Real Estate Flipping Tips: Strategies for Maximum Profit. Real estate flipping has become a popular investment strategy for those looking to generate significant profits in a relatively short amount of time. If done correctly, flipping properties can be both lucrative and fulfilling. Here, we provide essential tips and insights to help you succeed in the world of real estate flipping.

What Is Real Estate Flipping?

Real estate flipping involves purchasing properties at a lower price, improving or renovating them, and then selling them at a higher price. The process requires careful planning, a solid financial strategy, and market knowledge.

10 Essential Real Estate Flipping Tips

- Research the Market Thoroughly Understanding the local real estate market is crucial. Look for areas with increasing property values, high demand, and low inventory. Use tools like MLS, Zillow, or local real estate reports to analyze trends.

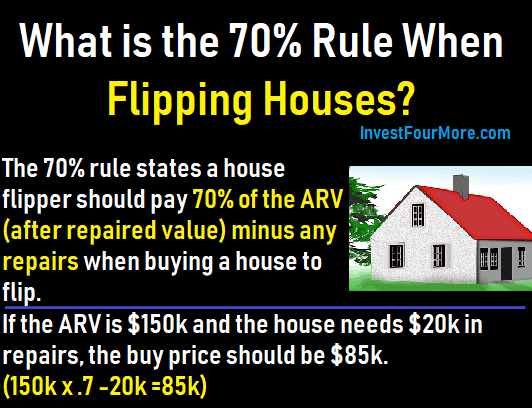

- Create a Realistic Budget Establish a detailed budget that includes purchase costs, renovation expenses, taxes, and unexpected costs. Sticking to your budget is vital to ensure profitability.

- Secure Proper Financing Explore various financing options such as hard money loans, private lenders, or traditional mortgages. Ensure that the financing aligns with your overall investment goals.

- Build a Reliable Team Surround yourself with skilled professionals, including contractors, real estate agents, and inspectors. A strong team can streamline the flipping process.

- Inspect the Property Thoroughly Conduct a detailed property inspection to identify structural issues, plumbing problems, or electrical concerns. Addressing these early will save time and money.

- Focus on High-ROI Renovations Invest in renovations that add the most value, such as kitchen upgrades, bathroom remodeling, and curb appeal improvements. Avoid overspending on unnecessary luxuries.

- Understand Local Laws and Regulations Familiarize yourself with zoning laws, building codes, and permit requirements in your area. Non-compliance can lead to delays and legal issues.

- Stage the Property Effectively Proper staging can make a property more appealing to potential buyers. Use neutral colors, modern décor, and strategic furniture placement to highlight the home’s best features.

- Price Competitively Conduct a comparative market analysis (CMA) to determine the optimal listing price. Pricing too high can deter buyers, while pricing too low can reduce profits.

- Market the Property Strategically Use online platforms, professional photography, and targeted advertising to attract buyers. Partnering with a skilled real estate agent can further enhance your marketing efforts.

10 Frequently Asked Questions (FAQs) About Real Estate Flipping

- What is the average profit margin for flipping properties? The average profit margin ranges from 10% to 20%, depending on the market and renovation costs.

- How long does it take to flip a property? On average, it takes 6 to 12 months from purchase to sale, but this varies based on the extent of renovations and market conditions.

- Do I need a real estate license to flip properties? No, but working with a licensed real estate agent can simplify the buying and selling process.

- Is real estate flipping risky? Yes, but thorough research and proper planning can mitigate risks.

- How do I find properties to flip? Use MLS listings, auctions, foreclosures, and networking with local real estate agents.

- What is the best way to finance a flip? Options include cash, hard money loans, private lenders, or traditional mortgages.

- What if the property doesn’t sell? You can rent it out or reduce the price to attract buyers.

- Can I flip properties part-time? Yes, but it requires effective time management and a strong team.

- What tax implications should I consider? Profits from flipping are often taxed as ordinary income, so consult a tax professional.

- How do I choose the right contractor? Seek recommendations, check credentials, and review past work to ensure reliability and quality.

Conclusion

Real estate flipping can be a rewarding investment strategy if approached with careful planning and strategic execution. By researching the market, budgeting wisely, and focusing on high-return renovations, you can increase your chances of success. Always remember to work with a trusted team and adhere to local regulations to avoid potential setbacks.

Ultimately, success in real estate flipping depends on adaptability and continuous learning. As you gain experience, you’ll refine your strategies and achieve greater profitability. Whether you’re a seasoned investor or a beginner, these tips will provide a solid foundation for your flipping journey. Good luck!