Long-Term Annuity Benefits: Financial Security for the Future. An annuity is a financial product that provides regular payments over a specified period, offering security and peace of mind, particularly for retirement. For individuals seeking stable and predictable income streams, long-term annuities can be an excellent option. This article explores the various long-term annuity benefits, how they work, and why they might be the right choice for securing your financial future. Whether you’re considering an annuity for retirement or long-term financial planning, understanding the benefits and options available will empower you to make informed decisions.

Understanding Long-Term Annuities

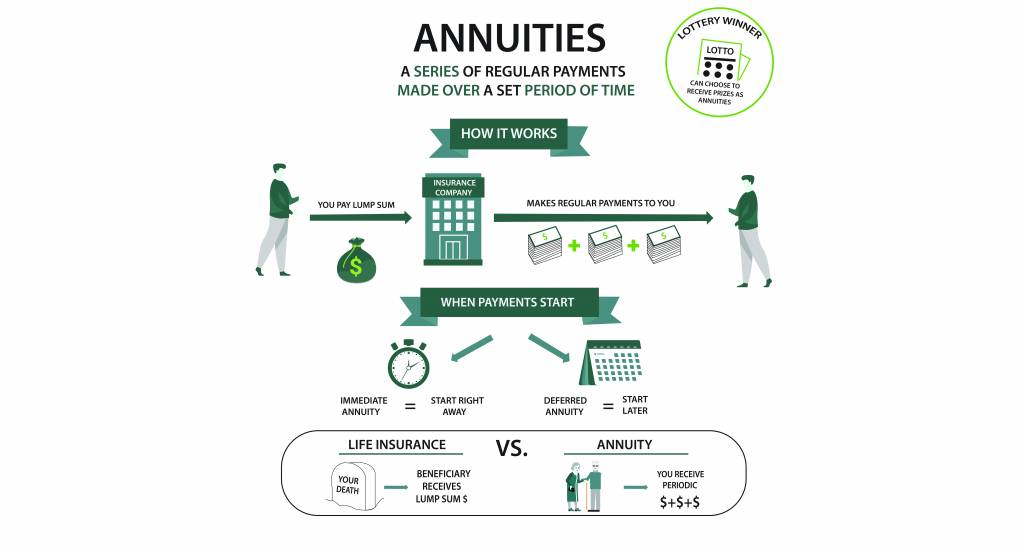

An annuity is typically a contract between an individual and an insurance company, where the individual makes a lump-sum payment or a series of payments in exchange for future income. Long-term annuities, specifically, are designed to provide payments for an extended period, often for the lifetime of the annuitant, or for a set number of years.

- What is a Long-Term Annuity? A long-term annuity is a financial product designed to deliver income over a long period. It can last for a set number of years or for the annuitant’s lifetime. The most common types of long-term annuities are fixed and variable annuities.

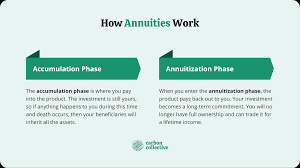

- How Do Long-Term Annuities Work? When you purchase a long-term annuity, you agree to pay an initial lump sum or make periodic contributions to the insurer. In return, the insurer agrees to pay you periodic income for a specified period or until death.

- Types of Long-Term Annuities

- Fixed Annuities: Provide a guaranteed, fixed income stream.

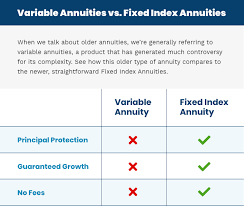

- Variable Annuities: Payments are based on the performance of investments chosen by the annuitant.

- Immediate Annuities: Begin payments almost immediately after the lump sum is paid.

- Deferred Annuities: Payments begin at a later date.

Benefits of Long-Term Annuities

- Steady Income Stream One of the key benefits of long-term annuities is the reliable income stream they provide. With annuities, you receive regular, predictable payments, which can be especially helpful in retirement when other sources of income, such as wages, may no longer be available.

- Longevity Protection Long-term annuities can be particularly beneficial for individuals worried about outliving their savings. For example, a lifetime annuity guarantees that you will receive income for as long as you live, no matter how long that might be.

- Tax Benefits The income generated from annuities is generally tax-deferred, meaning you won’t owe taxes on the earnings until you start receiving payments. This provides an opportunity for your investment to grow without being taxed immediately.

- Predictable Financial Planning By locking in a fixed income over a long period, annuities offer stability, allowing you to plan your finances more effectively. This predictability is crucial, especially during retirement, when you may have fixed expenses.

