Investing in Commodities: A Guide to Building Wealth. Investing in commodities can be an exciting and potentially lucrative venture for individuals looking to diversify their portfolio and hedge against inflation. Commodities are natural resources like oil, gold, agricultural products, and metals that are traded on financial markets. For centuries, they have served as valuable assets, often performing well during periods of economic uncertainty or inflation. However, like any investment, commodities come with their own set of risks and rewards. In this article, we will explore the basics of investing in commodities, strategies for successful investments, and important factors to consider before diving into the commodity market.

1. What Are Commodities?

Commodities are raw materials or primary agricultural products that can be bought and sold. They are typically standardized and interchangeable with other products of the same type. These include precious metals like gold and silver, energy products like oil and natural gas, agricultural goods such as wheat and coffee, and industrial metals like copper.

Key Types of Commodities:

- Hard Commodities: These include natural resources such as oil, metals, and minerals.

- Soft Commodities: These refer to agricultural products like wheat, cotton, and livestock.

2. Why Invest in Commodities?

Investing in commodities offers several benefits, including diversification and the potential for high returns. Commodities often have a low correlation with traditional stocks and bonds, meaning their prices may move independently of other asset classes. This makes them an attractive option for investors looking to reduce risk and increase overall portfolio stability.

Top Reasons to Invest:

- Hedge Against Inflation: Commodities, especially precious metals like gold, have historically been a safe haven during inflationary periods.

- Diversification: Commodities can reduce risk and increase the potential for returns by adding variety to your investment mix.

- Potential for High Returns: Due to their volatility, commodities can sometimes offer significant gains, especially during supply disruptions or geopolitical tensions.

3. Different Ways to Invest in Commodities

There are multiple ways to gain exposure to the commodity market, each with its own level of risk, return potential, and liquidity. Here are the most common methods:

- Physical Commodities: Directly buying the commodity itself, such as purchasing gold or oil.

- Commodity ETFs and Mutual Funds: These funds track the price of a commodity or a basket of commodities and are traded on stock exchanges.

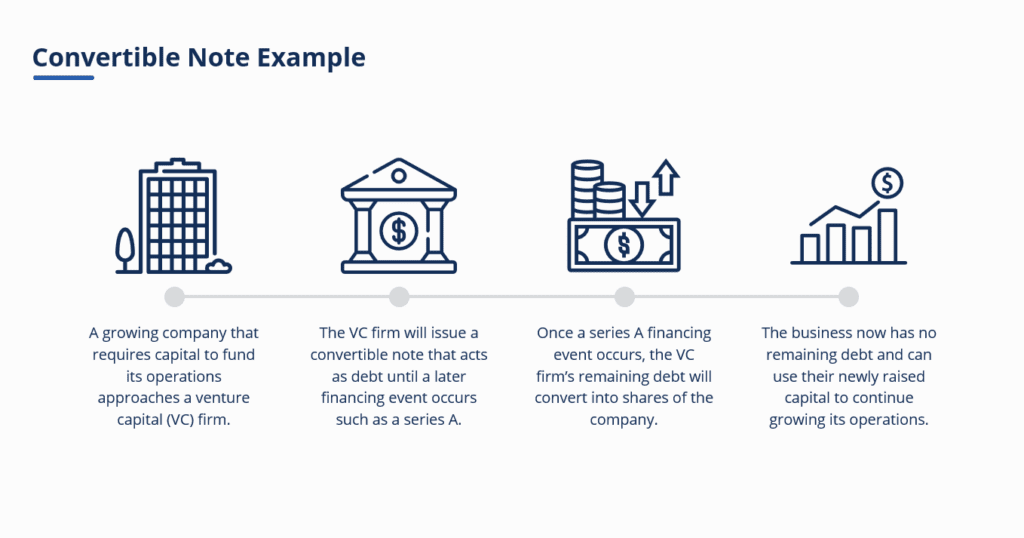

- Commodity Futures: Contracts that allow investors to buy or sell a commodity at a specific price at a future date.

- Stocks of Commodity-Related Companies: Investing in companies that produce or rely heavily on commodities, such as energy or mining companies.

- Commodity Options: A derivative contract that gives the investor the right but not the obligation to buy or sell a commodity at a specific price before a certain date.

4. How Commodities Are Traded

Commodities are typically traded on specialized exchanges, where buyers and sellers come together to execute transactions. These exchanges include the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX), and the London Metal Exchange (LME). Commodities can be traded either as physical goods or through financial instruments such as futures contracts, options, and ETFs.

5. Risks Involved in Commodity Investment

While commodities can be profitable, they come with their own set of risks that investors must understand before committing their capital. The primary risks include:

- Price Volatility: Commodity prices can fluctuate drastically due to factors like supply and demand, geopolitical events, and weather conditions.

- Political and Economic Factors: Government policies, trade wars, and global economic changes can significantly impact commodity prices.

