Dollar-Cost Averaging Benefits: Boost Your Investment Strategy. In the world of investing, one strategy that has consistently been recommended by financial experts is dollar-cost averaging (DCA). This method is designed to help investors minimize risk and take advantage of market fluctuations, ultimately promoting long-term financial growth. In this article, we’ll explore the numerous dollar-cost averaging benefits, why it works, and how it can be applied to your investment strategy. Whether you’re a seasoned investor or just getting started, understanding DCA can significantly enhance your financial decision-making.

What is Dollar-Cost Averaging?

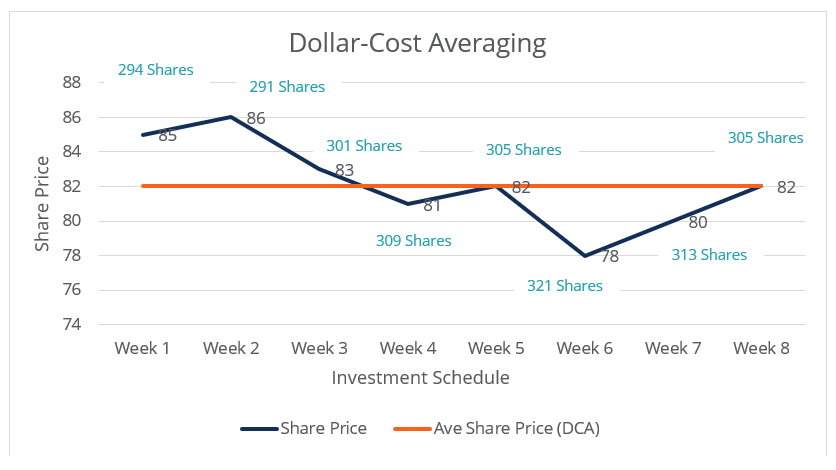

Dollar-cost averaging is an investment strategy where an investor divides the total amount to be invested into smaller, fixed amounts. These amounts are then invested at regular intervals, regardless of the price of the asset. This strategy helps reduce the impact of volatility by purchasing fewer shares when prices are high and more shares when prices are low.

The key principle behind DCA is to eliminate the need to time the market, which is notoriously difficult and risky. Instead, the strategy focuses on consistent investments over time, which can result in a lower average cost per share in fluctuating markets.

Dollar-Cost Averaging Benefits

- Reduces the Impact of Market Volatility

One of the primary dollar-cost averaging benefits is its ability to shield investors from market volatility. By making investments at regular intervals, you can smooth out the effects of short-term price fluctuations. Instead of buying a large quantity of shares all at once, which could be detrimental if the market is at a high point, DCA allows you to buy more shares when the market is down, balancing the overall purchase price.

- Helps Prevent Emotional Investing

Emotional decisions often lead to poor investment outcomes. With dollar-cost averaging, the focus is on a systematic approach that prevents impulsive actions based on market conditions. Investors avoid the temptation to buy when the market is high or sell in panic during downturns. This emotional discipline helps you stick to a plan and avoid costly mistakes.

- Ideal for Long-Term Investors

Dollar-cost averaging is a great fit for long-term investors who are not focused on short-term gains. It works best for individuals who are planning for future goals, such as retirement or education, and who understand that investing is a marathon, not a sprint. Over time, DCA allows investors to accumulate assets gradually, resulting in compounded returns over the long haul.

- Minimizes the Risk of Market Timing

Timing the market is one of the biggest challenges faced by investors. It’s difficult to predict when prices will be at their lowest or highest. By committing to DCA, you eliminate the need for market timing, reducing the risk of making poor decisions based on predictions or short-term trends.

- Affordable and Accessible for All Investors

Dollar-cost averaging doesn’t require a large initial investment, making it accessible to both new and experienced investors. Whether you’re investing $50 or $500 a month, you can start using DCA with any budget. This affordability allows individuals to participate in the market without needing a significant amount of capital upfront.