- Protection Against Market Volatility Fixed long-term annuities are not affected by market downturns, providing a level of protection against the volatility that can impact other types of investments. This makes them an appealing option for risk-averse individuals.

- Customized Options There are various options available to customize a long-term annuity to suit your needs. For example, you can add riders for inflation protection or a death benefit, ensuring that your beneficiaries are taken care of.

- Spousal Benefits Some long-term annuities come with spousal benefits, which ensure that your partner continues to receive payments even after your death. This is an important consideration for individuals with dependents or spouses who rely on their income.

- Estate Planning Advantages Annuities can be a useful tool in estate planning. Beneficiaries may inherit the remaining balance of the annuity, depending on the terms, offering a way to provide for your heirs after you pass away.

- Inflation Protection Some annuities offer inflation protection riders, which adjust your payments to keep pace with rising prices. This can be particularly beneficial for long-term financial security, as it helps your income maintain its purchasing power.

- Reduced Risk of Poor Financial Decisions When purchasing a long-term annuity, the risk of making poor investment decisions is minimized, as the insurer takes on the responsibility for managing the funds. This allows you to focus on other aspects of your financial life without worrying about complex investment strategies.

How to Choose the Right Long-Term Annuity

- Assess Your Financial Goals Before purchasing an annuity, consider your overall financial goals. Do you want guaranteed income for life, or are you looking for more flexibility with potential growth? Understanding your needs will help you choose between fixed, variable, or other annuity types.

- Consider Your Risk Tolerance Some long-term annuities, like fixed annuities, offer guaranteed returns, while others, like variable annuities, expose you to market risk. It’s important to select the type that aligns with your comfort level regarding risk.

- Review Fees and Charges Annuities may come with various fees, including administrative fees, surrender charges, and rider fees. Understanding the costs associated with an annuity will help you avoid surprises later.

- Understand the Payout Options Annuities offer different payout options, including life-only payments, joint and survivor payments, and period-certain payments. Be sure to choose the option that best meets your financial needs and preferences.

10 Tips for Maximizing the Benefits of Long-Term Annuities

- Shop around for the best annuity rates.

- Consider inflation protection riders to keep pace with rising costs.

- Focus on annuities with low fees to maximize returns.

- Compare fixed versus variable annuities based on your risk tolerance.

- Plan your annuity purchase ahead of retirement to lock in favorable terms.

- Use annuities as part of a diversified financial strategy.

- Understand the tax implications of your annuity payments.

- Evaluate the financial strength of the insurance company before purchasing.

- Consider the impact of inflation on long-term annuity payouts.

- Regularly review your annuity and financial plan to make adjustments if needed.

10 Frequently Asked Questions (FAQs)

- What is the difference between a fixed and variable annuity? A fixed annuity guarantees a set payout, while a variable annuity’s payouts depend on the performance of underlying investments.

- Are long-term annuities a good investment for retirement? Yes, long-term annuities provide a steady income stream, which is beneficial for retirement planning.

- Can I withdraw my money early from an annuity? Many annuities have surrender periods and may charge fees for early withdrawal, so it’s important to review the terms before purchasing.

- What happens if I outlive my annuity? If you purchase a lifetime annuity, you will continue to receive payments as long as you live.

- Is annuity income taxable? Yes, annuity income is generally taxed as ordinary income when you start receiving payments.

- Can I add a death benefit to my annuity? Yes, some annuities offer a death benefit rider, ensuring your beneficiaries receive a payout.

- What is the minimum investment required for an annuity? The minimum investment varies by insurer, but many long-term annuities require a lump-sum payment of several thousand dollars.

- Are annuities safe? Annuities are generally considered safe, especially if issued by a financially stable insurance company.

- How do annuities compare to other retirement income sources? Annuities offer predictable, steady income, unlike other investment options, such as stocks or bonds, which can be volatile.

- Can I change my annuity terms after purchase? Once purchased, the terms of an annuity are typically fixed, though certain options and riders can be added.

Conclusion

Long-term annuities offer several benefits, particularly for individuals seeking financial security and predictable income streams. By providing a steady flow of income, protection against longevity risk, and various customizable options, long-term annuities can play a vital role in retirement planning and long-term financial strategies.

Before purchasing a long-term annuity, it is essential to understand your financial goals, assess your risk tolerance, and review the terms, including fees and payout options. By making an informed decision, you can maximize the benefits of annuities and ensure a stable and secure financial future for yourself and your loved ones.