- Market Manipulation: Due to the speculative nature of commodities, some markets are susceptible to manipulation by powerful players.

6. How to Analyze Commodities Before Investing

Investors need to perform thorough research before investing in commodities. This includes understanding the factors that influence supply and demand, such as geopolitical tensions, weather patterns, and economic indicators.

Factors to Consider:

- Global Demand and Supply: For example, oil prices are heavily influenced by OPEC’s production levels, while agricultural commodity prices are affected by weather patterns.

- Economic Data: Economic reports, such as GDP growth, interest rates, and employment data, can provide insight into commodity price movements.

- Geopolitical Events: Political instability in key commodity-producing regions can lead to price fluctuations.

7. Best Commodities to Invest in

Not all commodities perform the same under varying market conditions. Some commodities tend to do well during economic downturns, while others may shine during periods of high demand.

Top Commodities for Investment:

- Gold: A traditional hedge against inflation and economic instability.

- Oil: The world’s most traded commodity, crucial for energy and industrial production.

- Silver: Often considered a more affordable alternative to gold, silver also has industrial uses.

- Agricultural Commodities: Wheat, corn, and soybeans are staples in global food markets.

- Metals: Copper, aluminum, and lithium are essential in electronics and infrastructure.

8. Strategies for Successful Commodity Investment

To invest successfully in commodities, it’s essential to have a strategy that aligns with your financial goals and risk tolerance. Here are some strategies to consider:

- Long-Term Investment: Hold commodities for an extended period, betting on their price increase over time.

- Short-Term Trading: Buy and sell commodities based on short-term market movements.

- Hedging: Use commodities to hedge against potential risks in other investments, such as stocks and bonds.

9. Tax Implications of Commodity Investments

Investors in commodities should be aware of the tax implications that come with trading in these assets. For example, profits from commodity futures may be subject to different tax rates compared to stock market gains.

Tax Considerations:

- Capital Gains: Profits from selling commodities can be taxed as either long-term or short-term capital gains, depending on how long you hold the asset.

- Tax-Advantaged Accounts: Using retirement accounts, such as IRAs, to invest in commodities may offer tax benefits.

10. The Future of Commodity Investing

The future of commodity investing looks promising as global demand continues to grow, particularly in emerging markets. However, sustainability concerns and technological advancements, such as electric vehicles and renewable energy, may reshape the demand for certain commodities. Investors should stay informed about these trends to make wise investment decisions.

10 Tips for Investing in Commodities

- Diversify your commodity investments to reduce risk.

- Use commodity ETFs for a low-cost, diversified exposure.

- Monitor global events and economic indicators closely.

- Invest in commodities that are essential to global industries.

- Understand the supply and demand factors that impact commodity prices.

- Start small to test the commodity market before committing larger amounts.

- Consider using commodity futures for advanced trading strategies.

- Be mindful of the high volatility in commodity markets.

- Use professional advice when trading more complex instruments.

- Protect your investments by employing risk management techniques.

10 Frequently Asked Questions (FAQ)

- What is the best commodity to invest in?

- The best commodity depends on your financial goals. Gold is a popular choice for safe-haven investments, while oil and agricultural products can offer growth potential.

- How do commodity ETFs work?

- Commodity ETFs track the price of commodities or a basket of commodities and trade like stocks on an exchange.

- Are commodities a good long-term investment?

- Commodities can be a good long-term investment if you focus on those with strong demand, such as gold or industrial metals.

- How do I invest in commodity futures?

- Commodity futures are contracts that let you buy or sell commodities at a future date. They require a brokerage account that offers futures trading.

- What factors affect commodity prices?

- Factors include global supply and demand, geopolitical events, weather conditions, and economic reports.

- Can commodities protect me from inflation?

- Yes, commodities like gold often perform well during inflationary periods as their prices tend to rise.

- What are the risks of investing in commodities?

- Risks include price volatility, political instability, and market manipulation.

- How are commodities traded?

- Commodities are traded on exchanges, such as the NYMEX or CME, through futures contracts, ETFs, and stocks.

- Is it difficult to invest in commodities?

- It can be complex, especially when dealing with futures contracts or physical commodities, but ETFs and mutual funds make it easier.

- Do commodity investments require a lot of capital?

- Not necessarily. ETFs and commodity stocks allow you to invest with smaller amounts of capital.

Conclusion

Investing in commodities can be a rewarding strategy for those seeking to diversify their investment portfolio and hedge against economic risks. While the potential for high returns is present, commodities come with their own set of risks, including volatility and market manipulation. By understanding the various ways to invest in commodities, the factors that influence their prices, and the strategies that work best for your financial goals, you can make informed decisions and potentially benefit from this exciting market.

In conclusion, successful commodity investing requires knowledge, strategic planning, and careful risk management. Keep up with market trends, understand the underlying factors that drive commodity prices, and choose the best investment method suited to your needs. With the right approach, commodities can become a valuable asset in your investment portfolio.