Consider Inflation-Protected Options – If concerned about inflation, look for annuities that offer inflation adjustments.

- Understand the Survivor Benefit Structure – Choose an annuity with a survivor benefit that meets your needs.

- Review the Payout Period – Ensure the annuity’s payout period aligns with your life expectancy and financial goals.

- Diversify Your Investment Portfolio – Don’t rely entirely on annuities; diversify your retirement savings for flexibility.

- Consult a Financial Advisor – Get professional advice to ensure the annuity fits into your overall financial strategy.

- Shop Around for Competitive Rates – Compare annuity providers to find the best payout rates and terms.

- Check for Fees – Be aware of any hidden fees that might reduce your overall payout.

- Consider Adding a Long-Term Care Rider – Some annuities offer long-term care benefits for an additional premium.

- Evaluate the Insurance Company’s Financial Stability – Choose a reputable insurer with a solid financial track record.

10 Frequently Asked Questions (FAQs)

- What is the difference between a joint-life annuity and a single-life annuity? A joint-life annuity covers two people, while a single-life annuity covers just one person.

- How does a joint-life annuity protect the surviving partner? After the death of one partner, the surviving partner continues to receive the agreed-upon payments.

- Can I customize the payout amounts of my joint-life annuity? Yes, many joint-life annuities allow customization of payout options, including survivor benefits.

- Is the amount I receive fixed, or can it change over time? Some joint-life annuities offer fixed payments, while others adjust according to inflation or market performance.

- What happens if both partners die before the annuity has paid out? Depending on the annuity type, some offer a death benefit to beneficiaries, while others may not.

- How do annuity providers calculate payouts? Payouts are typically based on your age, health, and the size of the initial investment.

- Are joint-life annuities taxable? Yes, annuity payments are generally subject to income tax, though there are exceptions depending on the country.

- Can I add a beneficiary to my joint-life annuity? Many joint-life annuities allow for a beneficiary to receive payments if both partners pass away.

- What if I need access to the lump sum after purchasing an annuity? Joint-life annuities are generally not liquid, so you can’t access the lump sum once it’s paid to the insurer.

- Is a joint-life annuity right for everyone? It’s ideal for couples who need guaranteed income for life, but not everyone may find it affordable or suitable based on their financial situation.

Conclusion

A joint-life annuity can provide invaluable peace of mind for couples in retirement by guaranteeing lifetime income for both partners. While there are some trade-offs, including the potential loss of flexibility and the upfront cost, the security it offers can be well worth it for many couples. By carefully considering your needs, consulting with a financial advisor, and choosing the right annuity option, you can ensure that both you and your partner are financially secure for the long term.

In conclusion, joint-life annuities are an effective tool for couples seeking reliable income throughout their retirement years. They offer protection against the financial risks of living longer, provide a stable income for both partners, and can be tailored to suit specific needs. However, it’s crucial to weigh the costs, benefits, and possible limitations to determine if it’s the best option for your retirement planning.