- Encourages Consistent Investing Habits

One of the psychological benefits of DCA is that it encourages regular investing habits. By making automatic investments at set intervals, you build a disciplined approach to saving and investing. This consistency can help you accumulate wealth over time, even if you’re not actively monitoring the market.

- Reduces Risk Through Diversification

While dollar-cost averaging doesn’t directly provide diversification, it often leads to diversified portfolios as investors spread their investments over time and across different assets. This gradual accumulation means you’re less likely to have all your money invested in one asset at a potentially volatile moment, reducing overall portfolio risk.

- Works Well with Volatile Markets

DCA is particularly beneficial during periods of market volatility. Since DCA doesn’t rely on the market timing approach, it allows you to take advantage of market downturns by purchasing assets at lower prices. Over time, this strategy helps smooth out market fluctuations and averages out the costs of your investments.

- Simplicity and Automation

DCA is a relatively simple strategy to implement. Investors can automate their contributions through their investment platform or broker, ensuring they stay consistent in their investment approach. Automation removes the complexity of manually timing investments, which can be stressful and time-consuming.

- Tax Efficiency

While DCA doesn’t directly provide tax benefits, it can contribute to tax efficiency in certain types of accounts. For example, in retirement accounts like IRAs or 401(k)s, dollar-cost averaging allows investments to grow tax-deferred, which can result in significant savings over time.

How to Implement Dollar-Cost Averaging

To effectively implement dollar-cost averaging, follow these steps:

- Set a Budget: Decide how much you want to invest each month.

- Choose Investments: Select the assets you want to invest in, whether they’re stocks, mutual funds, or ETFs.

- Automate Your Contributions: Set up automatic transfers from your bank account to your investment account on a monthly or weekly basis.

- Stick to Your Plan: Regardless of market conditions, commit to your DCA strategy. The goal is long-term growth, not short-term fluctuations.

Dollar-Cost Averaging vs. Lump-Sum Investing

A common question for investors is whether dollar-cost averaging is better than lump-sum investing. Lump-sum investing involves investing all your capital at once, rather than gradually over time. While lump-sum investing has historically outperformed DCA in rising markets, DCA offers significant protection in volatile or declining markets. The choice between the two strategies depends on your risk tolerance, investment goals, and time horizon.

10 Tips for Successful Dollar-Cost Averaging

- Start early to take advantage of compound interest.

- Stay consistent with your investment schedule, even during market downturns.

- Choose low-cost investment options to maximize returns.

- Diversify your portfolio to minimize risk.

- Avoid trying to time the market, stick to your plan.

- Keep your investment horizon long-term.

- Use tax-advantaged accounts like IRAs or 401(k)s.

- Regularly review your investments, but avoid making rash changes.

- Reinvest dividends and capital gains for compounding growth.

- Be patient and let your strategy work over time.

10 Frequently Asked Questions (FAQs)

- What is dollar-cost averaging?

- How does dollar-cost averaging reduce risk?

- Can DCA be used for retirement savings?

- Is dollar-cost averaging effective in a rising market?

- How often should I invest using DCA?

- Can I use dollar-cost averaging with individual stocks?

- What is the best asset for dollar-cost averaging?

- How does DCA work in volatile markets?

- Does dollar-cost averaging eliminate the need for financial planning?

- Can dollar-cost averaging be used by beginners?

Conclusion

Dollar-cost averaging is a powerful tool for investors looking to minimize risk while steadily growing their wealth. By focusing on consistent, small investments over time, you can avoid the pitfalls of market timing and reduce the emotional toll that can come with investing. While it may not provide immediate gratification, DCA can be a highly effective long-term strategy, particularly in volatile markets. Whether you’re saving for retirement, a major purchase, or simply looking to grow your portfolio, dollar-cost averaging offers an accessible and proven method for financial success.

Remember, the key to successful investing lies in discipline, patience, and consistency. By incorporating dollar-cost averaging into your strategy, you can build a solid financial foundation and watch your investments grow over time.