Robo-Advisors vs. Traditional Investment Methods: Right Approach. In today’s fast-evolving financial landscape, the debate between robo-advisors vs. traditional investment methods continues to captivate investors. Both approaches offer unique benefits, but they cater to different financial needs, goals, and levels of expertise. In this article, we explore the nuances of each option, offering insights into how you can make the most informed decision for your investment journey.

Understanding Robo-Advisors

What Are Robo-Advisors?

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services. They use advanced algorithms to build and manage investment portfolios, requiring minimal human intervention. Robo-advisors are ideal for investors seeking low-cost, hands-off investment solutions.

Key Features of Robo-Advisors

- Automation: Automates portfolio creation and rebalancing.

- Low Fees: Generally charges lower fees compared to traditional advisors.

- Accessibility: Available to investors with varying levels of capital.

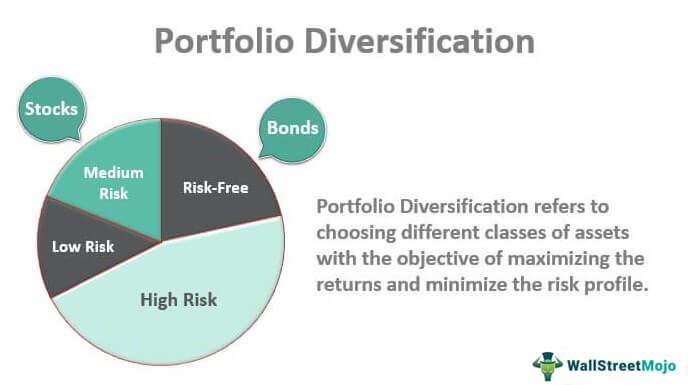

- Customization: Offers tailored portfolios based on individual goals and risk tolerance.

- Advanced Tools: Incorporates AI-driven insights and tax-loss harvesting.

Pros of Robo-Advisors

- Cost-effective.

- Simple and efficient.

- Provides 24/7 access to portfolios.

Cons of Robo-Advisors

- Limited human interaction.

- May not handle complex financial situations well.

Traditional Investment Methods

What Are Traditional Investment Methods?

Traditional investment methods involve working with human financial advisors or brokers who provide personalized financial advice and portfolio management. These advisors use their expertise to guide clients through the complexities of investing.

Key Features of Traditional Investment Methods

- Human Expertise: Offers personalized advice based on experience.

- Complex Strategies: Handles intricate financial plans.

- Holistic Planning: Includes retirement, estate planning, and more.

- Relationship-Oriented: Builds trust through one-on-one interactions.

- Diverse Product Offerings: Access to a broad range of financial instruments.

Pros of Traditional Investment Methods

- Personalized and holistic advice.

- Effective for complex financial goals.

- Access to broader financial products.

Cons of Traditional Investment Methods

- Higher fees.

- Time-intensive process.

Comparing Robo-Advisors vs. Traditional Investment Methods

Cost Comparison

Robo-advisors charge a fraction of the fees associated with traditional advisors. This affordability makes them attractive to budget-conscious investors.

Accessibility and Convenience

While robo-advisors provide round-the-clock access to your portfolio, traditional methods require scheduled meetings, which may not suit busy professionals.

Expertise and Customization

Traditional advisors excel in complex financial planning and offer a more tailored approach, while robo-advisors specialize in straightforward, algorithm-driven solutions.

Emotional Support

Human advisors provide reassurance during market downturns, a feature absent in robo-advisors.

10 Tips for Choosing Between Robo-Advisors and Traditional Advisors

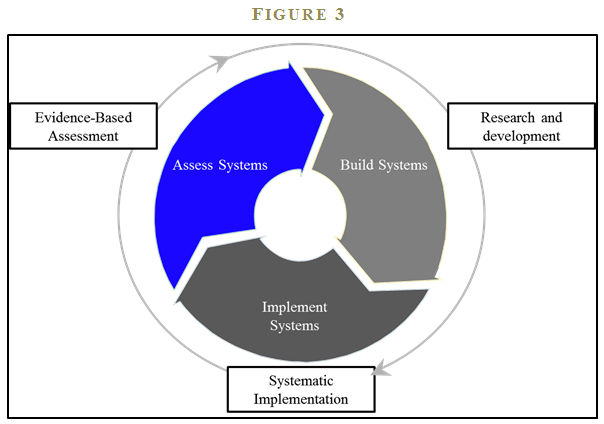

- Assess your financial goals and complexity.

- Evaluate your comfort with technology.

- Consider your budget for management fees.

- Determine the level of personal interaction you need.

- Analyze your investment knowledge and confidence.

- Research the tools and features offered by robo-advisors.

- Look for credentials and reviews of traditional advisors.

- Check for hybrid models that combine both approaches.

- Prioritize platforms that align with your risk tolerance.

- Test trial versions of robo-advisors for ease of use.

10 FAQs About Robo-Advisors vs. Traditional Investment Methods

- Are robo-advisors safe to use? Yes, they employ secure encryption and regulated practices.

- Can I switch between a robo-advisor and a traditional advisor? Yes, you can transition as your financial needs evolve.

- Do traditional advisors manage small portfolios? Some do, but many require a minimum asset threshold.

- How are robo-advisors taxed? Tax implications are similar to traditional investments, with potential advantages from tax-loss harvesting.

- Which is better for retirement planning? It depends on the complexity of your goals.

- Are hybrid models worth exploring? Yes, they combine automated efficiency with human expertise.

- How do fees differ between the two? Robo-advisors charge lower management fees, often 0.25% to 0.50%.

- Can robo-advisors handle estate planning? No, this is a strength of traditional advisors.

- Do traditional advisors use technology? Many use advanced tools for portfolio analysis and management.

- What is the minimum investment for robo-advisors? Some require as little as $500.

Conclusion

Both robo-advisors and traditional investment methods have their unique strengths and weaknesses. Robo-advisors excel in affordability and convenience, making them a strong choice for tech-savvy and budget-conscious investors. On the other hand, traditional methods offer personalized expertise, ideal for navigating complex financial landscapes.

Choosing the right approach ultimately depends on your financial goals, preferences, and resources. By understanding the benefits and limitations of each, you can make an informed decision that aligns with your journey toward financial success.